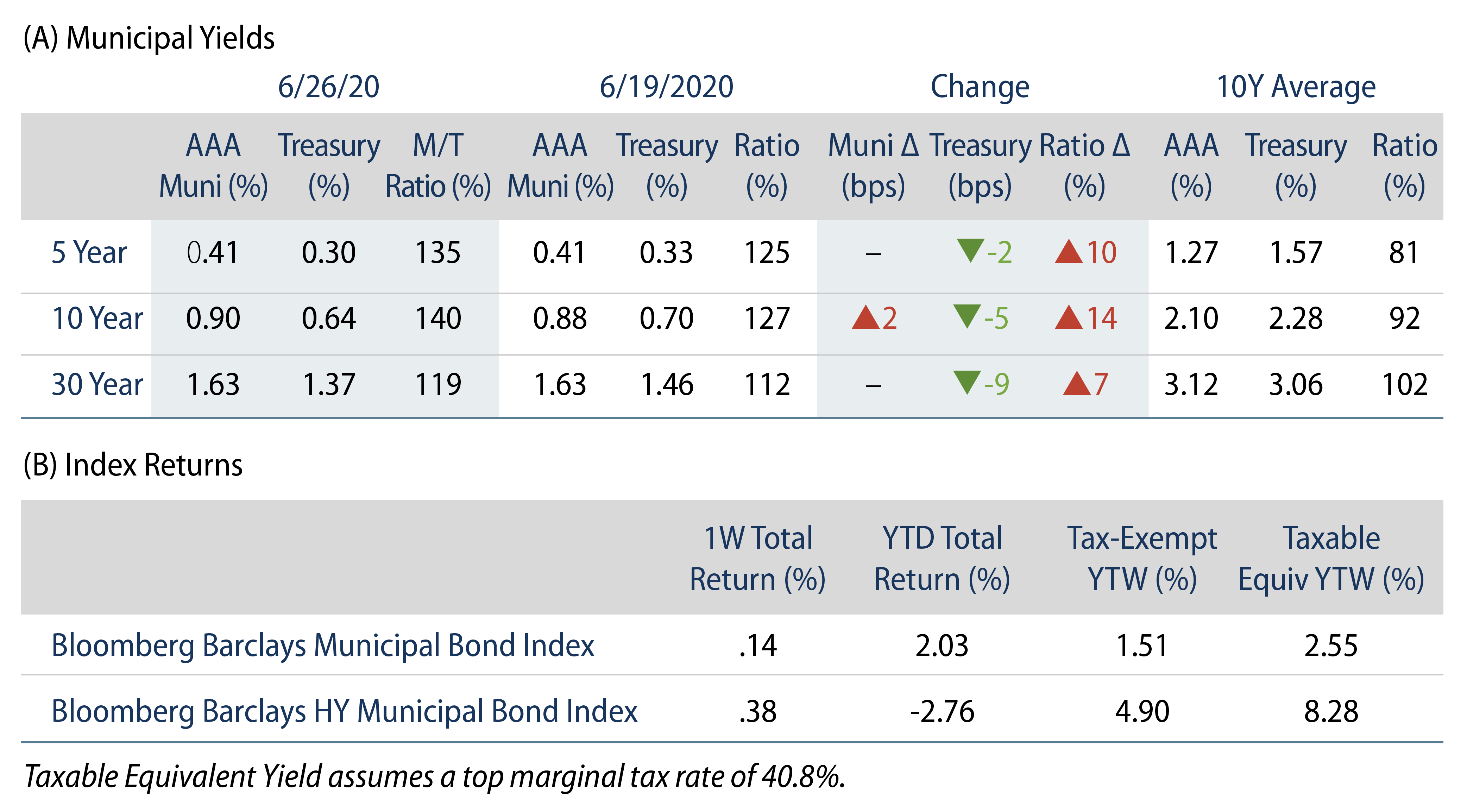

AAA municipal yields were generally unchanged during the week, as an elevated supply calendar paired with uncertainty around the implications of rising COVID-19 infections kept munis from keeping pace with the Treasury rate rally. The Bloomberg Barclays Municipal Index returned 0.14%, while the High-Yield Muni Index returned 0.38%.

Muni Technicals Strengthen, Supported by Robust Fund Flows

During the week ending June 24, municipal mutual funds reported a seventh consecutive week of inflows at $1.5 billion, according to Lipper. Long-term funds recorded $769 million of inflows, high-yield funds recorded $46 million of inflows, and intermediate funds recorded $26 million of outflows. Year-to-date (YTD) municipal fund net outflows now total $8.3 billion.

The muni market recorded $9.7 billion of new-issue volume last week, down 35% from the prior week. Issuance of $197 billion YTD is 24% above last year’s pace, primarily driven by taxable supply, which remains approximately 2.7x over last year’s levels, while tax-exempt supply is in line with last year’s levels. We anticipate approximately $7.4 billion in new issuance next week, which is considered elevated given the holiday-shortened week. This will be led by $1.2 billion short-term Los Angeles Tax and Revenue Anticipation Notes and $1.1 billion taxable Port Authority of NY/NJ transactions.

Airlines Issue Amid the Pandemic

Corporate airlines often access the municipal market to fund infrastructure initiatives for major airports. Despite sector volatility and enplanement challenges, American Airlines and United Airlines successfully placed large refunding transactions associated with terminal improvements at JFK Airport in New York and George Bush Intercontinental Airport in Houston, respectively.

Western Asset’s municipal process benefits from an integrated approach within a broader global fixed-income process, leveraging firmwide views from sector specialists on airline credit. The team evaluates the fundamental relative value of each security across the capital structure of the entity, and can look to the more liquid corporate market to inform after-tax relative value of the municipal security versus municipal and other fixed-income markets.

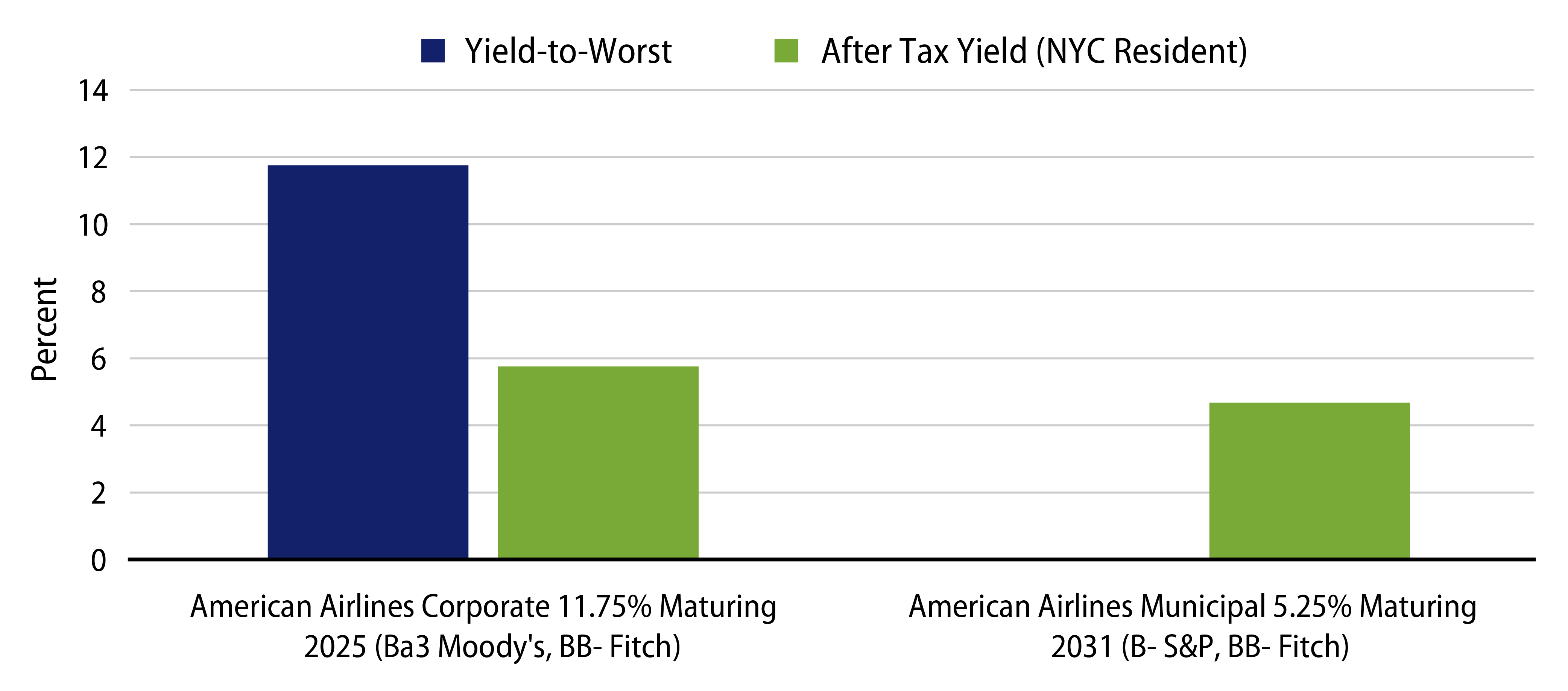

In recent weeks, we have observed dislocations between municipal and corporate valuations, even when considering the highest potential tax implications. The American Airlines transaction, rated B- by S&P and BB- by Fitch and maturing in 2031, priced to yield 5.5% on June 18 before trading higher to 4.68% on June 24, when a comparable American Airlines senior secured taxable issue had priced. The shorter duration, higher-rated (Ba3/BB-) taxable corporate security maturing in 2025 priced at 11.75%. Considering the highest marginal effective tax rate, a New York City resident in the top tax bracket would receive approximately 1.08% in incremental after-tax yield in the shorter duration, higher quality corporate CUSIP than the muni issue.

As highlighted in a blog post from April, Transportation, Interrupted, we are constructive on the transportation sector that has underperformed amid the COVID-19 crisis. We are finding value at the issuer level with diverse revenue streams or adequate liquidity profiles to weather the storm. This example highlights what we deem a mispricing in the municipal market, and how we utilize our global tools to discern where value exists, and perhaps more importantly, where value does not exist.