Performance Overview

Municipals posted modestly positive returns as Treasuries sold off in May.

In May, global government bond market volatility subsided as improved economic data and lower US-China trade tariffs led investors to reduce the perceived risk of a global downturn. The municipal market retraced some of the year-to-date (YTD) underperformance observed during the first four months of the year, with municipal indices posting modestly positive returns, while Treasuries and corporates recorded negative returns. A rebound in demand despite a consistently elevated supply level contributed to the relative outperformance of municipals.

Supply and Demand Technicals

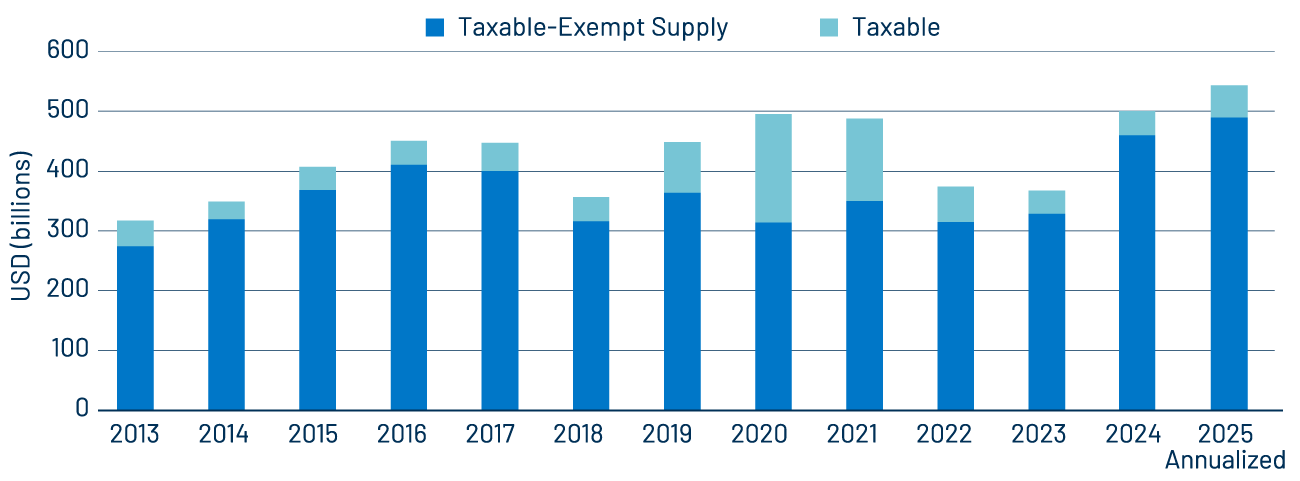

Muni supply remains at a record pace so far this year.

Municipal supply remained elevated in May. Total issuance in May reached $54 billion, marking the highest monthly issuance this year and representing a 14% increase over May 2024 levels. YTD issuance stood at $227 billion, 17% higher than the prior year, with tax-exempt issuance up 16% year-over-year (YoY) and taxable issuance up 30% YoY.

Municipal demand rebounded in May following the seasonal tax-related selling that occurred in April. Municipal mutual funds recorded $6.8 billion of inflows during the month, reversing the $6.3 billion of outflows seen in April, according to the Investment Company Institute (ICI). This brought YTD inflows to $12 billion.

Fundamentals/Outlook

New federal funding cuts and proposed endowment taxes may weaken the credit outlook for higher education municipal bonds.

As the Trump administration established its policies this year, much of the municipal market has focused on the potential implications of federal funding reductions for municipal credit. The House Ways and Means Committee’s release of the initial draft of the “One Big Beautiful Bill” extended these concerns for certain sectors. In addition to pay-for provisions that help extend current individual tax rates, the draft bill seeks to institute an endowment tax on higher education institutions based on endowment-per-student thresholds. Private universities with $2 million in endowment funds per student would pay 21% on net investment income, while schools with lower endowment levels would pay closer to the current rate of 1.4%. These potential taxes could compound pressures from federal funding and grants that also have been rescinded from many universities.

Valuations

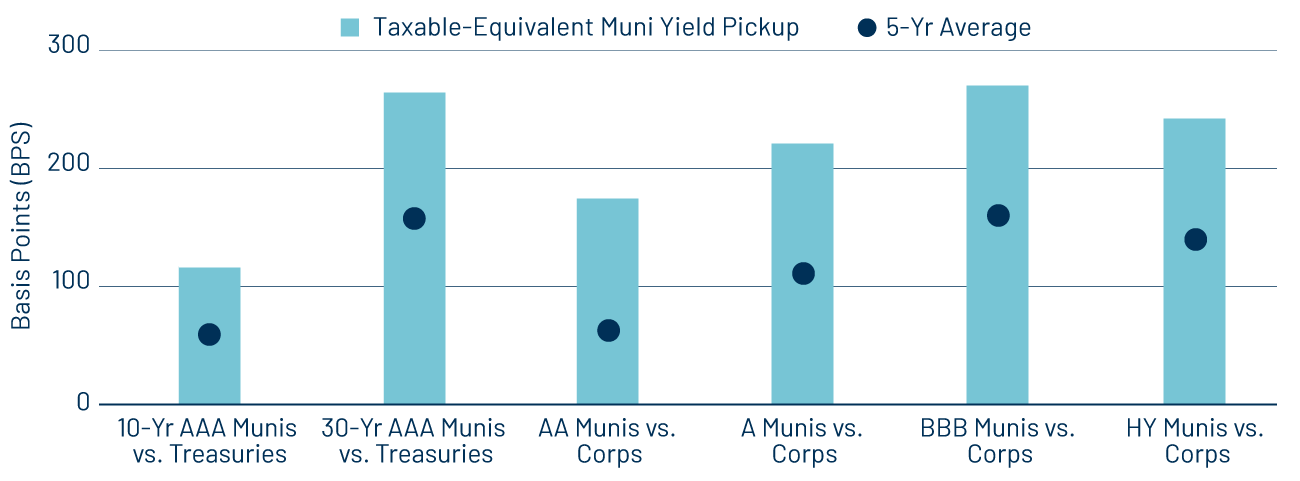

Municipals offer above-average after-tax relative value compared to taxable counterparts for investors in higher tax brackets.

Western Asset remains constructive on municipal relative valuations for investors in higher tax brackets. The Bloomberg Municipal Bond Index average yield-to-worst ended the month at 4.04%, or 6.82% on a taxable-equivalent basis. Despite the underperformance of other fixed-income sectors, the taxable-equivalent yield pickup between municipals and comparable taxable counterparts remained above five-year averages in May. While the draft tax legislation extends the current tax regime, it does not include material tax reductions for individuals or institutions, and we expect less future tax uncertainty to contribute positively to municipal market sentiment.