Performance Overview

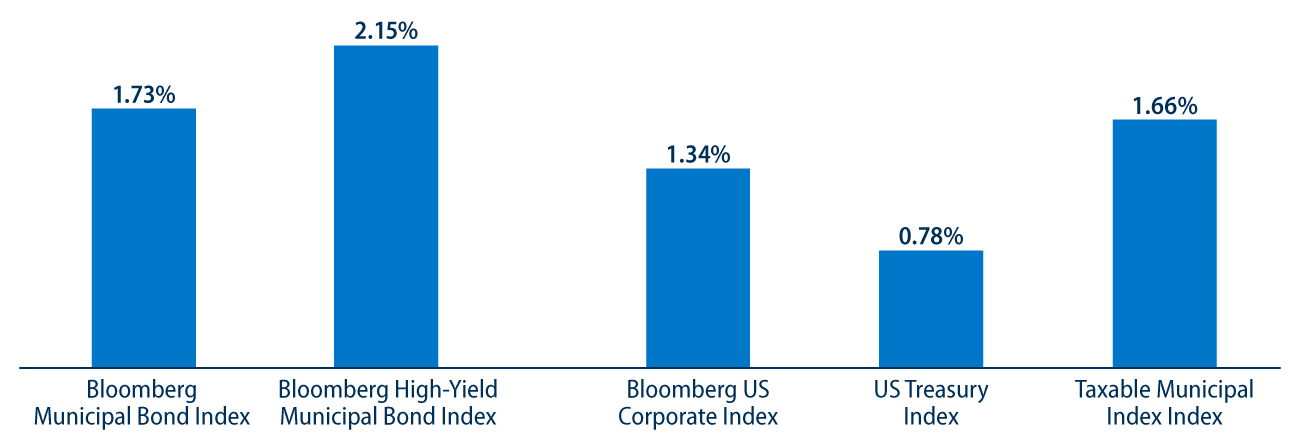

Municipals rallied in November, outperforming taxable fixed-income.

Fixed-income markets were volatile in November following the election as the market processed the implications of a Republican sweep. Treasury yields moved higher earlier in the month amid fears that easy fiscal policy could contribute to higher inflation, supporting higher long-term Treasury rates. However, the selection of Trump’s Treasury Secretary, Scott Bessent, allayed these fears of unchecked fiscal expansion, and rates ultimately moved lower. From an economic data standpoint, jobless claims, third-quarter GDP and Personal Consumption Expenditures (PCE) price index inflation data were reported in line with expectations and remained relatively unchanged from prior readings. Muni market yields trailed Treasuries lower and generally outperformed alongside stronger supply and demand technical conditions. The Bloomberg Municipal Bond Index returned 1.73% during the month. Longer-duration and lower-quality securities outperformed in the strong market.

Supply and Demand Technicals

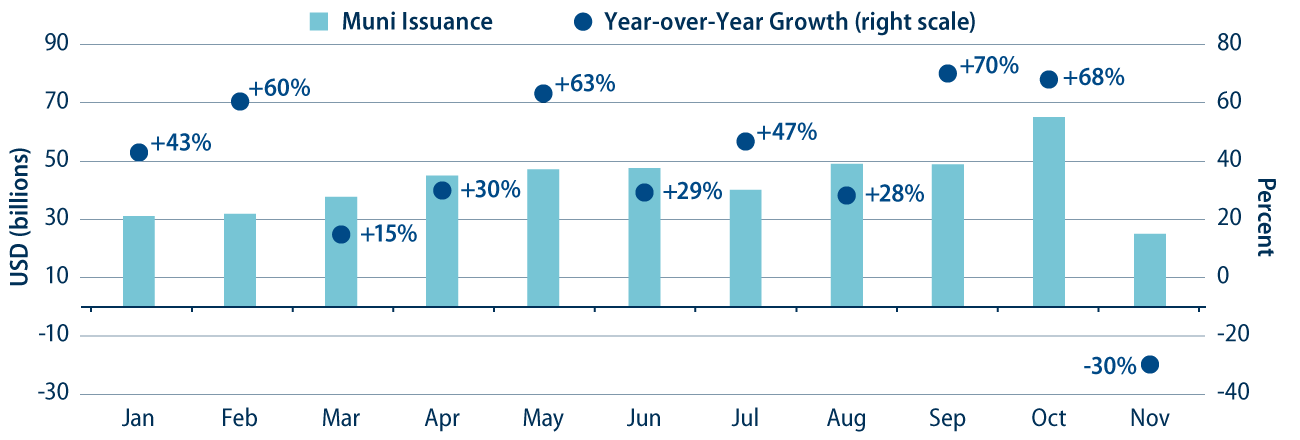

November supply stalled following a record YTD pace.

Entering November, year-to-date (YTD) municipal supply reached a record pace with a total municipal supply of $444 billion. This represents the highest level of supply recorded through the first 10 months of the year in muni market history. Due to the election, along with Veterans Day and Thanksgiving holidays, supply slowed in November as $25 billion of issuance represented the lowest supply level of the year and declined 30% from November 2023 levels.

Demand for municipals continued to improve in November, sidestepping fears that the value of the municipal tax exemption could decline with the upcoming administration. Municipal mutual funds recorded an estimated $7.5 billion of net inflows, according to Lipper, representing the highest month of inflows this year and extending YTD inflows to $45 billion. Long-term and high-yield category flows recorded the largest proportion of fund flows during the year.

Fundamentals

Municipal upgrades continue to outpace downgrades.

Municipal fundamentals remained resilient in November as rating agency upgrades continued to outpace downgrades. Notably, the City of Philadelphia was upgraded one notch to A+ by S&P. Conversely, the agency placed the City of Chicago (Baa3/BBB+/A- by S&P, Moody’s and Fitch) on Creditwatch Negative. Western Asset expects upgrades to continue to outpace downgrades given strong tax collections and credit fundamentals, though we expect the pace of upgrades relative to downgrades to slow.

Valuations

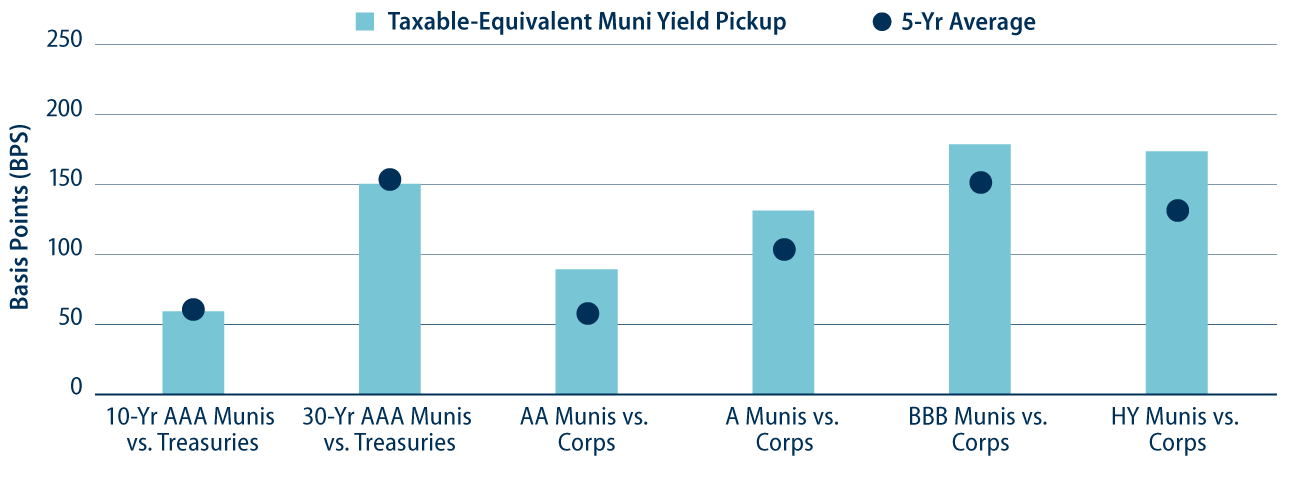

Municipals offer above-average after-tax yield pickup versus taxable counterparts.

Despite the November slowdown, 2024 supply remains elevated and has been supportive of tax-exempt income opportunities and relative valuations. However, strong November technicals and muni outperformance underscore potential reinvestment risk associated with lower supply and higher demand that could quickly emerge in the municipal market. Western Asset anticipates that the 2025 municipal supply will remain elevated due to domestic infrastructure needs, but these elevated supply conditions should be well absorbed by demand from individuals seeking higher after-tax income opportunities as the Federal Reserve is expected to continue cutting rates. Should supply underperform expectations, persistent demand could lead to additional muni outperformance that could limit future income opportunities, further supporting the entry point offered by attractive municipal valuations today.