Municipals Outperformed Treasuries

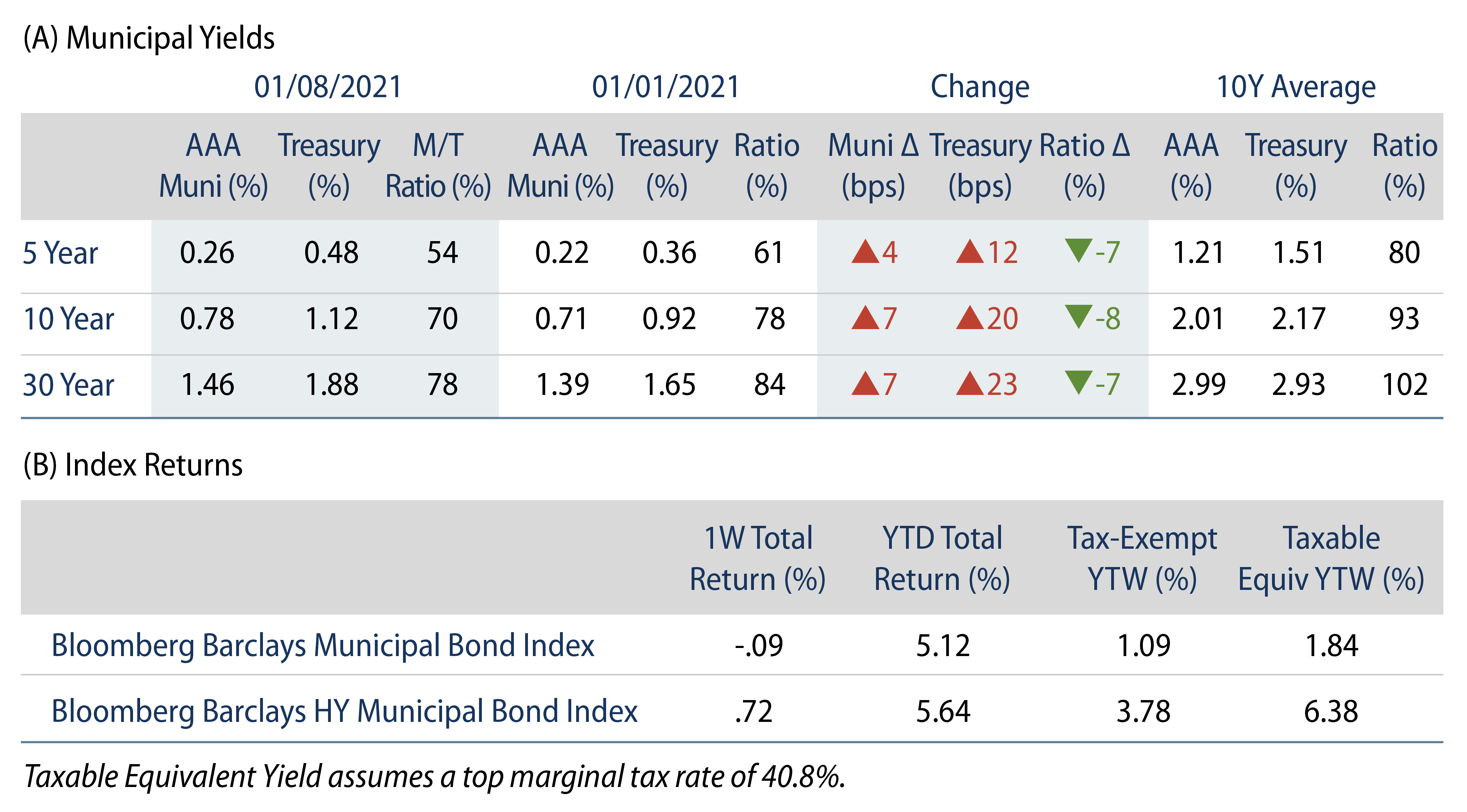

Municipal yields moved higher across the curve, but outperformed the heavy Treasury selloff during the week. Municipal mutual funds recorded a ninth consecutive week of inflows. AAA municipal yields moved 4-7 bps higher across the curve. Both 5- and 10-year Municipal/Treasury ratios touched record lows amid the Treasury selloff. The Bloomberg Barclays Municipal Index returned -0.09%, while the HY Muni Index returned 0.72% as credit spreads tightened due to increased stimulus hopes. Following the Georgia Senate runoffs, we evaluate the implications of a unified government.

Municipal Technicals Remain Strong, Supported by Positive Fund Flows

Fund Flows: Municipal mutual funds recorded a ninth consecutive week of inflows during the week ending January 6, reporting $1.1 billion of net inflows according to Lipper. Long-term funds recorded $465 million of inflows, intermediate funds recorded $150 million of inflows and high-yield funds recorded $98 million of inflows.

Supply: The muni market recorded $3.5 billion of new-issue volume during the first week of the year, and keeping pace with recent trends, one-third of issuance was in the form of taxable issuance. This week’s new-issue calendar is expected to increase to $7.8 billion (+123% week-over-week). The largest deals include $1.3 billion Baylor Scott & White and $651 million Columbus, Ohio general obligation transactions.

This Week in Munis: Implications of a Unified Government

- As we close a tumultuous election season, Democrats’ gaining control of two Senate seats from Georgia will likely have implications for the broader municipal market due to increased prospects of state and local aid, infrastructure initiatives and higher tax rates.

- Direct aid to state and local governments to solve for revenue shortfalls was a controversial issue in prior federal support packages. We expect this to be revisited in the early stages of the new administration as states and localities continue to grapple with sizeable budget gaps. Democrats had favored the measure, which would be positive for municipal credit, particularly among stressed segments of the market.

- Infrastructure is one of the few bipartisan issues Congress may attempt to address in the upcoming session, and the Biden administration may look to a Build America Bond-like solution to support the recovery from the current pandemic, similar to what was achieved during the Obama administration. A federally subsidized taxable debt program would incentivize additional taxable issuance, potentially providing value to a global investor base while creating additional scarcity value of tax-exempt income producing assets.

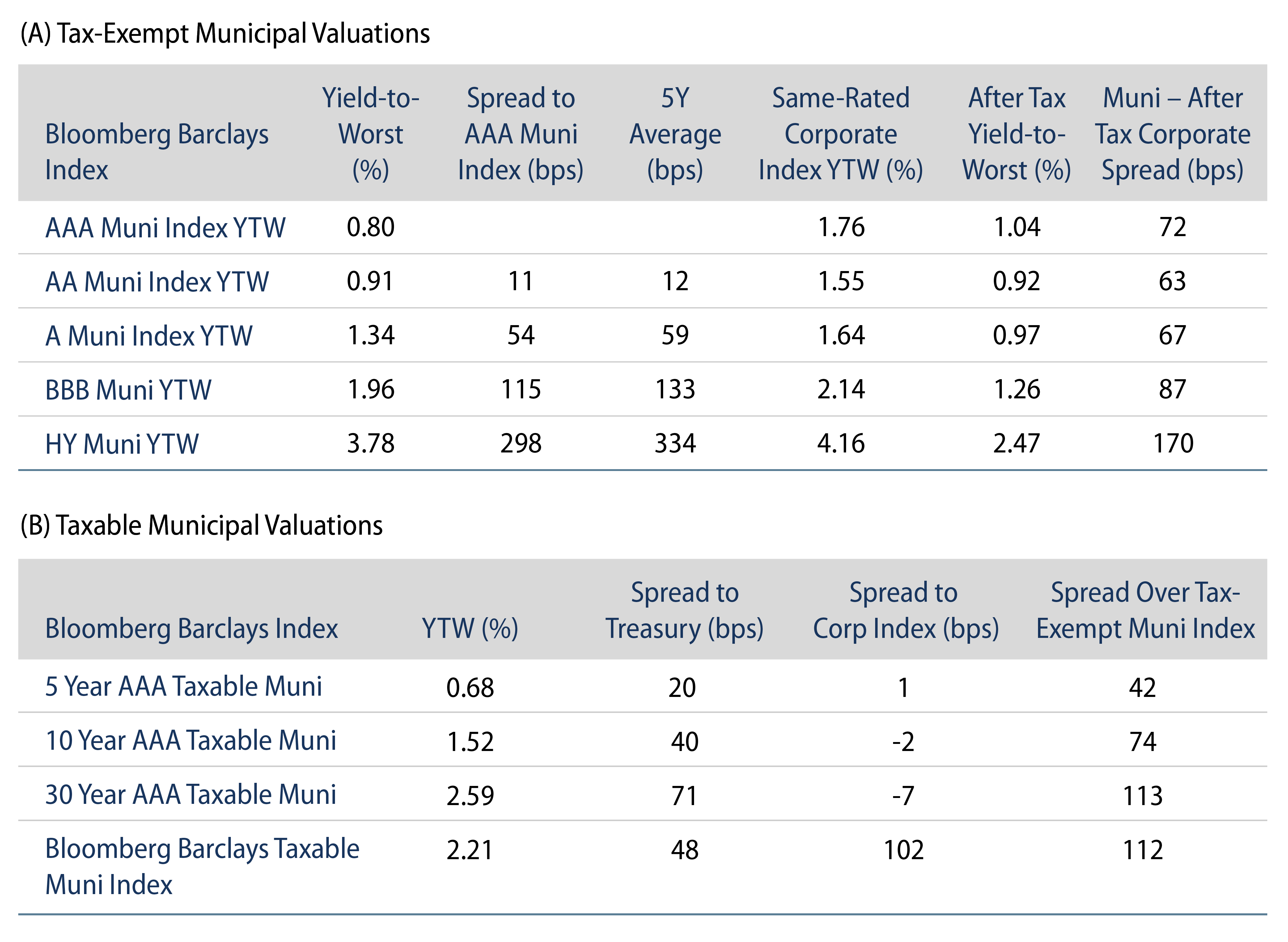

- Increases in higher marginal tax rates are more likely under a Democrat-controlled government, which would increase the relative value of tax-exempt income. Biden has advocated for increasing the highest marginal individual tax rates to 39.6% from 37.0%. The Biden plan also calls for raising the corporate tax rate from 21% to 28%, which would likely attract additional demand from institutions such as banks and insurance companies.

- While all of these measures would be significant and constructive for the municipal market from demand and credit perspectives, we believe Washington policy moves slower than headlines may suggest. We expect the focus of the new administration and Congress to prioritize additional aid and stimulus initiatives to support the economy through the pandemic, ahead of major tax reform initiatives.