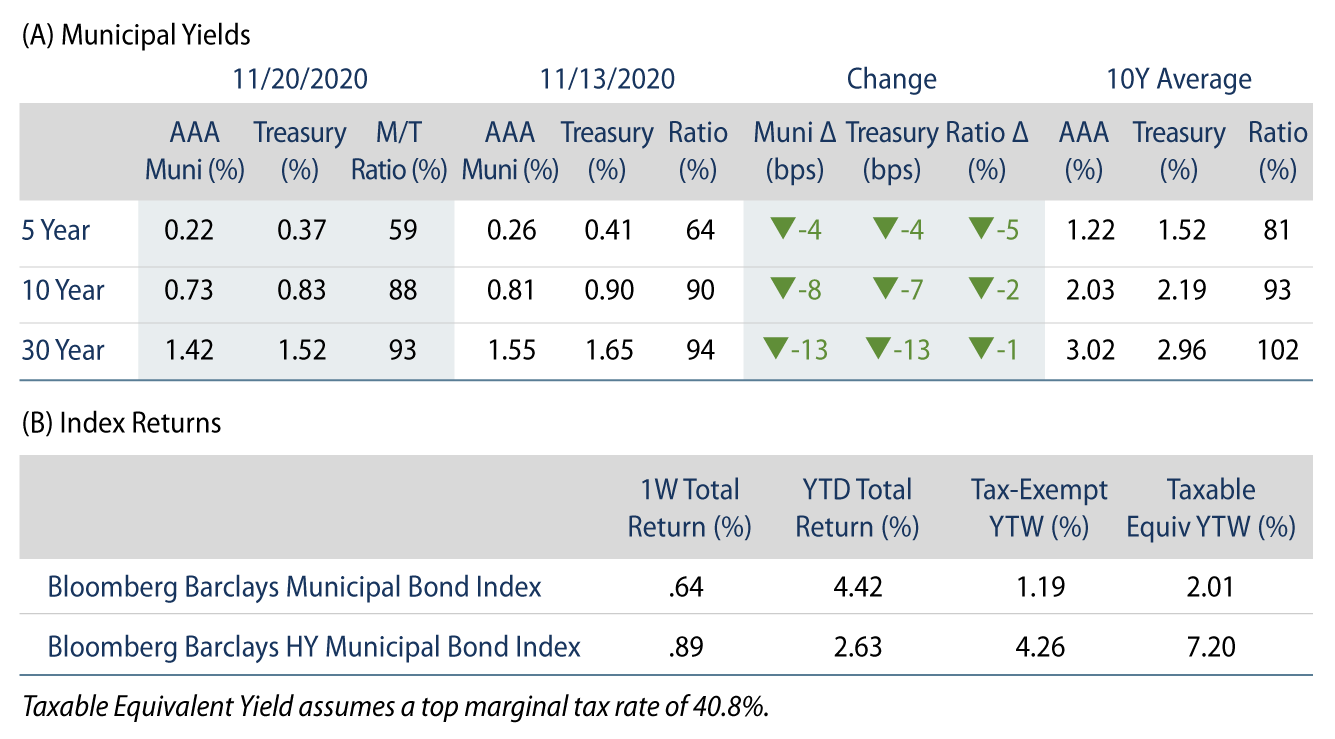

Municipals Rallied Across the Curve

Municipals rallied across the yield curve and outperformed Treasuries. Strong demand for tax-exempt municipal debt persists. AAA municipal yields moved 4-13 bps lower across the curve, outperforming Treasuries. The Bloomberg Barclays Municipal Index returned 0.64%, while the HY Muni Index returned 0.89%. This week, we discuss New Jersey’s move to bring a rare emergency General Obligation (GO) issue to market.

Municipals Recorded Another Week of Strong Demand

Fund Flows: During the week ending November 18, municipal mutual funds recorded $1.3 billion of inflows, according to Lipper. Long-term funds recorded $960 million of inflows, intermediate funds recorded $6 million of inflows and high-yield funds recorded $369 million of inflows. Municipal mutual fund net inflows YTD total $31.1 billion.

Supply: The muni market recorded $13.9 billion of new-issue volume last week, over $10 billion from the prior week as issuers took advantage of the full week of market attention before the Thanksgiving week. Issuance of $433 billion YTD remains 22% above last year’s pace, mostly driven by higher taxable issuance. New issuance is expected to total just $1.3 billion this week due to the holiday. The largest deals include $340 million New York Transportation Development Corporation and $267 million Denton, TX Independent School District transactions.

This Week in Munis: New Jersey Brings a Rare GO Issue

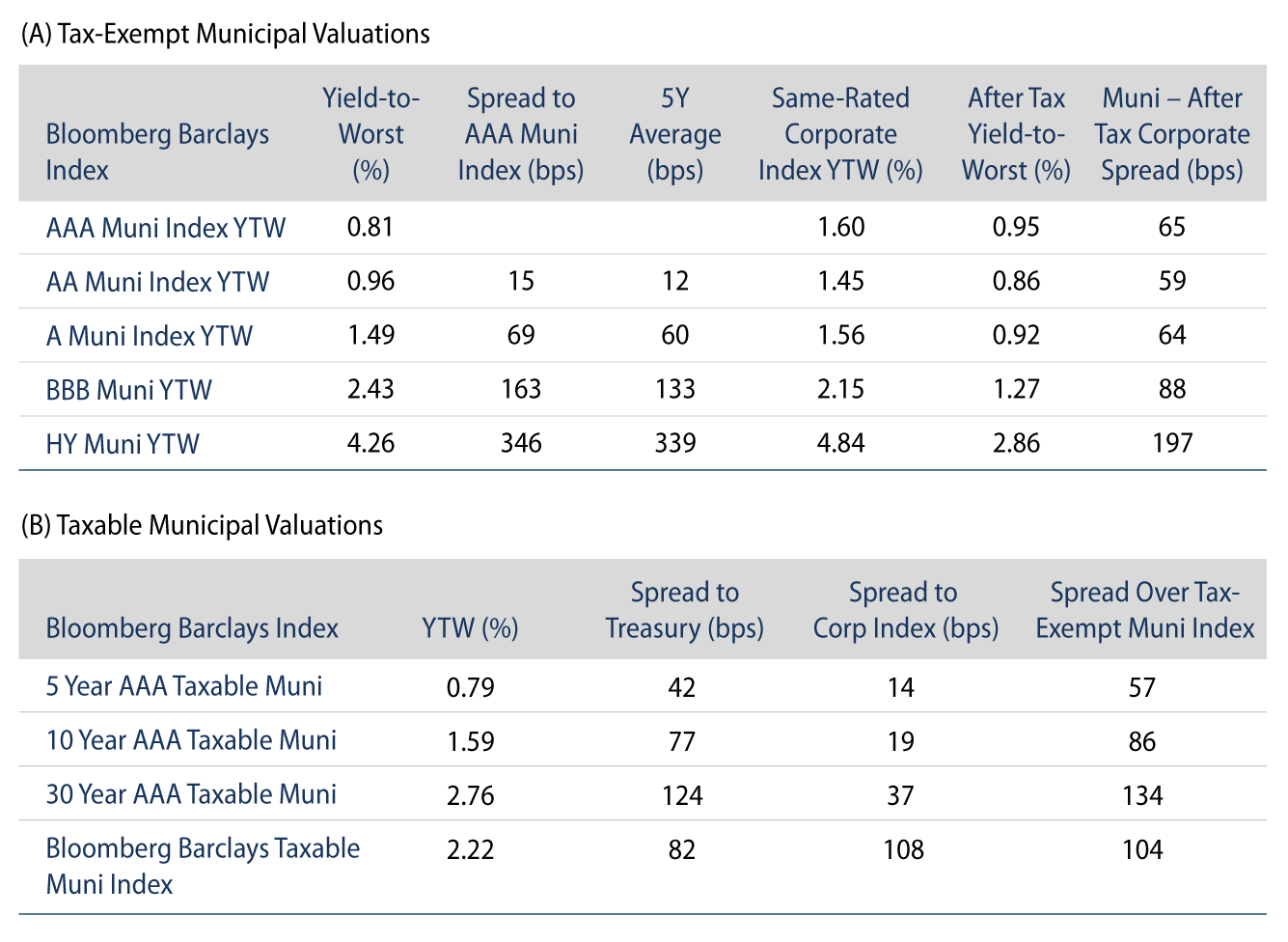

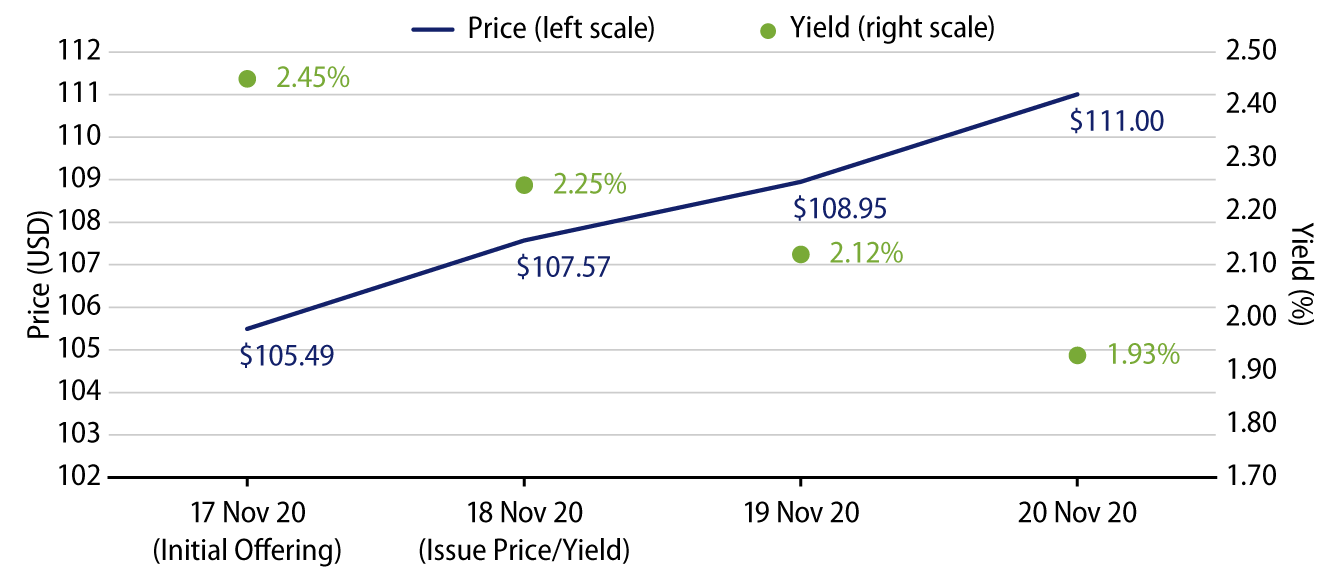

This week, New Jersey issued $4 billion in COVID-19 Emergency General Obligation bonds to close a budget gap caused by pandemic-driven revenue losses. The transaction was nearly 10x oversubscribed, pricing at 1.02%-2.25% from June 2023-2032 maturities. After the deal was free to trade, the market bid-side priced 42-46 bps through the initial pricing.

New Jersey’s fiscal challenges remain in the headlines. The state’s balance sheet is challenged by chronic underfunding of pension liabilities, which has contributed to high fixed costs, operating pressures and slim reserves. While these structural challenges will need to be addressed, the state continues to benefit from its strategic location on the I-95 corridor, proximate to the major job centers of Philadelphia and New York City, contributing to a diverse economy and wealthy tax base. Despite the pandemic, New Jersey’s revenues have held up relatively well this year due to better-than-anticipated tax collections, and may further benefit from cyclical migration to suburban areas. However, this large debt issuance will constrain the state’s financial flexibility and ability to reduce its fixed costs.

The emergency issue allowed the state to circumvent the voter approval process required to issue General Obligation bonds, which is why the majority of New Jersey’s capital structure is comprised of appropriation-backed debt. While we expect headline volatility within the New Jersey debt complex to remain over the secular horizon, we believe this senior lien GO transaction offers New Jersey investors a unique opportunity to improve their position within the state’s capital structure versus the appropriation lien. The issue’s significant market interest and near-term performance highlighted the significant demand outstanding for tax-exempt spread, bolstered by favorable demand technicals which we expect to continue into year-end.