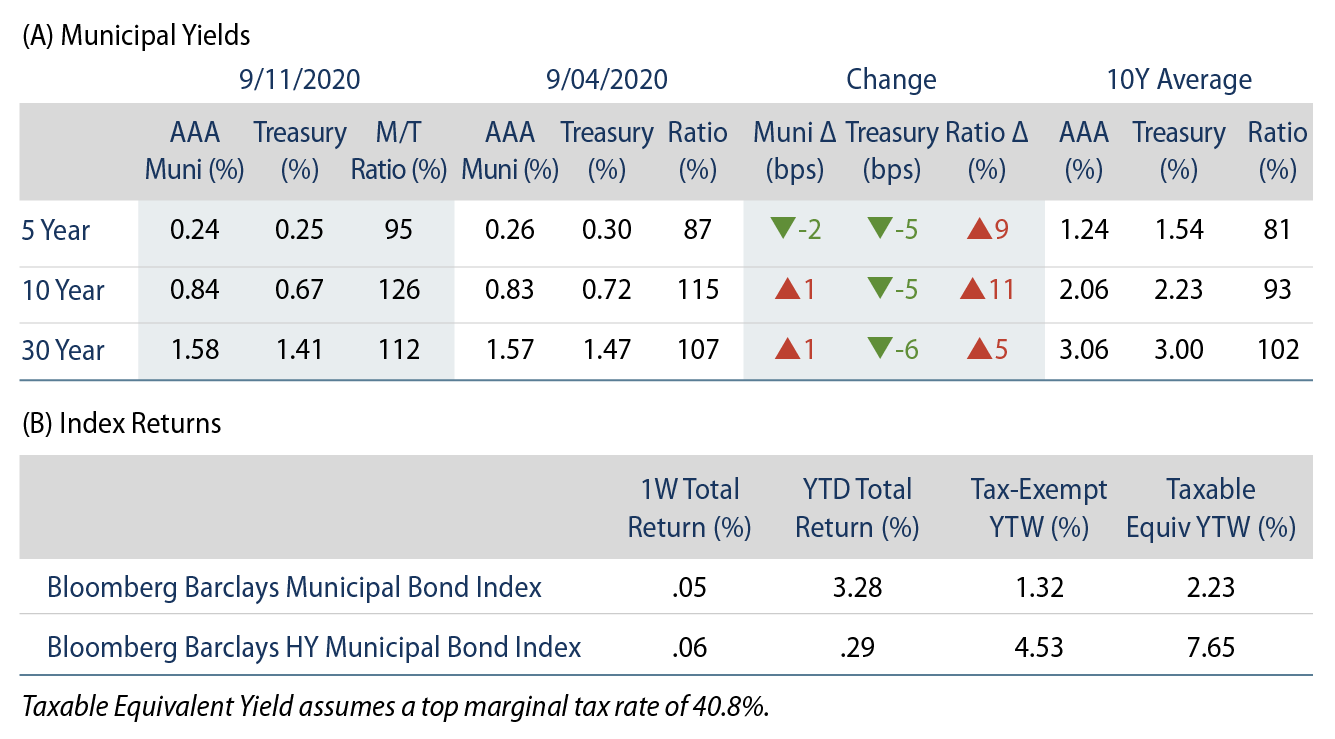

Municipal Yields Ticked Modestly Higher in Intermediate and Long Maturities

AAA Municipal yields were mixed across the curve, underperforming Treasuries, as index returns grinded higher. The Senate failed to advance through Congress its stimulus bill, which provided limited support for municipalities. The Bloomberg Barclays Municipal Index returned 0.05%, while the HY Muni Index returned 0.06%

Technicals: Demand for Munis Persists Amid an Elevated Calendar

Fund Flows: During the week ending September 9, municipal mutual funds reported an 18th consecutive week of inflows at $1.0 billion, according to Lipper. Long-term funds recorded $323 million of inflows, intermediate funds recorded $161 million of inflows, while high-yield funds recorded $88 million of outflows. Municipal mutual fund net inflows YTD total $19.2 billion.

Supply: The muni market recorded $8.4 billion of new-issue volume last week, down 37% from the prior week but remaining relatively elevated considering the holiday-shortened week. Issuance of $311 billion YTD is 28% above last year’s pace, primarily driven by taxable issuance which is up over 264% from last year’s levels. We anticipate approximately $10 billion in new issuance this week (+43% week-over-week). The largest deals include $1.1 billion New York City TFA and $835 million taxable Houston Airport transactions.

The Week in Munis: No Deal

Last week, the Senate voted 52-47 to advance its stimulus bill, failing to achieve the 60 votes required for progression through Congress. Sized at an estimated $500-$700 billion, the bill fell well short of the $2.2 trillion Democratic proposal, and the Democrats were unanimous in opposition.

The Senate’s failed proposal sought to target unemployment benefits and extend aid for small businesses. The proposal provided limited benefit for states and local governments facing massive revenue shortfalls as a result of COVID-19, providing just $105 billion for schools. By contrast, the prior proposal from the Democrats sought to direct $1 trillion of direct aid toward state and local governments. The Democrats’ proposal was met with resistance by the Republican senate majority and President Trump, who considered the package as a bailout of prior poor budgetary practices.

We continue to expect the majority of states and local governments will maintain adequate budgetary flexibility needed to weather revenue challenges associated with COVID-19. However, we believe an increasing prospect of very limited to zero aid to municipalities will result in budget gaps and austerity measures that will lead downgrades to outpace upgrades in the coming quarters. We continue to favor revenue-backed entities with the income diversity and underlying liquidity characteristics to weather the current economic climate, while remaining cautious on downstream entities reliant on state aid that could potentially be compromised during a prolonged period of austerity.