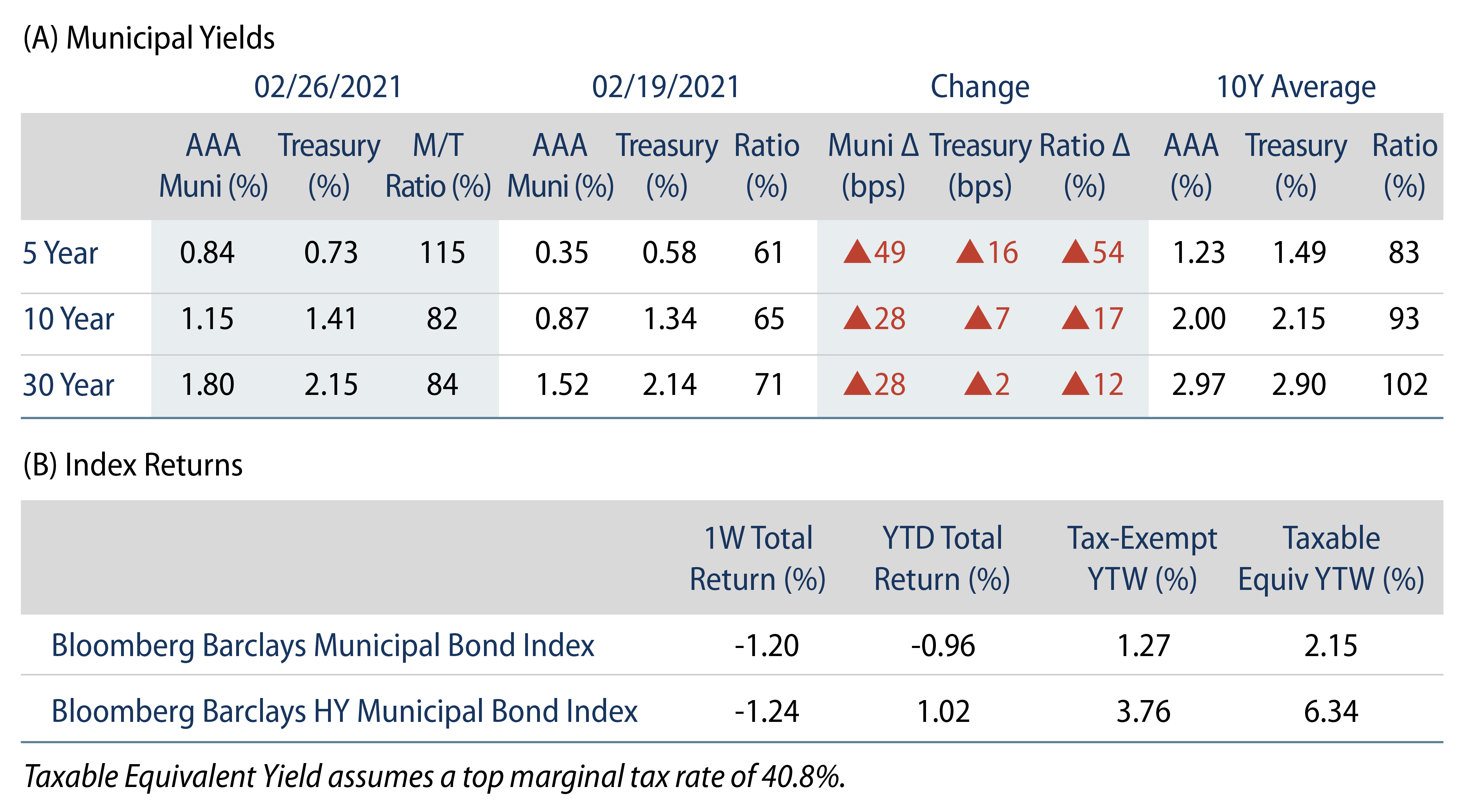

Municipal Yields Moved Higher Across the Curve

US municipal yields moved higher across the curve. Municipal fund flows decelerated but remained positive. AAA municipal yields moved 21-28 bps higher across the curve. Municipals underperformed Treasuries and ratios spiked from record lows to more normal levels. The Bloomberg Barclays Municipal Index returned -1.20%, while the HY Muni Index returned -1.24%. This week we examine the restructuring agreement reached in Puerto Rico.

Fund Inflows Slow, but Remain Positive Despite the Rate Selloff

Fund Flows: During the week ending February 24, municipal mutual funds recorded a 16th consecutive week of net inflows, totaling $38 million, down from $2.0 billion the prior week, according to Lipper. Long-term funds recorded $238 million of outflows, high-yield funds recorded $330 million of outflows and intermediate funds recorded $224 million of inflows. Year-to-date (YTD) net inflows stand at $26 billion.

Supply: The muni market recorded $10.3 billion of new-issue volume during the week, up 63% week-over-week (WoW). New issuance YTD of $60 billion was down 15% year-over-year. This week’s new-issue calendar is expected to decline to $8.2 billion (-20% WoW). The largest deals include $1.4 billion New York City general obligation (GO) and $727 million Bay Area Toll Authority transactions.

This Week in Munis: Puerto Rico Reaches a Tentative Deal

Last week, Puerto Rico reached a tentative deal with bondholders to reduce $18.8 billion of outstanding GO-backed debt liabilities. The deal would provide outstanding GO debtholders with $7 billion in cash and $7.4 billion in new GO debt that matures from 2022 to 2046. The deal also provides bondholders with a contingent interest on the island’s sales and uses tax should collections exceed certain thresholds.

Combined with the previously consummated COFINA creditor agreement, the restructuring will allow Puerto Rico to move forward with a debt structure that is significantly lower than its pre-petition position. The restricting will also enable Puerto Rico to emerge from bankruptcy with a debt burden that is lower than the average of the top-10 most indebted states—greatly enhancing the prospect for future economic stability. Tax-supported debt service as percentage of revenues will drop from 28.1% to 7.6%.

The market reacted favorably as the bellwether 8.0% coupon bond issued in 2014 traded up from $74.00 to $77.75 on the news. Other parts of the Puerto Rico capital structure, including the sales-tax COFINA and the PREPA electric utility liens, also reacted favorably to the news that would bring more clarity to the island’s path forward.

The agreement is an important step in the completion of the island’s debt restructuring process, which has lasted nearly four years and resulted in hundreds of millions of dollars in legal fees. We believe that last week’s solution would provide the Puerto Rican economy much needed debt relief, while allowing the island’s residents and its bondholders to benefit from better future economic prospects.