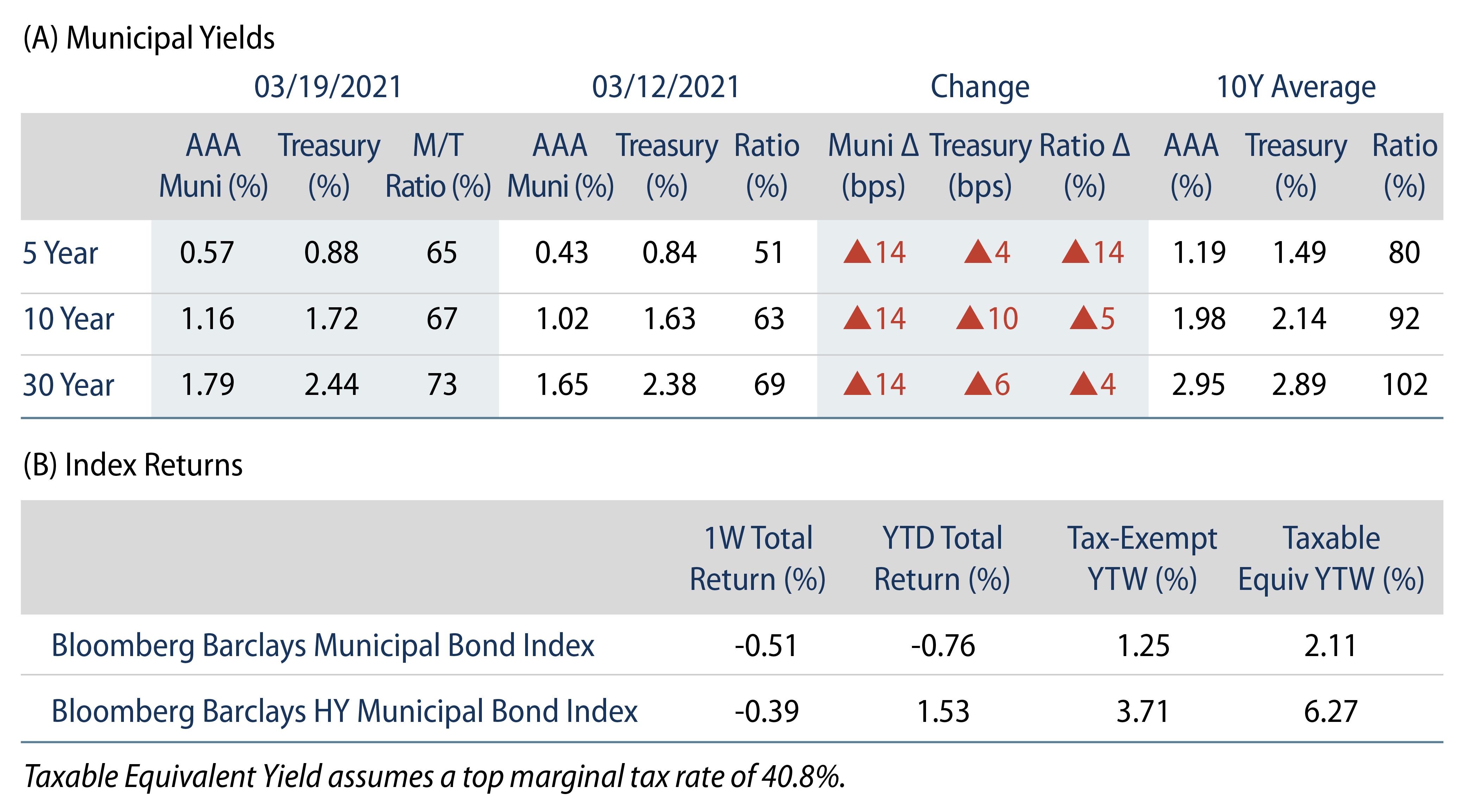

Municipal Yields Moved Higher, Catching Up to the Recent Treasury Selloff

US municipal yields moved higher across the curve, with AAA municipal yields moving 14 bps higher. Municipals underperformed Treasuries following recent weeks of outperformance. Fund flows remained positive amid elevated issuance. The Bloomberg Barclays Municipal Index returned -0.51%, while the HY Muni Index returned -0.39%. This week, as March Madness kicks off, we take a look at states’ sports gambling expansions.

Fund Flows Remained Positive Amid Elevated Supply

Fund Flows: During the week ending March 17, municipal mutual funds recorded $1.3 billion of net inflows. Long-term funds recorded $1.2 billion of inflows, high-yield funds recorded $650 million of inflows and intermediate funds recorded $112 million of inflows. Year-to-date (YTD) net inflows stand at $30.5 billion.

Supply: The muni market recorded $11.9 billion of new-issue volume during the week, up 18% from the prior week. Total issuance YTD of $91.2 billion is up 5% from last year’s levels, but tax-exempt issuance is up just 1% while taxable issuance is 17% higher. This week’s new-issue calendar is expected to remain elevated at $9.7 billion. The largest deals include $1.0 billion New York City Transitional Finance Authority and $695 million State Public Works Board of the state of California transactions.

This Week in Munis: Munis Wagering on March Madness

States have been rapidly expanding into sports gambling since 2018 when the Supreme Court overturned the Professional and Amateur Sports Protection Act, the law that banned sports betting nationwide except in Nevada. Sports betting is now legal in 26 states and Washington, DC, and 18 other states have introduced sports betting bills.

The pace of expansion is not surprising considering the money at stake. Sportsbooks are relatively simple to establish and represent a source of new employment. In addition, significant gambling activities were already present but untaxed across the country. Prior to 2018, Americans wagered an estimated $150 billion through local bookies and offshore operators, and the American Gaming Association estimated that $10 billion was wagered on NCAA March Madness in 2018, with just a miniscule 3% of wagers made lawfully.

We believe tax revenues received from sports gambling should help support states’ minor budget issues and target select education and infrastructure programs. However, the tax revenues should not be considered a panacea for states’ larger, structural challenges. Illinois launched its online gambling operations in June 2020, and in the first six-month period had collected over $20 million in gambling tax revenues. That figure is expected to grow to $70 million annually, but would still only represent just 0.2% of the state’s total tax revenues. In 2020, New Jersey recorded the highest sports betting handle of any state, garnering $65 million in tax collections, which also represented just 0.2% of the state’s tax revenues that year.

Optimistic future revenue collections should also be tempered by more competition. New York is taking note of its neighbor’s success and appears open to the idea of statewide online wagering. While every dollar counts for some issuers facing short-term headwinds, potential longer-term social costs will also be considered to assess whether this gamble really pays off for states.