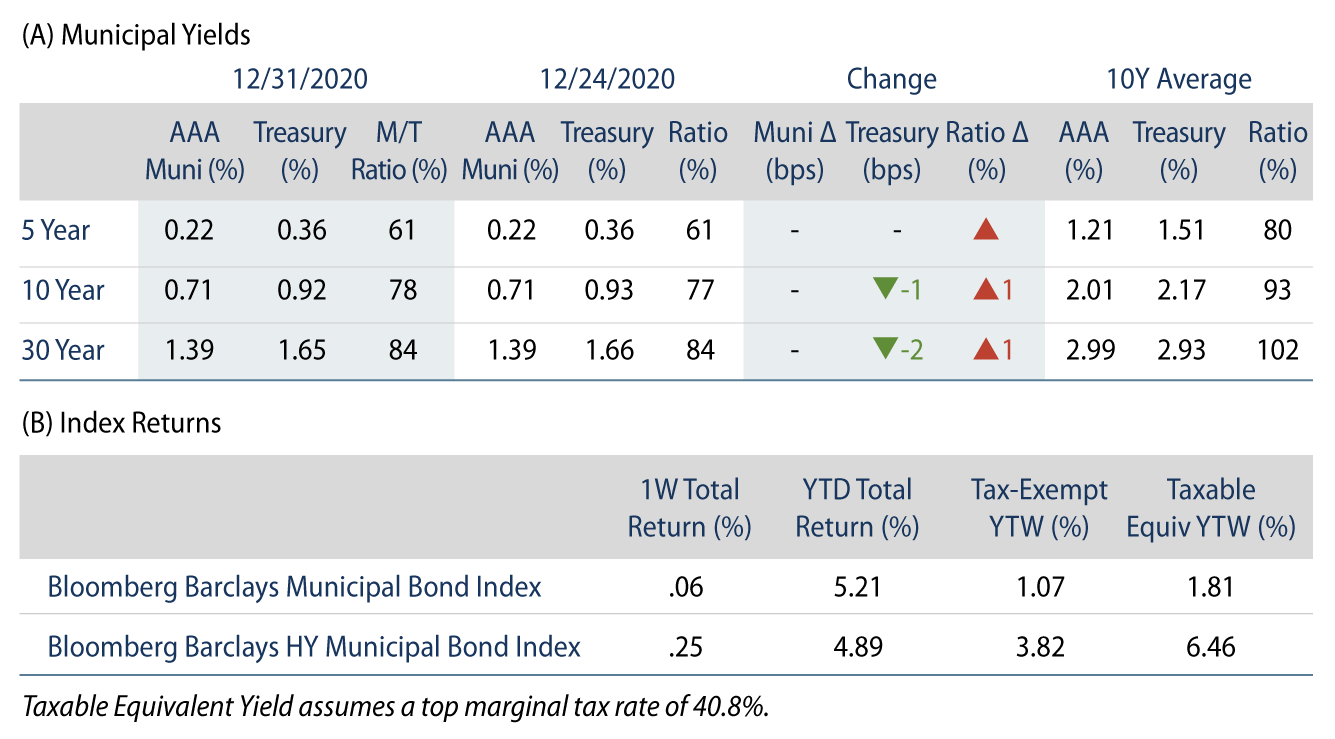

Quiet Week for Muni Yields

Municipal yields were unchanged during the quiet holiday-shortened week. Fund flows remained positive while new-issue supply was virtually non-existent during the last two weeks of 2020. AAA municipal yields were also unchanged during the week. Municipal/Treasury ratios moved slightly higher as Treasuries rallied. The Bloomberg Barclays Municipal Index returned 0.06%, while the HY Muni Index returned 0.25%. All told, the investment-grade index returned 5.21% in 2020, while the high-yield index returned 4.89%. This week we look back at last year’s key performance drivers and touch on our outlook as we head into 2021.

Municipal Technicals Remain Strong, Supported by Positive Fund Flows

Fund Flows: Municipal mutual funds recorded eight consecutive weeks of inflows to end the year. According to Lipper, during the week ending December 30 municipal mutual funds recorded $1.8 billion of net inflows. Long-term funds recorded $704 million of inflows, intermediate funds recorded $140 million of outflows and high-yield funds recorded $228 million of inflows. Municipal mutual fund net inflows ended the year at $39.7 billion, despite the $47.5 billion of outflows observed in March and April.

Supply: The muni market recorded $390 million of new-issue volume over the last two holiday-shortened weeks. Issuance of $498 billion in 2020 marked a record year of issuance, up 18% year-over-year (YoY), primarily driven by higher taxable issuance, which was 118% higher YoY. Tax-exempt issuance declined 3.8% YoY.

This Week in Munis: Year in Review

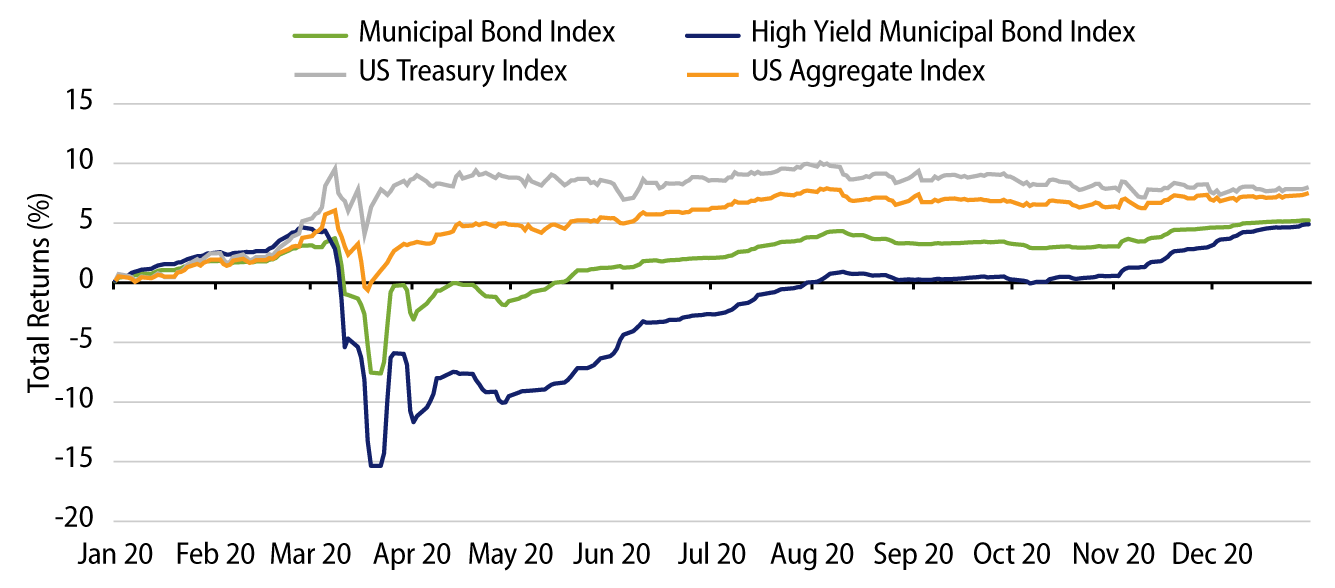

It was an unprecedented year for the municipal market. Munis disconnected from their traditional safe-haven status amid the heightened illiquidity and credit challenges observed in March when municipal mutual funds recorded their most rapid outflow cycle in the history of the municipal market. The Bloomberg Barclays Municipal Bond Index declined nearly 11% over that two-week period.

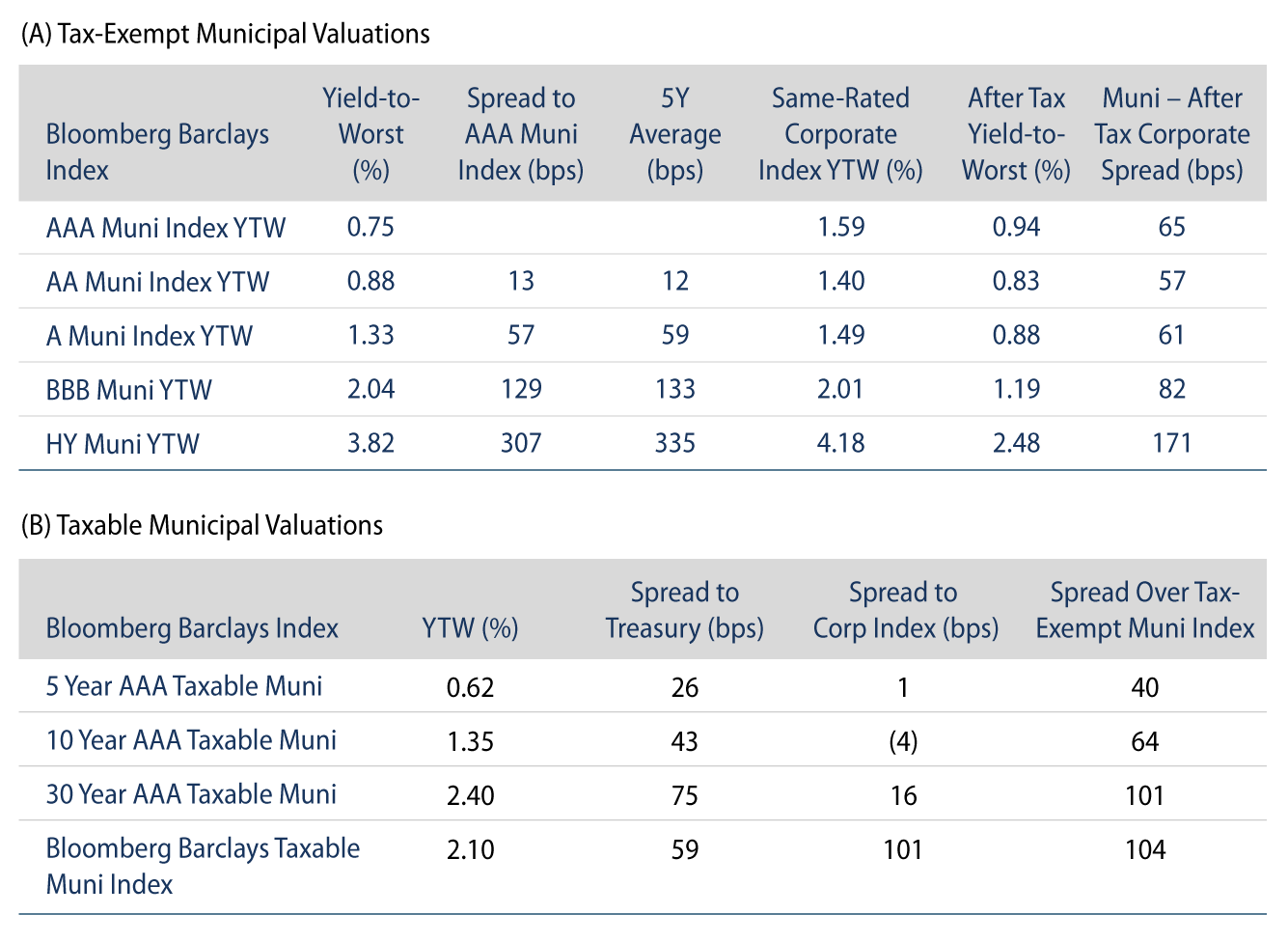

Following the congressional aid and Federal Reserve stabilization measures, the muni market recovered throughout 2020 and fund flows ended the year in positive territory. All told, the Bloomberg Barclays Municipal Bond Index returned 5.21% and the Taxable Municipal Bond Index returned 10.52%. Tax-exempts underperformed Treasuries and like-rated corporates, while taxable munis outperformed on increasing global demand for the asset class.

Quality Returns: Highest-quality municipals were the best performers of 2020, largely due to the severity of the pandemic-related drawdowns, particularly in HY municipal funds. AAA, AA and A rated indices returned 5.51%, 5.24%, and 5.27%, respectively. BBB and HY municipal indices underperformed, returning 4.55% and 4.89%, respectively.

Sector Returns: From a sector perspective, general obligation (GO) bonds outpaced revenue bonds, with the GO sector returning 5.49% and the revenue-backed sector returning 5.31%. Top-performing revenue sectors included the essential services; investment-grade tobacco, water & sewer, and health care sectors outperformed, returning 6.60%, 5.86% and 5.70%, respectively. Resource recovery, special tax and housing underperformed the broader index, returning 3.11%, 4.73%, and 4.47%, respectively.

Curve Returns: Duration contributed to municipal returns, as 10-year muni bonds and beyond outperformed the index for calendar year 2020. However, intermediate munis were the top performers as the 15-year municipal bond index returned 6.32% for the year.

Our Preliminary 2021 Muni Outlook

- Municipalities will continue to grapple with the economic impact of the pandemic and their need to address sizeable budget gaps through the first half of 2021 as large parts of the US remain quarantined. We do not anticipate vaccine rollouts to materially impact growth ahead of the second quarter.

- While states and locals did not receive the well-publicized stimulus needed to address revenue shortfalls, we expect the muni market to still benefit either directly or indirectly from the $900 billion bill passed through Congress at the end of 2020. The $281 billion Paycheck Protection Program should be supportive of tax collections, while certain sectors should benefit from direct aid measures, including $54 billion for primary and secondary education, $45 billion for transportation and $23 billion for higher education. We also anticipate Democrats will push for additional aid, specifically aid for state and local governments, after January 20 when President-elect Biden takes office.

- Given the anticipated austerity measures that will result from the budgetary gaps which are likely to persist throughout the year, absent additional aid, we anticipate downgrades to outpace upgrades, but for defaults to remain concentrated within the speculative-grade segment of the municipal market.

- The volatility and unprecedented conditions seen in 2020 underscore the benefits of active management in the municipal market. These benefits include investment managers’ ability to independently evaluate credits and anticipate expected volatility associated with downgrade pressures, as well as to manage liquidity ahead of increased market sensitivity to fund flow cycles.