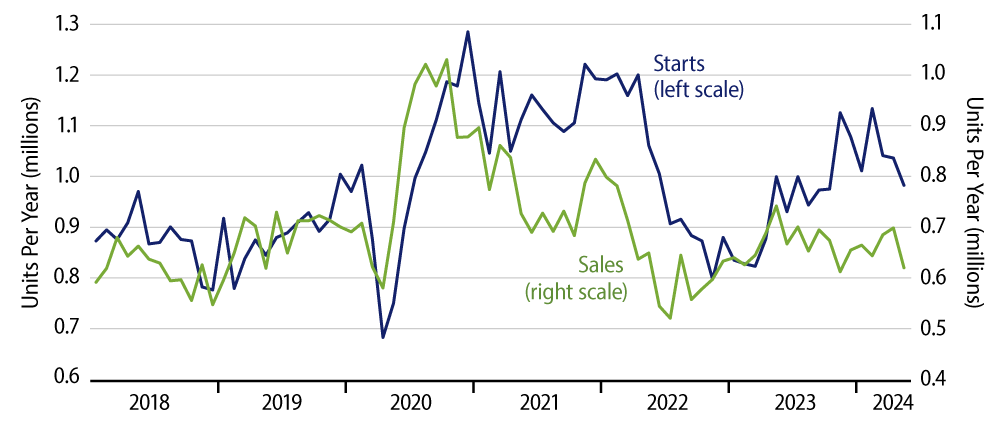

Sales of new homes declined -11.3% in May, but that was from an April sales level that was revised upward by +10.1%. In other words, May sales levels were only a little bit below the April sales estimate produced a month ago, and as you can see in the chart, new-home sales have been declining at only a leisurely pace over the last year. The problem we see for homebuilders is that while sales have not been declining sharply, they are nevertheless way too low to be consistent with current levels of single-family housing starts.

The gap between the two series is obvious. The scales in the chart are adjusted for the fact that owner-builds and other not-for-sale units show up in starts, but not in sales. The intention of the chart is that whenever the blue line (starts) is above the green line (sales), inventories of unsold homes are rising, and vice versa.

This has indeed been the case. From their swing points in February 2023, single-family starts are up +18.7% (even with the declines of the last three months), while new-home sales are down -1.0%. Over that period, inventories of unsold new homes have risen steadily and stood in May at 9.3 months’ sales. This is in comparison to a normal inventory-to-sales ratio for new homes of about 4 months’ sales.

The received wisdom among housing economists is that homes are in short supply. We have some reservations about that even for the existing-home market, in that a lack of existing homes for sale also means a lack of existing homeowners looking to buy somewhere else. Even so, one cannot look at the new-home data and claim any shortage of product there. Builders have been producing homes faster than they can sell them since late 2020.

The disparity between single-family starts and new-home sales in late 2021 led to a sharp decline in homebuilding in 2022, but builders then got optimistic again and ramped up construction last year. The present, apparent imbalance between starts and sales looks nearly as ominous as that of late 2021. It could well be that the declines in single-family starts of the last three months are just the beginning of a slide comparable to what we saw in 2022.

So, no, the May new-homes sales release was not particularly soft on net, as revisions offset much of the announced May decline. However, it would have required a sharp, sustained rise in new-home sales to take the pressure off homebuilders, and that we did not see.