Sales of new, single-family homes rose by 12.4% in November. That increase sounds impressive until you fold in the fact that the reported increase comes off an October sales level that was revised lower by -11.1%. On net, the home sales level reported for November was very slightly lower than that originally reported for October. (Yes, an 11.1% decline fully offsets a 12.4% increase. Do the math.)

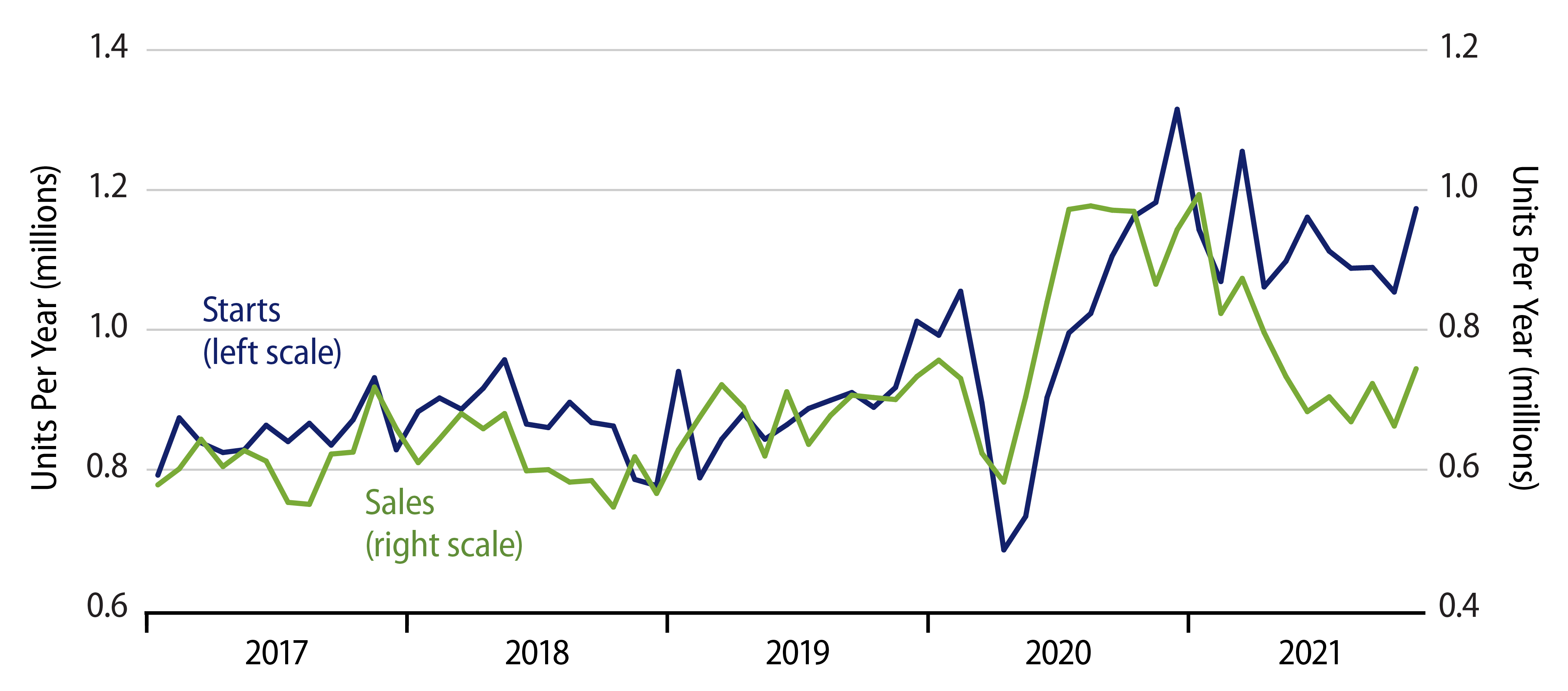

As you can see in the accompanying chart, sales of new homes have been languishing around the low-700,000s level since June. This pace isn’t bad. It is equal to the rate of new-home sales seen in the years prior to the pandemic. However, it is down markedly from the heady pace seen in the early days following reopening of the economy late last year.

A year ago, many analysts believed that the elevated levels of home sales seen in late-2020 were a sustainable trend. Dare we say, that seemed to be the consensus estimate. However, the experience of the last 10 months makes clear that that was a brief post-shutdown surge, with recent sales levels the sustainable reality.

The problem for homebuilders is that single-family housing starts have still not dropped to a rate consistent with current new-home sales levels, even though starts have also been dropping for most of the past year. The scales in the chart adjust for our estimate of owner-builds, which show up in starts of new homes, but not in sales. By that reckoning, starts have held well above sales levels for the past six months.

And indeed, inventories of new homes have been rising throughout those months. Inventories of unsold new homes rose to 402,000 units, equivalent to 6.5 months’ worth of sales. In contrast, inventories typically hold at four months’ worth of sales in non-frothy housing markets. (Also, if you hear someone claim that new-home sales are restrained by lack of supply, ask them how that could be when inventories of new homes continue to accumulate.)

As we have mentioned repeatedly when discussing the homebuilding market, we are not looking for actual weakness here, merely a return to pre-Covid operating norms. The new-home sales data have been consistent with this. However, builders have been slow to adapt to sales realities, with the result that unsold inventories are piling up. Look for starts and for residential construction spending to head markedly lower in months to come.

In other data released today, November consumer spending mirrored the softness evinced by November retail sales, with goods spending declining in real terms and service eking out only a modest gain, leaving total real consumer spending unchanged from October.

May you all enjoy a happy Christmas, Hanukkah, or whatever holiday you celebrate this month.