Headline retail sales rose 0.7% in March, with a +0.5% revision to the February sales estimate. The closely watched core sales measure rose an even stronger 1.1% in March, also with a +0.5% revision to February sales. (Control sales abstracts from sales at car dealers, gas stations, building material stores and restaurants, partly because sales at these sectors are especially volatile and partly in order to focus on more consumer-oriented retail sectors.)

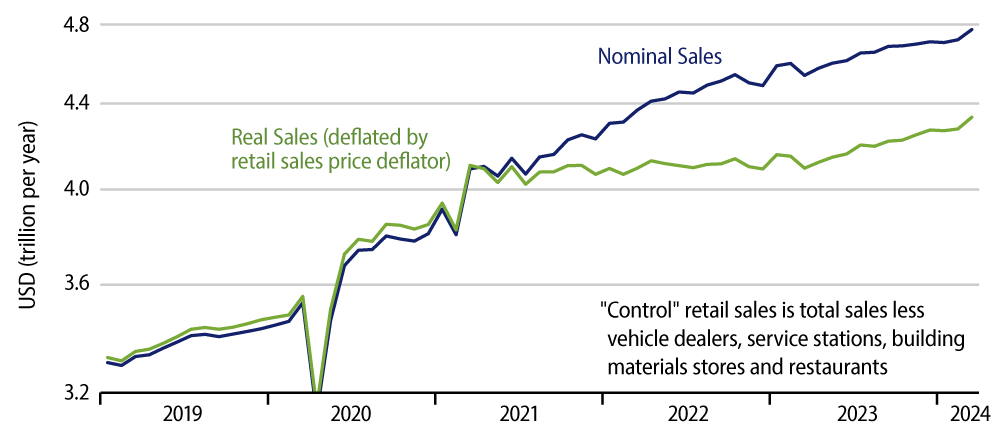

Retail sales had appeared to soften in January and February, with both months showing declines in real sales. However, today’s report pretty much obliterated that apparent softness, revising away much of the January/February declines and providing a good boost to real sales in March. As you can see in the chart, the March level of real sales is right on the trend line established over the last nine months of 2023.

If there was any blemish to the retail report, it was that the sales gains were concentrated among online vendors. Online sales accounted for most of the March sales gain and much of the upward revisions to February. Online sales had shown some unusual softness in the February report, but that was revised and reversed in today’s data.

This was a blemish only in the sense that brick-and-mortar retailers continue to struggle, while online sales are growing rapidly. One type of sales is as good as the other for propelling economic growth, but it might be a different story for retailer profits and employment.

Besides the gains in online sales, gas station sales have also shown a nice bounce in real terms over the last three months. Real gas station sales had been declining for most of 2022 and all of 2023, but they have risen each month this year, despite the bounce in gas prices. This has clearly not been summer driving season, so we are at a loss to explain this increase.

In fact, the consumer strength of the last year has been a surprise to us. Growth in real incomes has been only modest, but spending has risen nicely anyway, pushing personal saving rates to very low levels and pushing up credit card debt. We have been of the opinion that consumers were overextended and due to pull back, but there is no indication of this in the current data, especially with today’s news.