According to data released today by the Bureau of Labor Statistics, private-sector payrolls rose by 230,000 jobs in April, though there was a whopping -149,000 revision to the March employment estimate. Private-sector workweeks declined, offsetting some of the April job gains, and with the revisions to March, total hours worked actually show a net decline over the last two months (shorter workweeks more than offsetting job gains). Average hourly earnings rose by 0.5% for all workers and by 0.4% for production workers, with both gains somewhat above what we had seen in preceding months.

The Federal Reserve (Fed)—and most economists—have been expecting labor markets to weaken in response to the Fed’s rate hikes of the past 15 months. It is fair to say that we are all still waiting. As you would guess from the various facts stated above, the April report was mixed. However, “mixed” is not the “clearly weak” descriptor the markets have been hoping for, thus lower bond prices today in the wake of the data.

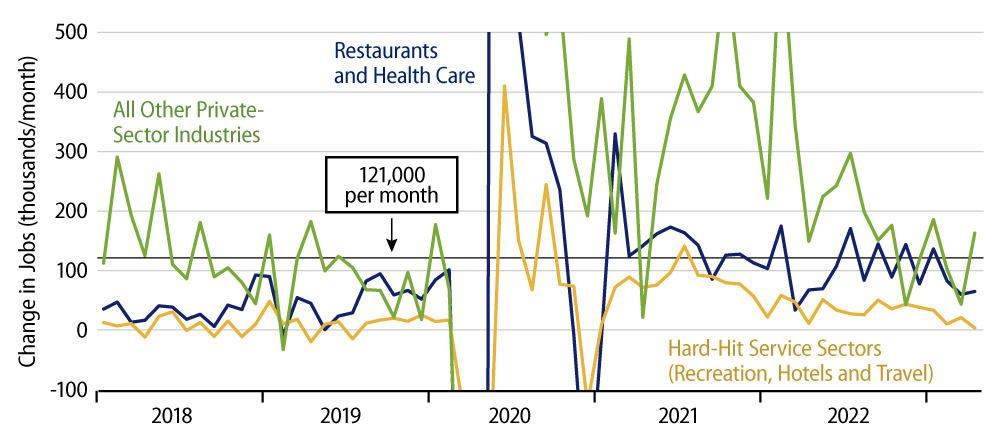

The chart breaks private-sector job growth down between Covid-afflicted sectors (gold and blue lines) and everybody else (green line). “Everybody else” saw some bounce in job growth in April, but this was mostly an offset of a weaker March gain, just as the January bounce was an offset of a weaker December. Beneath all this monthly chop, job growth does look to be slowing, but it is not as yet slowing precipitously enough to placate some.

Why is this? Covid still likely comes into play here. Enough companies are still struggling to re-attain normal staffing levels to provide lift to total jobs. This assertion is supported by the continued declines in workweeks opposite the job gains. Existing staff have been “overworked” over the past three years, and employers are continuing to hire to relieve these stresses. And, no, this process is not yet complete, as average workweeks in service industries are still markedly higher than they were prior to Covid.

That workweeks have been declining recently more than jobs have been rising indicates that total production is slowing/declining, which, by itself, would portend coming recession. At the same time, however, employers are not so worried about a coming recession that they are refraining from hiring now. All in all, again, a mixed bag in the labor markets at present.