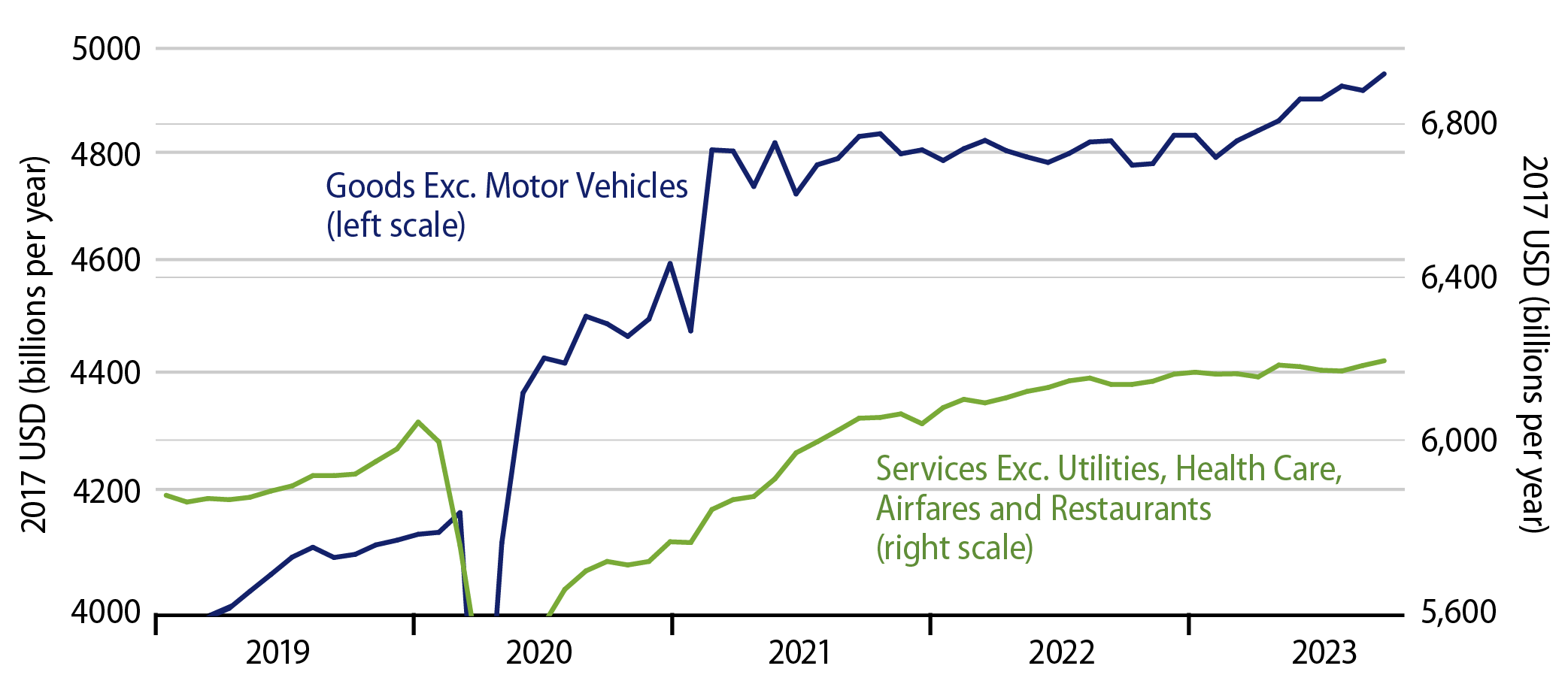

Real consumer spending rose 0.3% in November, but that was off an October spending level that was revised down by -0.2%. In other words, spending was up 0.1% from what was announced for October a month ago. Last week, we reported that the November retail sales data showed nice gains. Indeed, real consumer spending on merchandise other than motor vehicles rose by 0.6% in November, though also with a -0.2% revision to October. However, retail sales data do not cover the service sector (other than restaurants), and there, real spending rose just 0.1% in November, with a -0.2% revision to October.

These data suggest a slight, incipient parting of the ways between goods and services spending. Both had proceeded at a nice clip since the summer, but today’s data show possibly softer services spending growth going forward. One month doesn’t make a trend, so it is way too early to jump on today’s data for services, but the softer pattern there in the November release bears watching. Maybe it will be revised away next month, or maybe it is an indicator of a slower growth pattern for consumer spending.

The data do indicate slower consumer growth in 4Q. Street analysts had been looking for 4Q annualized consumer growth well into the 3-handle range. Today’s data cum revisions knock that down to 2.5%.

We would add that a slower consumption growth pace would be more consistent with the income growth trends seen over recent months. However, the consumer sector has fooled us to the upside throughout the last six months, so we will just have to see if the November readings stick.

One phenomenon that is sticking is the sharp slowing in inflation. The headline Personal Consumption Expenditure (PCE) price index declined -0.1% in November. The core PCE rose less than 0.1% (0.06% to be exact). Furthermore, in line with Fed Chair Powell’s remarks that reported shelter prices are known to be lagging market realities, core PCE excluding shelter was unchanged in November: 0.0% change.

And, no, this is not a short-term phenomenon. For the last six months, core PCE inflation has proceeded at a 1.9% annualized rate, while core PCE inflation excluding shelter has come in at a 1.1% annualized rate. In other words, even including overstated shelter prices, inflation has come in just under the Fed’s target, and abstracting from those shelter prices, core inflation has been way below the Fed’s target for half a year.

Fed officials have already begun to take notice of the inflation slowing in their policy deliberations, and they can’t help but take more serious notice of the recent data. Even if the incipient softness in consumption falls by the wayside, the inflation data alone would seem to be enough to fulfill the Fed’s guesstimates of policy easing next year. If softer consumption becomes an enduring reality as well, Fed moves in 2024 would likely be more intense than has already been suggested.

Merry Christmas, happy holidays, and a joyous 2024 to all our readers. Thank you for following our posts this year.