The first estimate of 4Q22 real GDP from the US Bureau of Economic Analysis (BEA) came in today at an annualized rate of 2.9%. This was above the market consensus at 2.0% and further above our own guesstimate of 0.8%. Inflation as per the price index for GDP came in at 3.5% annualized, so that nominal GDP was reported to have grown at a 6.5% annualized rate in 4Q.

While GDP was above forecast, the details were actually decidedly weaker than expected. Thus, real consumer spending grew at only a 2.1% rate, versus expectations of 2.9%, and consumer spending on goods was essentially unchanged, while spending on services was below expectations, up “only” 2.6%. Real business investment in equipment declined substantially (down at a -3.7% rate), so that only continued growth in research and development kept capital spending rising. Residential construction dropped very sharply.

The GDP growth surprise in 4Q was driven by inventories and foreign trade. For foreign trade, while real exports declined, real imports declined even more. Thanks to trade and inventories, BEA data show goods-sector GDP (output of manufacturing and mining) growing at a 6.6% per year rate in 4Q. In contrast, Federal Reserve (Fed) data show industrial output for these sectors declining at a -2.7% annualized rate.

We should point out that such discrepancies—as between the GDP and industrial data—are pretty common. Industrial output did not show the 1H22 declines indicated by the GDP data, and neither did it show the robust gains indicated by GDP data in 2H22.

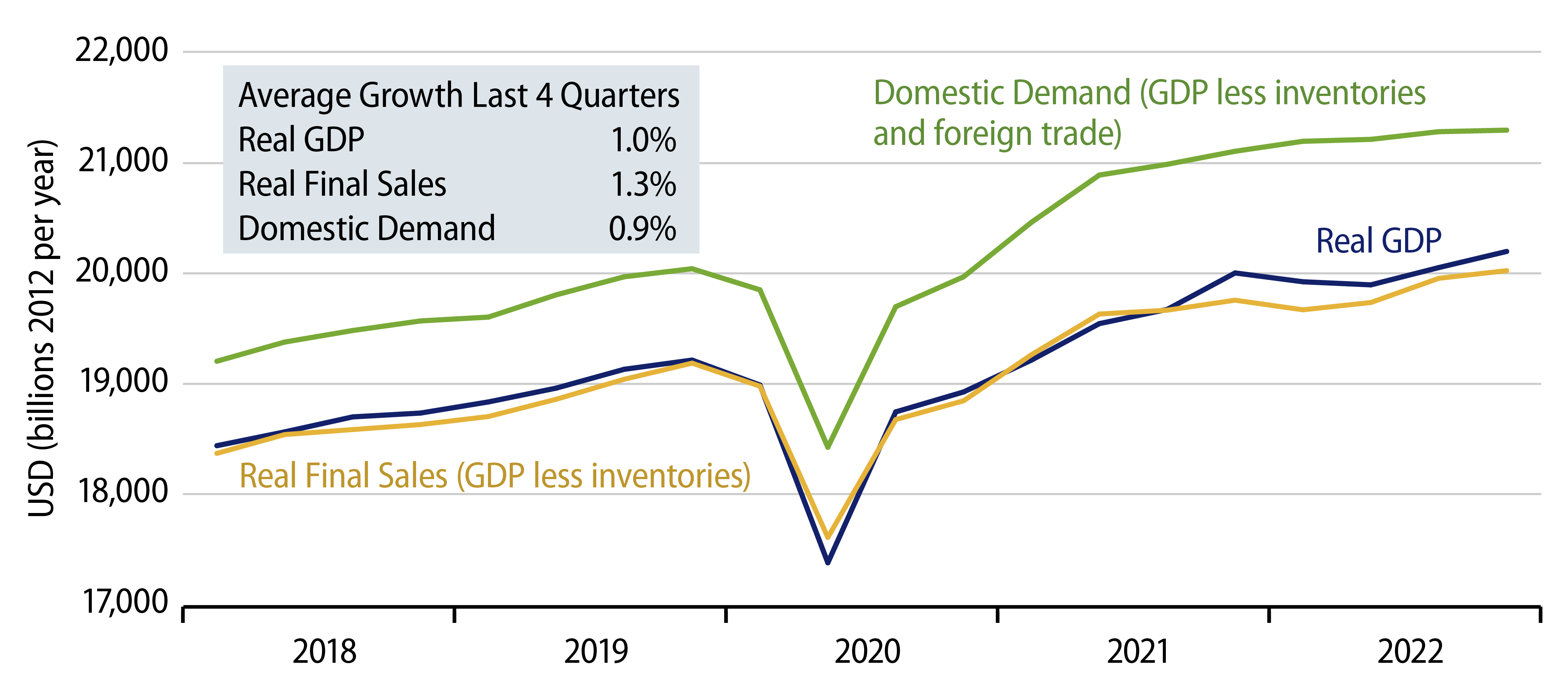

For all of 2022, the relevant statistics are reported in the chart. Real GDP grew 1.0% from 4Q21 to 4Q22. Real final sales are GDP less inventory investment, and this measure grew 1.3% over the four quarters of 2022. Domestic demand is the sum of domestic spending by consumers, businesses and government. It grew 0.9% for all of 2022 and at only a 0.3% rate in 4Q.

Clearly, US domestic spending growth slowed sharply in 2022, in line with the Fed’s wishes. It is doubtful that imports can continue to decline or that inventories will continue to grow such that they sustain reported GDP growth at recent rates. We don’t expect domestic demand to rebound, so we expect even slower overall growth in 2023 than was seen last year.