Headline retail sales rose 0.6% in August, on top of a +0.2% revision to the July sales estimate, according to data released today by the Census Bureau. The more closely watched “control” sales measure rose 0.7% in August with a +0.1% revision to its July estimate. (The control measure abstracts from sales at car dealers, service stations, building material stores and restaurants, in order to focus on retail sectors catering more to consumers rather than business customers.) Our estimate is that prices for the control group rose 0.1% in August, so even in real (inflation-adjusted) terms, control sales rose nicely in August.

As we mentioned a month ago, with healthy sales gains in July and sizable upward revisions to previous months’ data, the July retail sales release went a long way toward painting a healthier picture of consumer behavior than what we had seen previously. The August data continue that more upbeat take.

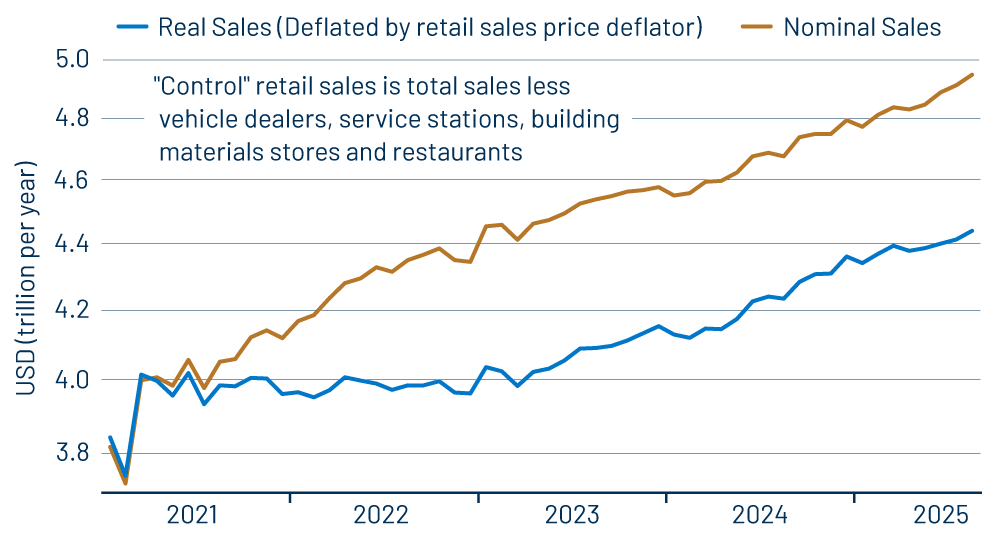

As you can see in Exhibit 1, real control sales now look to have been rising steadily for the last three years, with no sign of a recent slowing. This is in line with our take on the recent jobs data.

That is, while some analysts have been decrying a supposedly recent slowing in job growth, we have pointed out that job growth actually has been slowing for the last three years. And, as mentioned in our September 5 post, the recently announced benchmark revisions to 2024 job growth—which reduced said growth by 880,000 private-sector jobs—will make that slowing trend stand out more clearly.

Now, those revisions won’t be reflected in the official jobs data until next February. However, they are already reflected in the personal income data released by the Commerce Department, which are now benchmarked to complete payroll data through March 2025. That income data shows a healthy 2.1% annualized rate of increase for real private-sector wage and salary income year-to-date (YTD) through July. That is right in line with the 2.8% annualized YTD growth in real control sales through August.

If anything, real retail sales have grown slightly more rapidly than incomes so far this year. However, remember that retail sales cover consumer spending on merchandise. Spending on services has grown more slowly than spending on merchandise so far this year, which indicates that total consumer spending has grown about in line with incomes, and personal saving rates have inched up this year.

As we have mentioned previously, the faster growth in spending on merchandise than on services is somewhat anomalous. With tariffs affecting goods prices more than services prices, one would have expected services spending to hold up better under the effects of widespread tariff impositions. We are seeing the opposite, which suggests that other factors are much bigger influences on consumer behavior than tariffs.

Meanwhile, the more-than-decent growth in retail sales, both in nominal and real terms, indicates that consumers are holding up just fine. Again, while job growth is softish, growth in household incomes is holding up fine, and consumers are reacting accordingly. There are dark clouds on the housing horizon, and it may well be that we haven’t seen the full effects of tariffs on retail prices and consumer behavior. For now, though, there are no worrisome signals emanating from the retail sales data.