Headline retail sales were unchanged in September, held down by declines in sales at vehicle dealers, building material stores and service stations. All three of those sectors are excluded from so-called “control” sales, which also excludes restaurants. So, that more stable measure actually registered an increase of 0.4%.

Meanwhile, as disappointing as yesterday’s CPI print was, with core inflation proceeding at 0.6% on the month, goods prices were well-behaved. That is, core goods inflation was zero in September (even upon excluding falling gasoline prices). So, with control sales up 0.4% and core goods prices unchanged, real control sales showed a 0.4% gain.

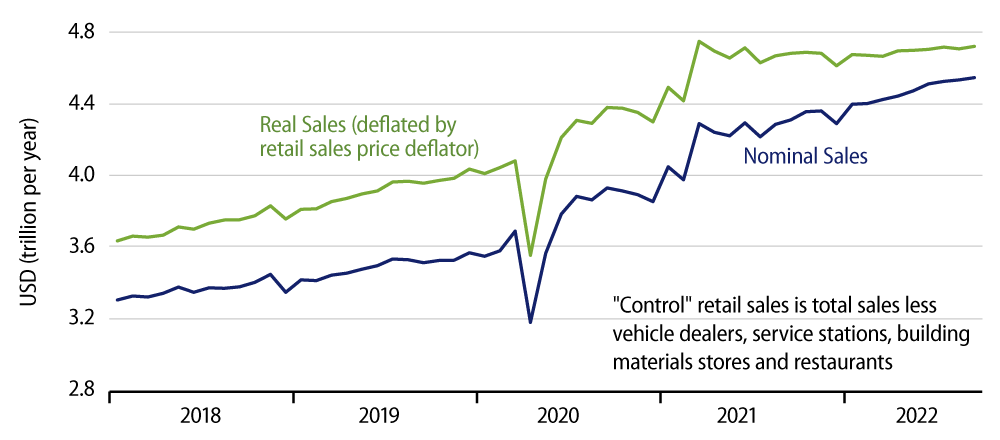

As you can see in the green line in the accompanying chart, this September gain does not change the narrative for goods consumption in place since March 2021. For the last 18 months, real goods consumption has been slowly declining as consumers shift outlays from goods to (previously unavailable) services. And, as mentioned in our September 30 post, services consumption growth has slowed slightly in recent months, as declining real incomes have bit into consumer outlays.

Still, the softening in consumer outlays has been remarkably gradual, and with goods consumption likely to eke out a small gain in September, that gradual adjustment still looks to be in place. In other words, despite a relatively quick turnaround in the housing sector from bubble to bust and despite the mounting effects of the Fed’s tightening efforts over this year, consumer activity remains on a path of only gradual slowing.

Given their rhetoric, Fed officials probably would prefer to see a more abrupt response in either hiring activity or consumption, but that has not yet been the case. Still, our advice to the Fed would be “Be careful what you wish for.” If they keep pushing, things might yet break.

In terms of sales by store type, most sectors mirror the gradual “downshift” evinced by real control sales shown in the chart. The most noticeable declines in real terms are at vehicle, building material, furniture and grocery stores. The declines in the first three likely reflect incipient effects of higher interest rates. Declines at grocery stores seem to reflect the responses of consumers to higher food prices, that is, a shift from premium to private-label brands and to lower-cost (and lower value-added) grades of meat and vegetables.

Meanwhile, general merchandise stores (department stores, etc.) are also seeing declining sales, likely reflecting the steady encroachment of online retailers into their domains. Sales at specialty retailers, such as health care products, apparel, electronics and recreational goods are generally flat in real terms.