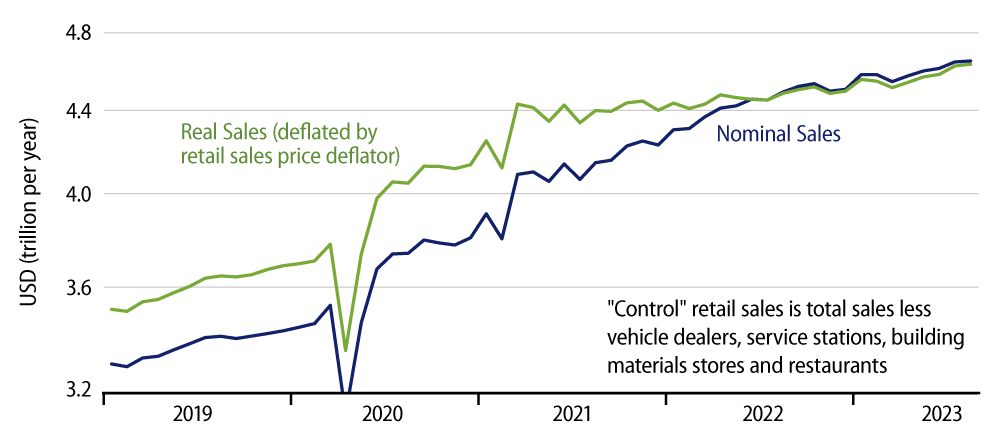

Headline retail sales rose by 0.6% in August, with the July sales estimate revised down by -0.4%, while the more widely watched control sales estimate rose a scant 0.1%, along with a -0.5% revision to the July sales estimate. This is according to data released this morning by the U.S. Census Bureau. The control measure takes out sales at car dealers, building material stores, gas stations and restaurants, in order to focus on store types that are more consumer-oriented (that is, less frequented by commonly commercial customers).

We learned from yesterday’s CPI data that gasoline prices rose 10% in August, and that boost accounted for the bulk of the reported increase in headline retail sales. Actually, gas station sales rose only 5.3% in August, so that “real” sales at gas stations fell.

Net of the revisions to July, the August estimate for control sales was 0.4% below the July sales estimate released a month ago. That month-ago sales release suggested buoyant consumer spending growth and led some analysts to project very strong 3Q GDP growth. The downward revisions to July along with soft August growth will likely cause those forecasts to be marked down substantially.

Even with the July revisions and August softness, retail sales growth still shows better performance over recent months than it did in 2022 and early-2023. It is just that a little bit of the “bloom on the rose” has faded with today’s data.

Granted, we did not expect consumer spending to improve in mid-2023, given the higher interest rates, weaker asset prices and low saving rates that characterize current consumer financial conditions. Consumer growth improved anyway. Maybe the softer August numbers are a return to preceding trends. Maybe they are a flash (down) in the pan. We’ll see in coming months.

As for details by store type, spending volumes are rising nicely at electronics and appliance stores, at online vendors (though August sales there declined slightly), and possibly at restaurants (though here too sales softened in August). For all other vendors, sales are either flat or declining in real terms. Still, the growth in the first three store types has been enough to drive the overall sales growth seen recently that is reflected in the accompanying chart.

Big three carmakers have been on a production binge over the summer, apparently producing enough vehicles to tide the industry over through a likely labor strike. Car sales have risen modestly, but nowhere nearly as sharply as has production. Thus, car dealer inventories are rising. Inventories are not high enough to cause carmakers to panic, but with or without a strike, production is going to have to pull back to levels more in lines with current sales.