The US Census Bureau announced today that headline retail sales rose 0.2% in June, with the May sales estimate revised upward by 0.2%. Financial markets focus more on the “control” sales measure, which abstracts from store types frequented heavily by businesses as well as consumers. That measure rose a sprightlier 0.6%, with a +0.1% revision to May sales. Core goods prices were flat in June, so the nominal sales gains stated here for June also hold in real (inflation-adjusted) terms.

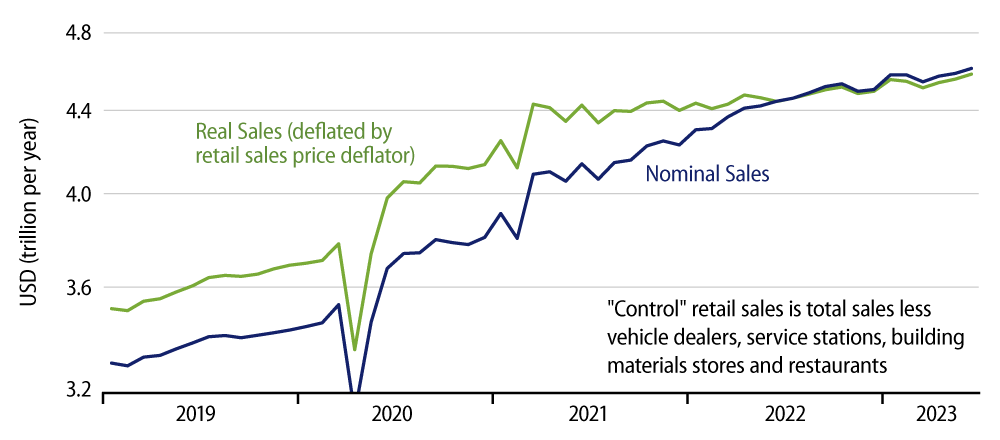

The June sales gains were decent, better than what we had generally seen in preceding months, but not substantially so. As you would conclude from looking at the chart here, the June data are mostly in line with the trends of the last two years. Consumer demand is growing at only a modest rate, with most of that growth occurring in services, not the goods-sector data reflected here. By the same token, however, consumer demand is not dropping off the table.

The details within the headlines are perhaps revealing. In June, sales in real terms rose for vehicle dealers, electronics and appliance stores, furniture stores, and online vendors. They declined in real terms for grocery stores, restaurants, department stores, apparel stores, service stations, sporting and leisure goods stores, drug stores, and hardware stores.

With a previous chip shortage alleviated, carmakers have ramped up production ahead of their model-year changeover. Car sales have gone up in turn, but not nearly as much as has production. Even with the June gain, real car sales are still well below early-year levels. Vehicle inventories are rising, but thanks to the dearth of production earlier, vehicle inventory levels are not dangerously high. Then again, the vehicles now in inventory will be “last year’s models” in two months.

The gains at electronics stores and online vendors are more impressive, but these have been occurring for some time, as have the declines at the store types listed above. None of the declining sectors look especially weak, but all of them evince steady while slight moves lower.

Consumer demand in general and retail demand specifically are stagnant but not abjectly weak. That already looked to be the case prior to today’s news, and the June data didn’t change the picture any.