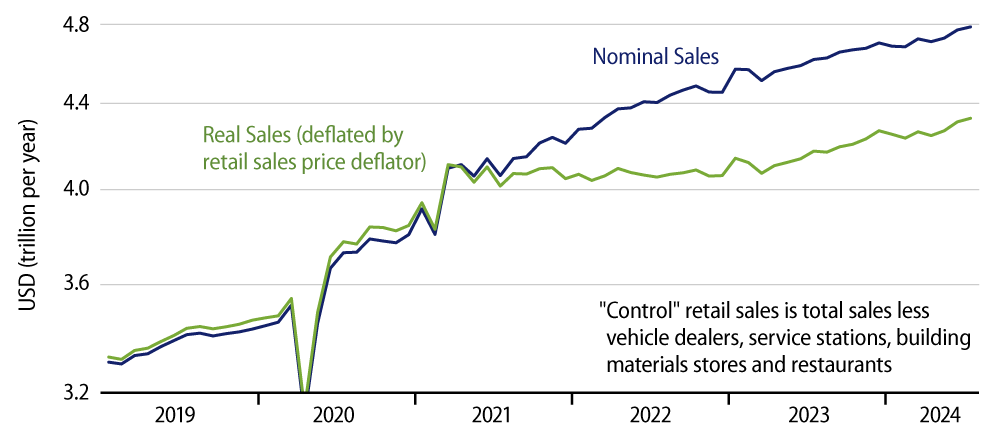

Headline retail sales rose +1.0% in July, offset slightly by a -0.2% revision to June sales. The more closely watched ''control'' sales measure showed a more modest gain of 0.3%, with essentially no revision to its June sales estimate. The control sales measure excludes sales at vehicle dealers, building material stores, gas stations and restaurants, mostly because these store types are heavily frequented by businesses, and the control measure focuses on more consumer-oriented sectors. Also, most of the difference between sales gains in headline and control measures was due to a +4.0% increase in vehicle-dealer sales in July, which, in turn, merely offset an equally large decline in June.

In other words, the large gain in headline sales was statistical noise. However, that does not change the fact that the 0.3% rise in control sales was above market expectations and failed to confirm rumors that consumer spending was weakening. There have been a number of published stories recently about consumers retrenching in the face of much-higher insurance premia and higher prices in general.

However, both the strong retail sales report for June and the modest gains reported today for July are at odds with those claims. Granted, the recent gains in control sales have not been explosive, and there has been slowing in consumer spending on services (which don’t show up in retail sales, except for restaurants). Still, again, the recent retail sales data just don’t show any softness in tune with the media reports. So, while this month’s job and Consumer Price Index (CPI) releases pointed directly to a Federal Reserve (Fed) rate cut, there was no such support from today’s retail news.

The modest gains in overall control sales were mirrored for most store types. Sales for online vendors continue to grow steadily and strongly, but brick-and-mortar stores generally show flat sales trends over recent months. Again, this is neither a robust retail picture nor is it the kind of weakening that would drive the Fed to strong action.