Headline retail sales rose 0.7% in September on top of a +0.4% revision to the August estimate. Financial market economists typically pay more attention to the “control” sales measure, which abstracts from especially volatile components such as motor vehicles and gasoline. That measure rose 0.6%, also a healthy gain, and there were upward revisions of 0.2% to August estimates for that aggregate. Remember too that in addition to the gains in nominal sales already reported, prices of merchandise other than motor vehicles and gasoline fell about 0.2% in September, thus giving a bit more of a boost to real sales.

The store-type components of retail sales were something of a mixed bag. The control group sales gains were paced by especially large gains at nonstore (online) vendors (+1.1%) and drug stores (+0.8%), while sales declined at furniture (-0.05%), electronics and appliance (-0.8%), apparel (-0.8%), and sporting/hobby (-0.04%) stores. Big box retailers and grocery stores saw sales gain right in line with the 0.4% rise in control sales. Of course, for the store types seeing declining sales, online sales substitute for these brick-and-mortar retailers, so that actual consumer spending of these merchandise types (furniture, appliances, apparel, etc.) likely held up better than is suggested by the sales data for corresponding store types.

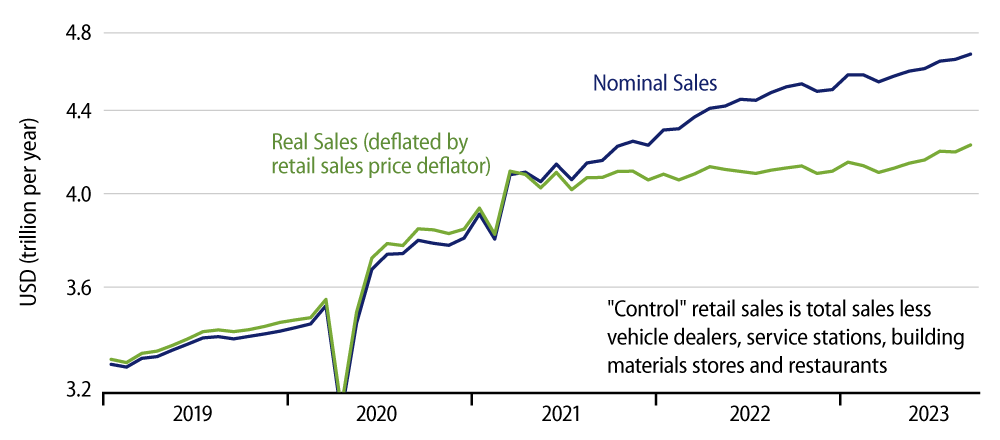

After sluggish retail sales performance from early-2021 through early-2023, retail activity improved in the middle months of this year. We thought the softer sales report for August likely signaled a return to 2021-2022 growth trends, but the stronger growth in September dispels that notion.

With real incomes flat, with saving rates extremely low, with consumer interest rates up sharply, and consumer borrowing slowing, we have been expecting consumer spending activity to slow markedly. Sales data to date stubbornly refuse to bear out this call.