Headline retail sales showed a 0.9% increase in April on top of a +0.6% revision to the March estimate. The “control” sales measure is more closely watched than the headline aggregate, as it abstracts from the motor vehicle, gas station, building material and restaurant sectors, all of which are especially volatile and are frequented substantially by businesses as well as consumers. That control sales measure showed a 1.2% increase in April, with a +0.2% upward revision to March. In other words, both measures showed about the same net change.

These April gains are likely to be read by the Wall Street consensus as a sign of strong demand. We disagree. In fact, these strong-sounding gains fail to change the narrative of flat-to-falling sales volume of the last year plus.

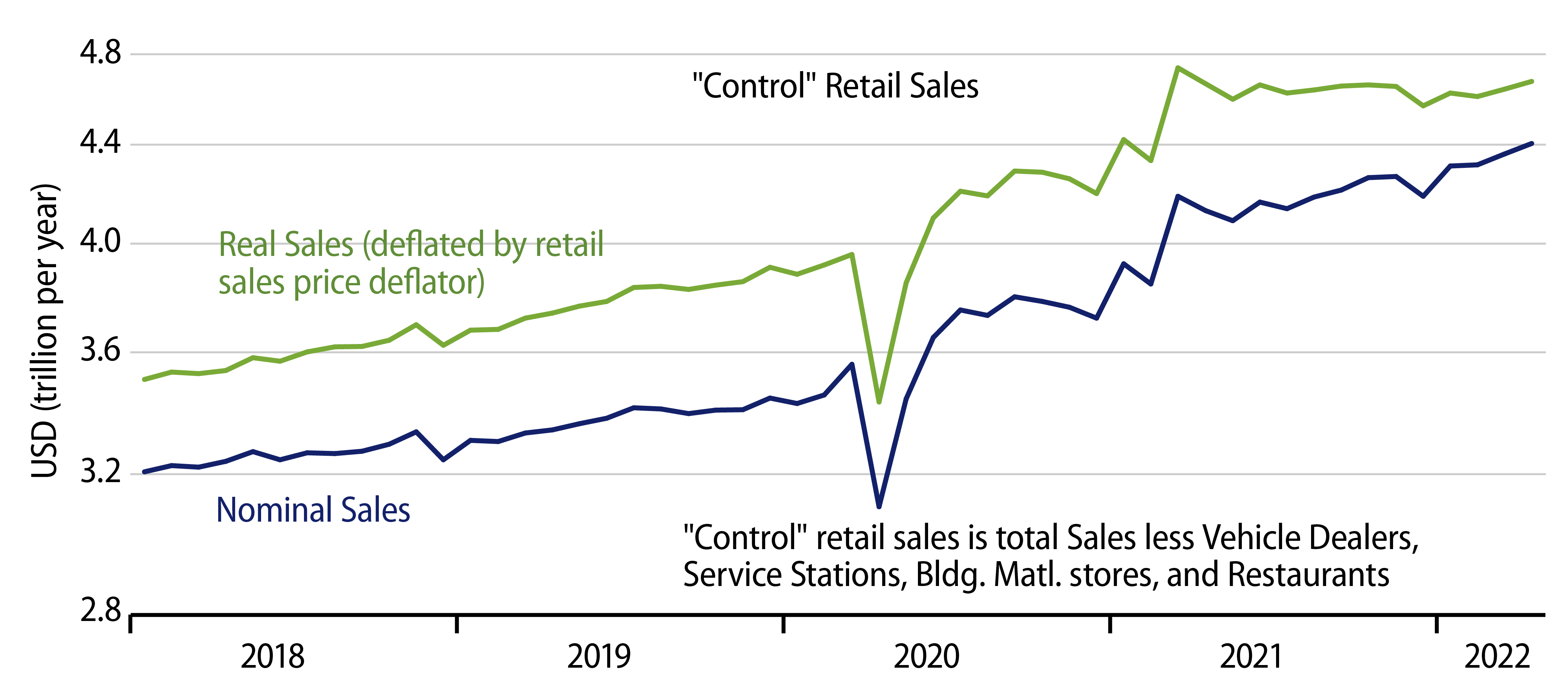

The chart shows nominal control sales as reported by the Census Bureau, as well as real control sales, using a retail sales deflator produced by the Bureau of Economic Analysis (with a +0.2% April change based on the Consumer Price Index). The likely 1.0% April gain plotted in the chart barely brings real control sales back to their November level.

As you may recall from our past posts, when the sharp December decline in sales was announced four months ago, we thought it was a fluke that would be reversed in subsequent reports. Well, the January news reversed a portion of that decline and February saw a further decline. It has taken the sales gains of the last two months to finally, fully reverse that December plunge.

Still, even with these gains, the flat-to-falling real sales trend in place since March 2021 does not look to have been disturbed. Over the last 13 months, real control sales have declined at a -1.2% annualized rate. Over the last six months, real control sales have risen at an annualized rate of only about 0.7%.

The six-month figure is especially interesting in that it has been over this period—since October 2021—that real personal income has faltered, the victim of the accompanying inflation surge. Prior to October 2021, growth in real “earned” income—income from work and investments—had grown at a 3.5% annualized rate, and real consumer spending in turn grew at a 3.0% annual rate. Real spending on goods was zero to negative over that period, but robust gains in services consumption more than made up for that.

Since October, again, robust job gains have not been able to offset the effects of higher prices, as wage gains have slowed. Real earned incomes grew at only a 0.1% rate from October 2021 through March 2022, and April payroll and price data suggest a similar rate of gain. In line with much slower income growth, total real consumer spending grew at only a 0.8% annualized rate from October through March. Goods and services consumption slowed together over that stretch.

Provided services consumption registers some April gains, the April retail sales gains will change those numbers a bit, but not much. The trend toward substantially slower growth in real consumer spending in recent months still looks to be in place, despite the upbeat sound of today’s retail report.