Headline retail sales rose 0.1% in May, though that was more than offset by a -0.4% revision to the April sales estimate. More closely watched is the control sales measure, which excludes sales at car dealers, gas stations, building material stores and restaurants. (These sectors are especially volatile. Also, they cater to businesses as much as to consumers, so control sales emphasize consumer-oriented sales.) There, sales rose 0.4%, but that was also offset by a -0.4% revision to estimated April sales.

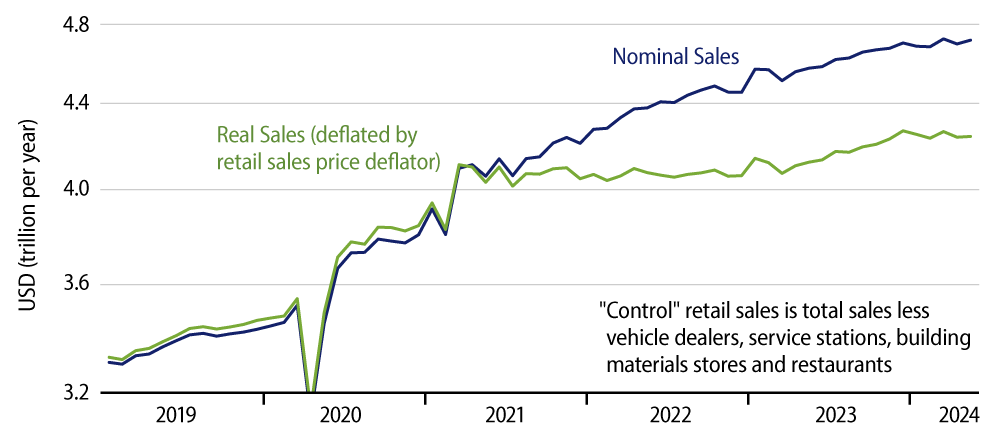

As you can see in the chart, real control sales on net have declined at an average annualized rate of -1.5% per year so far in 2024, after having risen nicely in the last nine months of 2023. The 2023 pickup in retail sales was credited by many with driving the upturn in GDP growth seen last year, so the softening so far this year is portentous.

Retail sales concern consumer spending on merchandise. While spending on merchandise has been soft since December, services consumption softened only over March and April. We’ll see how the May services spending data look later this month.

One service sector that is included in total retail sales is food services, restaurants. There, real sales have declined at a -6.1% annualized rate since last November. Much of this might reflect a decline in businesses’ frequenting of restaurants, as the April data showed a milder rate of decline for real consumer spending on restaurants. Still, the restaurant sector was especially hard hit by the Covid shutdown and only started recovering in 2022 and 2023. So, the downturn in real restaurant sales suggests that the tailwinds from the post-pandemic rebound are fading even for more lately reviving sectors.

Sales have softened so far this year almost across the board for retailers. The only sectors showing any continued growth in real sales are car dealers and electronics stores. Elsewhere, even real online sales have shown a slight decline. Cars and phones. At least consumers have their priorities straight!