Headline retail sales rose 0.6% in December, with November sales unrevised from estimates published a month ago. The core sales measure excludes especially volatile store types and is more closely watched by analysts. That core measure showed an even stronger gain, up 0.8%, with November sales estimates revised up by 0.1%.

Wall Street analysts had expected December sales gains to be paced by a bounce in vehicle sales. These were indeed up a nice 1.2%. However, sales outside motor vehicles were much stronger than estimates. (Witness the gains in core sales which exclude motor vehicles and gasoline.)

Gains were especially strong for the sectors one would expect to be bolstered by holiday shopping. Thus, general merchandise (department stores and big box retailers) enjoyed a 1.3% sales gain in December, clothing stores saw a 1.5% gain, and nonstore (online) vendors also saw a 1.5% increase. Nonstore vendors had seen robust sales gains throughout the last four years. General merchandise and clothing stores had been suffering through flat real sales since the pandemic, but shoppers got out and frequented these stores in December.

Other store types saw more modest gains, no weakness really, but not the type of sales gains enjoyed by vehicle dealers and the department/clothing/online nexus just described. Oddly enough, restaurant sales did not get a holiday lift, but they had grown nicely in preceding periods.

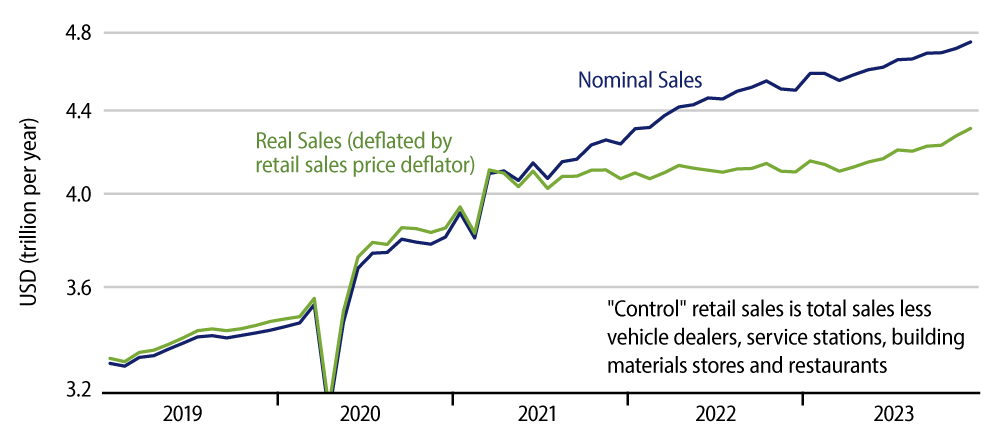

As you can see in the chart, the December gains finished off a strong second half of 2023 for retail sales. We estimate a 7.1% annualized rate of increase for real control sales over 2H23, after a 3.0% annualized rate of increase in 1H23 and a -0.4% annualized rate of decline in 2H22. Certainly, improving real incomes driven by falling inflation helped kindle these sales gains. However, consumer spending on services showed no acceleration at all in recent months and personal saving rates continued to hold at very low levels.

We have thought that low saving rates and high interest rates would eventually rein in consumers. We could point out that durable goods retailers fared less well during the holiday season (other than motor vehicles, where sales would seem to have been boosted by the end of the UAW strike). However, that is a very weak reed to pose against the generally strong tenor of retail sales in the last half of 2023. Overall, there are no meaningful signs of softening consumer spending in today’s data, quite the opposite.