Fixed-income investors, having just endured the worst bear market for bonds in decades, are now being presented with yields that have been repriced back to attractive levels. With the Treasury yield curve inverted, markets participants have accepted that some further policy hikes are on the way while also expecting inflation to head back toward pre-Covid trends. We also know that higher financing costs affect consumer and business decisions. The most interest-rate sensitive sectors, including housing and autos, are already quickly adjusting to this new reality. What is not clear is what the full impact will be of this hiking cycle given its quick and steep pace along with the usual uncertainties of the “long and variable lags” with which monetary policy works. Income investors now face the dilemma of how to navigate the crosscurrents of already decelerating inflation and slowing economic growth.

Where Can Investors Find Attractive Yields Today?

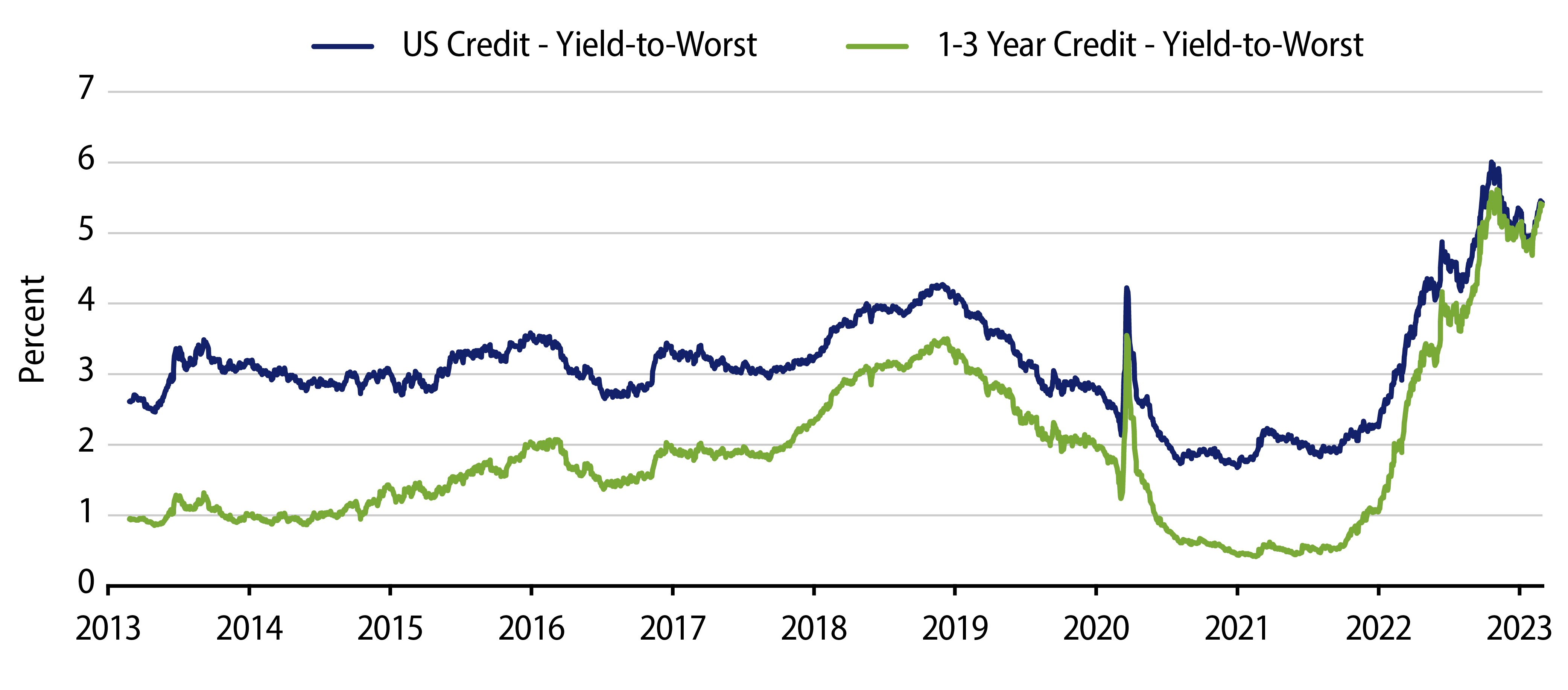

The answer to this question depends on whether the economy will experience a recession and if so how the Fed will respond. But in the absence of a strong conviction on how the path unfolds, shorter-maturity investment-grade corporate bonds may now present an attractive opportunity. As seen in Exhibit 1, the inverted Treasury curve has allowed yields on shorter-maturity credit to rival longer-maturity bonds.

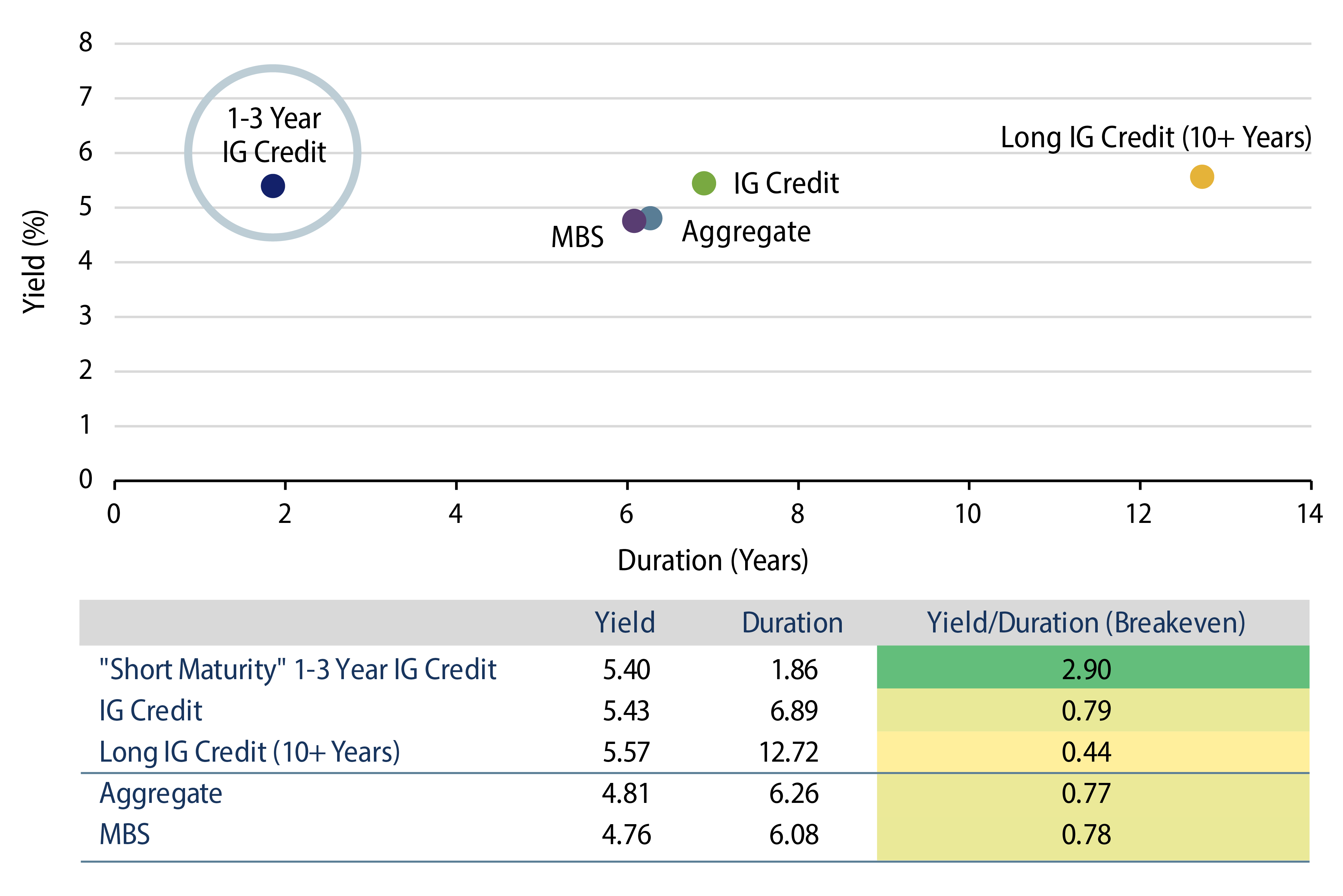

Shorter-maturity corporate bonds offer roughly the same yield as longer-maturity bonds but with a fraction of the duration. As seen in Exhibit 2 the yield per unit of duration is highest in the front end. This measure, also known as the breakeven, is an indication of how much all-in yields can rise (either from widening credit spreads or rising Treasury yields) before the negative price impact overtakes the annual carry. At this time, it would take an almost 300-bp increase in yields before short maturity corporate bonds experienced a negative total return.

Hard Landing/Recession Scenario

Will the economy see a “hard landing” or “soft landing”? And even with the newer “no landing” possibility, it can be difficult to navigate all the different paths the economy could take over the next 12-18 months. Western Asset believes the path with the highest probability would see growth decelerating but with the economy still able to avoid a recession. We are open-minded to meaningful probabilities of other scenarios that are not just “tail events” playing out. With this backdrop in mind, investment-grade credit at the front end looks compelling as investors can source attractive yields with relatively low risk from principal loss or volatility.

Should the economy stumble, credit spreads would likely widen, but front-end Treasury yields could be expected to fall as markets price in an easing reaction from the Fed (Exhibit 3). Thus, if the consumer finally capitulates in 2023 and a recession ensues, these offsetting factors should blunt the price volatility for shorter-maturity credit. Investors can still achieve a positive total return in this negative economic scenario.

Crossing Over the Investment-Grade/High-Yield Divide into High-Quality High-Yield

For investors that are less sensitive to the optical risk of below-investment-grade ratings, there are currently attractive opportunities in short maturity, higher quality high-yield bonds. Investing in high-yield credit involves accepting higher default risk; however, this risk can be significantly mitigated through active issue selection. Staying near the top of the ratings range and in shorter-maturity paper greatly increases the probability of the bond maturing. Just below the investment-grade/high-yield divide are many BB rated issuers with stable fundamentals. Additionally, some of these companies have fundamentals that are trending better and are considered rising-star candidates (i.e., ratings anticipated to be upgraded back into investment-grade territory). These BB rated issuers have historically had low long-term default probabilities. Should a recession unfold, these BB rated bonds may experience more spread volatility than their investment-grade-rated counterparts. But, given the short maturities and the issuers’ fundamentals, there is a very high likelihood of these bonds maturing.

The Sweet Spot

In these uncertain times investors can simply turn to cash for yield once again. But will these yields be available if the economy falters and the Fed needs to pivot? The flatness of the corporate bond curve at this time means investors do not need to venture far out the maturity spectrum to find attractive yields. Taking one step out the risk curve from cash, one can find attractive opportunities in shorter-maturity investment-grade credit. Should the economy slide into a recession, credit spreads may widen but against that, front-end Treasury yields are likely to decline as the Fed reacts. These offsetting forces should blunt price volatility. Last, even more compelling opportunities exist for investors willing to take another step down the quality spectrum into select short maturity BB credits.