Sales of new single-family homes dropped -4.7% in April on top of a -4.0% revision to the March sales estimate, fully erasing a modest net increase over the first three months of 2024 that had previously been reported. While recent new-home sales levels are not especially low, they are far lower than what is necessary to sustain current levels of housing starts.

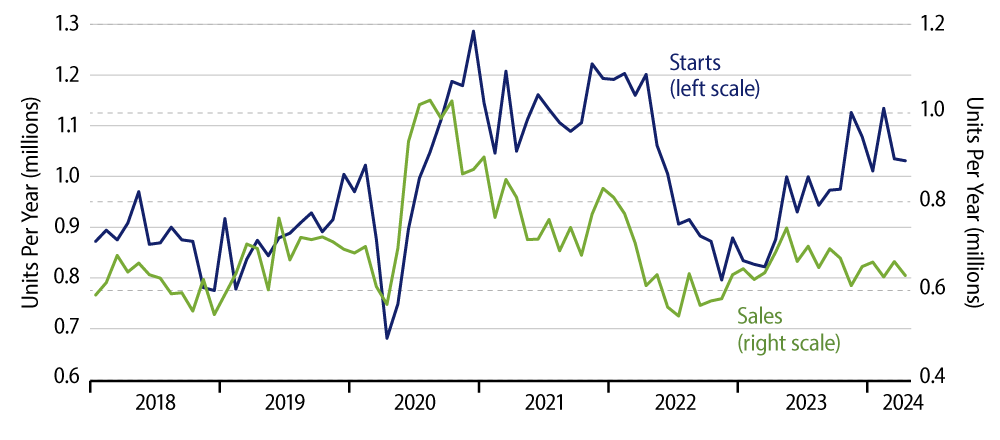

Single-family homebuilding has been a veritable roller coaster over the last few years, briefly plunging during the Covid shutdown and rebounding strongly following the reopening, only to plunge again in 2022 and then rebound nearly as sharply in 2023. With new-home sales having run well behind single-family housing starts for the last 12 months, the indications are that single-family homebuilding is in for another spate of declines over the rest of this year and possibly into 2025. That is clearly what happened in 2022, after starts had run well ahead of sales through most of 2021.

Builders have obviously been very optimistic, betting that sales would eventually catch up with construction rates, just as they were similarly optimistic coming out of the Covid shutdown. However, homebuyers eventually have to come to the plate, or the house as it were. When that didn’t happen in 2021-2022, housing starts had to pull back. We are in a similar position now.

Back in 2022, the ratio of inventories of unsold new homes to new-home sales got up to a high of 10.2 months’ worth. Presently, that inventory-to-sales ratio is “only” 9.1 months. However, that rate is way above the 4-months ratio prevalent prior to the 2003-2005 housing bubble or the 5-months ratios in place after that bubble burst.

Starts need not decline as sharply as they did in 2022, but barring a burst of new-home sales activity, it would seem that starts would have to drop at the very least to a rate of 0.85 million units per year—from 1.0 million units per year presently—to keep new-home inventories from piling up further. Meanwhile, the level of new-home sales seen through the April data announced today likely does not yet reflect the further increase in mortgage rates that occurred in April.

Construction accounted for most of the acceleration in GDP growth that occurred last year. That came from strong growth in all three major components of construction spending: single-family residential, multi-family residential and nonresidential. Multi-family construction is already declining sharply, reversing a building surge there over 2021-2023. Nonresidential construction has shown incipient declines over recent months, as federal infrastructure spending appears to have peaked.

A move to declines in single-family building would complete this “trifecta.” GDP growth was already in the low 1-handle range in 1Q, despite construction activity still growing then. A move to declining construction spending would pull that rate well lower. Obviously, single-family starts and construction spending bear watching in the months ahead, to see if they confirm what new-home sales data are suggesting.