In data released today, real GDP is reported to have grown at a 3.3% annualized rate in 4Q23, while the GDP price index show a 1.5% annualized rate of inflation. The Personal Consumption Expenditures (PCE) price index, measuring consumer prices within the GDP data, showed a 1.7% annualized inflation rate in 4Q23, while the core PCE registered a 2.0% inflation rate.

The real GDP growth print came in above most analysts’ expectations, thanks to much stronger inventory investment outside of motor vehicles. That is, vehicles were affected by the UAW strike. Carmakers had boosted production and inventories in 3Q23 in anticipation of the strike, and both production and inventories of vehicles declined sharply in 4Q23 due to the strike. Outside of motor vehicles, inventory investment actually increased slightly, while our and others’ forecasts looked for a sharp decline. The difference boosted 4Q23 growth by about 1.3 percentage points. Foreign trade also boosted growth vis-à-vis expectations.

Elsewhere, growth was actually a bit below our expectations. For example, real consumer spending rose at a 2.8% rate, a bit slower than the 3.1% growth we had been expecting. Similarly, vehicle production declined more than we had projected. Construction spending also grew slightly slower than expected. Neither the consumer nor construction gains were weak; they were just slower than expected.

The inflation data continued the good news of recent months. Core PCE inflation has proceeded at a 2.0% rate in each of the last two quarters, right at the Federal Reserve’s (Fed) targets. Furthermore, we have previously mentioned that reported shelter prices seem to be at odds with “on-the-ground” home prices and rents, due to technical lags in the government’s reporting practices. Fed Chair Jerome Powell himself has mentioned this. Well, excluding shelter, core PCE inflation proceeded at a 1.2% rate both in 4Q and 3Q.

We expect reported shelter inflation to cool substantially in coming months, as the technical lags are worked through. So, even if goods prices rebound a bit in coming months, as some analysts expect, the odds are that any boost to overall inflation coming from there will be offset or more than offset by lower reported shelter inflation.

Again, even including shelter, core PCE inflation has been at Fed targets for six months now. We believe it will remain at recent rates (or lower) in coming months. So, even on the 12-month basis favored by the financial press, core inflation should be at Fed targets by the middle of the year, contrary to many reported opinions that 2% will be hard to achieve.

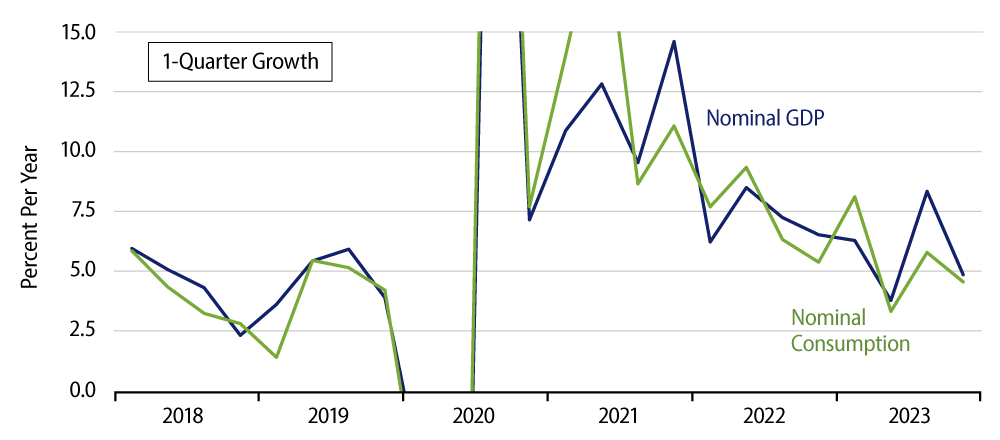

One reason we are confident inflation will remain restrained is the continued deceleration in nominal (dollar) spending. Monetary policy ultimately affects the economy via nominal spending. If nominal spending is slowing, inflation can proceed only with slower real growth, and the latter will dissipate inflation pressures. Well, as you can see in the chart, nominal spending growth has been trending slower throughout the last two years. Recent growth rates have been right around pre-Covid/pre-inflation rates. We expect nominal spending growth to continue to trend slower, exerting further downward pressure on inflation.