Headline retail sales were reported today as declining -0.9% in January, with the December sales level seeing a slight +0.1% upward revision. Most analysts focus on a ''control'' sales measure for consumer-oriented retail sectors by subtracting out the store types heavily frequented by businesses as well as consumers: car dealers, service stations, building material stores and restaurants. That control measure declined -0.8%, with its December sales estimate revised lower by -0.2%.

These sales data come on the heels of January CPI data that showed relatively large increases, with headline CPI up 0.47%, core CPI up 0.45%, and even core goods prices up 0.28%. (All statistics reported on this post are seasonally-adjusted monthly rates, non-annualized.) Does it make much sense that sales would decline substantially in a month where prices increased? No, it doesn’t.

We are fond of saying that knowing how the economic data are constructed is much like knowing how hot dogs are made. It is a messy, possibly disgusting process. Government stat-folks do the best they can, but they are tasked with taking incomplete data, extrapolating it to the broad economy, and then, for good measure, accurately adjusting out purely seasonal fluctuations.

The difficulty of this task is compounded during months such as January, when the economy is unwinding from the Christmas rush just as winter storms—or the lack thereof—may be disrupting normal shopping patterns. On top of all this is the fact that in January, seasonal adjustment factors are typically re-calculated, using still-preliminary data from the just-completed year. And don’t get us started on the vagaries of the seasonal adjustment process.

Long story short, January data should usually be taken with a grain of salt. This goes for both the reported jump in consumer prices and the reported plunge in retail sales. Did inflation suddenly explode last month after two years of steady deceleration? Did consumers suddenly pull back after spending buoyantly throughout 2024? The sensible answer to both questions is no, but we must acknowledge that that answer is at odds with the available data. Enjoy those hot dogs!

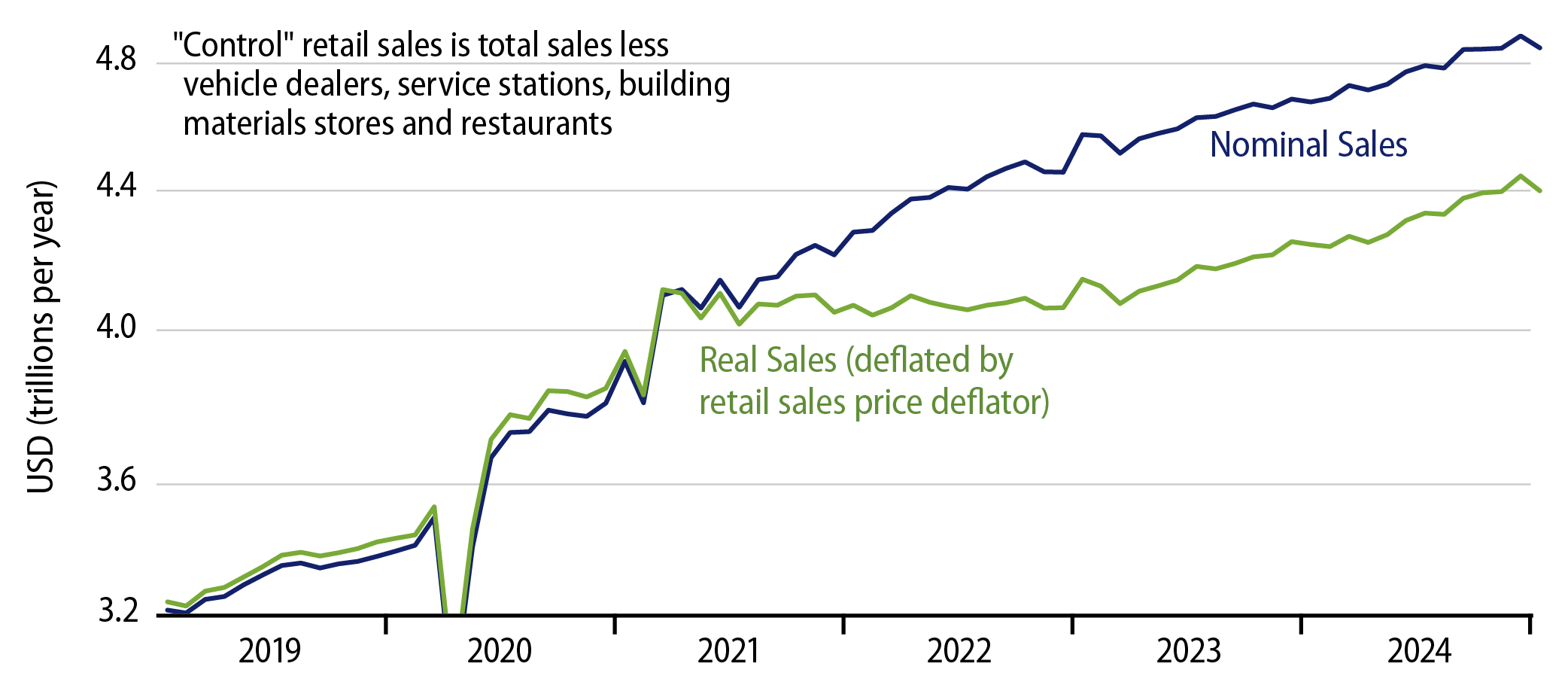

For the record, as you can see in the chart: as scary as the January sales declines might sound, they don’t make a serious dent in the sales growth trends seen in 2024. (And you can also see some wild swings both up and down in previous January measures.) The same goes for charts and the CPI.

For the record, sales were reported as declining in January at every major store type except for gas stations, department/warehouse stores, and restaurants. The largest declines were at sporting good/hobby stores (4.7%), car dealers (-2.8%), non-store (online) retailers (-1.9%), and furniture stores (-1.8%). For all these store types except those in the sporting/hobby sector, the reported declines come after a year of good monthly gains. The decline in online sales was especially eye-catching, but therefore possibly especially spurious.

As always, one month does not make a trend, and this is especially true when that one month is January. We are inclined to think that February data for both inflation and retail sales will moderate the wild swings reported this week for January. As always, we’ll see when new data become available.