Regional Focus: Latin America

Last year was turbulent for all of fixed-income. As a large buyer of predominantly risk-free (“safe”) assets, were central banks spared from the market meltdown?

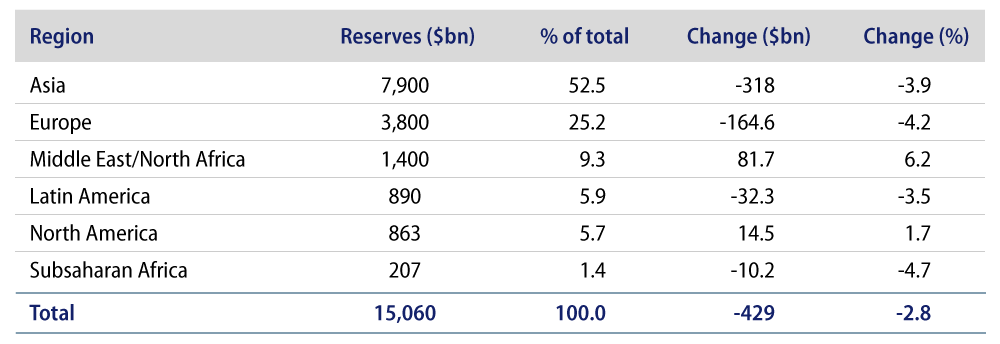

Unfortunately, not. According to a recent central bank survey, 80% of reserve managers experienced losses in their portfolio in the 12-month period ending March 2023 mainly due to the sharp decline in asset prices and intervention measures intended to support currencies versus a stronger US dollar.1 The only region that experienced a material increase in reserves was the Middle East and North Africa, which benefited from the rebound in oil prices since the lows of April 2020 (Exhibit 1). For reserve managers, minimizing downward pressures on reserve levels is a key priority. Central banks hold foreign exchange (FX) reserves to support a number of critical objectives such as: supporting and maintaining confidence in the country’s exchange rate, providing liquidity during crises, supporting external debt obligations and maintaining reserves in case of national emergencies.2

How are reserve managers looking to bounce back?

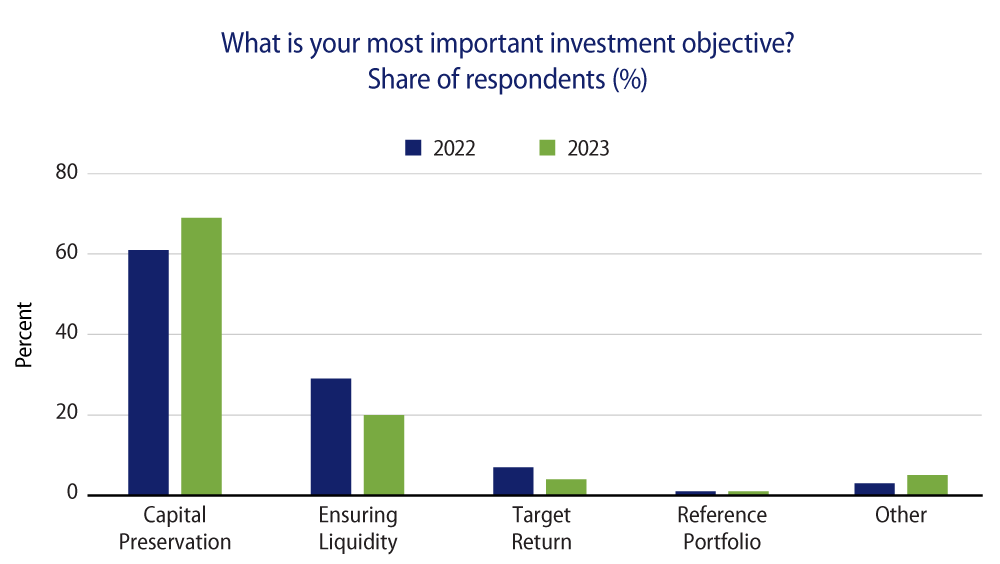

After a difficult period of trying to generate returns in a sustained period of low or negative rates, reserve managers globally are cautiously revisiting their investment portfolios with many increasingly leaning toward capital preservation versus taking on more risk (Exhibit 2). This should not be surprising given that safety and liquidity are paramount in sovereign reserves investing. The risk of incurring further losses and/or not knowing how quickly they’ll see a turnaround in portfolio performance also looms large: almost 20% of those surveyed expect to recoup their losses over the next 12 months while over 60% believe it will take two to five years.4 This pessimistic outlook reflects uncertainty over the path of global growth, inflation and policy rates, as well as heightened concerns over geopolitical risk and banking sector stability.

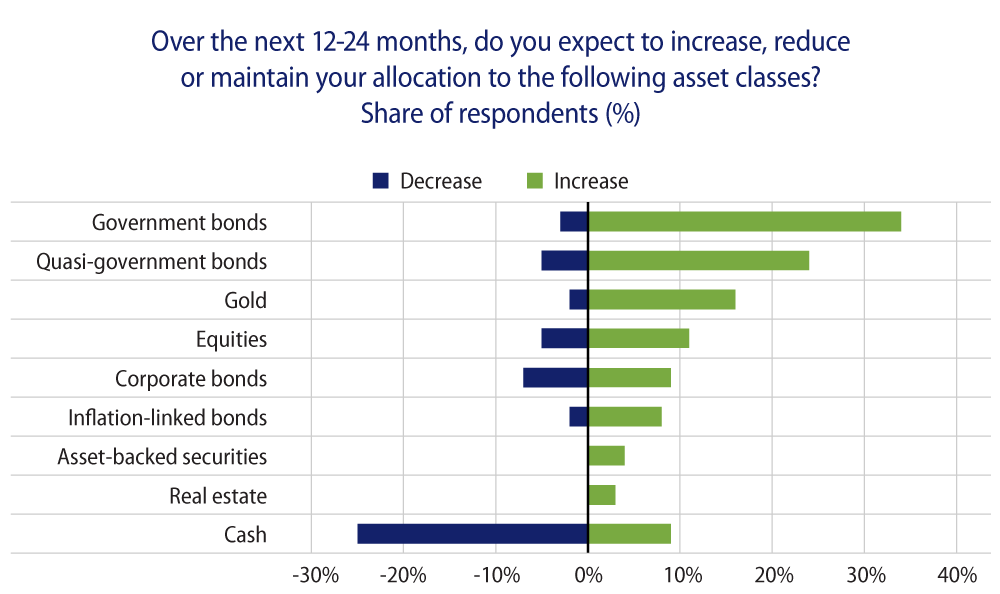

All that stated, today’s higher-yield environment does present reserve managers with a prime opportunity to rebuild their reserves by bolstering returns and diversifying their portfolio holdings. Investors looking to capitalize on the moment plan to further increase their allocation to fixed-income, mainly government bonds (e.g., shorter-dated US Treasuries (USTs) and money market instruments, which offer the compelling combination of safety and much higher yields), and quasi-government bonds. Other areas of interest in fixed-income include corporate bonds, inflation-linked bonds and asset-backed securities.

What investment trends has Western Asset observed as of late among central banks in Latin America?

As context, reserves across central banks in Latin America have seen little growth over the past decade, and reserves as a percentage of GDP have also steadily declined during the same period. This is mainly due to economic and political challenges in countries such as Brazil, Mexico and Peru, which have placed downward pressure on growth and reserve asset positions. Another force weighing on reserves growth is risk aversion. Reserve managers in Latin America are conservative investors with 93% of portfolio assets denominated in US dollars—the most of any region—and the bulk of those assets typically comprise government bonds, gold and cash.5

We continue to see sovereign investors in Latin America managing reserves between liquidity portfolios and separately managed, longer-term fixed-income accounts in order to deal with different goals and constraints. These separately managed accounts are typically outsourced to external managers such as Western Asset. Liquidity portfolios are currently enjoying yield levels unseen in over a decade, and our money market fund platform has benefited from steady inflows. Broad-market mandates tend to be made up of USTs or global sovereign bonds (hedged to the US dollar) with short-to-intermediate duration guidelines. In some cases, we’ve seen small, off-benchmark allocations to asset classes with higher return (and volatility) profiles, such as US investment-grade credit and agency mortgage-backed securities (MBS).

Recently, agency MBS have been negatively impacted by minimal Federal Reserve (Fed) and bank demand, coupled with heightened volatility. However, the fundamental picture has improved with significantly wider spreads and low prepayment risk. With prevailing mortgage rates around 6.9% and the average borrower locked into a 3.5% rate, refinancing activity remains structurally muted. We anticipate further reduction in mortgage industry excess capacity and tighter bank lending standards to further weigh on financing activity, while home prices are supported by limited supply of houses on the market and decreased affordability. Given this backdrop of low prepayment risk and limited mortgage origination supply, we’re constructive on the investment prospects for agency MBS.

As for US investment-grade credit, we still believe this asset class offers attractive risk-adjusted return potential to investors, while also providing a cushion if a recession were to materialize. While credit spreads currently trade tight, the all-in yield within the investment-grade credit space remains closer to the highs of the past several years. The fundamentals for the asset class remain solid, primarily due to prudent corporate balance sheet management. Last, the size of the US investment-grade corporate bond market is estimated at over $7 trillion dollars—deep and liquid markets are an important consideration for sovereign investors seeking attractive returns while taking moderate credit risk.6

How has Western Asset aided reserve managers in Latin America with their investment programs?

Over the past few years, we’ve witnessed increasingly sophisticated reserve management departments in Latin America looking to achieve greater diversification benefits via measured incremental exposure to spread sectors. As discussed, the areas of most interest are agency MBS and investment-grade corporate credit. However, for reserve managers, taking the first steps into these domains can introduce operational complexity, and the due diligence and ongoing investment program can require a considerable investment in human and capital resources. Indeed, in Latin America, 73% of those surveyed experienced operational challenges in recruitment and training—the highest in any region.7

Our base of sovereign clients and prospects look to Western Asset not only for our fixed-income investment capabilities, but also for our thought leadership, and comprehensive technology transfer and training programs. In addition to assisting these reserve managers with analyzing, selecting, and implementing custom benchmarks and investment guidelines, we also help them with the construction of model portfolios and scenario stress-testing to help in the asset allocation decision-making process.

For instance, we recently worked with one sovereign reserves manager that was looking to increase its exposure to spread sectors in a low tracking-error global sovereign portfolio. We were able to provide risk and return characteristics for specific time periods for a diverse range of benchmarks, as well as representative account performance and guidelines, which our prospect incorporated into their analysis to determine the most suitable benchmark blend and investment opportunity set.

Looking ahead, we see reserve managers globally continuing to adapt to changing market conditions and working more closely with external managers such as Western Asset to refine and bolster their long-term investment strategies. In an environment of prolonged uncertainty and expectations of continued volatility, we see investment flexibility and portfolio diversification as vital pillars for future reserves growth and resiliency.

ENDNOTES

1. Official Monetary and Financial Institutions Forum (OMFIF), Global Public Investor (GPI) Survey, May 2023

2. IMF, Revised Guidelines for Foreign Exchange Reserve Management, 2014

3. Data reflects 171 central banks; assets include foreign exchange, gold, IMF position and special drawing rights holdings.

4. OMFIF, GPI Survey 2023

5. OMFIF, GPI Survey 2023

6. Bloomberg index data as of July 2023

7. OMFIF, GPI Survey 2023