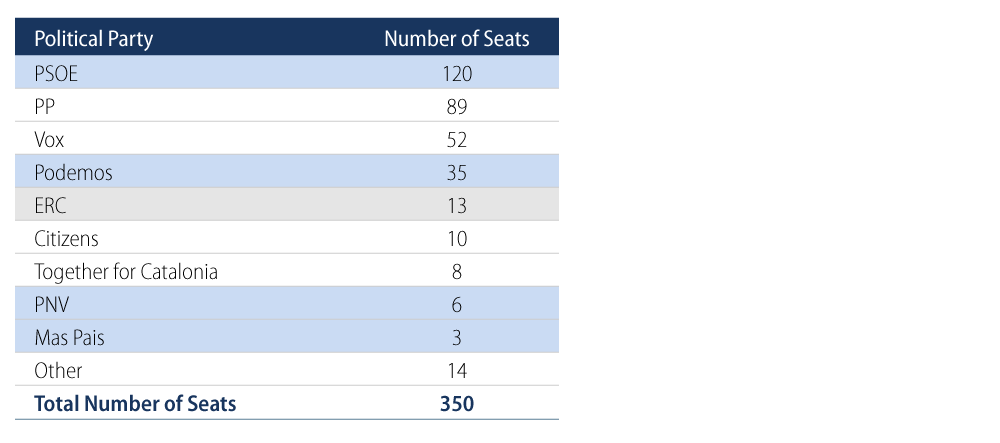

In early January, Spain’s parliament approved Pedro Sánchez’s return as Prime Minister, leading a coalition government of his Spanish Socialist Workers’ Party (PSOE) and the left-wing populist Podemos group. The margin of the vote was small—passing by a simple majority of only two and relying on the support and abstention of other parties. This outcome largely reflects increased political fragmentation as seen elsewhere in Europe in the aftermath of the global financial and European debt crises; Podemos itself was founded in 2014 as a protest movement opposing corruption and austerity measures. Adding to the political fragmentation seen in Spain is the issue of Catalan independence, leading up to and following an illegally held referendum in 2017.

How Fragile Will This Government Be?

One may conclude that this must leave the minority coalition extremely fragile and at risk of collapse, but this is not the case. Spanish electoral law dictates that a vote of no confidence in the Prime Minister can only be held if there is support for an alternative candidate by an absolute majority (176 votes). Therefore the fragmentation that posed difficulties in forming a government now helps to protect it from challenges.

We recognize that the agreement made with the Catalan-separatist ERC party in return for its abstention does not include support for key policy measures, such as the 2020 budget proposal, and that there is some political uncertainty associated with this. However, recent brokering would have likely already included comprehensive discussion of the immediate agenda. As a result, near-term risks should be contained.

Looking Forward

Western Asset has been constructive on Spanish government bonds and maintains an overweight exposure in global portfolios. As the market began to recognize the likelihood that Sánchez would be able to count on enough support for the coalition, Spanish bonds outperformed.

We believe that Spanish government bonds will continue to remain well supported by the current low-yield backdrop, accommodative monetary policy and extended forward guidance from the European Central Bank. We note also that Sánchez has announced a cabinet in which key economic posts are held by members of his Socialist party, promoting those such as the experienced and highly regarded Nadia Calviño, from Economics Minister to a Deputy Prime Minister (one of four) overseeing economic affairs. This reassures investors over fears about some of Podemos’ more radical policies.

Nevertheless, we will continue to monitor the situation closely as more details on spending plans are announced. Spending priorities are expected to include investments related to education, research and development, and women’s access to employment. Risks to job creation and business investment could come from a proposed minimum wage increase. The government has said that it will finance the increased spending through higher taxes in order to maintain its budget balance and avoid running afoul of European Commission rules.

After several years outpacing European peers, growth in Spain has begun to converge towards the EU average with forecasts for 2020 at around 1.6%. This is consistent with our expectations, although we believe there is some upside potential should we see improvement in global trade.

With respect to the investor base in recent years, we have seen increased turnover and greater diversification among holders of Spanish government bonds, aided by credit rating upgrades early in 2018. Domestic bank holdings are also at a historically low level; another technical factor that should help to protect against a persistent widening in spreads.

In summary, Spain remains one of our favourite markets within the eurozone and is a rare example of where a challenging political backdrop doesn’t weaken the investment rationale.