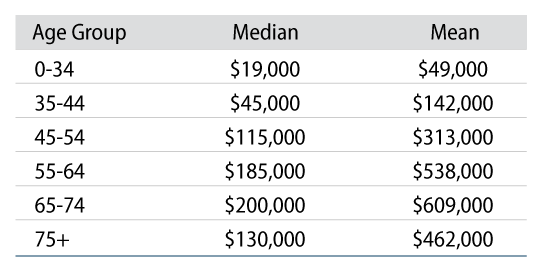

There is significant concern about insufficient retirement savings in the US, increasing lifespans relative to savings and heightened uncertainty regarding the viability of government programs such as Social Security and Medicare. According to the Federal Reserve’s most recent Survey of Consumer Finances, the median retirement savings for people ages 55-64 is only $185,000, and for those 65-74 it is slightly higher at $200,000.

According to the Bureau of Labor and Statistics, the current weekly earnings of full-time workers are $1,197 (ages 55-64) and $1,154 (ages 65-74), respectively, or $62,244 and $60,008 annually.

If an investor is able to earn an annual yield of 4%-5% on a portfolio1 made up predominately by bonds, retirees can expect to earn approximately $10,000 a year from their savings to help replace or supplement their income. If you add to that the average monthly Social Security benefit payment of $1,7832, or $21,396 annually, they would be able to replace only half of their current income without touching their principal if they were to quit working today (assuming those returns are steady, which we all know they aren’t). According to the Social Security Administration, life expectancy in the US is currently 76 years for men and 81 years for women born today. But once reaching age 65, a person can expect to live another 18-20 years. In 10 years, life expectancy will have further increased, and those aged 65 will be expected to live another 19 to 21 years.3

Compounding the issue, Census Bureau data reveals that as of 2020 only 58% of people ages 56-64 even have a retirement account to which the numbers in Exhibit 2 would apply. For younger workers the percentage is lower, though of course that is offset by the fact that they have more time to begin saving.

Social Security is also facing financial challenges, with the Social Security Board of Trustees reporting that they can pay scheduled retirement benefits only through 2033. “At that time, the fund’s reserves will become depleted and continuing program income will be sufficient to pay 79 percent of scheduled benefits.”4 If you look at the Old-Age & Survivors Insurance (OASI) Trust Fund and Disability Insurance together, the funds would last until 2035, at which time the fund’s income would only be sufficient to pay 83% of scheduled benefits.5

What Does This Mean?

First, longevity increases are, of course, good, but there are implications for the number of workers in the economy and their ability to have adequate retirement savings and Social Security benefits. The labor force participation rate for adults aged 55-64 is expected to increase 3.3% by 2033 from 2023 levels, and 3.5% for those aged 65-74, to levels of 69.1% and 30.4%, respectively.6

Second, most Americans have insufficient retirement savings, both in terms of the number of people with retirement accounts, and the savings in those accounts. We looked at the median savings rather than averages here, because there is a larger amount of savings held by those with higher disposable income and so means (averages) are distorted higher.

Third, Social Security benefits will need to be reduced in the near future if nothing changes regarding benefits paid and taxes received. These benefits are a larger percentage of retirement income for those with lower retirement savings. And an across-the-board adjustment would have a meaningful impact on quality of life for retirees and on broader economic activity.

From a policy standpoint, these three factors necessitate changes to retirement savings plans and government policy (to both benefits and taxation), and may have the highest impact for those with existing savings. It is highly likely that government benefits will have to be reduced for those with higher savings, and that taxes will be increased to supplement the benefit programs. Additionally, new programs may need to be put in place for those with less disposable income to save for retirement. Defined benefit plans such as traditional pensions used to fill this role, and there is a growing chorus of people who predict or hope that they will make a comeback. Only time will tell.

ENDNOTES

1. Sample actively managed US Broad Market portfolio yields

2. Monthly Statistical Snapshot, August 2024, Table 2. Social Security benefits, August 2024, https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/

3. Social Security Administration, Period Life Expectancy – 2024 OASDI Trustees Report, Table V.A4. – Period Life Expectancy, https://www.ssa.gov/OACT/TR/2024/lr5a4.html

4. Social Security Administration, “A Summary of the 2024 Annual Reports”, Social Security and Medicare Boards of Trustees, https://www.ssa.gov/oact/TRSUM/index.html

5. Ibid.

6. U.S. Bureau of Labor Statistics; Employment Projections: Civilian labor force participation rate by age, sex, race and ethnicity, as of September 6, 2023; https://www.bls.gov/emp/tables/civilian-labor-force-participation-rate.htm