Private-sector payrolls expanded by 220,000 in December, though there was a -48,000 revision to the November level. Once again, the brunt of what job growth did occur was concentrated in sectors still attempting to recover from Covid restrictions.

Workweeks declined, and hourly wages rose at rates slower than those prevailing prior to the onset of Covid. Meanwhile, manufacturing showed clear signs of decline, with declining production hours mirroring what we have been seeing from industrial production and orders/shipments data.

All these developments are indications of the growing impact of Fed policy tightening on the economy. With these trends pointing in the “right” direction, one might think that the Fed would take succor from them and step back from its hiking regimen. If so, the Fed’s recent comments would suggest one has another think coming.

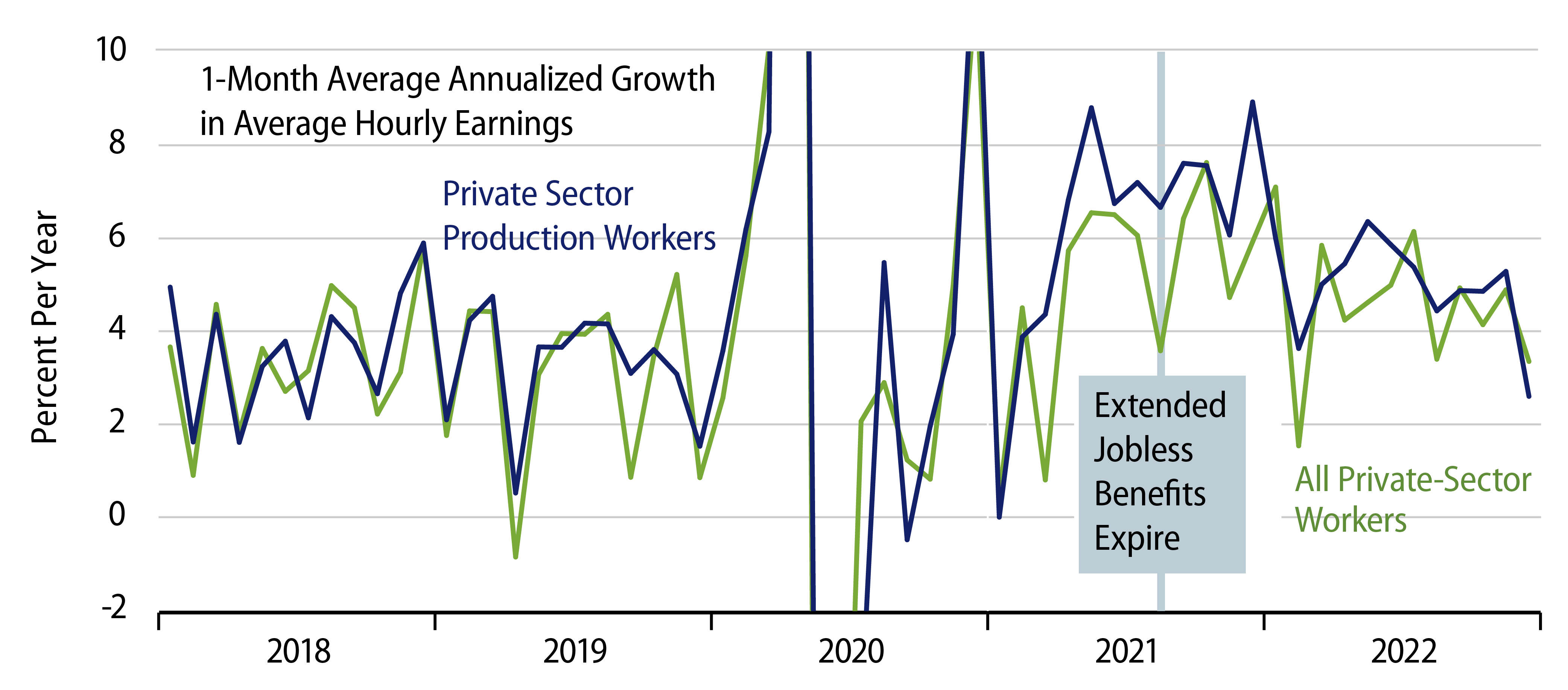

The accompanying chart shows monthly changes in average hourly wages, both the all-worker and the production-worker measures. As you can see, both measures rose in December at rates substantially slower than what we were seeing during the low inflation days prior to Covid.

It is true that low rates of wage growth have been in place only very recently. However, wages have been on a clearly decelerating path for over a year now. There is a difference between saying progress on the wage front is not yet clearly sufficient and saying there has been no progress at all. And even if one holds to the former view, what reason is there to think that wages will suddenly buck a year-long trend and reaccelerate? None we can think of.

Rather than wage growth, we typically have shown a chart of job growth by sector. Today’s details for this take are right in line with what we reported a month ago. For industries other than the Covid epicenter sectors, payroll jobs grew by only 90,000 in December, with November levels revised down by 33,000. This compares to average gains of 100,000 to 150,000 per month pre-Covid. Growth in production jobs has slowed even more sharply, suggesting that while firms are still attempting to bring “overhead” staffing back to normal, they are cutting production runs.

For Covid-epicenter sectors, health care jobs continue to expand relatively nicely, but growth in restaurant jobs is slowing. Recreation jobs bounced a bit, rising 31,000 in December, but still 135,000 (5.5%) below pre-Covid levels. Transportation and accommodation jobs both rose 10,000 or less, with accommodation employment still 340,000 below pre-Covid levels and transportation down slightly on net from early-2020.

Finally, manufacturing production jobs were about unchanged, while production workweeks declined 0.3 hours, for a -0.6% change in factory production hours worked. This points to a substantial decline in factory output within the Fed’s upcoming December industrial production report.

All in all, while job growth remains positive, the trend in growth is clearly downward, with sympathetic moves in workweeks and wages, and outright weakness in some key sectors. We’ll see whether the Fed is paying attention.