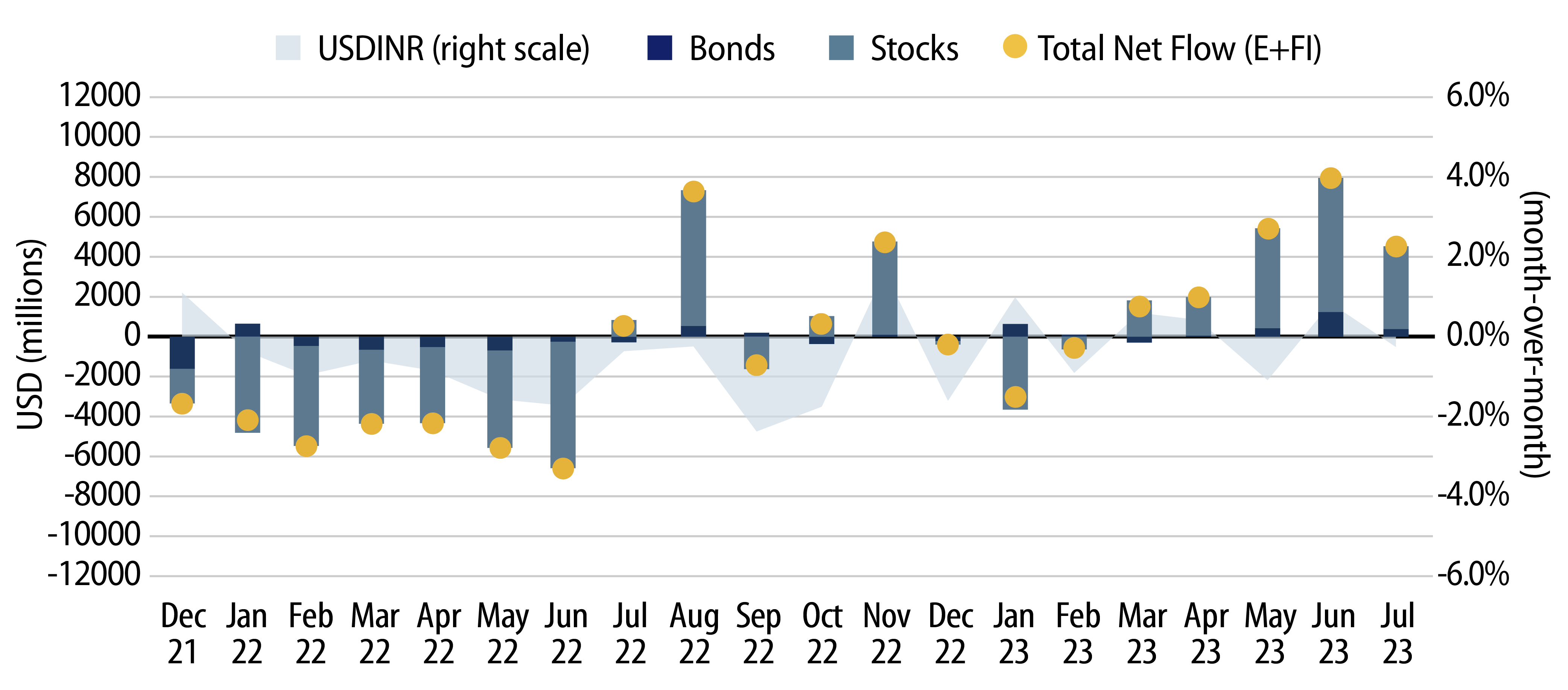

India has been one of the fastest growing economies in Asia post-Covid with preliminary forecasts putting its GDP growth rate near regional highs going into 2024. The Indian equity market has responded in kind with the NIFTY 50, a benchmark of the 50 largest Indian companies listed on the National Stock Exchange, rising over 11% year to date (YTD). Foreign investors have taken notice and injected USD21 billion into the local equity market since March 2023. However, flows into the local bond market have been more muted over this period. Western Asset is of the opinion that the Indian bond market presents a unique opportunity as it is underpinned by strong fundamentals, attractive valuations and demand boosted by technical tailwinds of emerging market (EM) bond index inclusion.

India’s Improving Macroeconomics

In 2Q23, of the nine largest Asian economies ex-Japan, India had the highest GDP print, at 7.8%. India’s high rate of growth has been buoyed by strong domestic demand, particularly from the services sector. As we close out the year, domestic demand is likely to normalize and the contributors to GDP growth will likely skew more toward investment and capital expenditures, resulting in some deceleration of the economy. That said, GDP growth is forecast to remain near the top versus Asian peers. Consumer Price Index (CPI) inflation drifted lower from 6.52% in January 2023 to 4.31% by May 2023. However, it has recently crept back up to 6.83% at the end of August 2023. The recent spike in inflation has been due to the largest rainfall deficit during monsoon season in eight years which has impacted the price of food, which is nearly 50% of the CPI basket. Despite the recent uptick in headline inflation, it is likely to moderate back down close to 5.00% by the start of next year with September rains recouping some of the deficit. Western Asset anticipates that the Reserve Bank of India (RBI) will keep its key policy rates unchanged at 6.50% through the end of the year with CPI inflation within RBI’s target range between 2% and 6%.

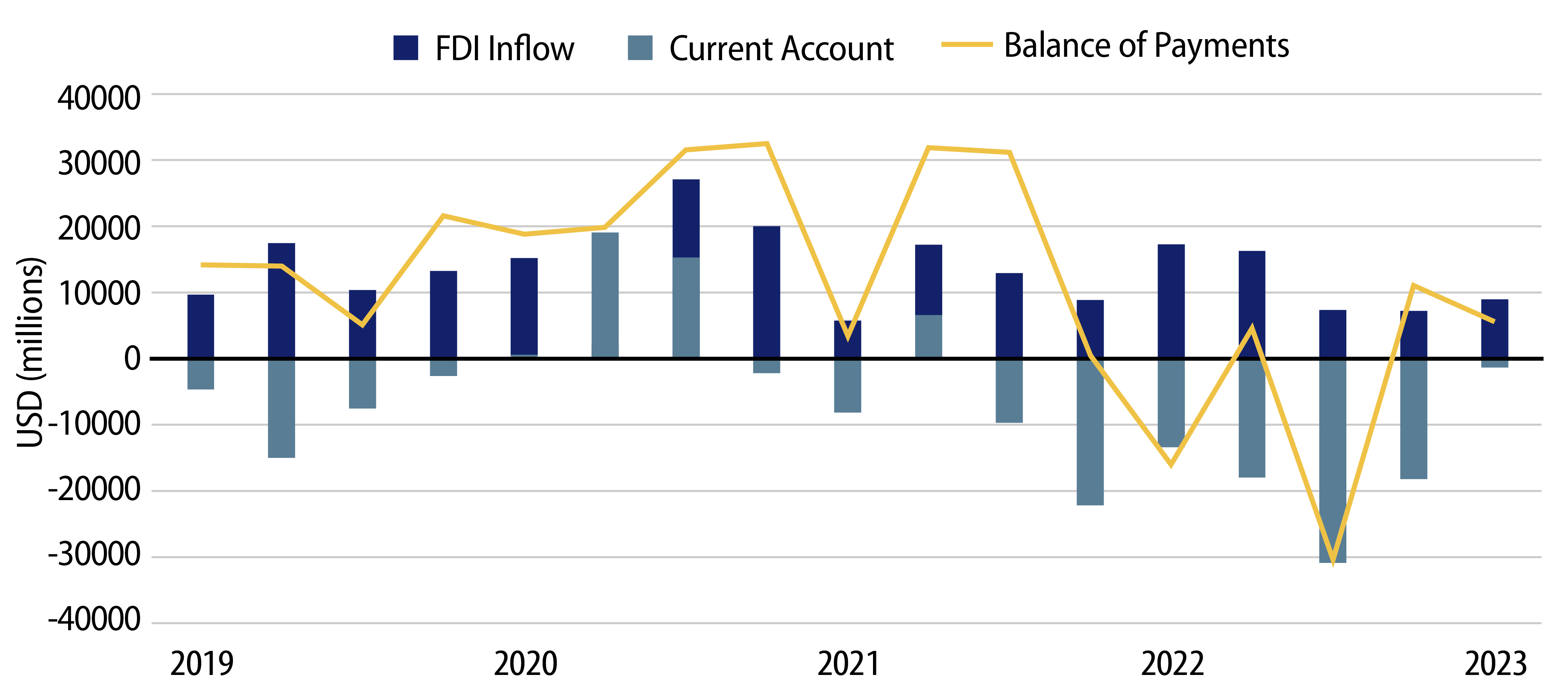

Large FX Reserves and FDI Inflows

India’s strength in recent times has been its external position. India currently ranks among the top five globally in foreign exchange (FX) reserves, at a staggering USD599 billion. When it comes to India’s overall balance of payments, after being in a surplus in the years leading up to Covid, it suffered a deficit during parts of 2022, before rebounding back to a surplus in late 2022. The surplus has been buttressed by continued foreign direct investment (FDI) due to the China+1 supply chain diversification, increasing services exports and portfolio flows. India’s current account has benefited from its relationship with Russia, procuring a reported 42% of its crude oil requirements from Russia at a discount. While it is not fully disclosed as to how much India has benefited, estimates put the reduction of the oil import receipts at as much as 10%. India’s balance of payments surplus is forecasted to rise to about USD 15 billion as we close out the year.

Attractive Valuations in India vs. Indonesia

From a relative value perspective, India boasts the highest bond yields of the nine largest Asian economies ex-Japan. As of mid-September 2023, the yield on the 10-year Indian government bond is 7.19% while the next closest competitor is Indonesia, with the 10-year Indonesian government bond yield at 6.69%. In absolute US dollar terms, Indonesia has been the clear outperformer in Asia, with a 6.2% YTD, while India has been second best, at 4.6% YTD. Foreign holdings of Indian government bonds are just north of 1%—a stark contrast to the 15% foreign holdings of Indonesia government bonds.

Key Elections Next Year

Both India and Indonesia are heading into general election cycles in 2024 and there is a degree of uncertainty regarding Indonesia, while Indian Prime Minister Narendra Modi is likely to win a third term with a strong election showing in the Lower House.

Ample Domestic Liquidity

There has been considerable foreign interest in India’s equity market with flows between March and August of 2023 amounting to USD21 billion. In that same period, there have only been USD2.7 billion of foreign inflows into India’s bond market. In fact, foreign holdings of the Indian bond market are at less than 1% of total outstanding bonds. As such, the Indian bond market is less susceptible to the gyrations of global markets. If we compare the performance of the 10-year US Treasury (UST) yield and the 10-year Indian government bond yield from the end of 2022 to the end of August 2023, the 10-year UST yield was +23 bps higher, while the 10-year Indian government bond yield fell -16 bps. In Asia ex-Japan, the Indian bond market is the third largest, just behind China and South Korea. Yet, India is not a part of any major global bond index. There is the possibility for this to change as India is under consideration for entry into the JP Morgan Global Diversified Index, with a potential weighting of 10% of the benchmark. This could result in approximately USD20 billion of passive inflows.

The Appeal of Indian Bonds

The Indian government bond market is highly liquid with bid/ask spreads within 1 bp for on-the-run bonds in clip sizes of INR1 billion (USD12 million), with the most liquid bond, the 10-year benchmark bond, able to reach sizes of INR3 billion (USD36 million) without the spread-widening. Even off-the-run bonds, in sizes of INR1 billion may see bid/ask spreads widen to just slightly under 2 bps. There is also a growing Masala bond market (INR-denominated bonds which settle in US dollars through Euroclear) that enjoys tax exemptions and ease of settlement with high-quality supranational issuers that would be suited for those investors who cannot obtain a Foreign Portfolio Investor (FPI) license.