Western Asset has maintained that US inflation would return to Federal Reserve (Fed) targets and restrictive Fed policy rates would have to be reduced. With the labor market back in balance and inflation running near Fed targets, Treasury Inflation-Protected Securities (TIPS) fell out of favor with the investment community, in sharp contrast to early 2022, when 10-year inflation expectations exceeded 3%. Now, with TIPS breakeven inflation rates near their targets, our view is that TIPS may offer good value relative to nominal Treasuries. Considering that real yields are still above the average of the last two decades, TIPS are also at least fair value on an outright basis even if, as we expect, the US economy continues to defy recession forecasts.

Inflation is expected to remain moderate going forward, with further disinflation to come from lags in declining housing costs and lower wage gains given the recent rise in the unemployment rate. Though wage gains are not yet down to pre-pandemic levels, all wage trends are moving lower. The indicators of the balance of labor supply and demand, such as the unemployment rate, the Job Opening and Labor Turnover (JOLTS) rate, quits rate and hiring rate, are all at or below pre-pandemic levels. Goods prices are still likely to reflect not only pre-pandemic secular forces of technology and globalization, but also the current excess capacity seen in both domestic and international economies, particularly in China. While anticipated US policy shifts following the upcoming election may have one-off effects on trade prices, moderating domestic inflation pressures should remain intact.

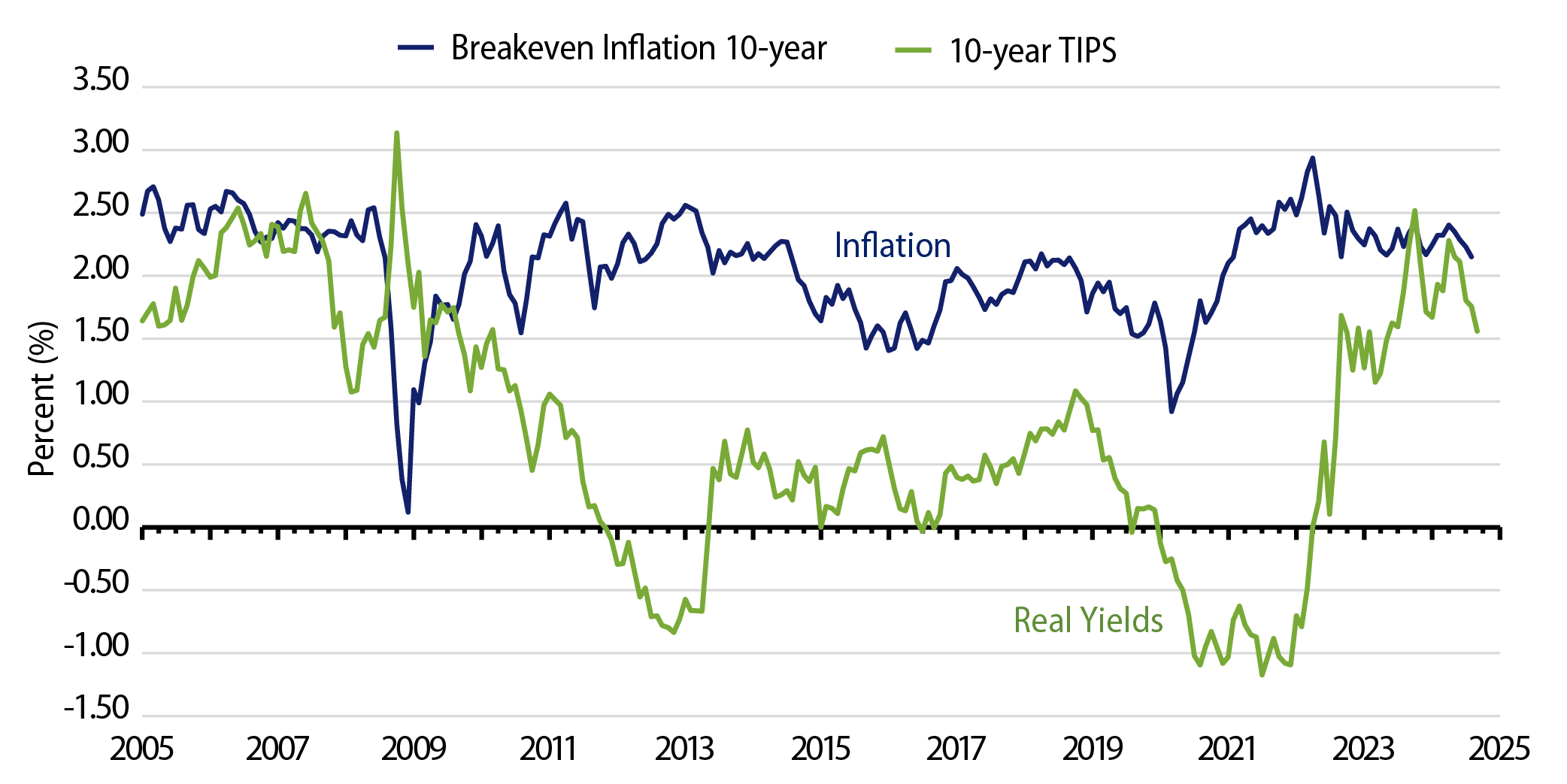

Exhibit 1 shows the 10-year real yield and 10-year expected inflation rate since 2005. After a decade of low real yields, the 10-year real yield of 1.5% is higher than any level seen between 2009 and 2021. The Breakeven Inflation (BEI) rate represents the required level for TIPS to have the same total return as a nominal US Treasury (UST) of similar maturity at the market’s expected inflation rate. TIPS are a good value relative to nominal USTs when the BEI rate is low and actual inflation can exceed that rate in the future. After peaking at over 3% in April 2022, 10-year TIPS BEI rates have cheapened over the last two years and are now right near the Fed’s inflation target at 2.1%.

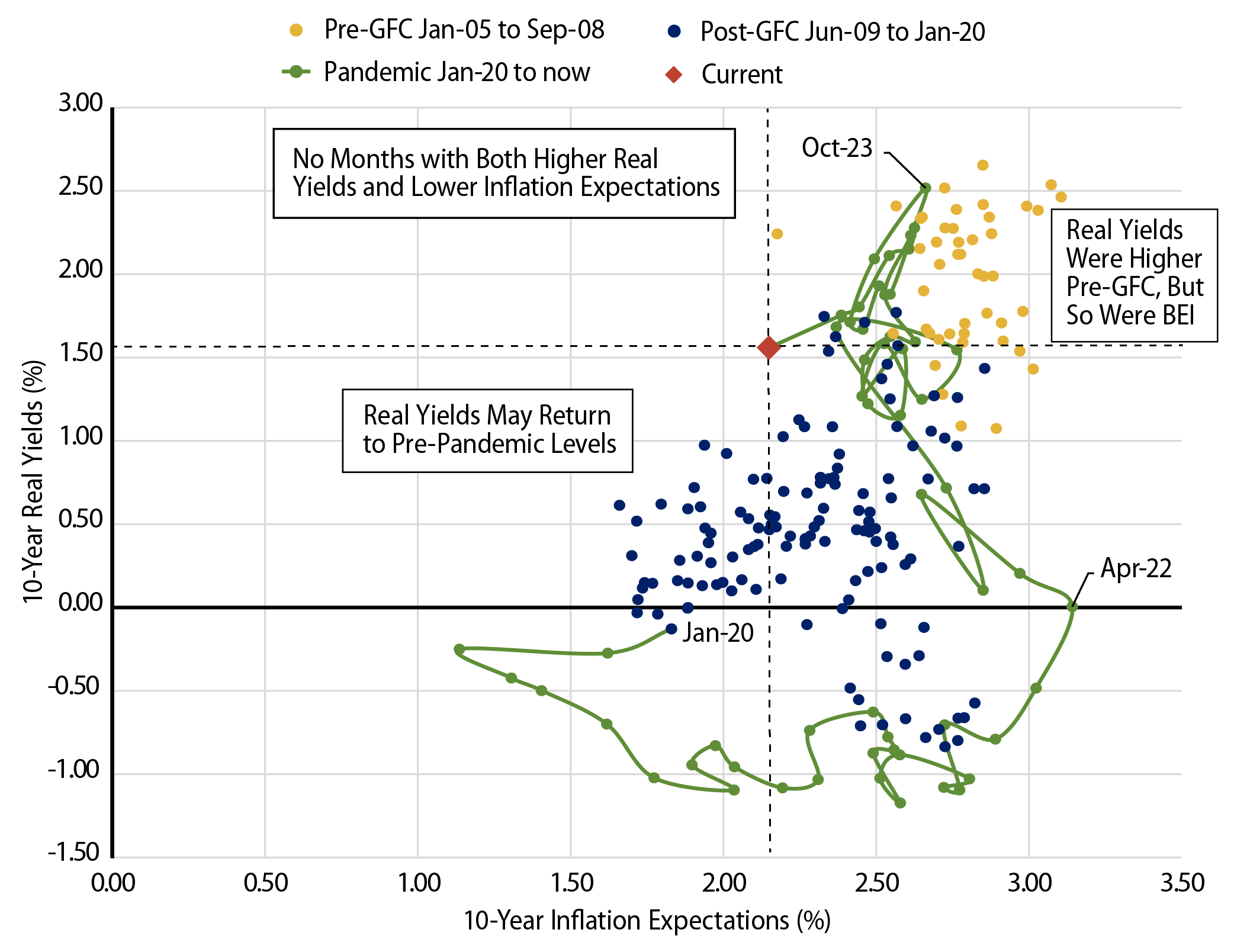

We believe another way to assess real yield and BEI is to compare their current combination against historical combinations. Exhibit 2 uses the same data as Exhibit 1 but shows more explicitly that real yields are relatively high; when they have been higher, it’s because inflation expectations were also higher. Note that there are no observations with both higher real yields and lower BEI rates (the upper left quadrant relative to today’s rates) using data since 2005. We excluded the period between October 2008 to June 2009 because the global financial crisis (GFC) was a time when financial institutions were dumping TIPS into an illiquid market. At that time valuations across markets, especially for TIPS, went haywire.

The pre-GFC observations in Exhibit 2 are mostly in the upper right quadrant from a time when both real yields and the BEI rate were also higher. The blue observations were for the period between the GFC and the pandemic, when real yields were lower and a mid-range BEI rate prevailed. Since the pandemic, the green line shows the circuitous route from negative real yields and low BEI rates to both high real yields and a high BEI rate. Now, TIPS still have reasonably high real yields, but the BEI rate is down to a modest level near Fed policy targets.

Exhibit 2 illustrates that there can be at least two TIPS buyer types: those who think real yields will return to pre-pandemic levels, and those that think inflation expectations will return to pre-GFC levels. We believe that real yields should decline even without a recession. Investors are being paid a real return on a bond that has neither credit risk nor excess inflation risk. There is a risk of underperformance if the US falls into a recession and real yields would likely fall. BEI rates would also fall, causing TIPS to underperform USTs.

The upcoming US election may result in policy shifts that alter near-term inflation. Higher tariffs on imported goods may cause a one-time increase in goods prices, though they are unlikely to impact long-term inflation expectations beyond 2025. Policies that encourage more domestic fossil fuel production could reduce headline CPI inflation, thereby reducing the attractiveness of TIPS relative to nominal USTs.

As Fed Chair Powell said in the recent Federal Open Market Committee press conference, policy rates were reduced by an outsized 50 bps because of the Fed’s confidence that inflation is contained. With the Fed now taking its eye off the inflation ball due to a weakening labor market, TIPS are likely to benefit from those seeking lower real yields. For those already overweight in fixed-income but perhaps fearing another above-target inflation episode in the next 10 years, TIPS allocations are now attractive relative to USTs.