The US merchandise trade deficit widened in December by $7.6 billion, from -$82.1 billion to -$89.7 billion, both on a monthly rate, as exports changed -1.7%, while imports changed +1.9%. In real terms, adjusting for price changes, that is, the deficit increased more mildly, as real exports increased 1.6%, while real imports increased 2.0%.

With real exports up while nominal exports were down, it should be obvious that US export prices were declining in December. Indeed, export prices declined for a variety of non-oil items as well as for oil, continuing a trend toward lower-traded goods prices that has been in place since June.

Over the six months since June, exports prices in general are down 9.1%, while prices of exports other than oil are down about 6.4%. Prices of imports are down 3.7%, while prices of imports other than oil are down 1.4%. Trade volumes rose in early-2022 and traded goods prices rose in tandem, as merchants scrambled to alleviate clogged ports in the wake of the Covid shutdown and to replenish inventories.

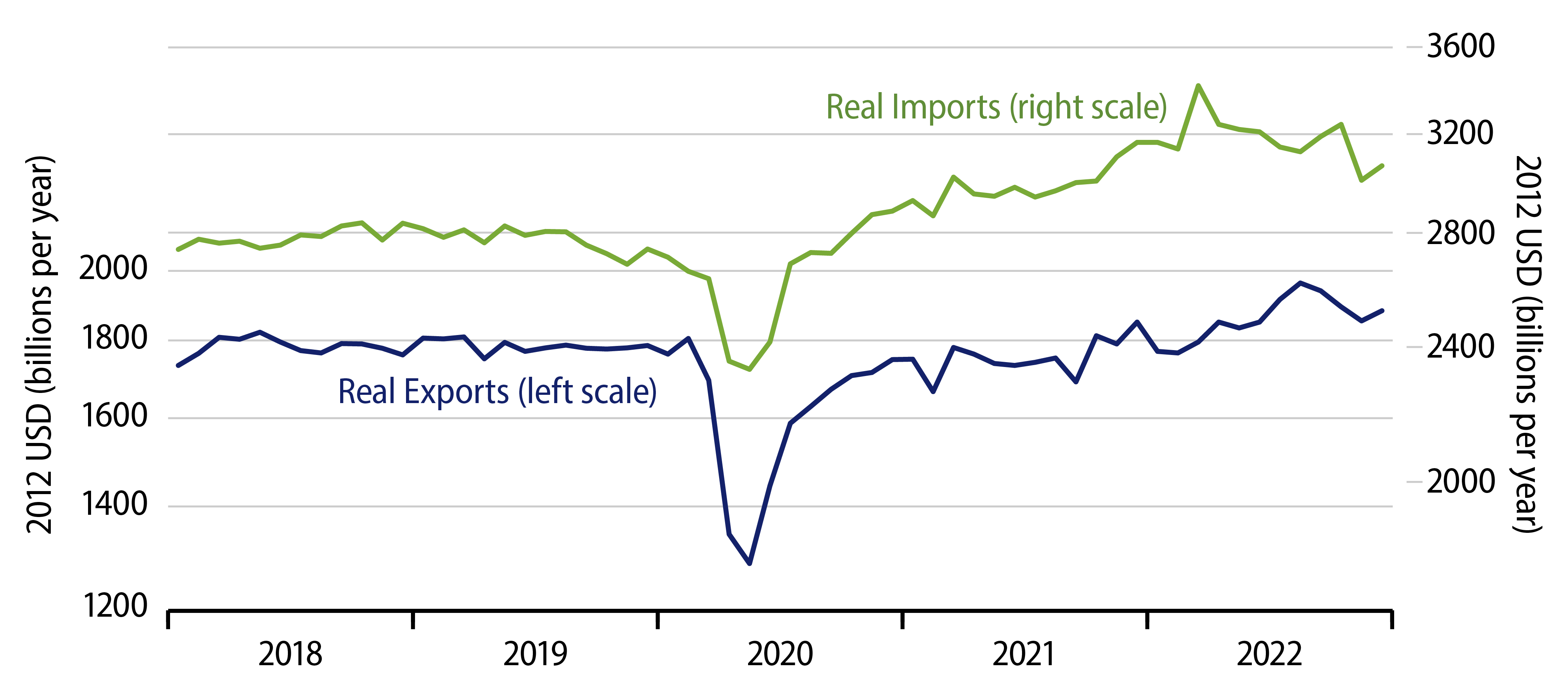

That process has worked in reverse over the last six months, as inventory shortages turned to inventory gluts. As you can see in the chart, declines in both exports and imports have occurred in recent months, and, again export and import prices have moved lower as well. That, in turn, has worked to reverse inflation pressures for domestic goods purchases.

Meanwhile, the surge in imports in early-2022 was a major factor driving negative GDP growth in the first half of 2022. By the same token, the decline in imports in 2H worked to boost GDP growth. We don’t believe that domestic production actually moved in tandem with these swings. In fact, supply-side production data show a much stronger US manufacturing sector in 1H22 than in 2H22. Still, regardless of whether the import swings drove reverse swings in actual economic growth, in the reported GDP data they are recorded as having done so.

While US import swings were driven largely by the aforementioned restocking of American merchants, with import volumes dominated by consumer and capital goods, the US export upturn in mid-2022 was driven mostly by raw materials—not just petroleum products, but also plastics, chemicals and metals. Those external demands have flagged some in recent months.

As for prices, both exports and imports began to decline at roughly equal rates in July and after. Recently, import price declines have moderated, while export price declines have continued. The levelling off in import prices likely means less downward pressure on goods prices within consumer price indices. However, it doesn’t point to a rebound in those prices, especially with consumer goods spending being as soft as it has been in recent months.