So far this year, markets have experienced significant turbulence due to a sudden surge of AI-related volatility in the global tech sector and President Trump’s unexpected announcement of tariffs on Colombia—a country previously not on the radar of market participants. This was followed by this past weekend’s announcements of 25% tariffs on Mexico and Canada, which, for now, have been paused until early March. Additionally, the administration announced an extra 10% tariff on China. Although these developments were widely anticipated, the critical question is the duration for which these tariffs will remain in effect once they become official. Should the tariffs persist through the second half of 2025, it’s likely to have adverse implications for US growth and inflation. These economic factors, in turn, could significantly influence the Federal Reserve’s (Fed) monetary policy decisions. It’s important to note that President Trump has moved to invoke the International Emergency Economic Powers Act (IEEPA), which would grant him greater authority to impose tariffs. However, we believe this action is likely to face legal challenges.

As is always the case with markets, the risks are two-sided. Given the intense focus on trade tensions recently, market prices may already reflect some of the downside risks. It could very well be the case that what has been announced thus far proves to be manageable for the US and the global economy. The news on tariffs could even improve from here, either due to a negotiated détente among the affected countries or possibly some kind of agreement in other trade areas. Any such positive development would presumably provide some support for spread sectors. However, one can’t ignore the possibility that trade tensions may worsen. If tensions were to continue to escalate, it’s not unreasonable to expect further pressure on spread sectors. This risk case underscores the need for diversification.

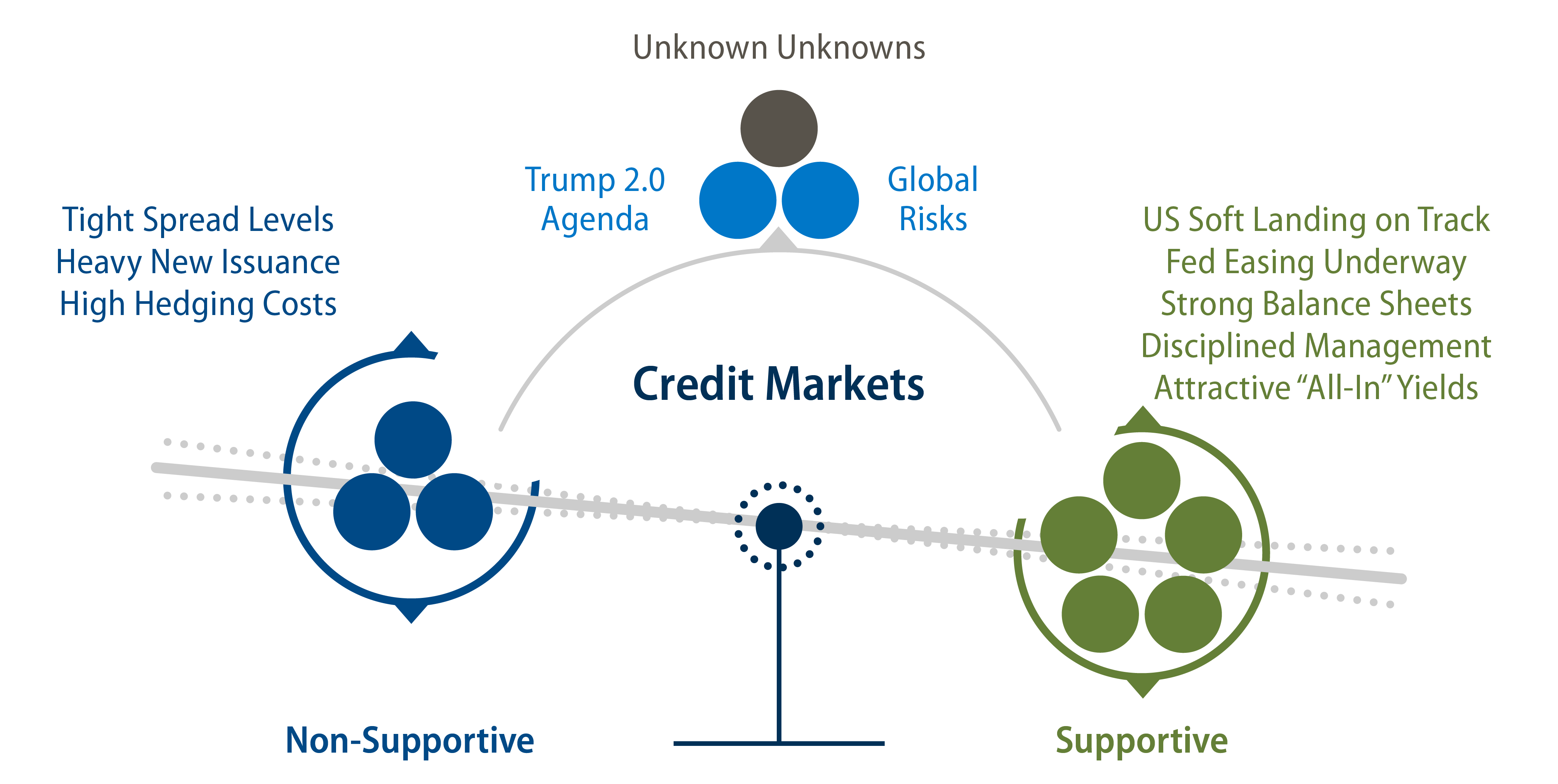

One way to help navigate through this period of trade-related uncertainty is to hold a diversified portfolio of high-income securities across various credit asset classes through a multi-asset credit (MAC) solution. This can be either on a standalone basis or as a complement to a core bond portfolio. We believe embracing a MAC solution has merit, given the presence of significant fundamental and technical supportive factors across high-yield credit, bank loans and securitized credit, which can help mitigate ongoing risks related to the Trump trade and geopolitical agenda.

In 2024, MAC-type strategies saw robust investor demand. According to Morningstar’s annual flow report, these strategies topped the active taxable bond category, raking in $56 billion in inflows and accounting for a quarter of the total market share. Intermediate core plus and ultrashort bond strategies also saw significant inflows, rounding out the top three in the category.

The demand for MAC strategies reaffirms what we highlighted in our blog post from last October. We emphasized that corporate balance sheets were strong, global financial conditions would likely remain favorable for credit, and that prevailing all-in yields across credit markets were still compelling relative to decade-long averages. Additionally, we anticipated that the easing cycle across both developed (DM) and emerging market (EM) central banks would continue amid the ongoing global economic slowdown and subdued inflation, though the magnitude and timing of rate cuts would vary globally. Our base case macro view, detailed in our latest Big Picture report for 1Q25, supports the persistence of these trends.

That stated, the recent tariff developments are certain to raise questions about their immediate impact across key segments of the credit market. In the following, we offer our latest fixed-income investment perspectives.

High-Yield Credit

Expanded and enforced tariffs are expected to exert additional pressure on retailers’ financials in the near term, potentially squeezing margins for companies with significant revenue shares in the affected regions. On the other hand, domestic companies and those that have relocated operations back to the US or to countries less likely to face tariffs should gain a competitive edge during these negotiations. With this in mind, we continue to see opportunities in service-related sectors still recovering from the pandemic, such as cruise lines and lodging, as well as in energy companies (E&P) and potential rising stars. Conversely, we remain more cautious about the consumer products, retail and home construction sectors.

Bank Loans

Since 4Q24, we’ve been reducing exposure to cyclical sectors such as autos, chemicals and building products in our bank loan investments due to tight spreads and moderating growth. Additionally, in light of the Trump presidency and tariff expectations, we have avoided auto companies with supply chains based in Mexico. Beyond the auto sector, we have ensured that our portfolio holdings do not have significant manufacturing exposure in Mexico, particularly within industrials, building products or consumer products. Despite these adjustments, we expect that bank loans should perform well, supported by attractive yields and a favorable collateralized loan obligation (CLO) issuance environment that will drive demand.

CLOs

CLOs are likely to follow macro sentiment, particularly for the lower-rated segments of the capital structure. However, most CLOs are backed by broadly diversified baskets of loans, which help insulate the investment-grade portions of the capital structure. The tail risks for BB rated CLOs and equity tranches can increase, especially in deals with significant exposure to names and sectors that could be negatively impacted by tariffs. We are remaining selective and avoiding below-investment-grade CLOs that are either less diversified or have substantial exposure to specific names within the auto, chemicals and building products sectors. From a tenor perspective, we favor maintaining a shorter spread duration within each rating category and looking to add or rotate positions on any widening, as the overall yields are already attractive within the CLO space.

Investment-Grade Credit

Investment-grade corporate fundamentals began the year from a very strong position, with an upgrade-to-downgrade ratio of 4.7 times in 2024—the highest ratio since 2007. Demand for investment-grade corporates has kept pace with robust supply, a trend we expect to continue as the rates market offers attractive yields. The Bloomberg US Credit Index tightened by 16 basis points (bps) to close the year at +77 bps, reflecting an optimistic, low-volatility environment. Among the sectors most affected by trade and tariff issues, the automotive sector stands out. Consequently, we reduced our exposure in the latter half of 2024 and are now maintaining a neutral position.

Non-Agency Residential Mortgage-Backed Securities (NARMBS)

NARMBS performed strongly in 2024 amid elevated new-issue volumes, with credit spreads ending the year at tight levels, though still wider than pre-pandemic benchmarks. Residential housing fundamentals remain supportive, with low existing and new-home supply expected to continue. We favor new-issue deals at the top of the credit stack and seasoned credit bonds with upgrade potential as deals de-lever. The impact of tariffs is anticipated to be muted, with a potential decrease in new home construction making it more expensive, thereby continuing to support higher home prices.

Non-Agency Commercial MBS (CMBS)

The immediate reaction of the CMBS market to the tariffs is likely to be influenced by the performance of credit and equity markets. If there’s a broad-based pullback in risk, the CMBS market will likely follow suit, potentially causing delays in financings. Fundamentally, higher costs of goods may challenge rents in consumer-oriented subsectors such as lodging, retail and, to a lesser extent, multifamily housing. Additionally, some corporate tenants in industrial sectors might experience reduced demand for space due to decreased foreign trade. Compounding these challenges, if tariffs delay further rate cuts the outcome could be negative for most commercial real estate credits and real estate values overall. This would pressure refinancing success rates and values, further dampening an already constrained lending environment. Despite these concerns, our view is that the CMBS market still offers a substantial quantity of mispriced credits. However, we will adopt a cautious approach to any near-term volatility.

EM

At a regional level, Latin America is likely to be affected through three primary channels. First, a stronger US dollar will likely pressure Latin American currencies and disrupt the region’s projected easing cycle. Second, with US oil production at its peak, Trump’s “drill baby drill” agenda might push Saudi Arabia to ramp up production, which could drive oil prices lower to force out competitors. This scenario would hurt revenue prospects for Latin American oil exporters struggling to cover growing fiscal deficits. Third, beyond the repercussion of tariffs, Trump’s immigration policies could significantly impact remittance flows, which are a vital source of household income for many in the region.

In Asia, higher tariffs on Chinese exports will add to China’s already extensive list of concerns, with implications for weaker global growth, particularly for export-oriented economies such as Singapore, Thailand and the Philippines. If Trump’s policies lead to higher inflation and subsequently higher long-dated US Treasury yields, this would disrupt the Fed’s glide path to lower interest rates. Higher US rates relative to Asia would likely result in a stronger US dollar versus Asian currencies, limiting easing moves by Asian central banks.

China’s response to higher tariffs is uncertain. In 2018, the renminbi weakened to offset the impact of US tariffs. Our Asia team believes that Chinese authorities will opt for currency stability this time around, given domestic economic challenges. Recently, China’s Politburo announced a stimulus package that calls for a “moderately loose” monetary policy for next year along with a “more active” fiscal policy. However, the effectiveness of this package on the economy remains unpredictable due to the aggressiveness of Trump’s latest tariff agenda.

We maintain our view that EM has more room to run as the market has already priced in a considerable amount of pessimism over the past year. While more trade-related surprises should be expected given the unpredictability of Trump’s policies, any unexpected catalyst prompting a significant repricing of EM assets would likely present a prime buying opportunity for EM credit and select FX and rates plays.