Growth and Trade Impacts: Negative

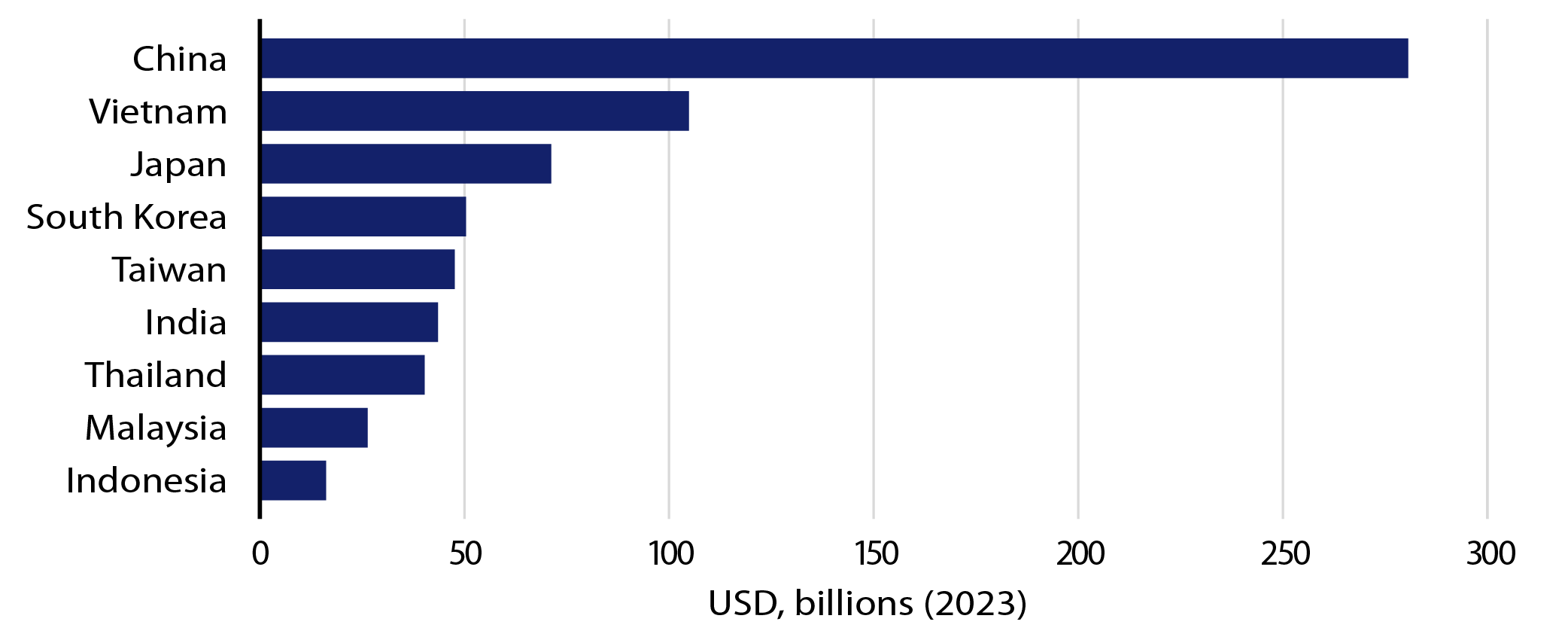

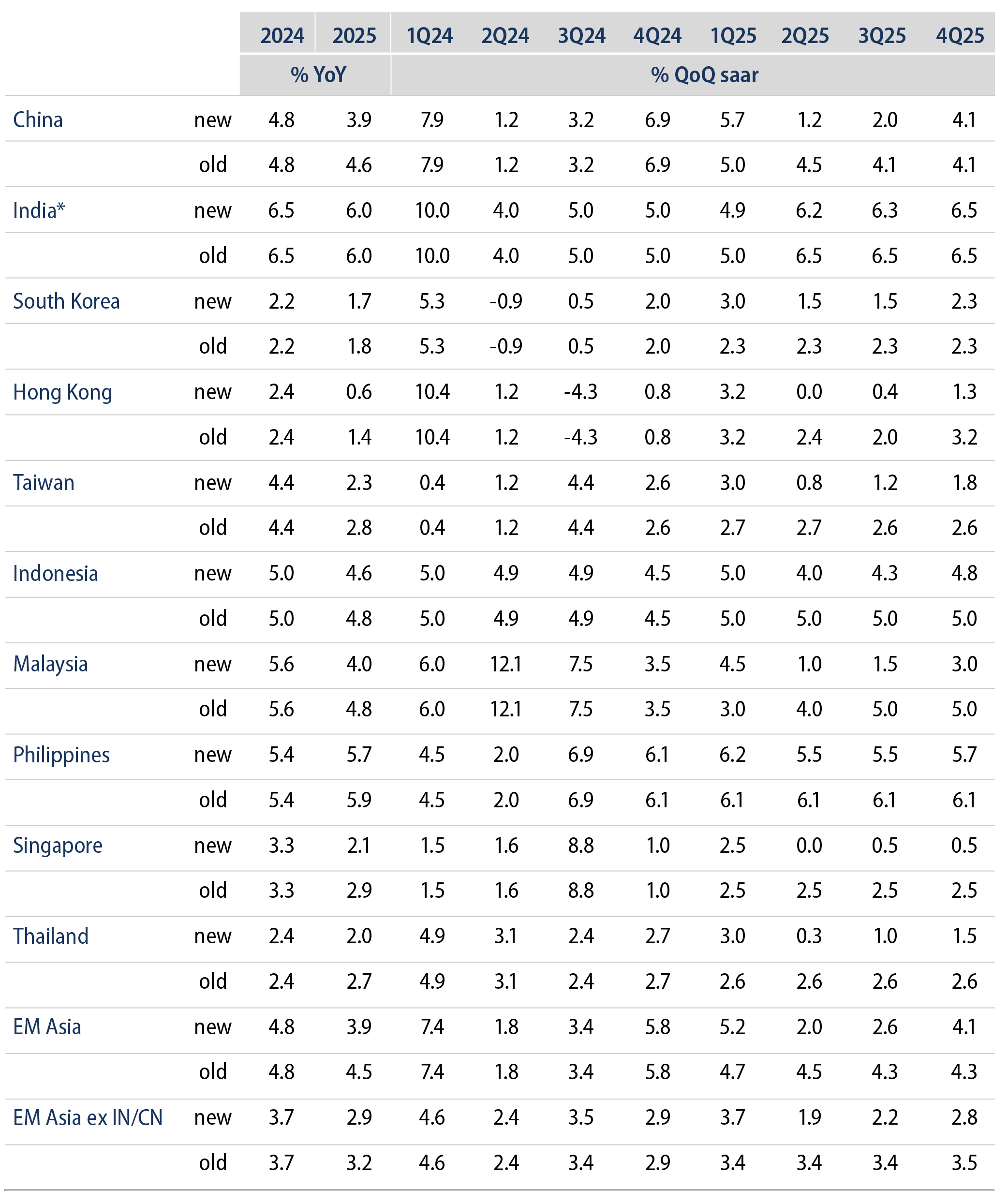

Trump tariffs and “made in USA” industrial policies are designed to promote US-centric growth and will generally mean weaker global growth, particularly for Asian export-oriented economies that have significant trade surpluses with the US (Exhibit 1). While Asian countries with large domestic economies such as India and Indonesia will be better shielded from policy impacts (Exhibit 2), China is in the crosshairs of Trump’s proposed 60% tariffs and may suffer disproportionately. However, the Middle Kingdom learned its lessons from the Trump 1.0 tariffs and have developed strategies to mitigate the adverse impacts of the proposed large tariffs. These counter-measures include fiscal stimulus, accommodative monetary policies, diversifying exports to the “friendly” belt of BRIC nations and the Middle East, and rerouting exports through other countries.

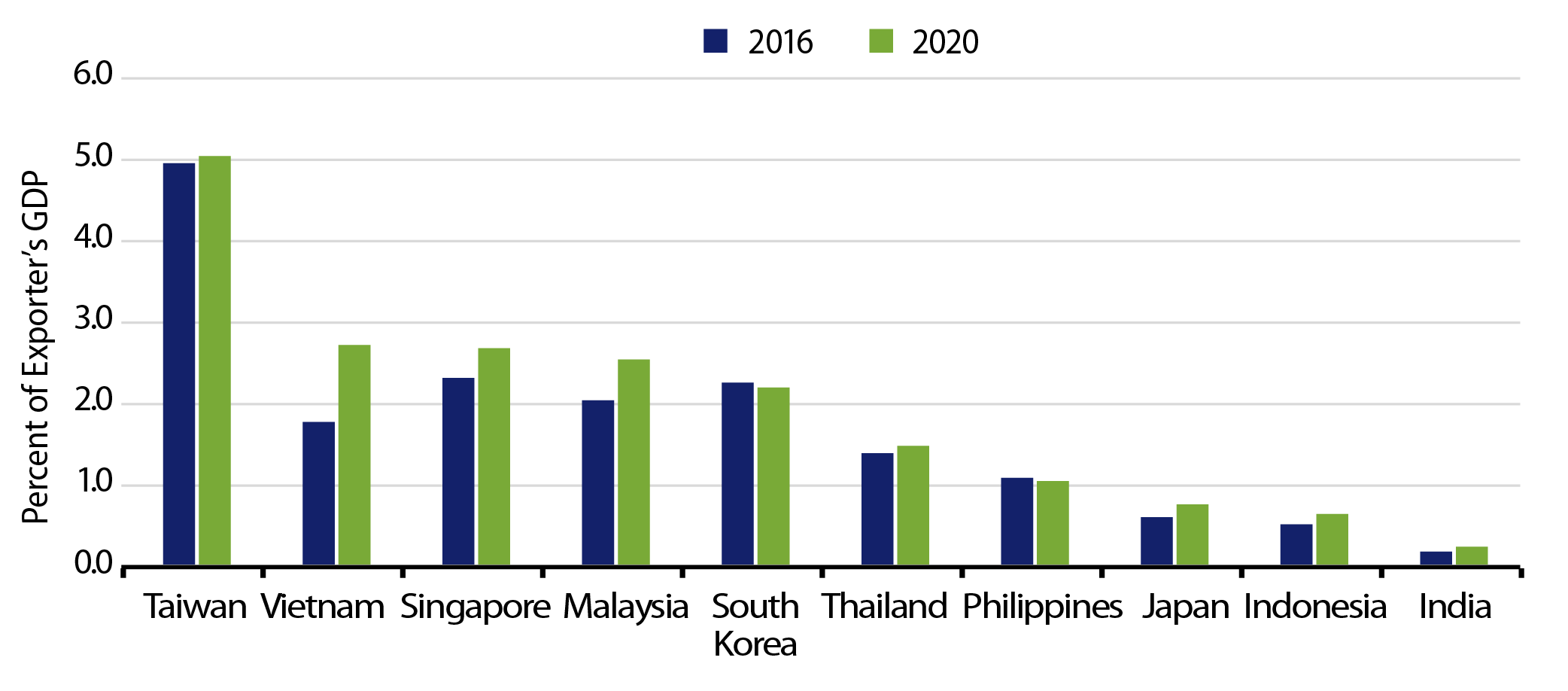

Smaller export-oriented Asian economies such as South Korea, Vietnam, Thailand and Malaysia may suffer second-order effects if Trump tariffs result in slower global growth, particularly if its impacts to China are significant (Exhibit 3). In addition to tariffs, the Trump administration’s likely expansion of US high-tech restrictions on China would also impact South Korea and Singapore disproportionally given the sophisticated nature of their electronic exports.

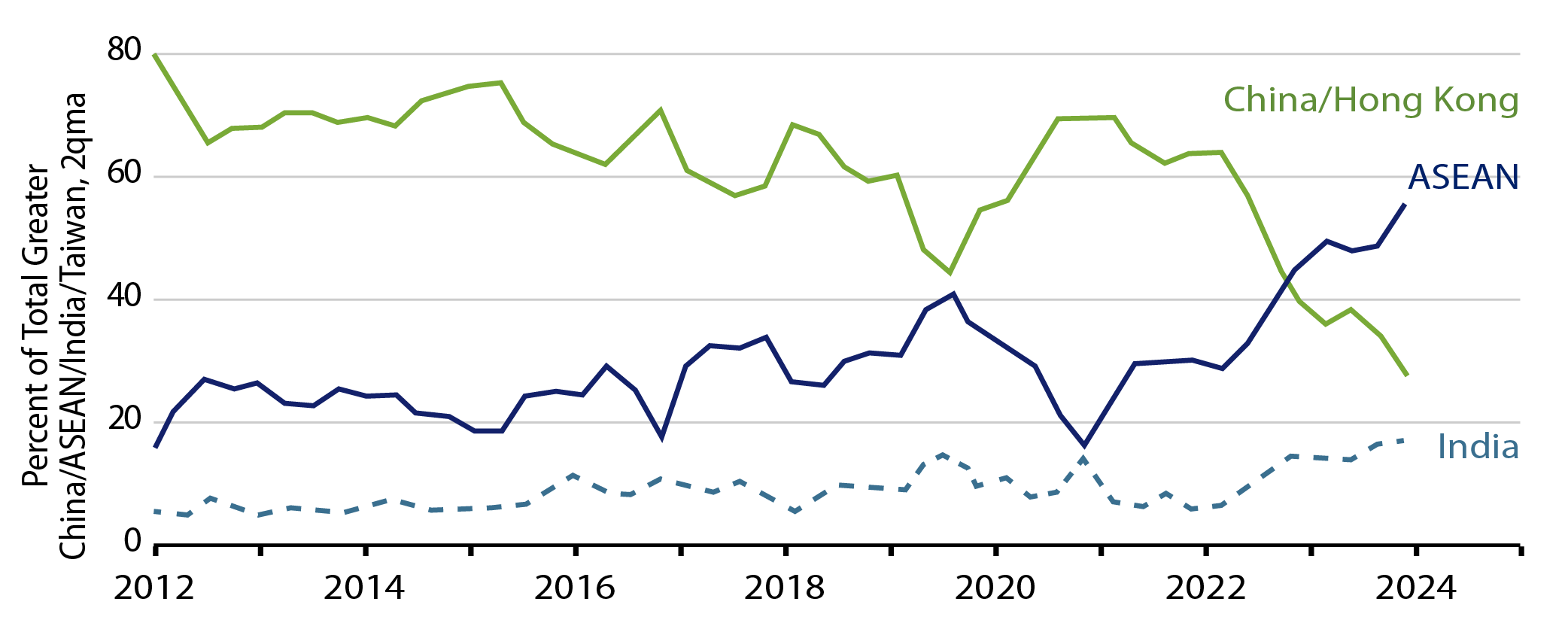

Chinese overseas direct investment (ODI) into ASEAN territories has grown significantly in the last four years (Exhibit 4) as Chinese companies seek to manufacture overseas to tap friendly Asia markets and avoid US tariffs. However, these large Chinese manufacturing plants in ASEAN may be impacted if the Trump administration takes a harsh stance to investigate the Chinese origins of these ASEAN exports.

Inflation Impact: Mixed

Trump tariffs, immigration curbs and tax cuts are all expected to stoke inflationary fires in the US. However, some of Trump’s pro-growth deregulation policies may enhance productivity and increase the supply side, thereby dampening the inflationary impact. Further, the delta from US inflation to Asia inflation is expected to be low given subdued domestic inflationary pressures in Asia. Among the factors driving Asian inflation, energy prices are expected to be soft due to the Trump mantra of “drill, baby, drill.” Food inflation carries significant weight in Asia’s Consumer Price Index (CPI) and could be volatile due to increasingly erratic weather patterns.

Asia Rates and FX Impacts: Modestly Negative

Trump’s proposed policies on tariffs, immigration curbs and tax cuts that would increase the US fiscal deficit are expected to have a higher inflationary impact and will likely lead to higher yields on long-dated US Treasuries (USTs). This is likely to disrupt the Federal Reserve’s glide path to lower interest rates. Higher US rates relative to the rest of the world are likely to result in a strong US dollar backdrop. Hence, Asia foreign exchange (FX) is likely to weaken versus the greenback in 2025.

Traditionally, the Asia government bond yields of Hong Kong (the USD/HKD FX peg), South Korea and Singapore (FX-centred policy) have a significant delta to the moves in UST yields. However, the long end of these Asia government bond markets has no large supply overhang due to greater fiscal prudence (unlike the large UST fiscal deficit). The demand for long-dated bonds is anchored by large domestic insurance and pension funds.

Chinese government bond yields (<10% are foreign owned) have diverged from rising global bond yields over the last three to four years due to domestic economic considerations of slow growth, softness in the real estate market, and the need for continuing monetary and fiscal policy support. These factors are unlikely to change during the next Trump presidency (Exhibit 5).

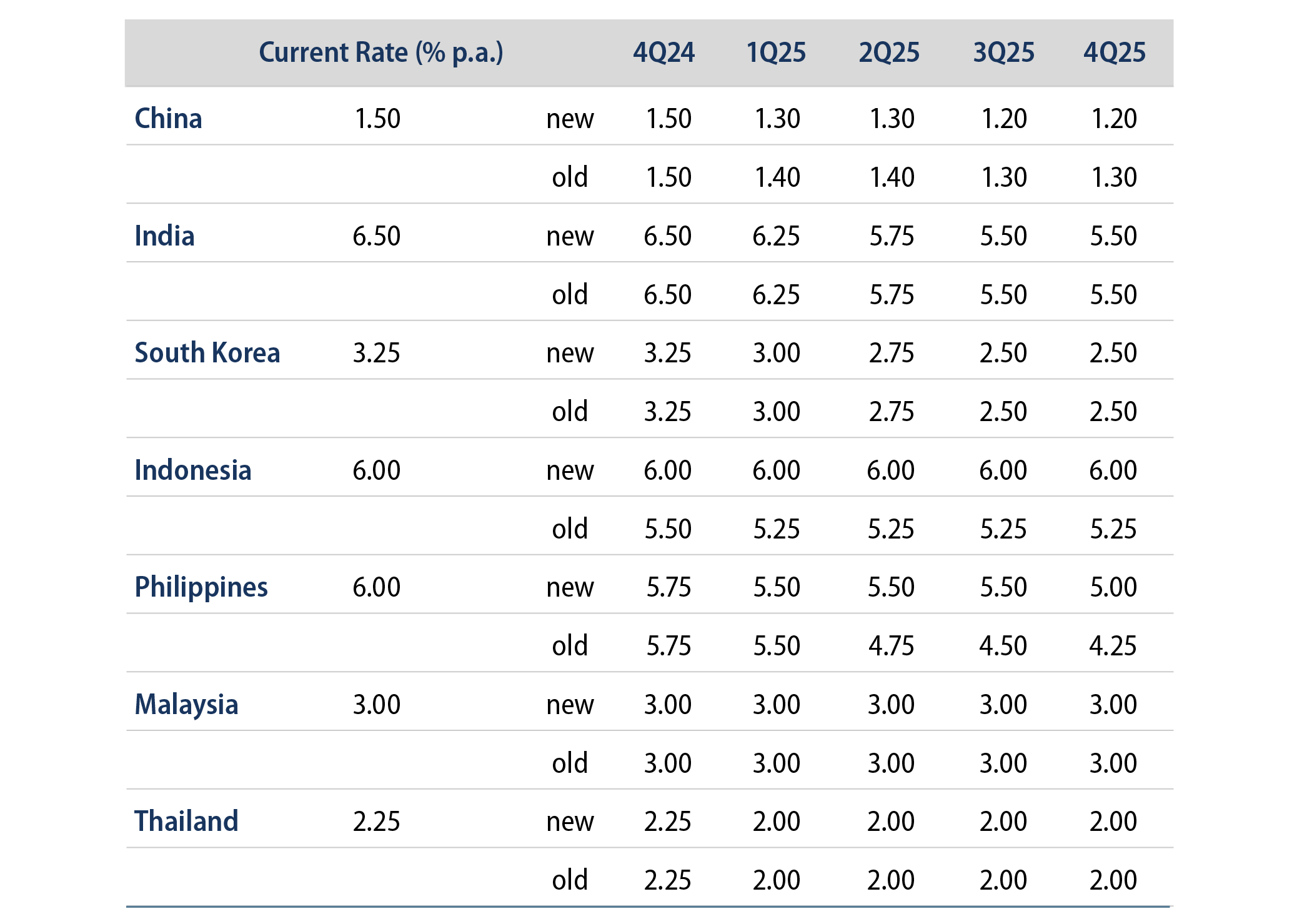

A strong US dollar backdrop will limit significant easing moves by Asian central banks such as in South Korea, Indonesia, Thailand and the Philippines. In our central scenario, we believe that the People’s Bank of China will focus on USD/CNY stability by managing the Yuan within CNY/CFET basket range, strictly enforce capital controls to avoid a large disorderly CNY depreciation in response to Trump tariffs. Instead, China will apply large fiscal stimulus and accommodative monetary policy to support its economy. That said, given the likely strong US dollar backdrop, USD/CNY should follow the lead of other Asian FX and to trade higher in 2025.

Geopolitical and Investment Flow Impacts: Negative

The geopolitical inclinations of “America First” are likely to have an adverse impact on Asian security and investment flows. However, our view is that this impact will fall disproportionally on South Korea and Greater China.

In South Asia, India may be less affected. The US shares deep economic and strategic interests with the country as it is seen as a strategic counterweight to China on foreign policy. India is a large, domestic-demand-driven economy and a major beneficiary of the supply chain reconfiguration. In addition, Prime Minister Modi and Trump share a strong relationship.

Singapore is the most open economy in the ASEAN region and a key beneficiary of global investment flows. As a result, it is likely to be adversely impacted by Trump’s protectionist policies. However, Singapore has a free-trade agreement and a positive trade balance with the US, which would shield the island republic from direct tariff impacts. Its neighbours Malaysia and Indonesia are likely to be resilient. Malaysia is gathering significant foreign direct investment due to its establishment of the Johore State Special Economic Zone (JSSEZ) and Prime Minister Anwar’s fiscal consolidation programs. In our view, Indonesia will continue to benefit from its large resource base, a significant domestic economy and its strategic location/importance in the South China sea. Both Indonesia and Malaysia have rebuilt their relations with Singapore, which will likely result in increased direct and portfolio investments.

Whether significant tariffs will pass remains to be seen. China recently flexed its muscles in the looming trade war by responding to Biden’s trade restrictions on essential components for AI chips. President Xi Jinping retaliated by opening a probe into Nvidia and banning exports of rare minerals for use in chip production in a measure that could curtail the apparent boundless rise of the chip manufacturer and larger AI growth in America. In addition, the sequencing of Trump 2.0 policies, the actual tariff levels and whether they are selective or across the board matters.

Trump also invited Jinping to his inauguration in January, a move meant to symbolize diplomacy. Jinping’s response may signal a new era of positive international relations—or further distancing.