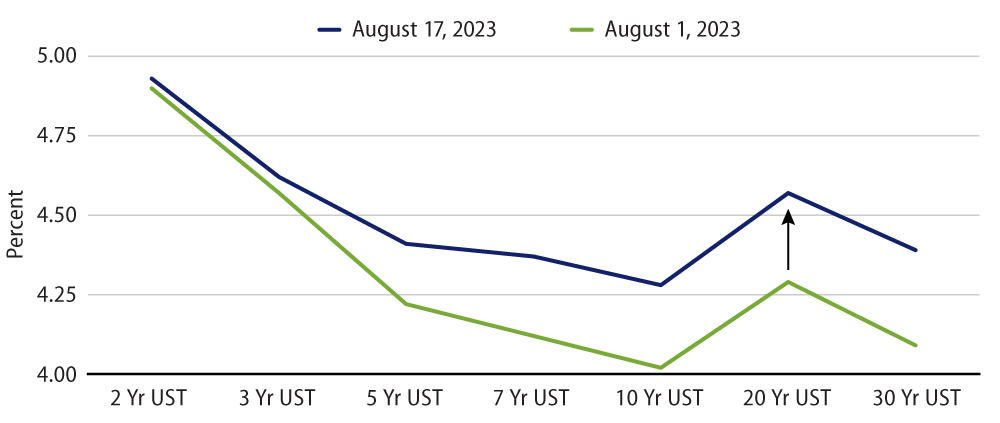

US Treasuries (USTs) have moved materially higher month to date, with the bulk of the repricing occurring at the back end of the yield curve. This has resulted in a rare bear-steepening of the curve. Here we describe the contributing factors we believe led to this development along with our outlook for investors.

Rationale

We believe this bear-steepening of the UST curve can be attributed to the following catalysts:

- Market capacity to absorb increased UST supply. (1) Long-dated rates came under pressure early in the month following an announcement from the US Treasury that coupon issuance will be higher and more front-loaded than what the market had originally estimated. (2) There was also concern that foreign central banks might start “dumping” USTs to mitigate the impact of a stronger US dollar on their home currencies. On the first point, Treasury International Capital (TIC) data from June shows that demand for USTs by foreign official and private investors (e.g., in Europe) remains healthy at these yield levels. On the second point, it’s important to note that holdings of USTs by foreign central banks are more concentrated at shorter maturities; longer-maturity USTs (e.g., more than 20 years) account for less than 5% of their Treasury holdings while notes maturing in three years or less account for about 40% of their holdings.1

- The Bank of Japan’s (BoJ) recent adjustment of its yield curve control (YCC) framework, which widened the band at the 10-year point of the Japanese government bond (JGB) yield curve. This was not completely unexpected as the BoJ indicated back in December 2022 that an adjustment might be forthcoming depending on the path of inflation. Nonetheless, global bond yields (especially at the 10-year point) moved higher following the YCC development. USTs, in particular, were impacted by the view that higher JGB yields might reduce Japanese demand for USD-denominated assets.

- Fitch’s downgrade of the US credit rating to AA+ from AAA. As we discussed in a recent blog, Fitch’s Downgrade of the US—Interesting Timing with Muted Market Reaction, the initial reaction to the downgrade news was a mild bear-steepening of the UST curve. This makes sense as market participants were already aware that Fitch had put the US credit rating on “Negative Watch” in May 2023.

- Poor reception to the Bank of England’s (BoE) most recent rate hike. Another external factor weighing on global bond yields was the BoE’s decision to hike rates by 25 bps (versus 50 bps). The market deemed the decision too soft (especially in light of new data that showed continued nominal wage pressure), which prompted a selloff across the gilt curve.

- Thin trading markets. The annual seasonality effect of the summer months does not help the technical picture for USTs.

Western Asset’s Outlook

From our vantage point, we see resilient US growth and labor market data, as well as hawkish language from the latest Federal Open Market Committee (FOMC) minutes causing the market to price more risk premium further out the curve. In other words, if the economy hasn’t yet responded to a 550-bp hike in the fed funds rate then this suggests the neutral/longer-run rates need to be higher. Although that’s what the market is pricing, we believe this conclusion may be premature. Our view is that restrictive monetary policy (with real rates above pre-pandemic levels) and tighter credit conditions will continue to weigh on economic activity, and that inflation prints will continue to come in at 0.2% month-over-month allowing the Fed to skip in September and ultimately go on hold in November.

ENDNOTES

1. ''JP Morgan Says Stop Blaming Foreign Central Banks for Bond Rout'' Bloomberg, August 18, 2023