Macros, Markets and Munis

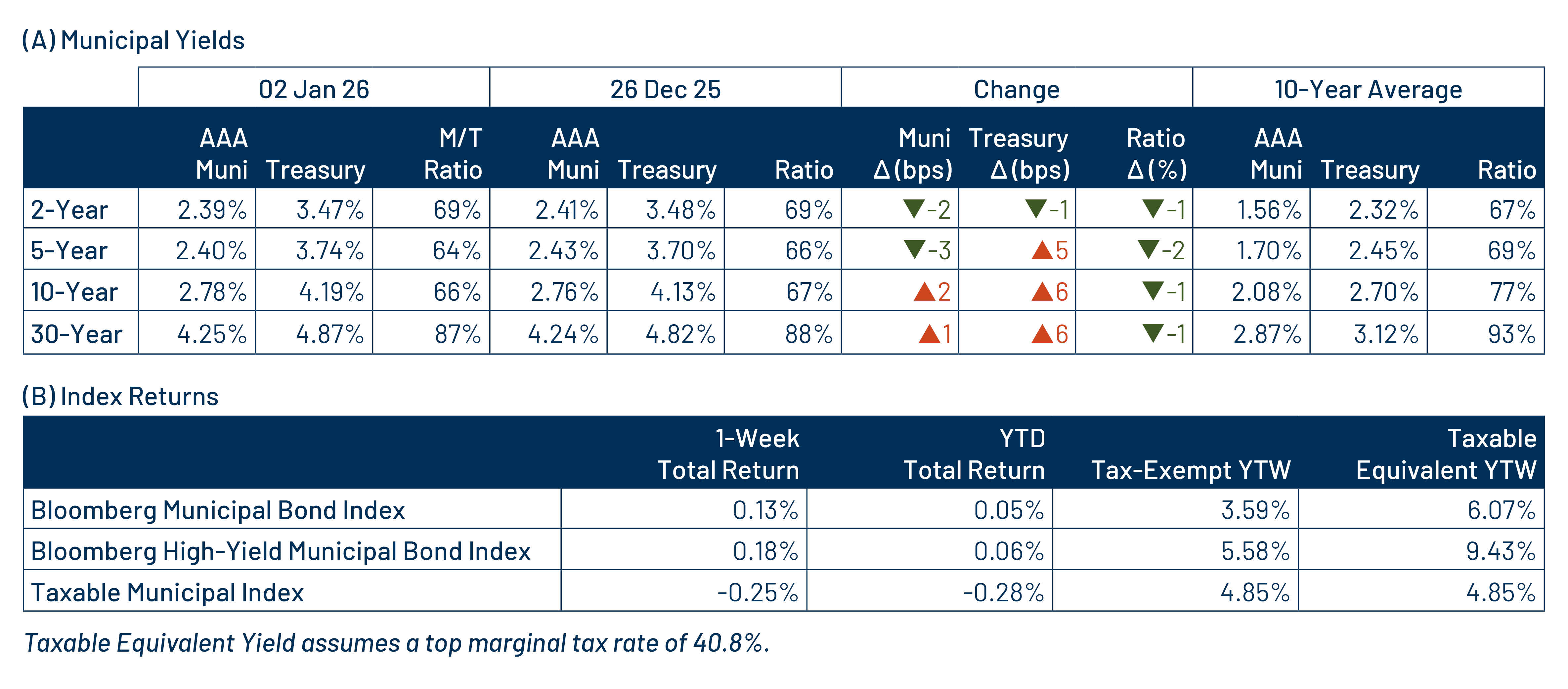

Munis posted positive returns last week and outperformed most fixed-income sectors. Economic data was limited in the last holiday-shortened week of 2025. Initial jobless claims data declined and came in lower than expected. The Treasury curve steepened, with yields moving lower in short maturities and rising by 6 basis points (bps) in longer maturities. Munis followed the steepening trend but outperformed amid improved technical conditions, given the lack of a meaningful new-issue calendar and continued fund inflows during the week. This week we provide a 2025 muni market review.

This Week in Munis: 2025 Market Review

Performance

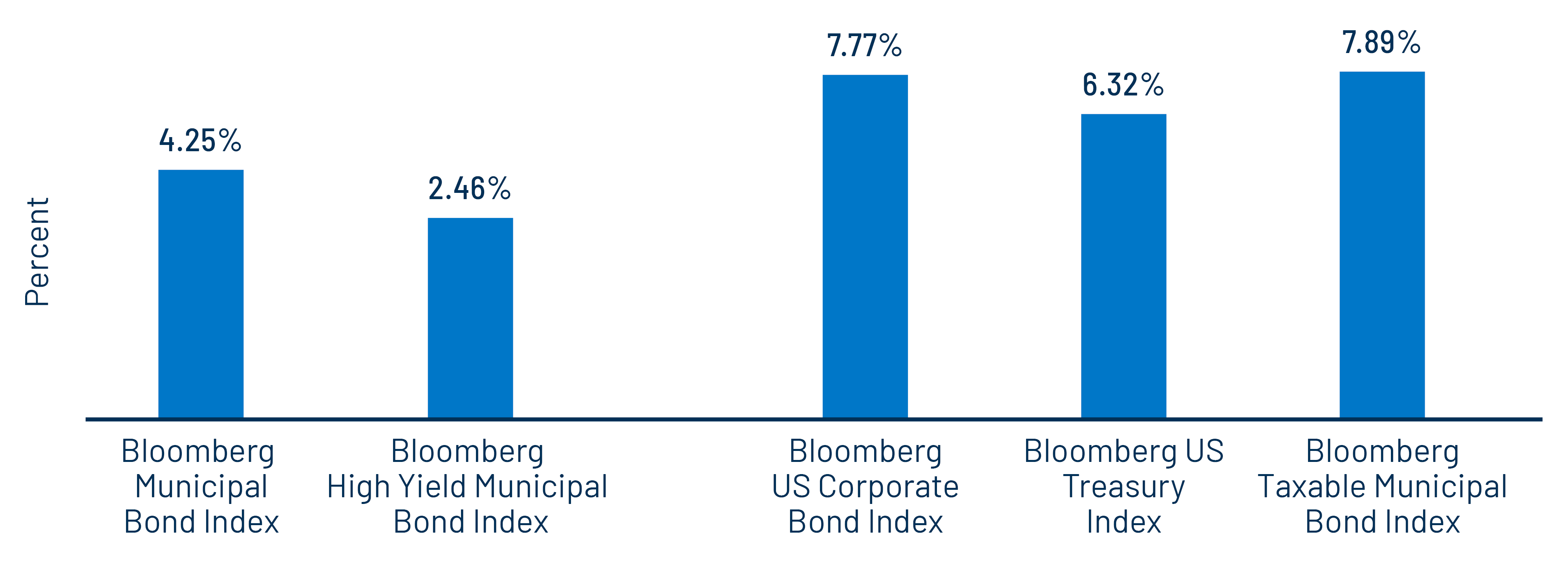

Fixed-income yields declined over the year as economic growth softened and inflation continued its downward trajectory, contributing to the Federal Reserve’s (Fed) decision to continue its rate-cutting cycle, delivering three rate cuts from September through December. The municipal market posted positive returns of 4.25% in 2025, underperforming the stronger returns observed in taxable fixed-income markets. Performance was mixed across the curve and credit cohorts, with intermediate maturities and mid-investment-grade securities generally outperforming while high-yield securities underperformed.

The taxable municipal market outperformed tax-exempt munis as well as Treasuries and corporates, amid limited supply conditions. The Bloomberg Taxable Municipal Bond Index returned 7.89%, outperforming Treasuries and corporates, which returned 6.32% and 7.77%, respectively. Within the taxable municipal market, longer-duration and higher-quality segments outperformed.

Technicals

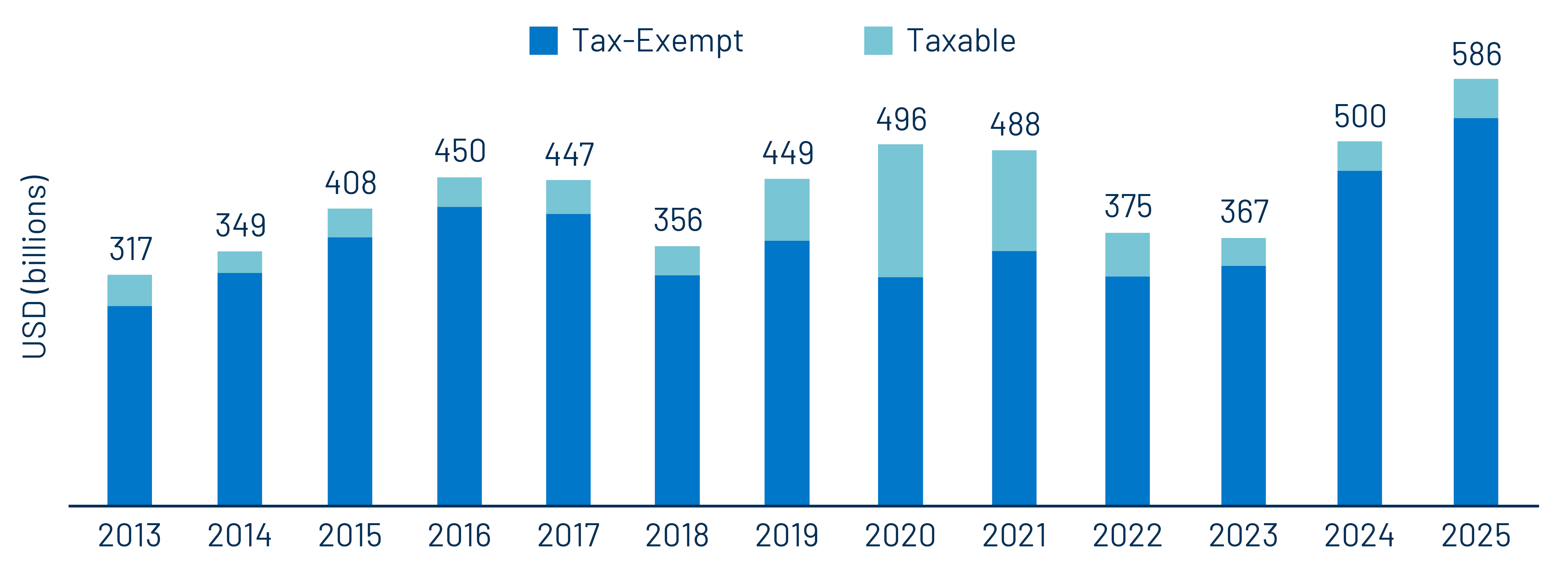

Municipal technicals were challenged in 2025 by record new-issue supply, with total muni issuance of $586 billion that surpassed the prior-year record by 17%. Tax-exempt issuance totaled $532 billion, up 16% year over year (YoY), while taxable supply reached $54 billion, up 35% YoY.

Municipal demand fluctuated throughout the year but improved steadily toward year-end 2025. Muni mutual fund flows were limited in the first half of the year amid choppy economic data and policy uncertainty, but strengthened in the second half as it became clear that the Fed would continue its rate-cutting cycle and as prior underperformance contributed to more attractive valuations. Overall, municipal mutual funds recorded $51 billion of net inflows in 2025, up 21% YoY, extending cumulative net inflows from early 2024 to $93 billion, according to Lipper.

Fundamentals

Municipal credit fundamentals continued to show resilience despite slowing growth trends. Census-reported 2Q25 state and local tax collection estimates, which capture fiscal year-end results for most governments, showed 12-month trailing collections increased 4% YoY to $2.1 trillion, a record high. Twelve-month trailing individual income tax collections rose 8% YoY, sales tax collections increased 2% YoY while corporate income tax collections were relatively flat. Rolling 12-month property tax collections, the primary revenue source for local governments, increased 2% YoY.

The improved credit trends were reflected in ratings activity. Public rating agency upgrades outpaced downgrades by more than 2 to 1, according to Bloomberg. Muni default activity also remained limited and largely isolated to select high-yield sectors and issuers. Through December 15, 2025, the muni market recorded 51 first-time payment defaults totaling $1.5 billion, down from 60 defaults totaling $2.1 billion in 2024, according to Bloomberg.

Valuations

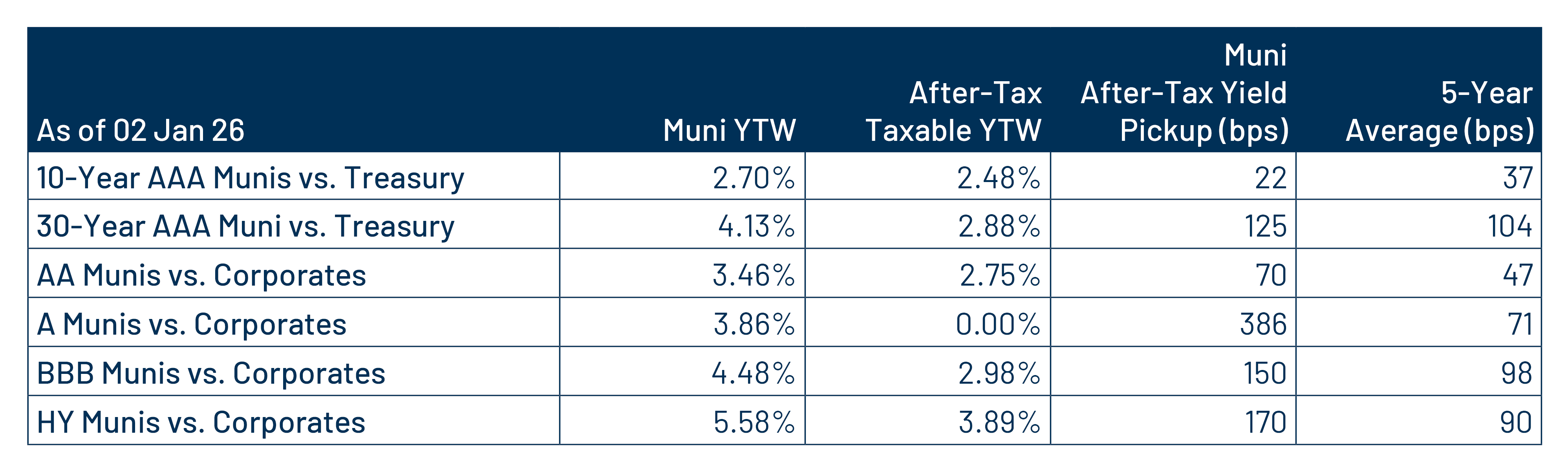

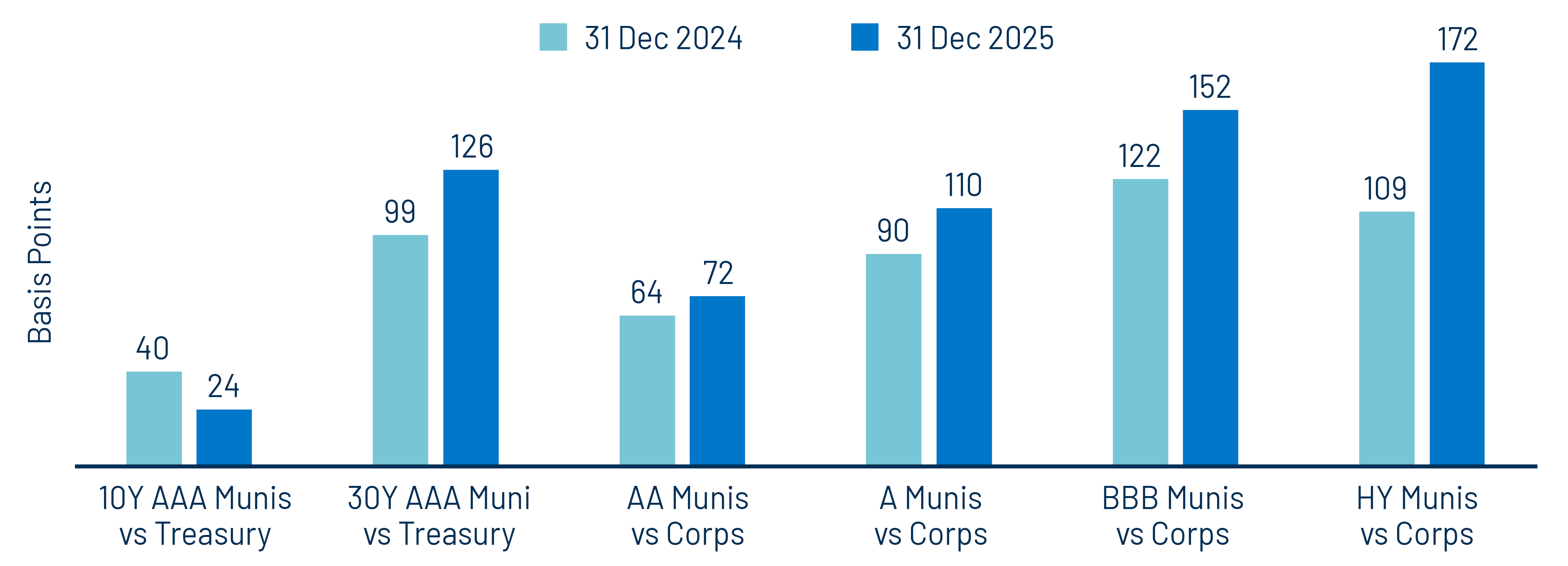

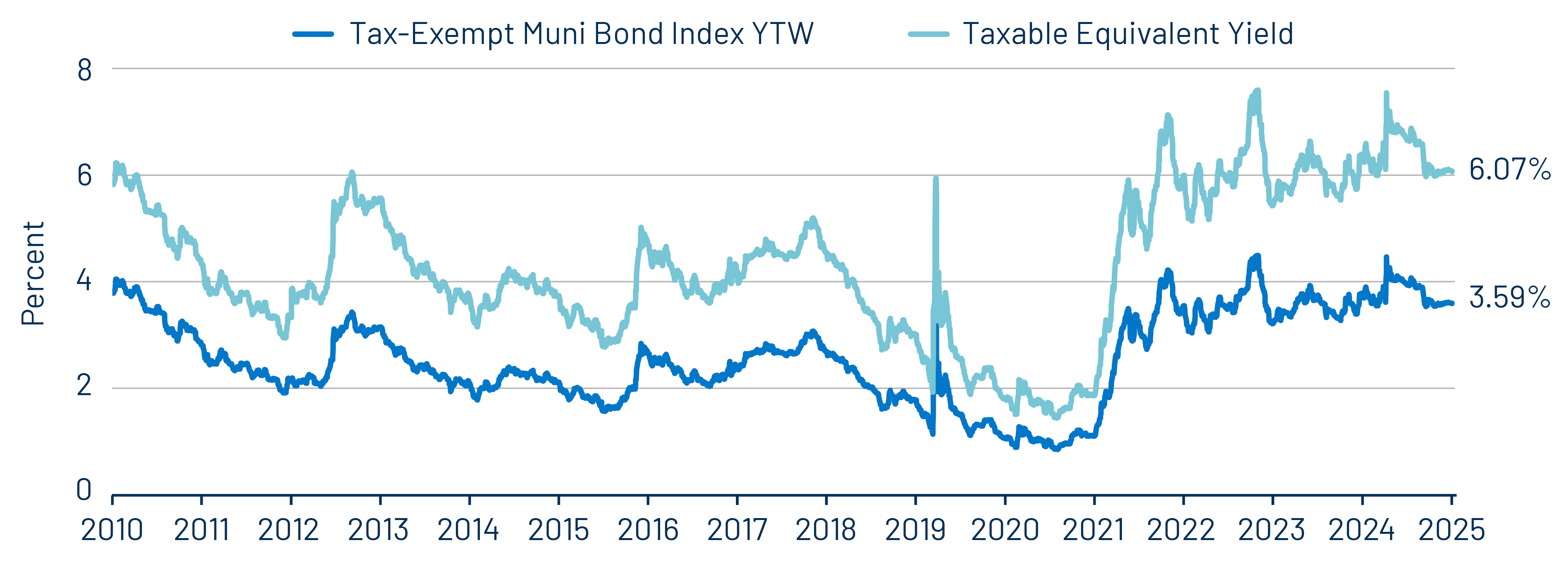

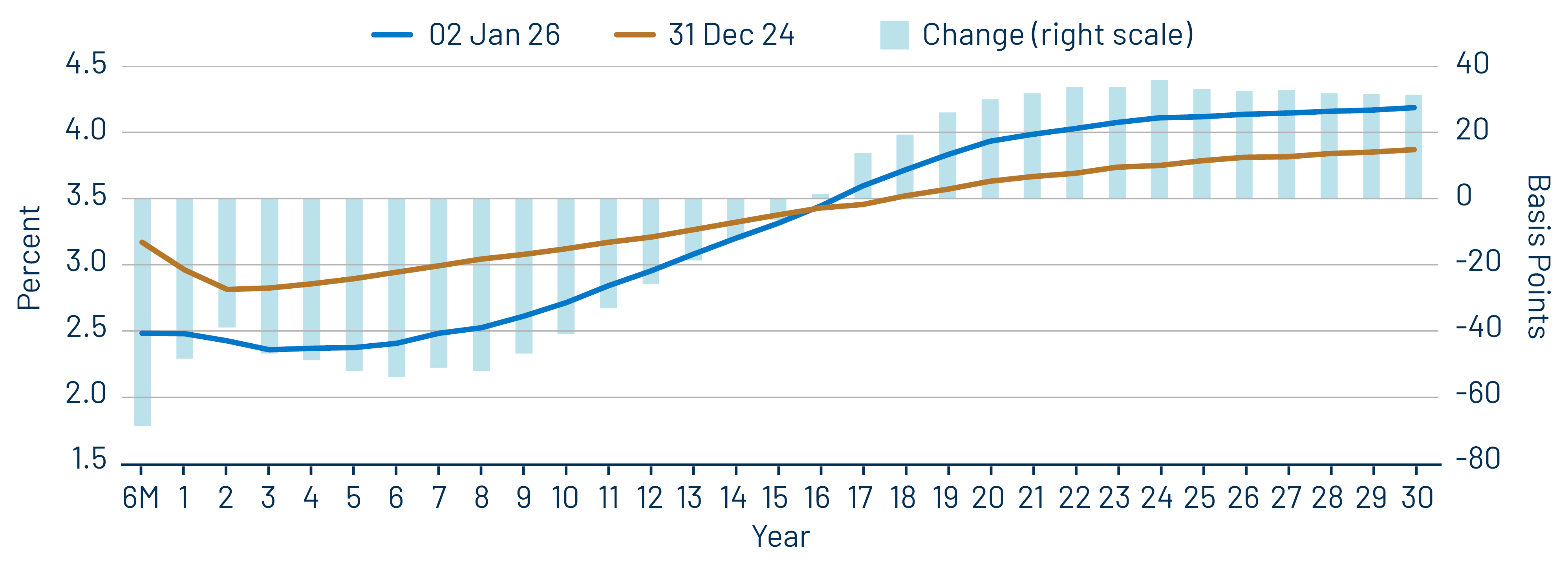

Relative underperformance and record supply conditions improved the tax-efficient income opportunities offered by munis entering 2026. The average investment-grade municipal yield, as measured by the Bloomberg Municipal Bond Index, ended the year just 14 bps lower at 3.60%. By comparison, yields on the Bloomberg Treasury Index and Bloomberg Corporate Index declined by 56 bps and 52 bps, respectively. Given the smaller magnitude of the municipal yield decline, after-tax relative valuations improved across most segments of the curve and credit structures over the year.

Municipal Credit Curves and Relative Value

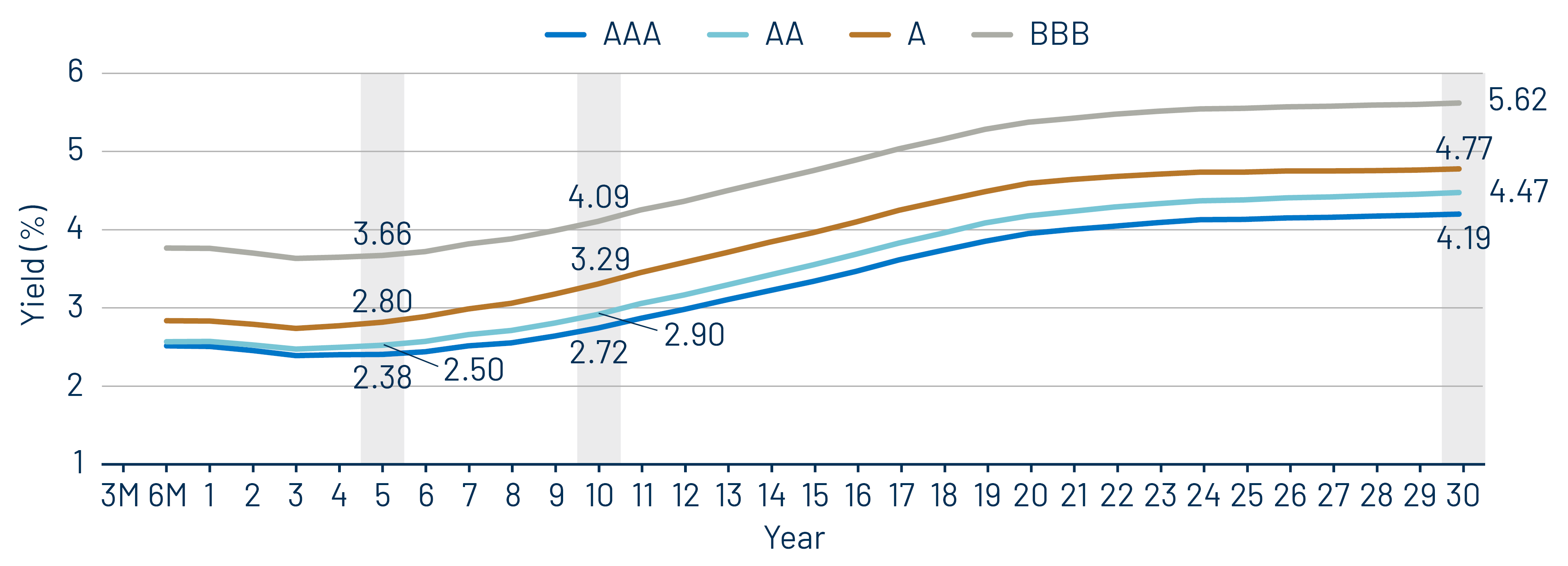

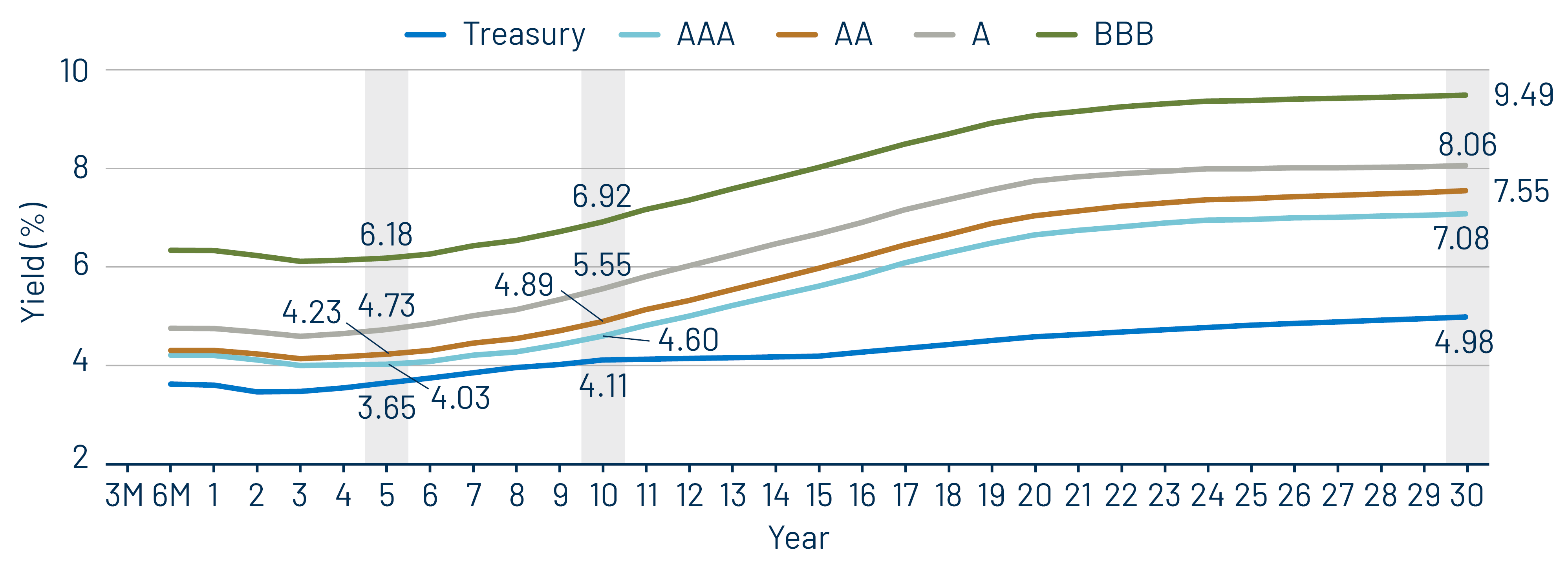

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

Theme #2: The AAA muni curve steepened in 2025, offering better value in intermediate and longer maturities.

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.