Municipals Posted Positive Returns Last Week

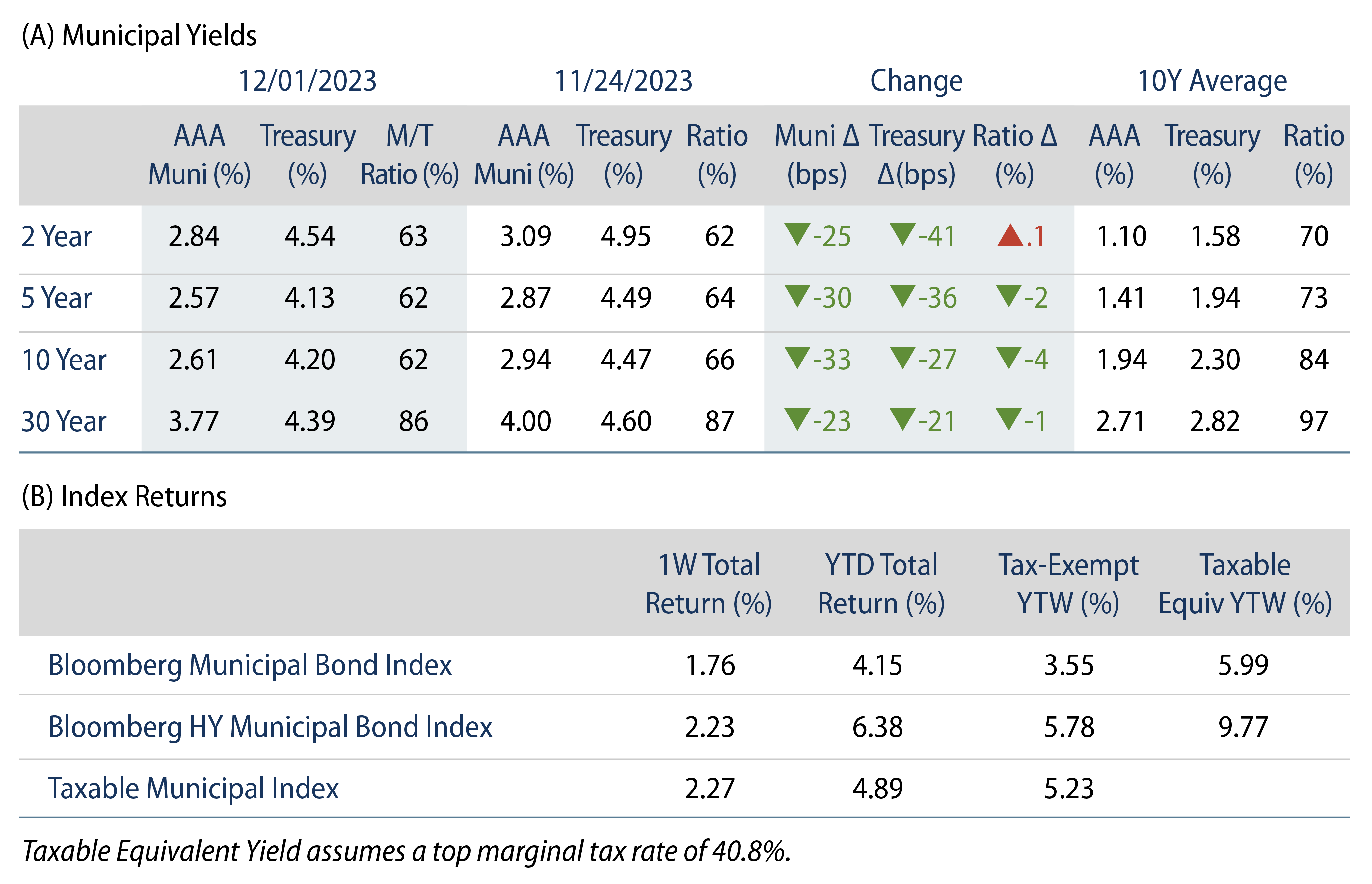

The muni rally continued last week, as municipals rallied with Treasuries, driven again by lower-than-anticipated inflation data. High-grade muni yields moved 23 to 33 bps lower across 2- to -30-year maturities. Meanwhile, municipal demand technicals continued to improve. The Bloomberg Municipal Index returned 1.76% during the week, the High Yield Muni Index returned 2.23% and the Taxable Muni Index returned 2.27%. This week we highlight record performance of munis observed over the month of November.

Muni Demand Improved with the Rate Rally

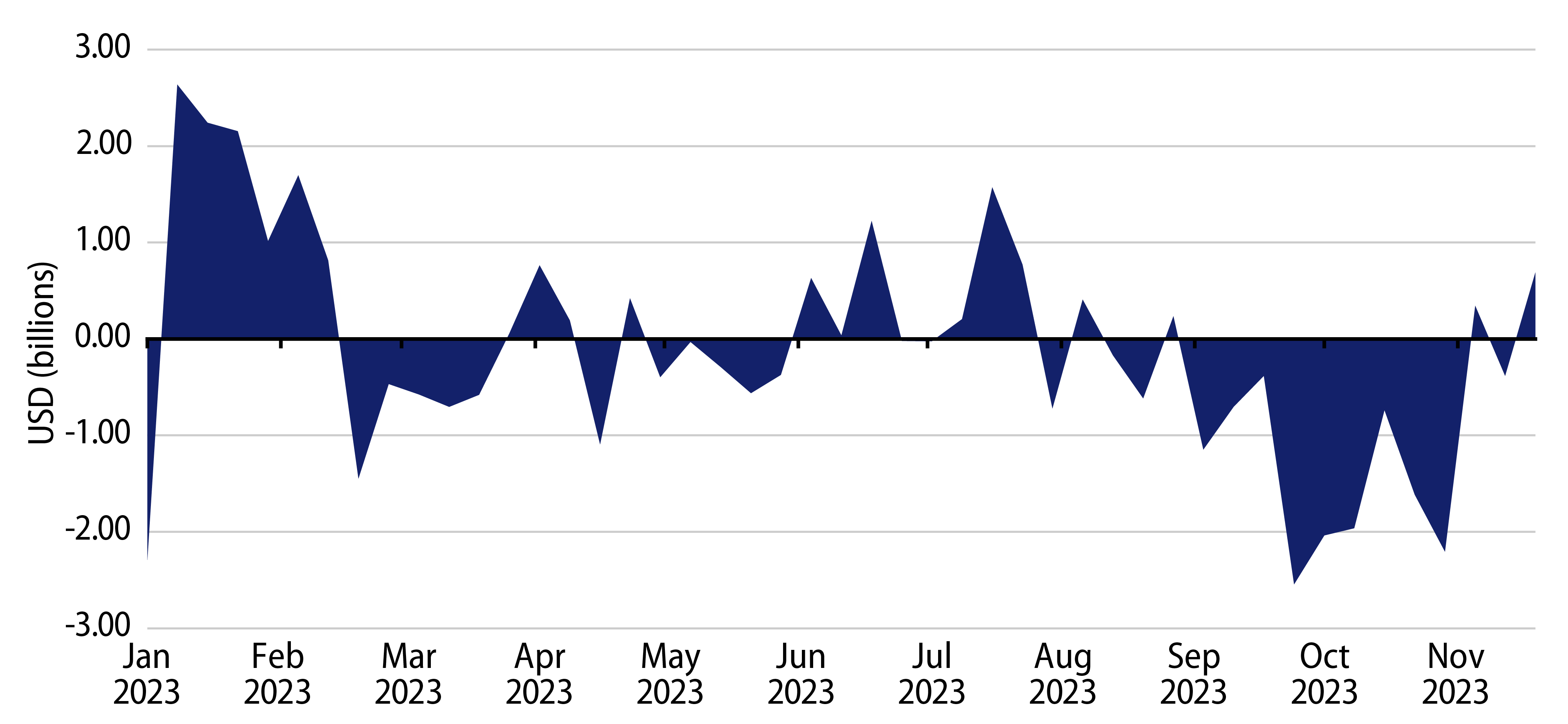

Fund Flows: During the week ending November 29, weekly reporting municipal mutual funds recorded $64 million of net outflows, according to Lipper, with long-term and high-yield categories reporting inflows. Long-term funds recorded $129 million of inflows, high-yield funds recorded $65 million of inflows and intermediate funds recorded $54 million of outflows. This week’s flows bring year-to-date (YTD) net outflows to an estimated $24 billion.

Supply: The muni market recorded $12 billion of new-issue volume last week, picking back up to elevated levels following the Thanksgiving holiday week. The calendar was led by the State of Illinois which was well received. YTD issuance of $343 billion is 1% higher than last year’s level, with tax-exempt issuance 7% higher and taxable issuance 35% lower year-over-year. This week’s calendar is expected to remain elevated at $10 billion.

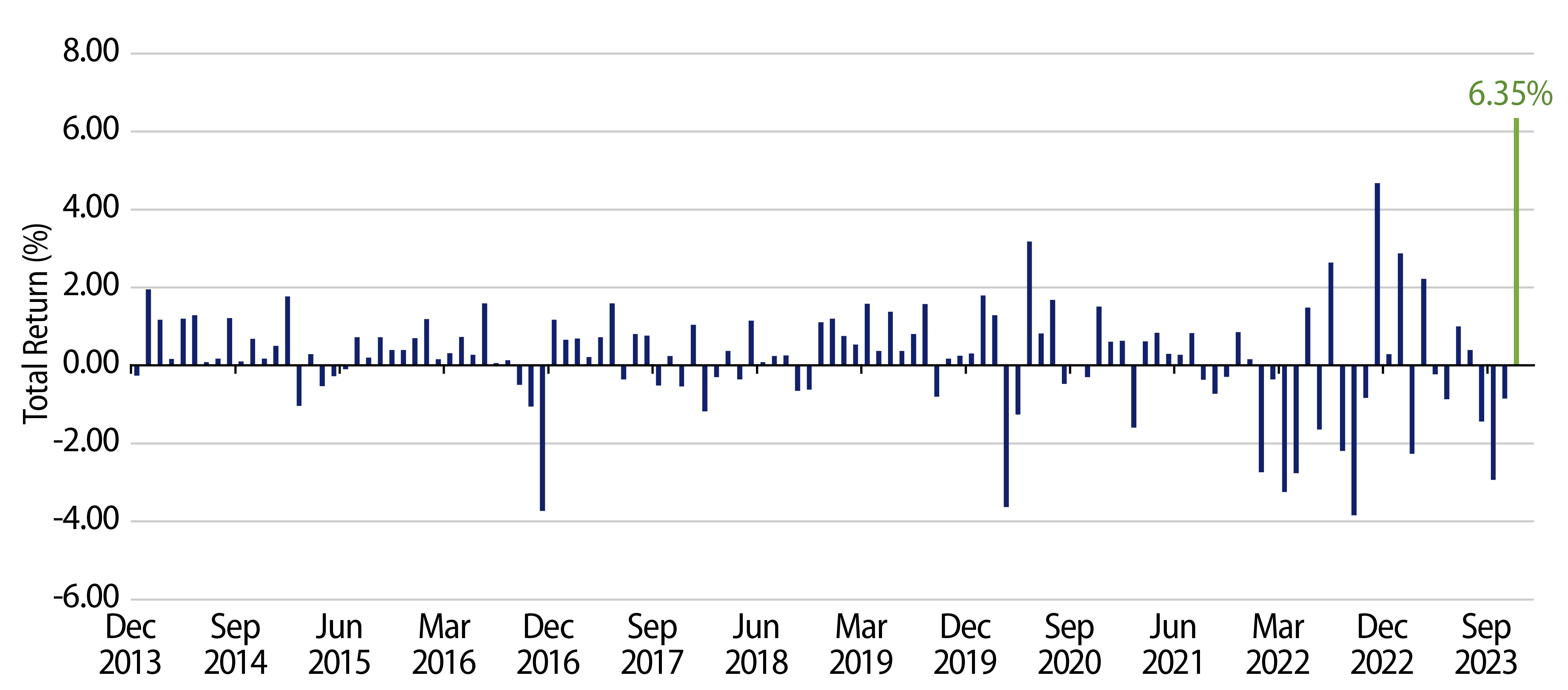

This Week in Munis: A November to Remember

In November, the Bloomberg Municipal Bond Index posted near-record monthly returns and outperformed most fixed-income asset classes. November’s monthly muni return of 6.35% was the highest market return observed over the past 40 years, and fully reversed the losses observed earlier in the year. The Bloomberg Muni Index outperformed the US Corporate Index return of 5.98% and US Treasury return of 3.47% as investors sought to lock in longer-term levels of tax-exempt income. From a yield perspective, high-grade municipal yields moved 80 to 98 bps lower across 2- to 30-year maturities during the month, exceeding the 40 to 61 bps yield decline observed in the Treasury market.

The significant municipal outperformance was supported by demand returning back to the marketplace following lower-than-anticipated inflation data and the sharp Treasury rally. Following $13 billion of mutual fund outflows that took place over nine consecutive weeks from the start of September through October, municipal fund flows turned positive in November, according to ICI. We also anticipate mutual fund managers that were benefiting from relatively high cash income levels extended duration. In addition to mutual fund demand, SMA demand across the industry has remained robust and also supported the rally.

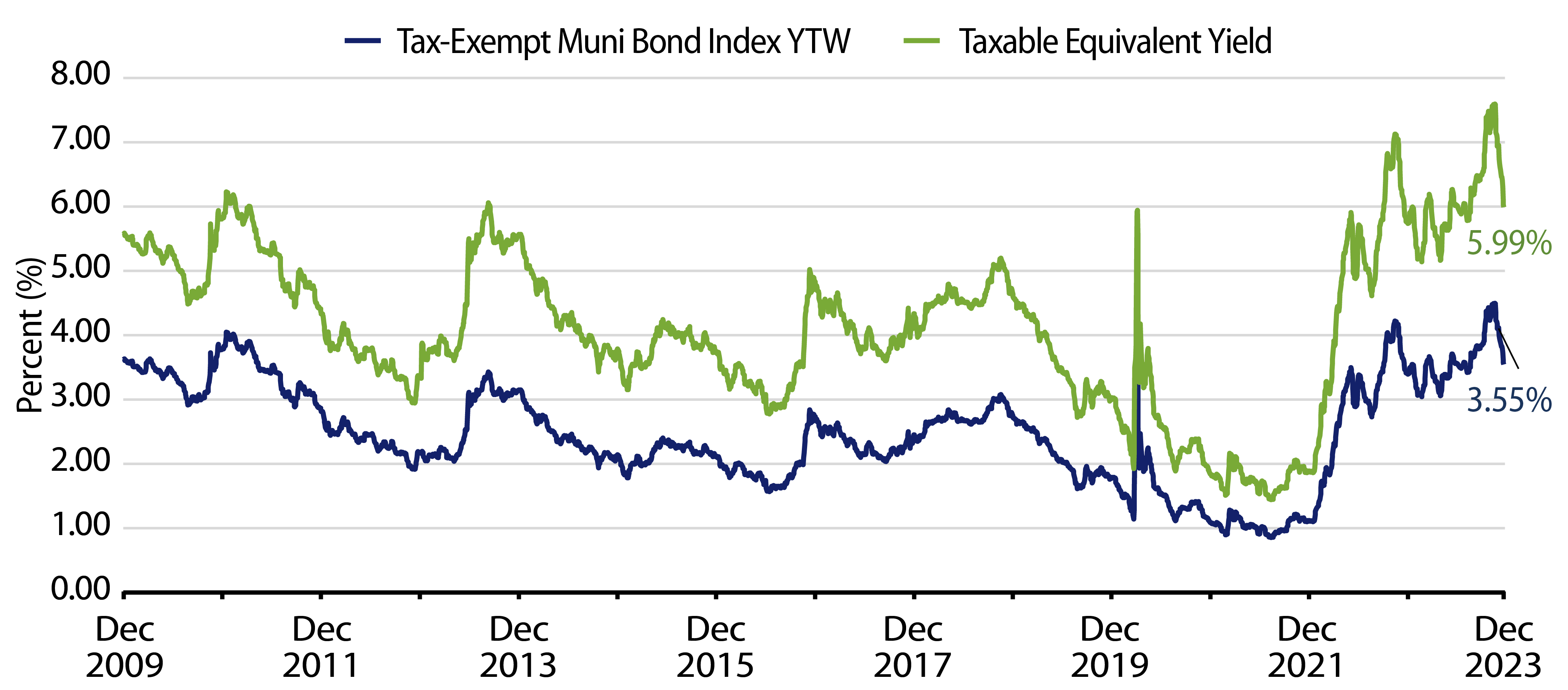

The sharp move in municipal yields in November highlights the potential fleeting nature of elevated tax-exempt income opportunities that can come and go in the muni market, particularly considering the market’s challenged liquidity conditions. Considering restrictive federal reserve policy that can constrain growth, inflation and the upward trajectory of interest rates, paired with limited new-issue supply levels on the horizon, the highest yields that emerged from the most recent hiking cycle could be behind us. However, municipal yield levels remain near decade highs and offer attractive after-tax income opportunities.

Western Asset Key Themes for Muni Investors

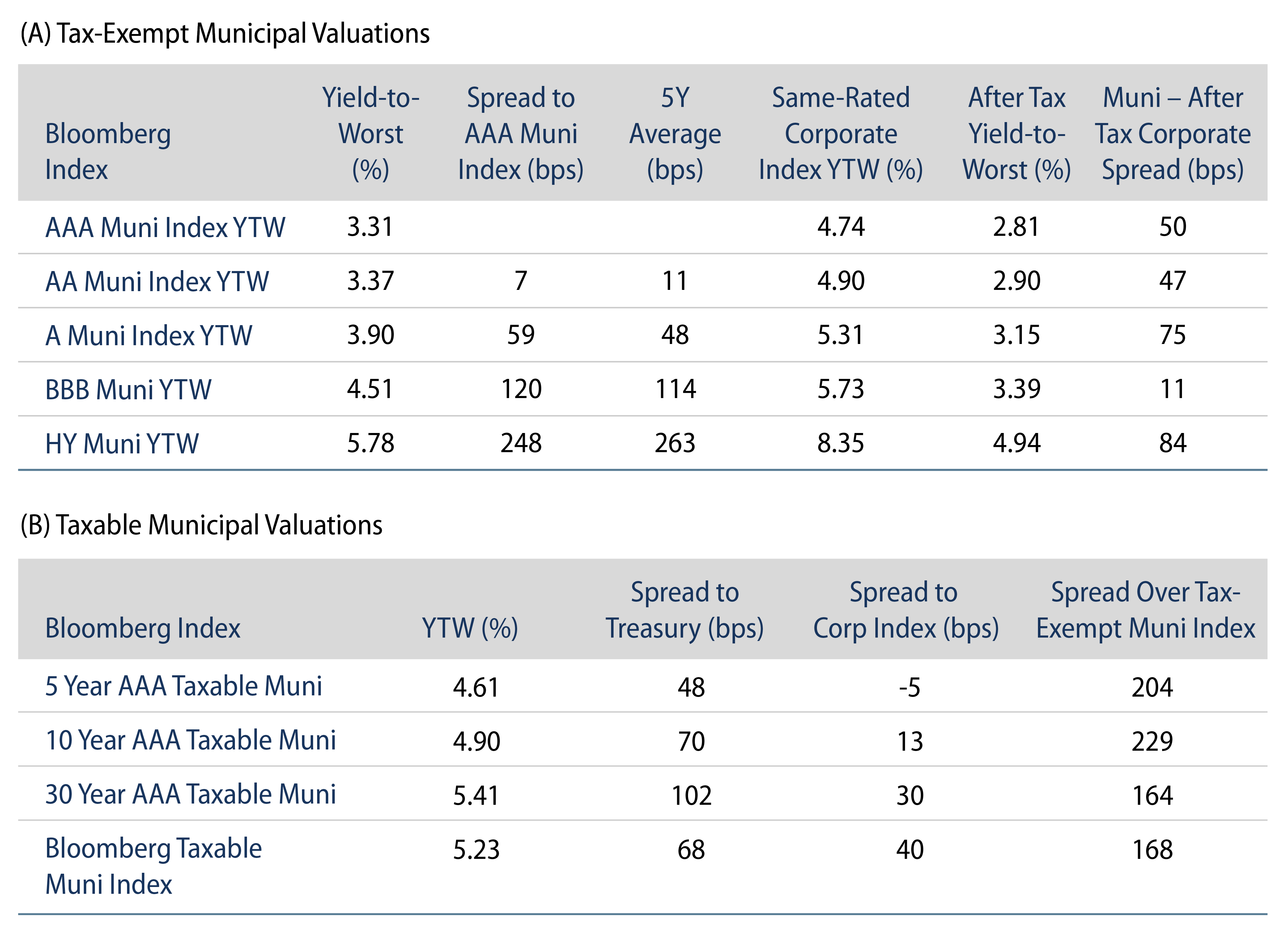

Theme #1: Municipal index yields and taxable equivalent yields are above decade highs.

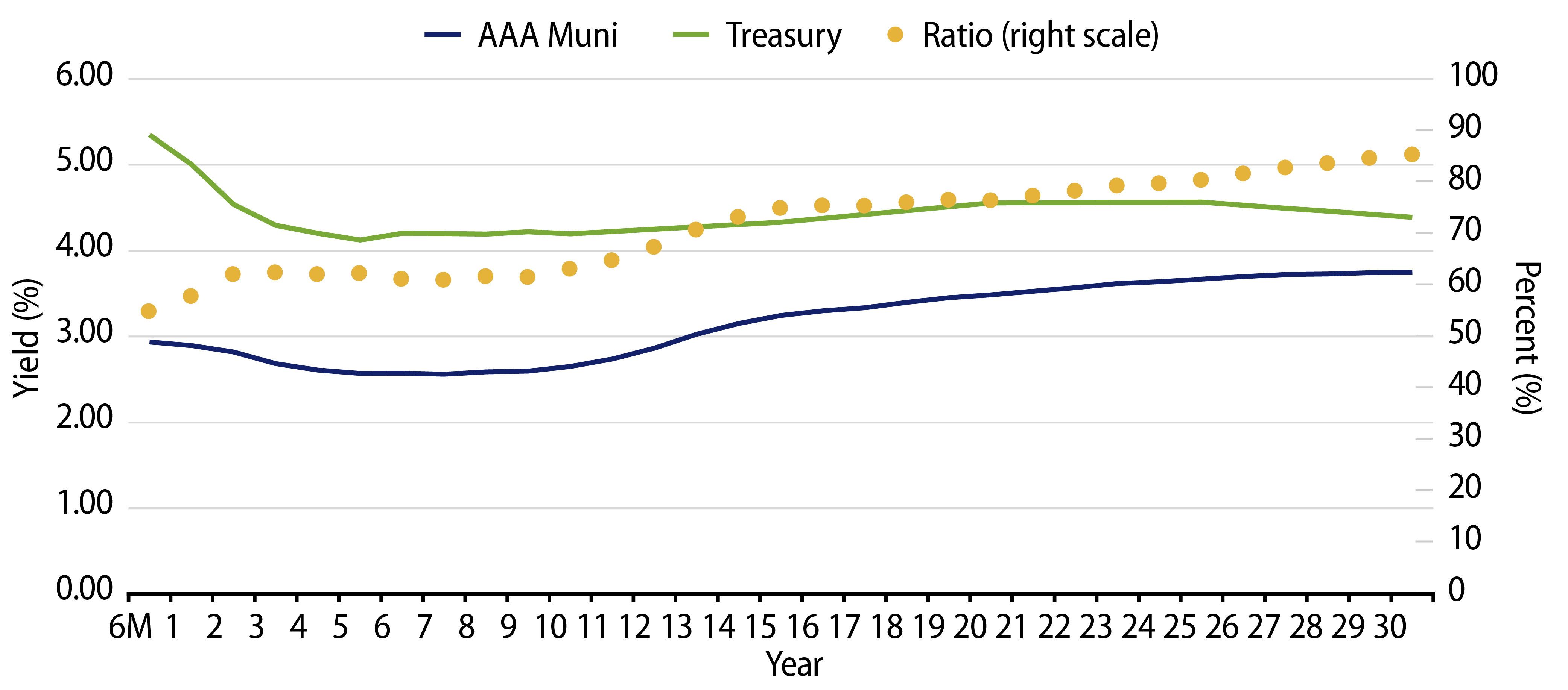

Theme #2: Recent disinversion of the muni yield curve offers better relative value out the curve.

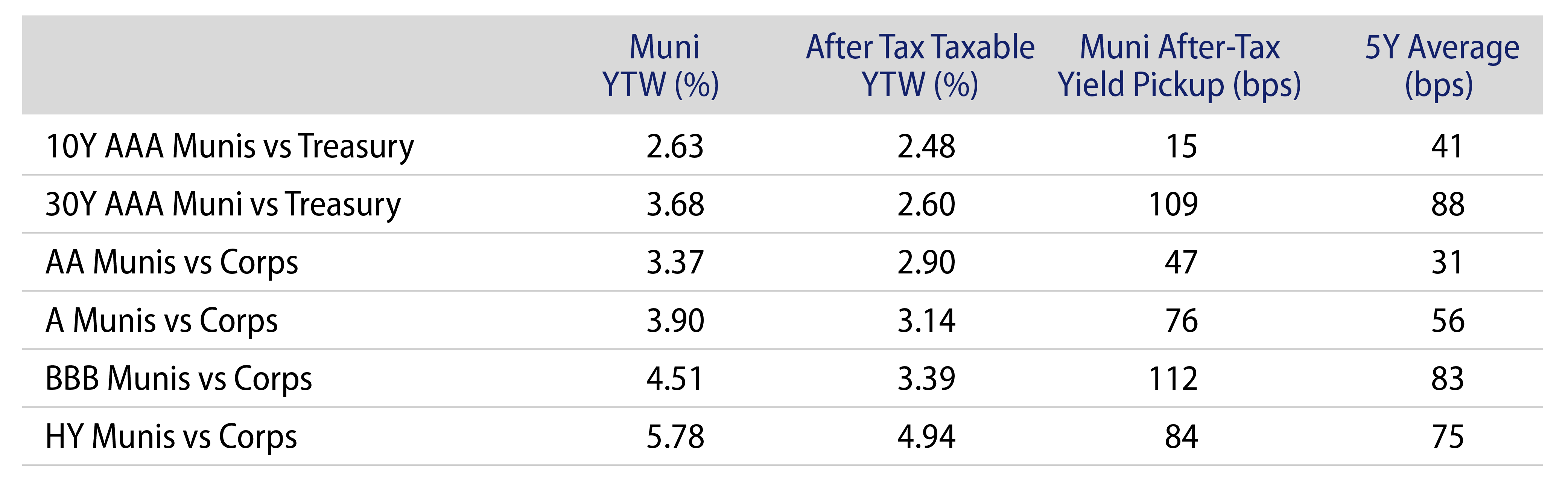

Theme #3: Munis offer attractive after-tax yield pickup versus Treasuries and corporate credit.