Municipals Sold Off with Treasuries Last Week

Munis sold off with Treasuries last week and followed Treasuries higher as stronger-than-anticipated retail sales data led the market to cut back expectations for near-term aggressive Fed rate cuts. High-grade muni yields moved 9-20 bps higher across the curve. Meanwhile, market technicals improved as municipal mutual funds recorded inflows. The Bloomberg Municipal Index returned -0.77% during the week, the High Yield Muni Index returned -1.40% and the Taxable Muni Index returned -1.16%. This week we highlight drivers of underperformance in the muni market so far this year, which have countered the traditionally strong “January Effect.”

Technicals Improved Over the Week Amid Higher Demand and Lower Supply Conditions

Fund Flows: During the week ending January 17, weekly reporting municipal mutual funds recorded $898 million of net inflows, according to Lipper. Long-term funds recorded $828 million of inflows, high-yield funds recorded $295 million of inflows and intermediate funds recorded $194 million of inflows. This week’s inflows led year-to-date (YTD) net mutual fund flows higher to $379 million.

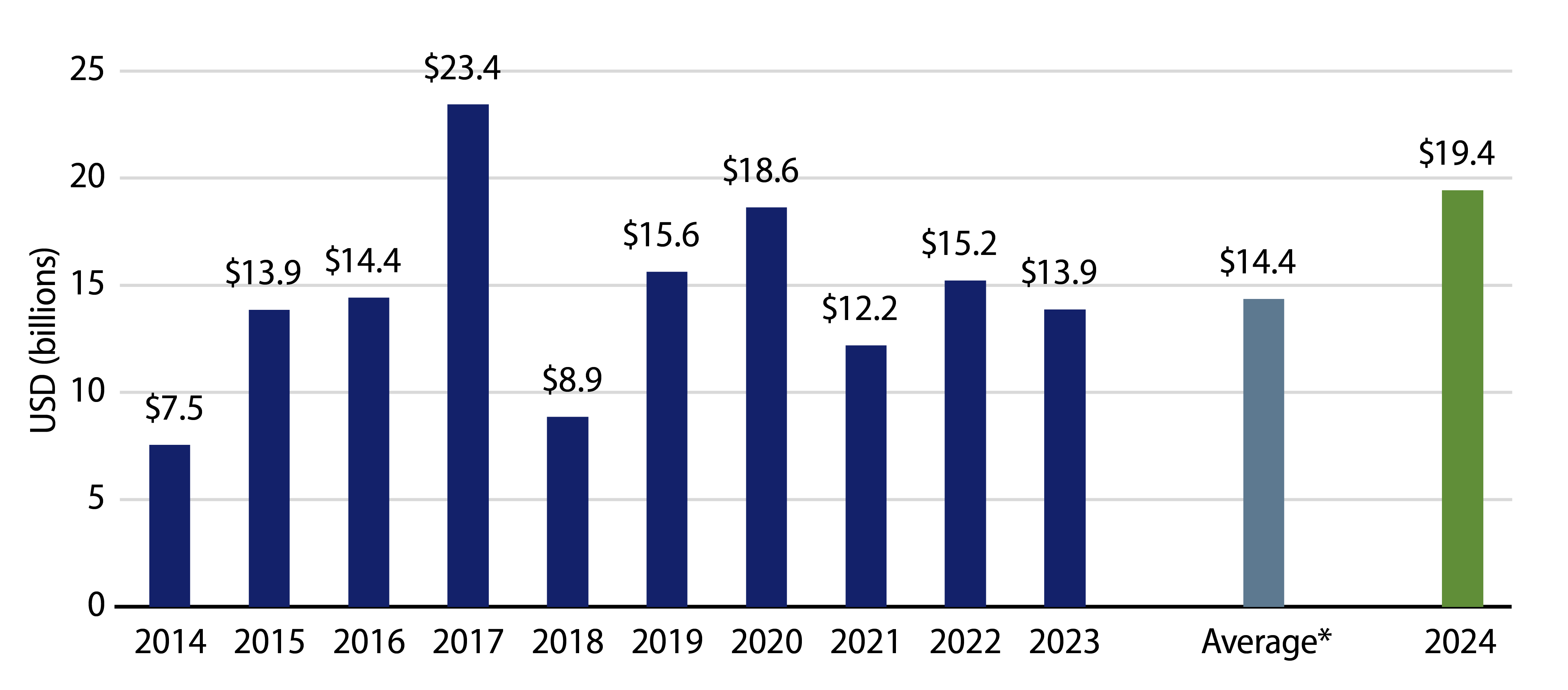

Supply: The muni market recorded $9 billion of new-issue volume last week, down 21% from the prior week. YTD issuance of $19 billion is 40% higher from last year’s level. This week’s calendar is expected to fall slightly to $8 billion. The largest transactions include $1.7 billion University of California Board of Regents and $540 million Commonwealth of Massachusetts.

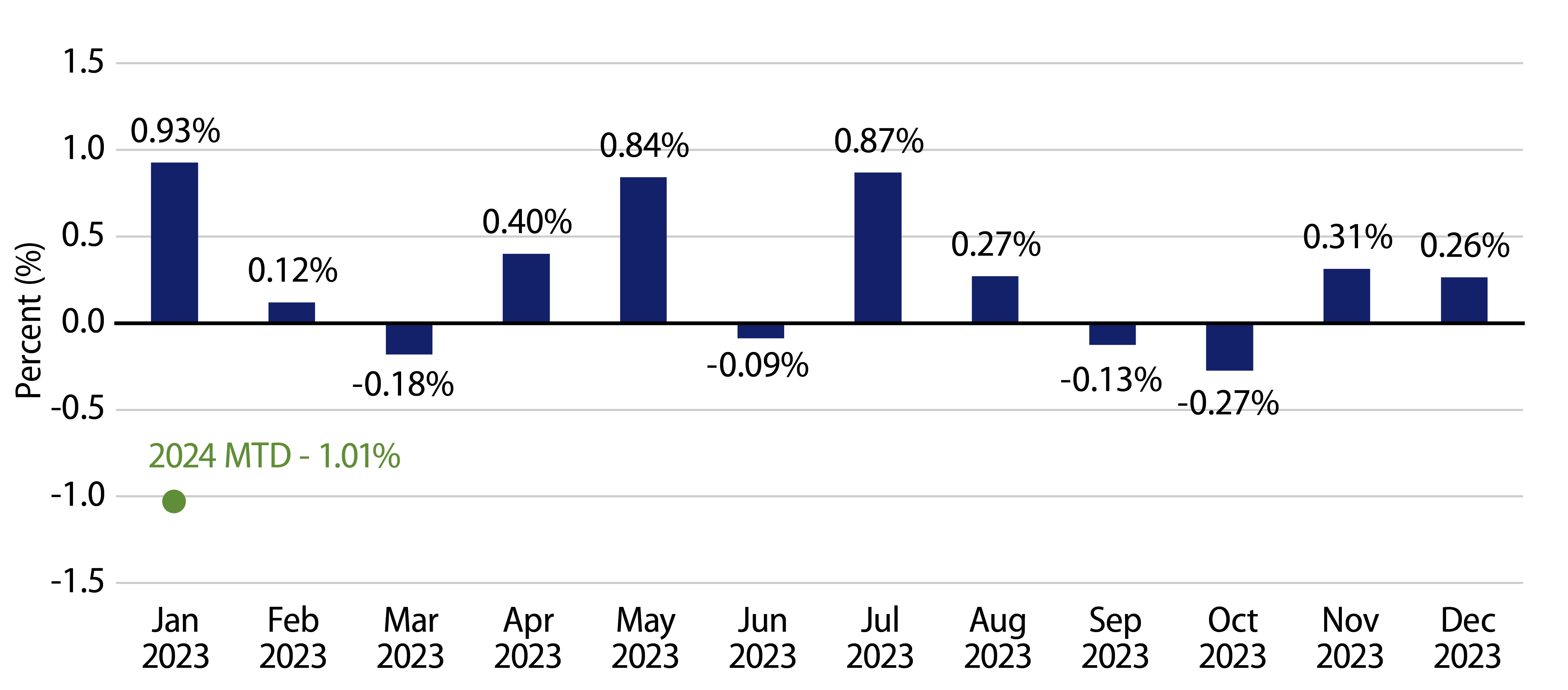

This Week in Munis: Bucking the “January Effect”

From 2009 to 2023, the month of January has represented the strongest month of total returns, averaging 0.93%. This historically strong performance is characterized by the “January Effect” of low supply as issuers return from the holidays and improved demand as investors rebalance portfolios and put seasonally high coupon payments back to work. Despite the seasonal technical strength, through the first three weeks of 2024 the Bloomberg Muni Index posted a relatively sharp negative total return of -1.01% as the muni market contended with ongoing interest-rate volatility following the strong rally at the end of 2023.

From a supply standpoint, 2024 new issuance has been greater than typically observed in January, contributing to relative market weakness. Through the first three weeks of the year, total muni new-issue supply of $19 billion was 35% above the prior 10-year average, and marked the second highest total supply level over the last decade.

The demand perspective appears a bit more constructive for the market conditions. Through January 17, municipal mutual funds recorded nearly $379 million of inflows, according to Lipper. While the slow return of demand to muni mutual funds is positive for the market, the month’s inflows remain dwarfed by the past two consecutive years of net outflows, which surpassed $122 billion.

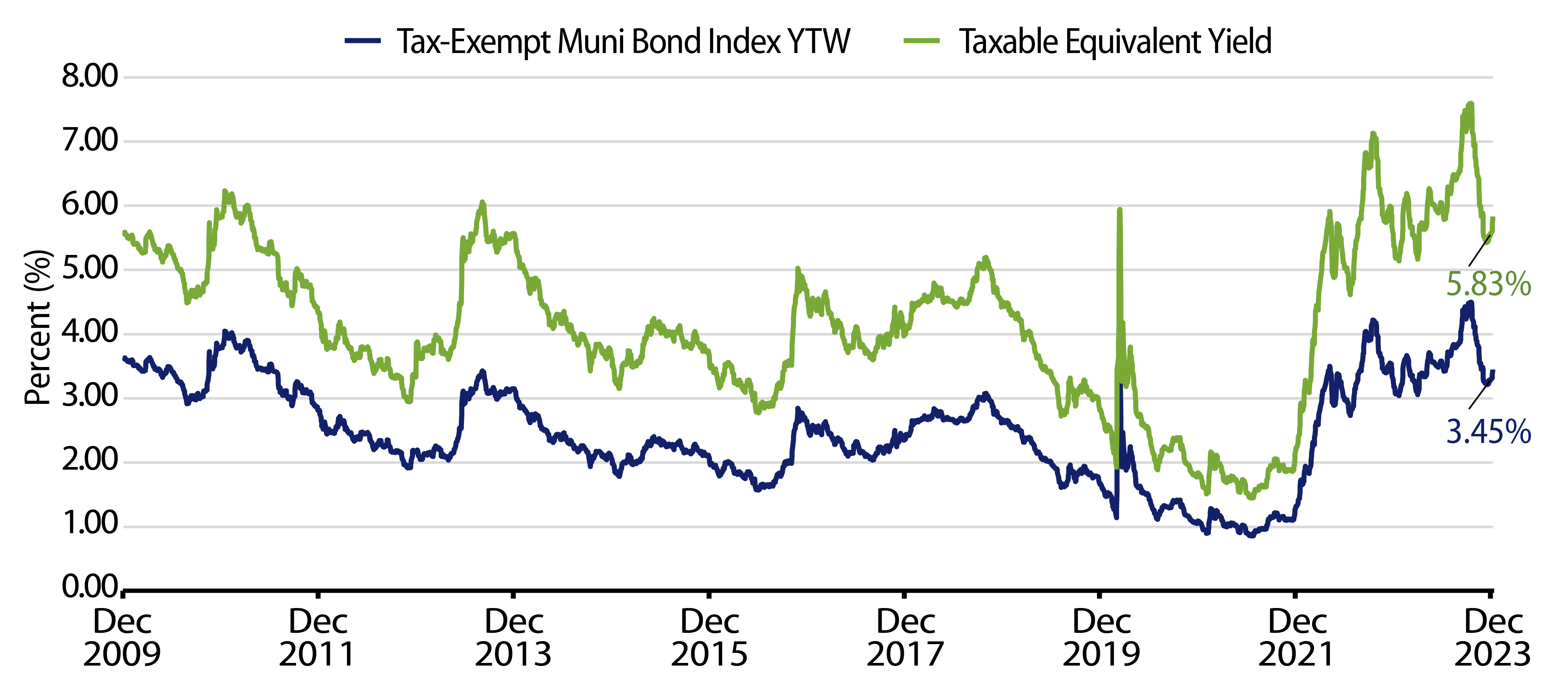

Considering the offsetting supply and demand dynamics, the negative returns that counter traditional January strength are most attributable to the extended rate volatility, and relatively rich Municipal/Treasury ratios that have led the muni investor base to question whether the 8%+ rally that occurred during the final two months of 2023 went too far, too fast. Nevertheless, the higher municipal yields observed this month should provide tax-exempt income investors a more attractive entry point than was seen at the start of the year. As municipal yields remain well above what could be achieved on average for the past decade, we believe muni investors will be rewarded by taking advantage of these tax-exempt income opportunities, particularly given the backdrop of slowing growth and inflation that could drive future yields and tax-exempt income opportunities lower.

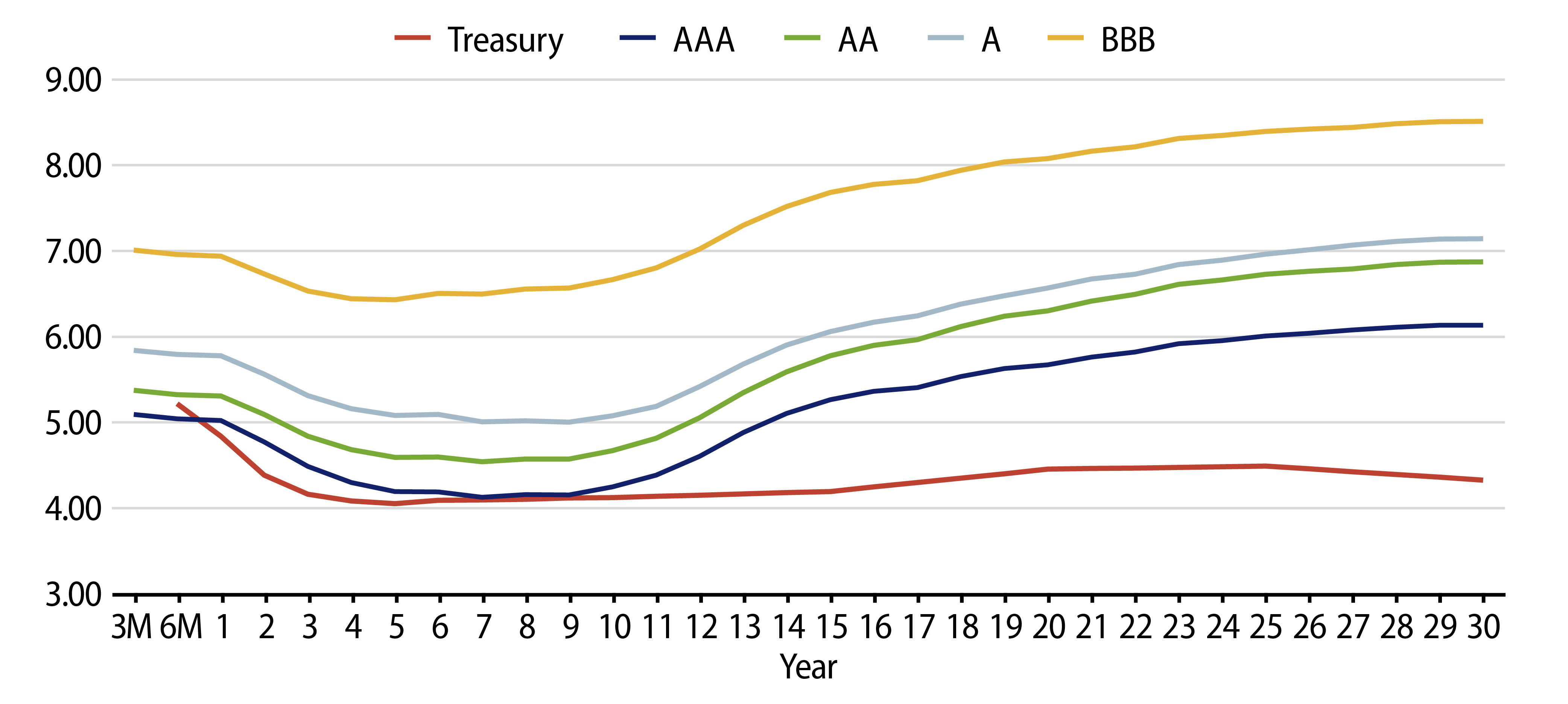

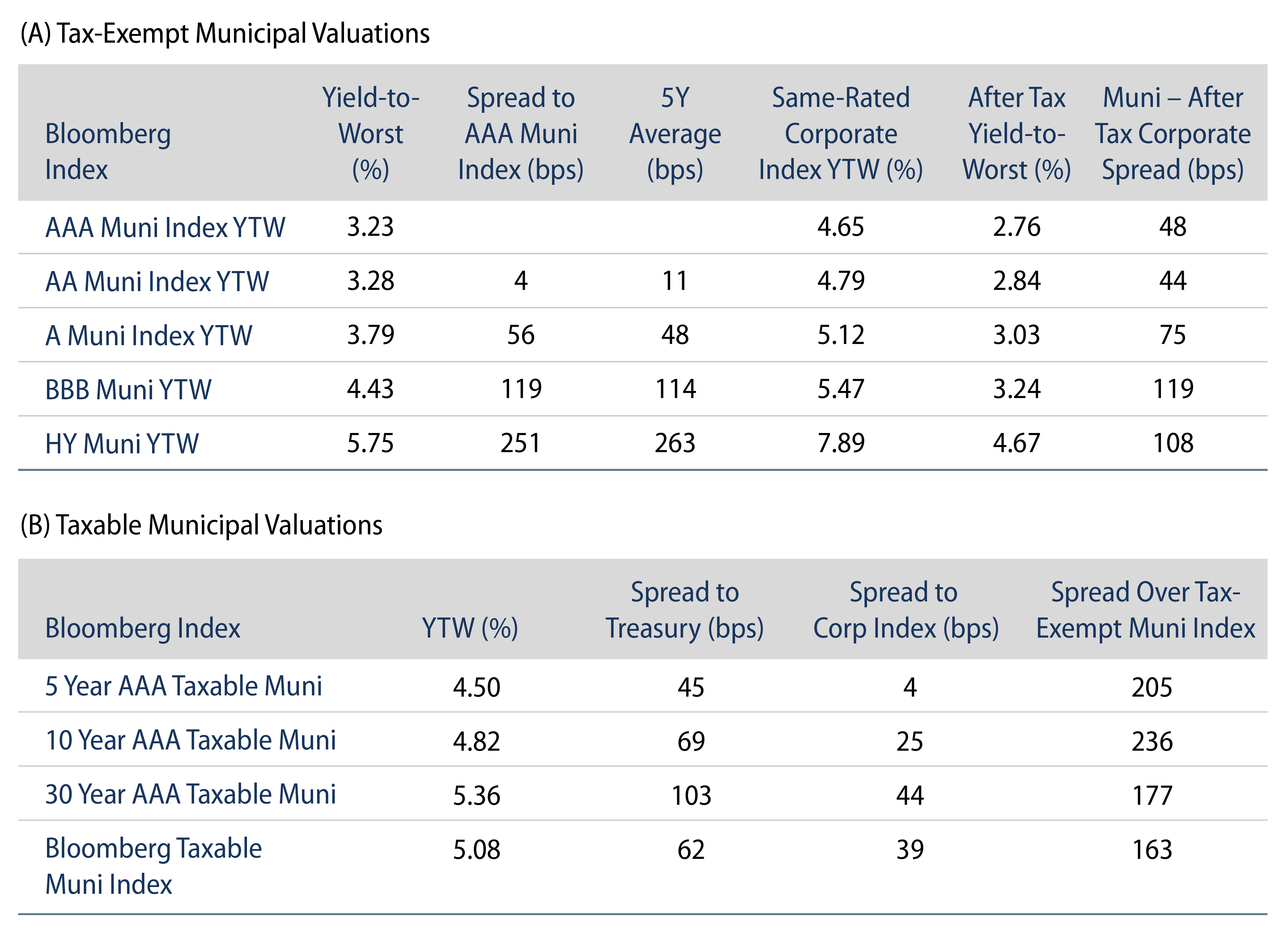

Theme #1: Municipal index yields and taxable-equivalent yields are above decade highs.

Theme #2: Recent yield curve steepening has highlighted value in moving out to longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.