Municipals Posted Positive Returns Last Week

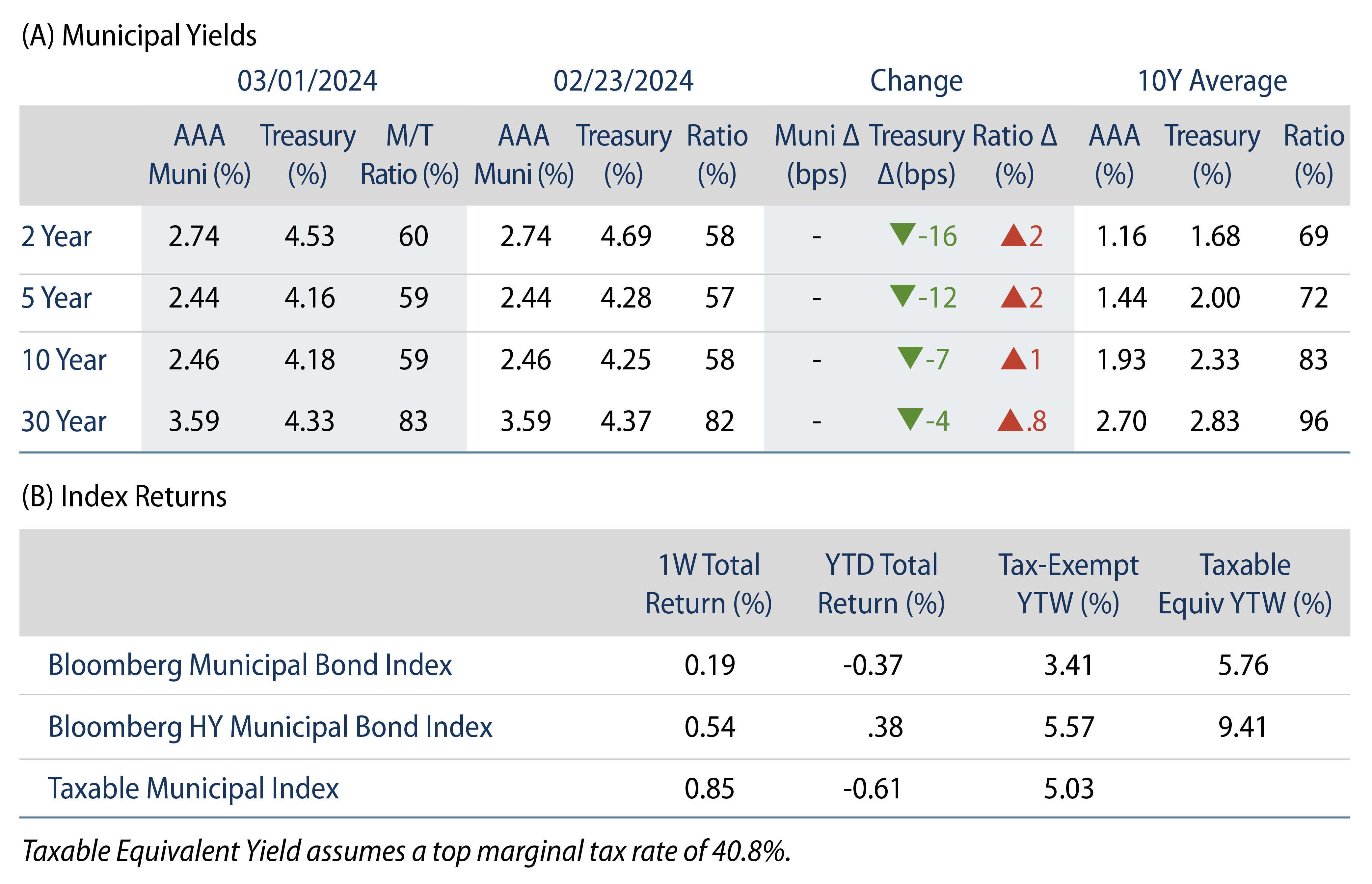

Munis posted positive returns, generally underperforming the Treasury rally during the week, as Personal Consumption Expenditure (PCE) figures continued to decelerate in line with consensus. High-grade muni yields were generally unchanged during the week. Meanwhile, technicals improved as municipal mutual funds recorded inflows. The Bloomberg Municipal Index returned 0.19% during the week, the High Yield Muni Index returned 0.54%, and the Taxable Muni Index returned 0.85%. This week we highlight key takeaways from the beginning of budget season.

Muni Technicals Improved as Funds Recorded Inflows

Fund Flows: During the week ending February 28, weekly reporting municipal mutual funds recorded $73 million of net inflows, according to Lipper. Long-term funds recorded $342 million of inflows and high-yield funds recorded $353 million of inflows. Intermediate funds recorded $274 million of outflows and short-term funds recorded $2 million of outflows. This week’s inflows lead estimated year-to-date (YTD) net inflows higher, to $4.6 billion.

Supply: The muni market recorded $8.4 billion of new issue volume last week, up 56% from the prior week. YTD issuance of $63 billion is 44% higher from last year’s level, with tax-exempt issuance 58% higher and taxable issuance 19% higher year-over year (YoY). This week’s calendar is expected to increase to remain healthy at $8 billion. The largest deals include $1.7 billion President and Fellows of Harvard College and $1 billion Regents of University of California transactions.

This Week in Munis: Budget Season Begins

This budget season, governors of the 33 states that enact annual budgets will finalize budget proposals for fiscal year 2025. These proposals provide insight into non-audited financial health of fiscal 2024, upcoming spending initiatives and outlook for the years ahead considering economic expectations. The fiscal 2025 budget cycle also provides insight into more normal post-pandemic conditions as return-to-office trends are normalized, and the economy continues to wean off of Federal Reserve (Fed) and stimulus support.

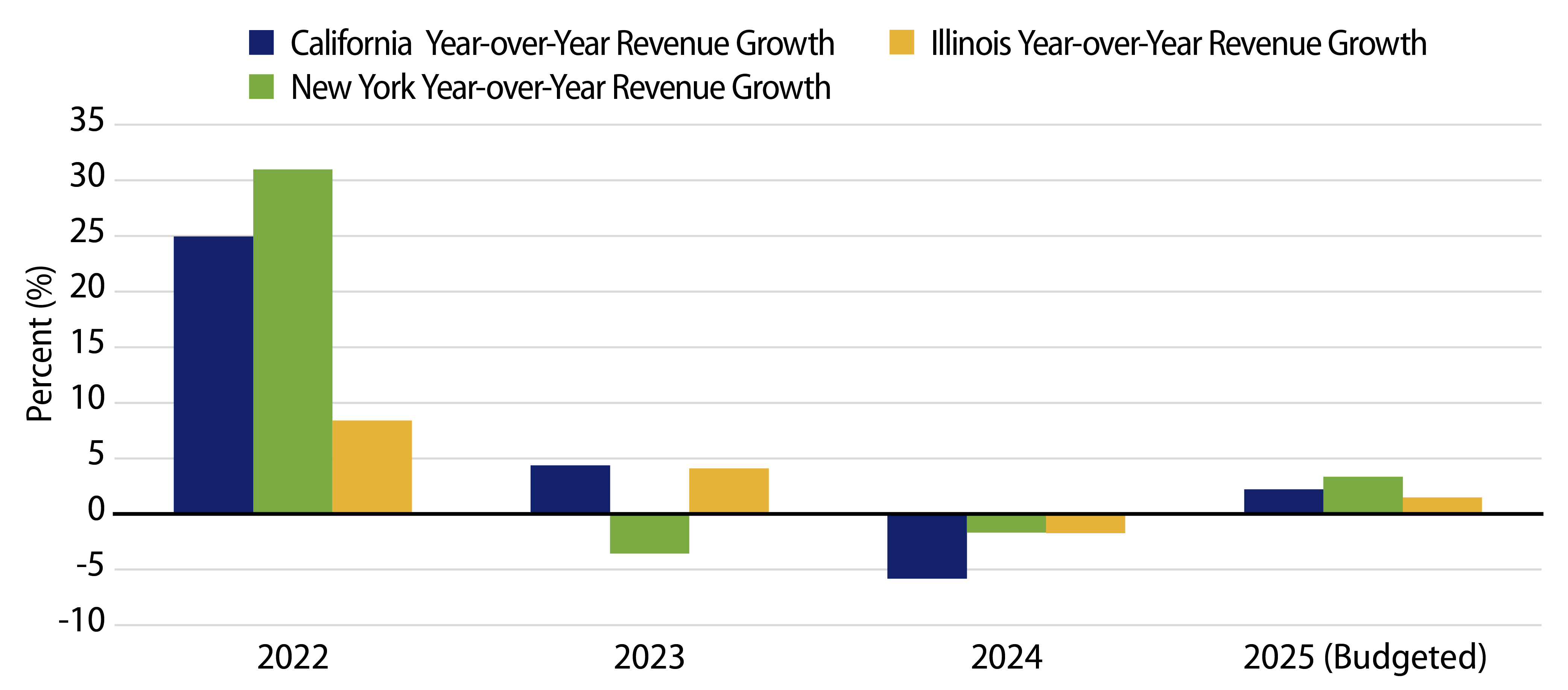

Examining early budget proposals of key muni issuers of California, New York, and Illinois, fiscal 2023 and 2024 revenue trends decelerated from the strong growth trends observed in 2022. The slowing revenue trends are partially attributable to decelerating economic activity and a drop-off in capital gains collections in these high-wealth-level states that generally rely more on capital gains collections. Looking to 2025, these states conservatively estimate 1%-3% revenue growth, which reflect slowing but continued economic growth, but could have room to surprise to the upside considering the lagged effect of financial market recovery and resilient labor markets.

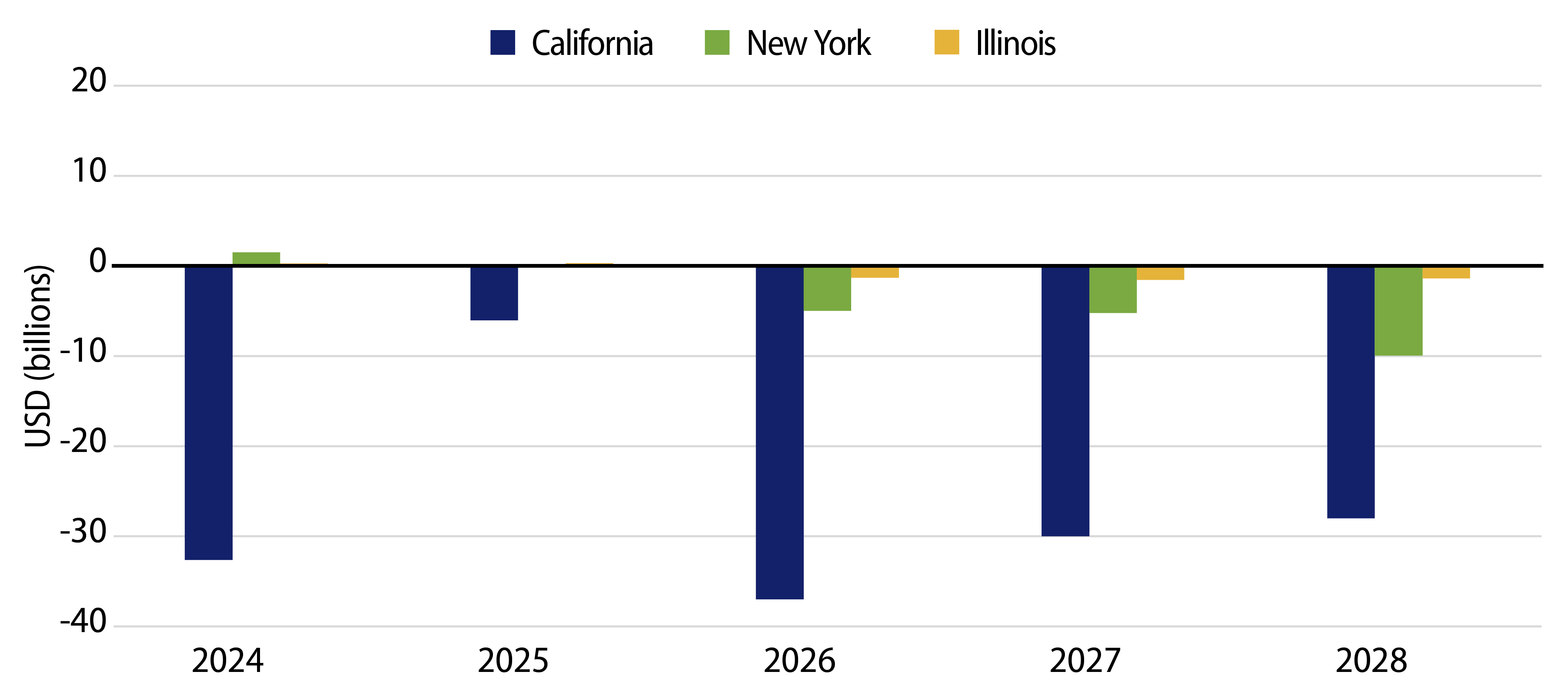

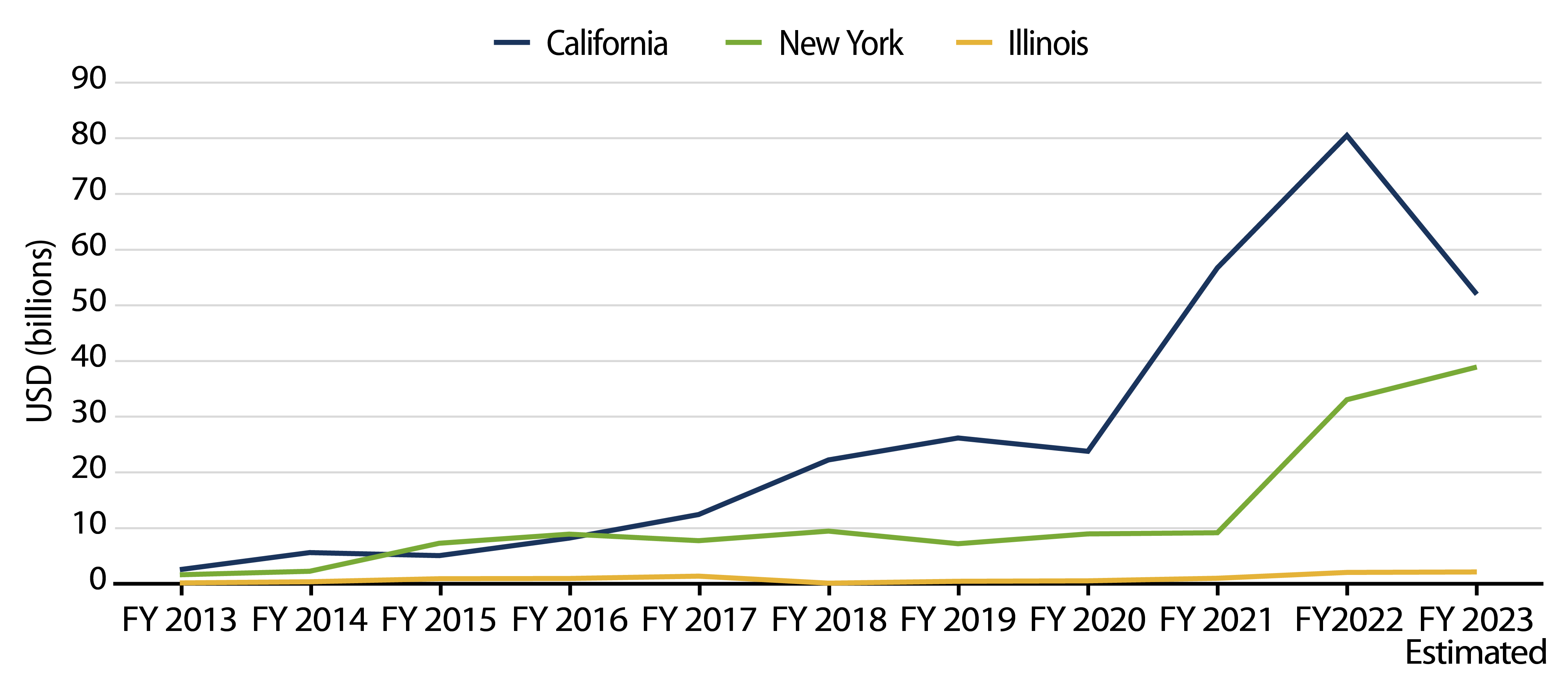

As revenue growth has slowed across states, California, New York and Illinois are projecting three-year budget gaps of $95 billion, $20 billion and $4 billion, respectively. While headline-grabbing, these projected deficits do not reflect likely spending reductions, nor the expected drawdown of record cash balances. As of the end of fiscal 2023, total Fund Balances/Reserves for California, New York and Illinois reached $52 billion, $39 billion and $2 billion, respectively, thanks to recent unprecedented stimulus and a prioritization to build reserves. In addition to these reserves, California has reduced its budget size by 10%, while Illinois and New York highlight a 1.4% and 2.5% increase in spending for 2025.

The current budget releases are preliminary and subject to change in the coming months, but continue to highlight general credit stability within the muni market. While revenue collections appear resilient and the willingness to rein in expenditures is apparent, out-year projected deficits will need to be addressed and will likely represent a headwind for many states and localities, particularly if economic conditions decelerate. Western Asset anticipates that general budgetary flexibility, as well as strong cash balances will continue to support municipal credit. However, considering the likelihood of austerity ahead, we expect the pace of upgrades relative to downgrades throughout the muni market to decline.

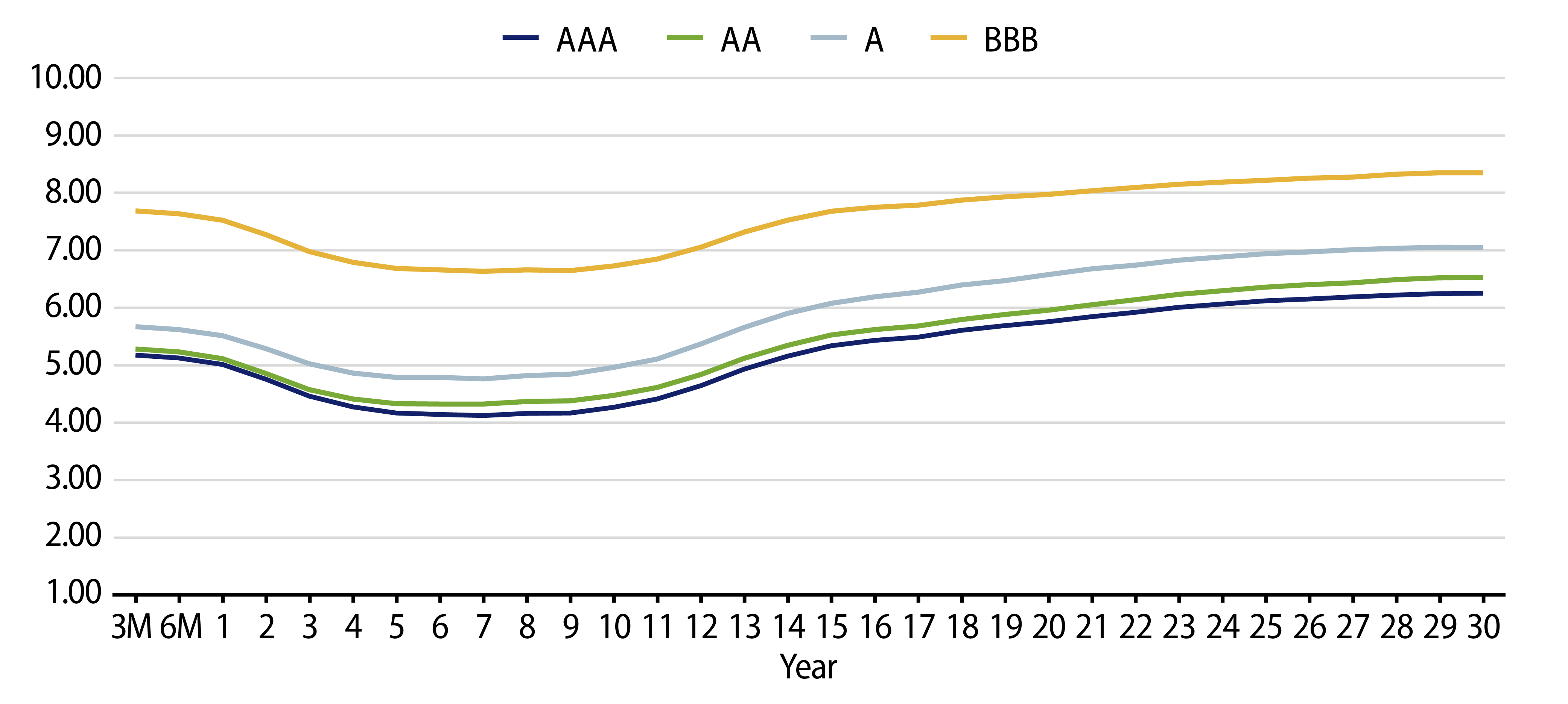

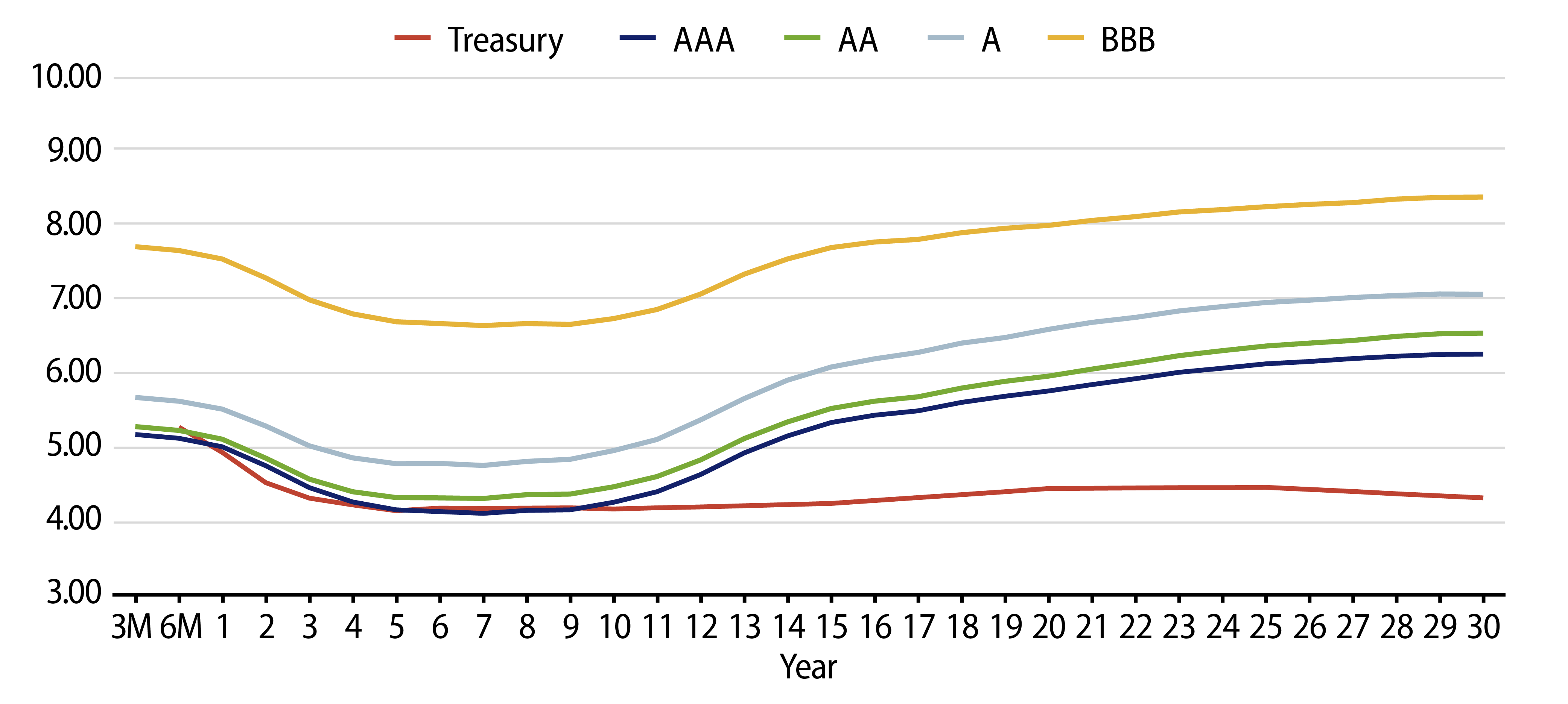

Municipal Credit Curves and Relative Value

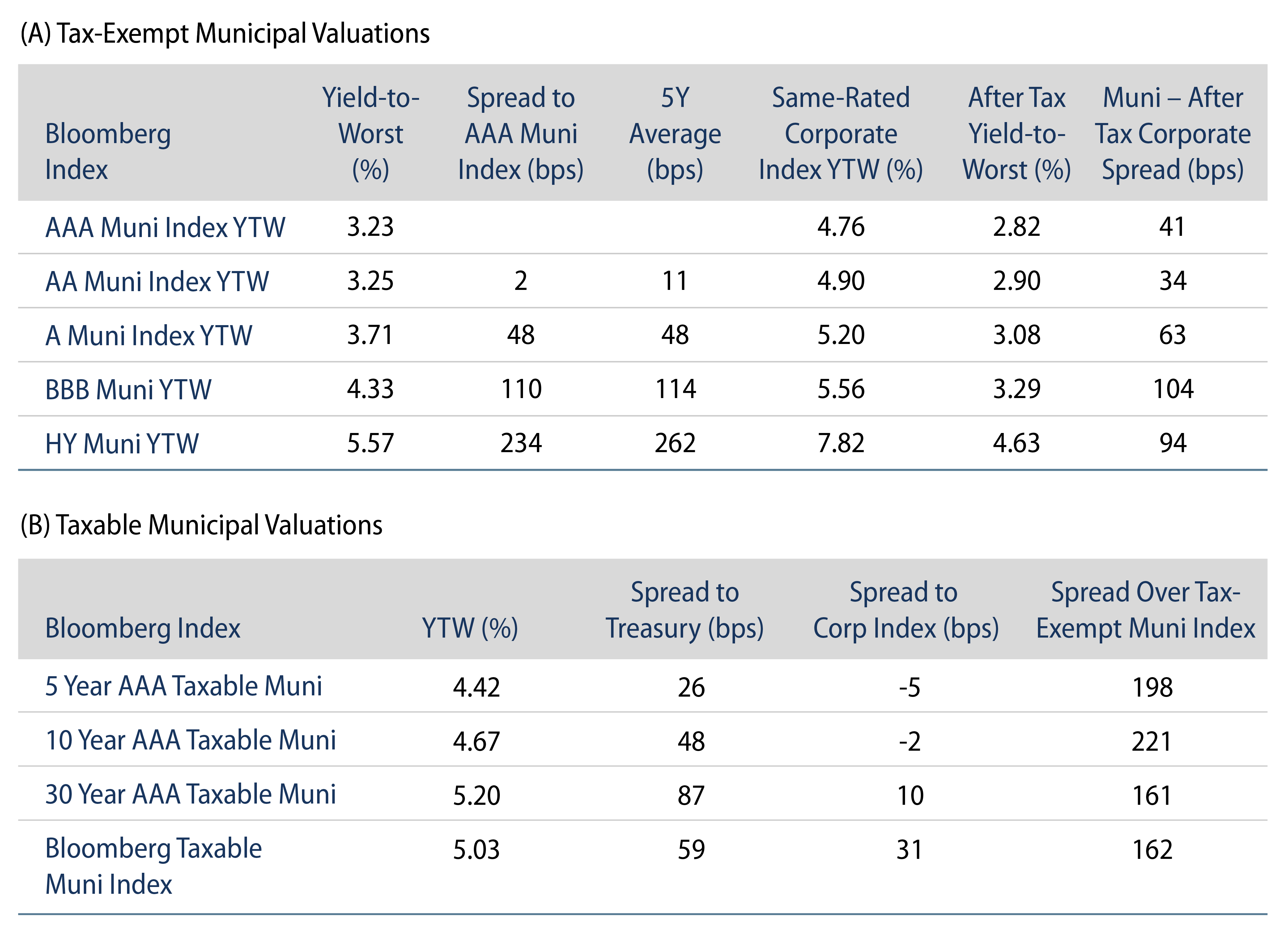

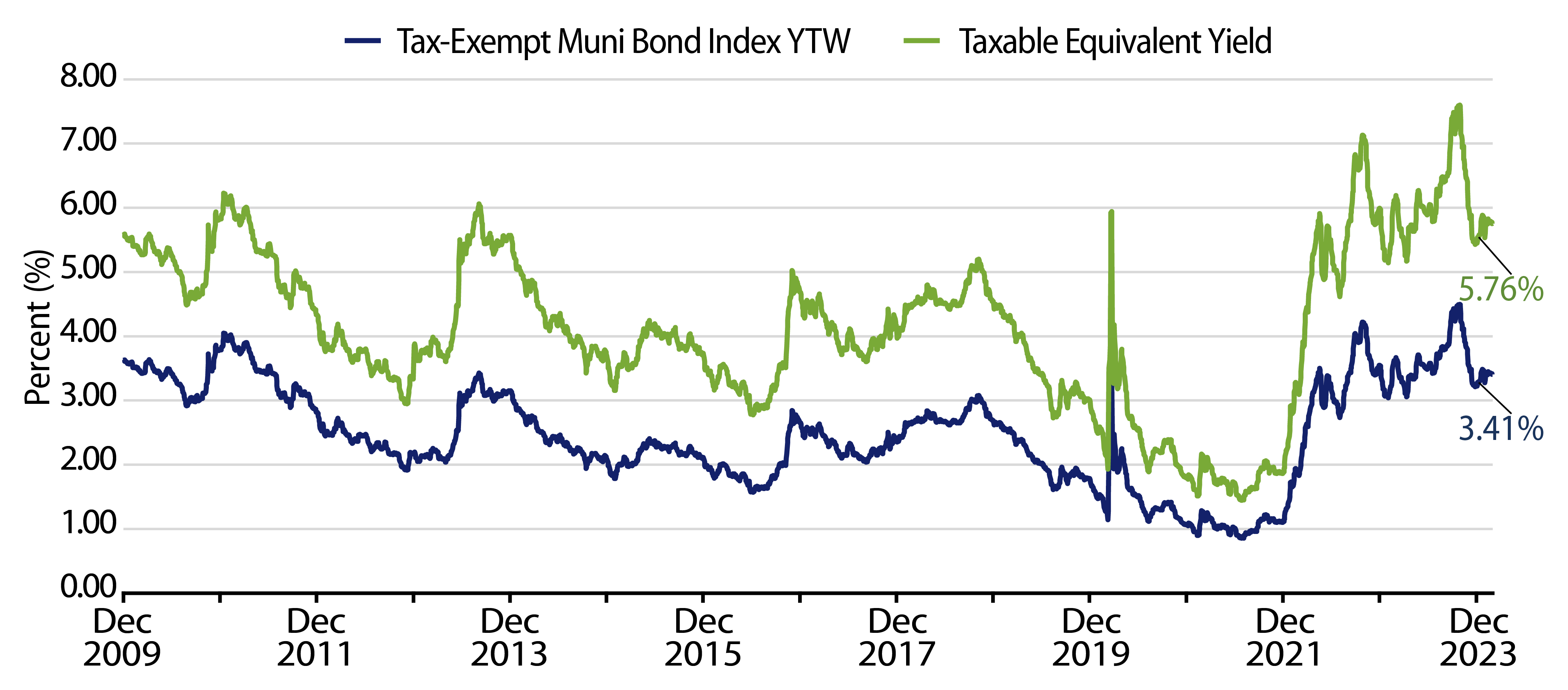

Theme #1: Municipal taxable-equivalent yields are above decade averages.

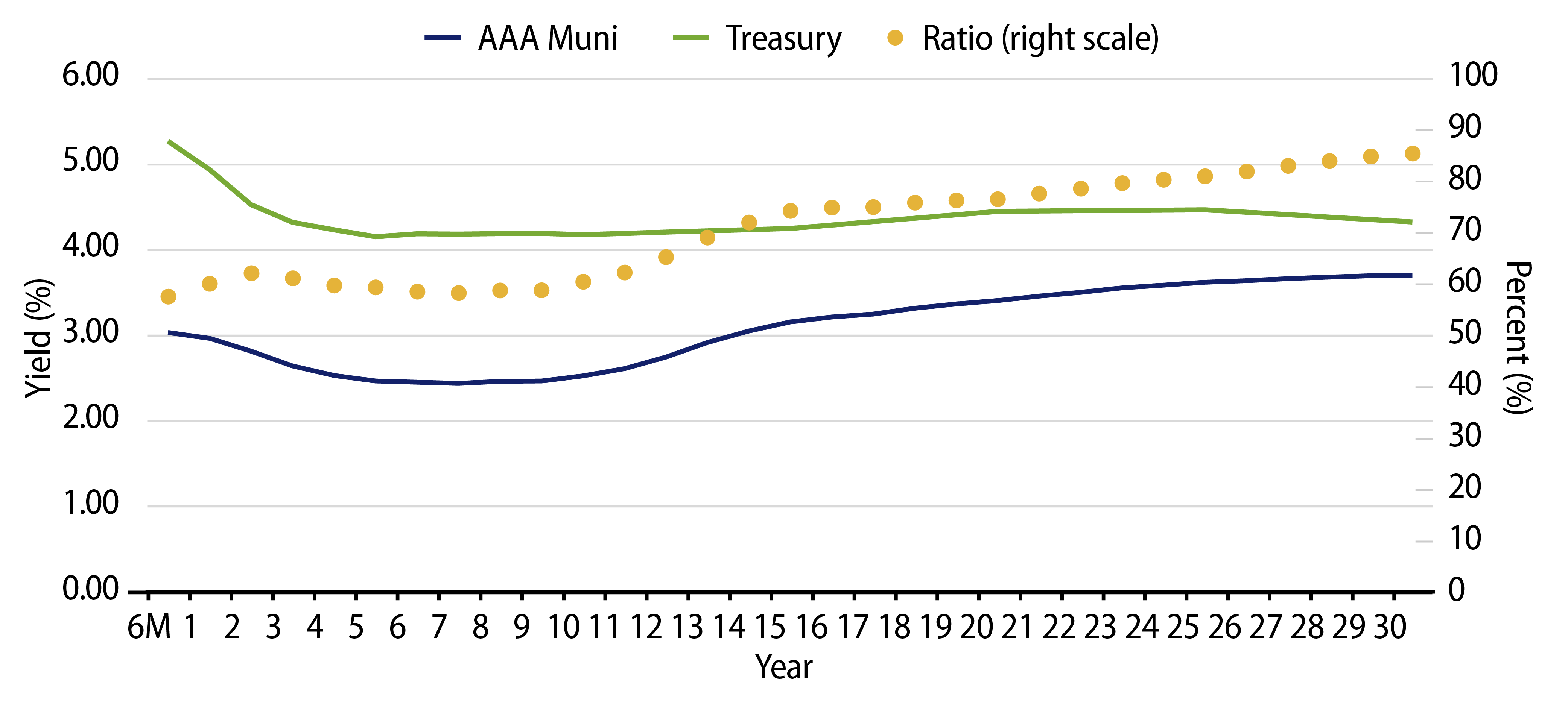

Theme #2: Recent yield curve steepening has highlighted relative value in longer maturities.

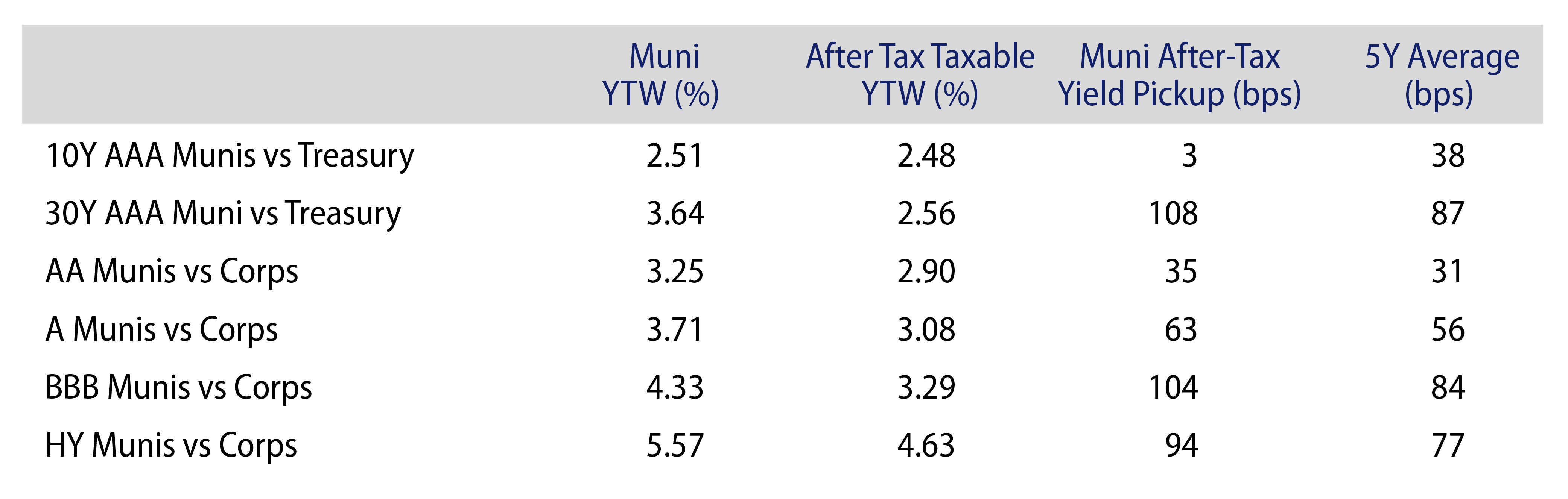

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.