Municipals Posted Negative Returns Last Week

Munis posted negative returns last week and underperformed Treasuries, which moved higher on stronger than expected payroll data. High-grade muni yields moved higher across the yield curve and market technicals improved on muni fund inflows and lower supply. The Bloomberg Municipal Index returned -0.65% during the week, the High Yield Muni Index returned - 0.83% and the Taxable Muni Index returned -1.52%. This week we highlight the increasing call activity associated with taxable Build America Bonds (BABs).

Fund Inflows and Lower Supply Conditions Provided Technical Support

Fund Flows: During the week ending April 3, weekly reporting municipal mutual funds recorded $80 million of net inflows, according to Lipper. Long-term funds recorded $161 million of inflows, intermediate funds recorded $32 million of inflows and high-yield funds recorded $161 million of inflows. Short-term funds recorded $21 million of outflows. This week’s inflows lead estimated year-to-date (YTD) net inflows higher to $9.9 billion.

Supply: The muni market recorded $6 billion of new-issue volume last week, down 40% from the prior week. YTD issuance of $106 billion is 41% higher than last year’s level, with tax-exempt issuance 56% higher and taxable issuance 49% lower year-over-year. Tax-exempt issuance has comprised 95% of issuance YTD. This week’s calendar is expected to pick up to $8 billion. Largest deals include $711 million Harvard University and $610 million Cornell University transactions.

This Week in Munis: State and Local Revenues Improve

Taxable Build America Bonds (BABs) were established as part of the 2009 American Recovery and Reinvestment Act. Under the BABs program, municipal issuers could receive a federal subsidy of up to 35% of the interest payments from taxable muni bonds issued to fund infrastructure initiatives. The effort was successful in expanding the municipal buyer base to a global scale, more than $180 billion of BABs were issued in 2009 and 2010, and BABs have since comprised a significant share of the overall taxable municipal market.

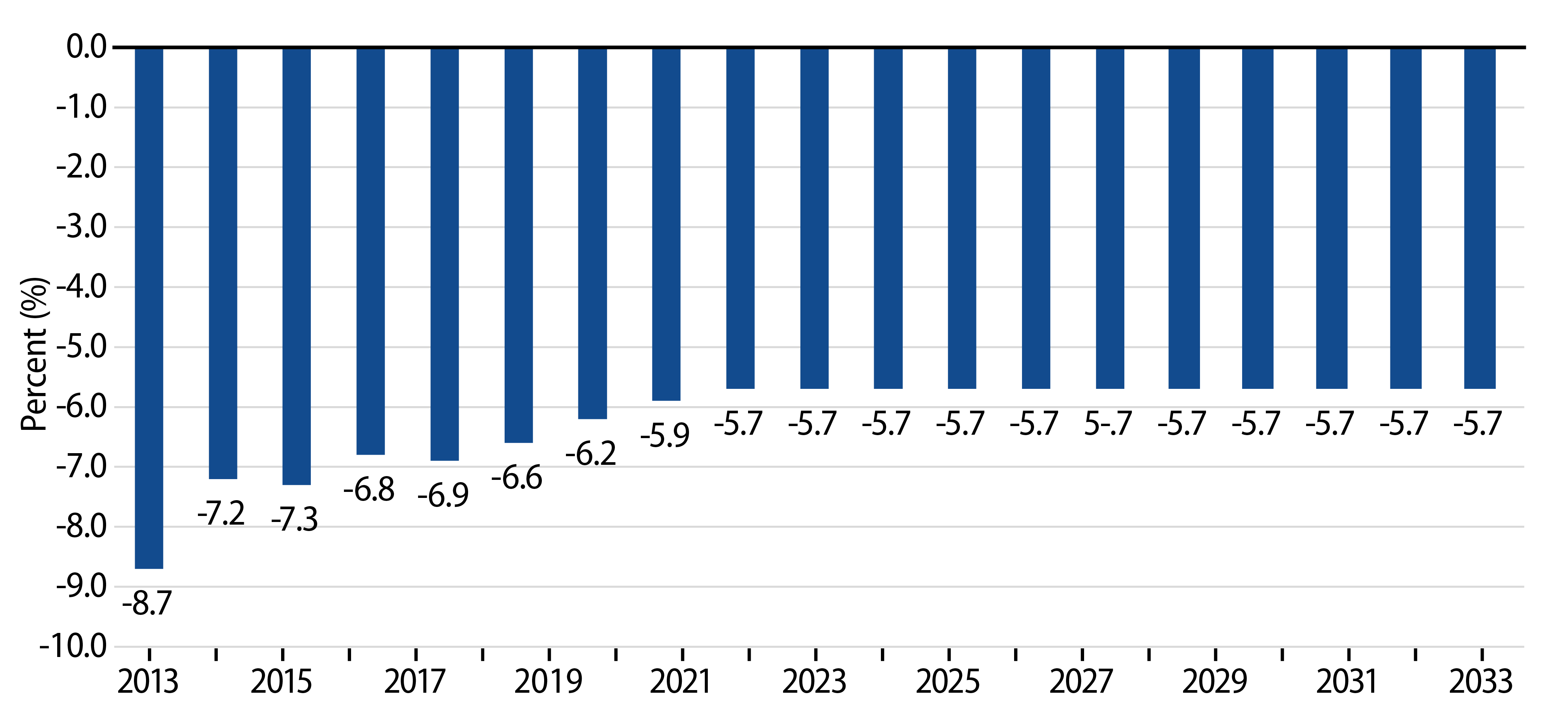

This year, we have seen an increase in the number of BABs being called under Extraordinary Redemption Provisions (ERPs), specifically citing a reduction of the federal subsidy as rationale for issuers to call outstanding municipal debt. As a result of federal sequestration measures, the federal subsidy reductions have ranged from 8.7% to 5.7% annually over the past decade.

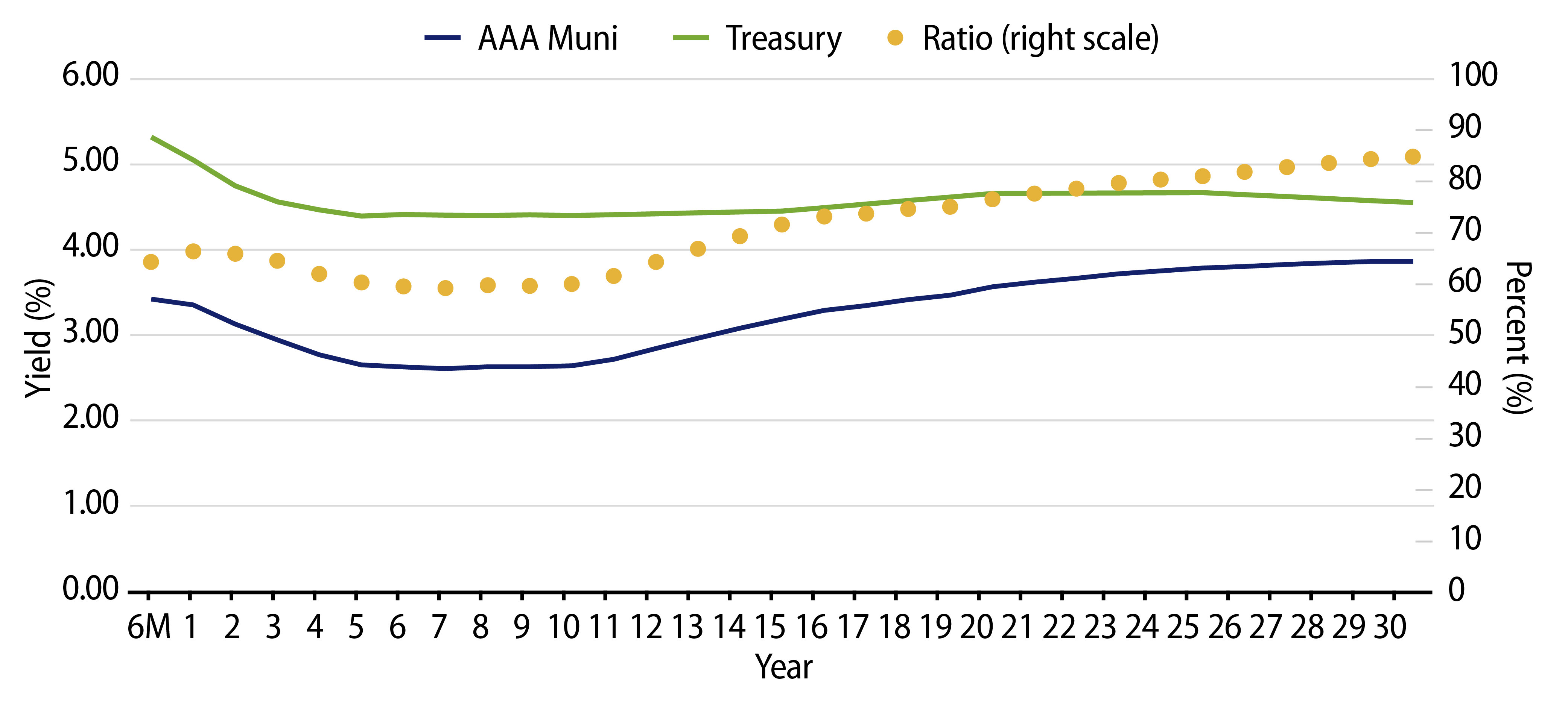

These subsidy reductions have deteriorated issuer economics of keeping the taxable debt outstanding versus tax-exempt funding alternatives. This dynamic has been exacerbated recently by high quality tax-exempt issuance trading at near record-low Muni/Taxable ratios. As municipal fundamentals improved over the past few years, more issuers were upgraded to higher quality cohorts, supporting the ability to capitalize on the cost savings offered in the high quality tax-exempt municipal market.

While more economical than ever to call outstanding BABs, we believe that ERP call activity could remain limited. First, attractive tax-exempt relative valuations are more contained to the highest quality AAA cohort, as AA and A rated bonds’ tax-exempt relative value is less compelling for issuers. Second, fixed costs associated with new issuance could overwhelm the positive refinancing benefits, particularly for smaller deals outstanding. Last, we believe issuers could question whether the sequestration of BABs subsidies qualify as an ERP event, and may ultimately determine that costs associated with legal challenges could outweigh positive economics associated with the refinancing.

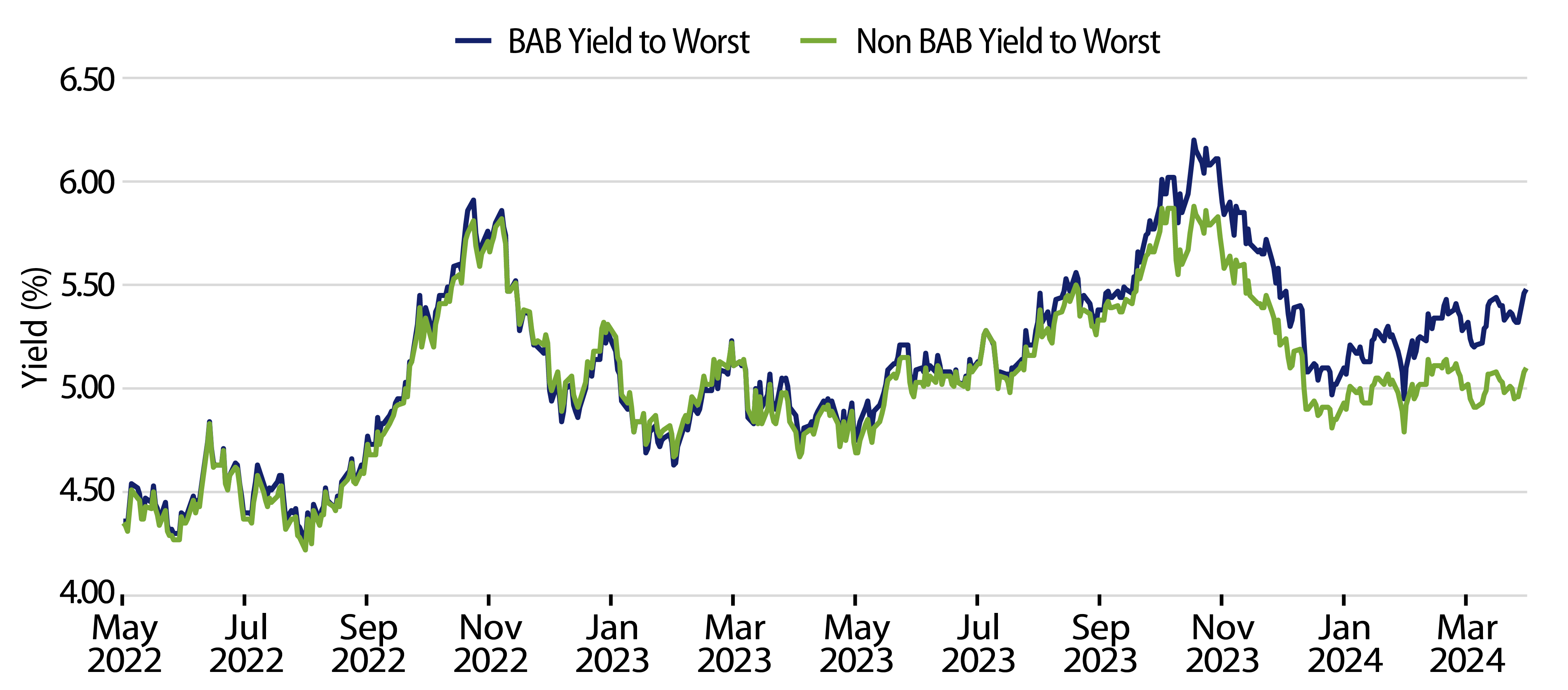

Since the call risk increased in earnest this year, BABs have since traded at higher relative yields versus non-BAB taxable muni counterparts (Exhibit 3), representing potential value for investors willing to weigh the call risk associated with these issues. For tax-exempt muni investors, higher refunding volumes in the market should be welcomed, given the recent positive demand that has led relative valuations richer in the higher quality segment of the market. Such an increase in tax-exempt refunding issuance may also prove a self-correcting catalyst as higher supply levels could contribute to higher tax-exempt yields, and deteriorate the favorable call economics that currently exist.

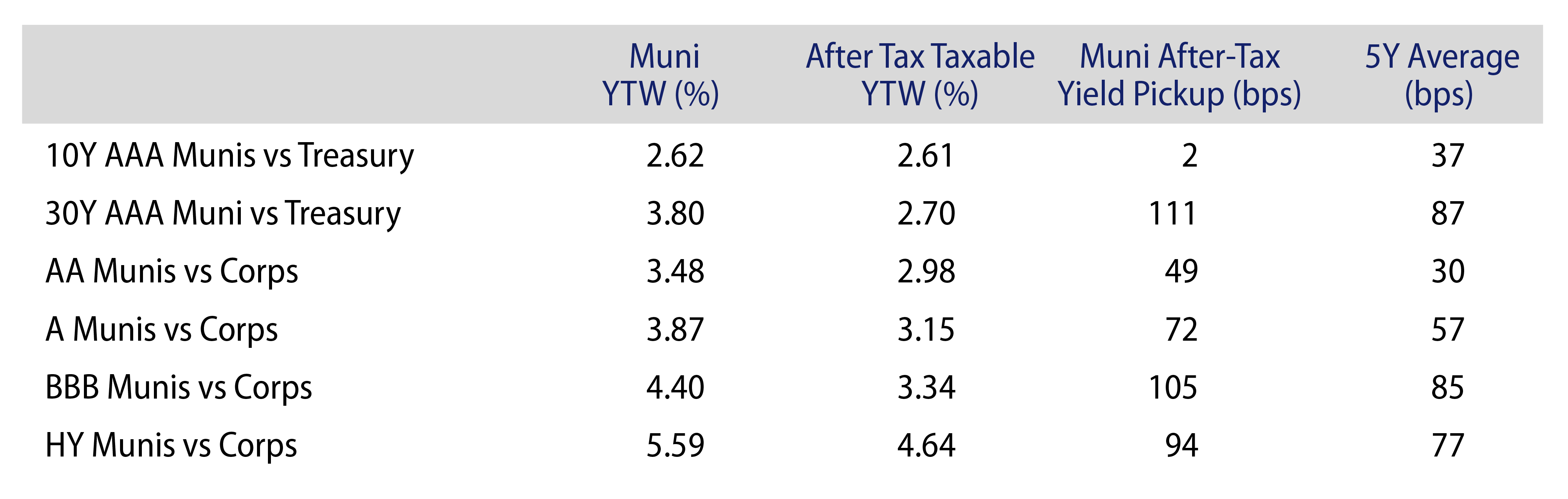

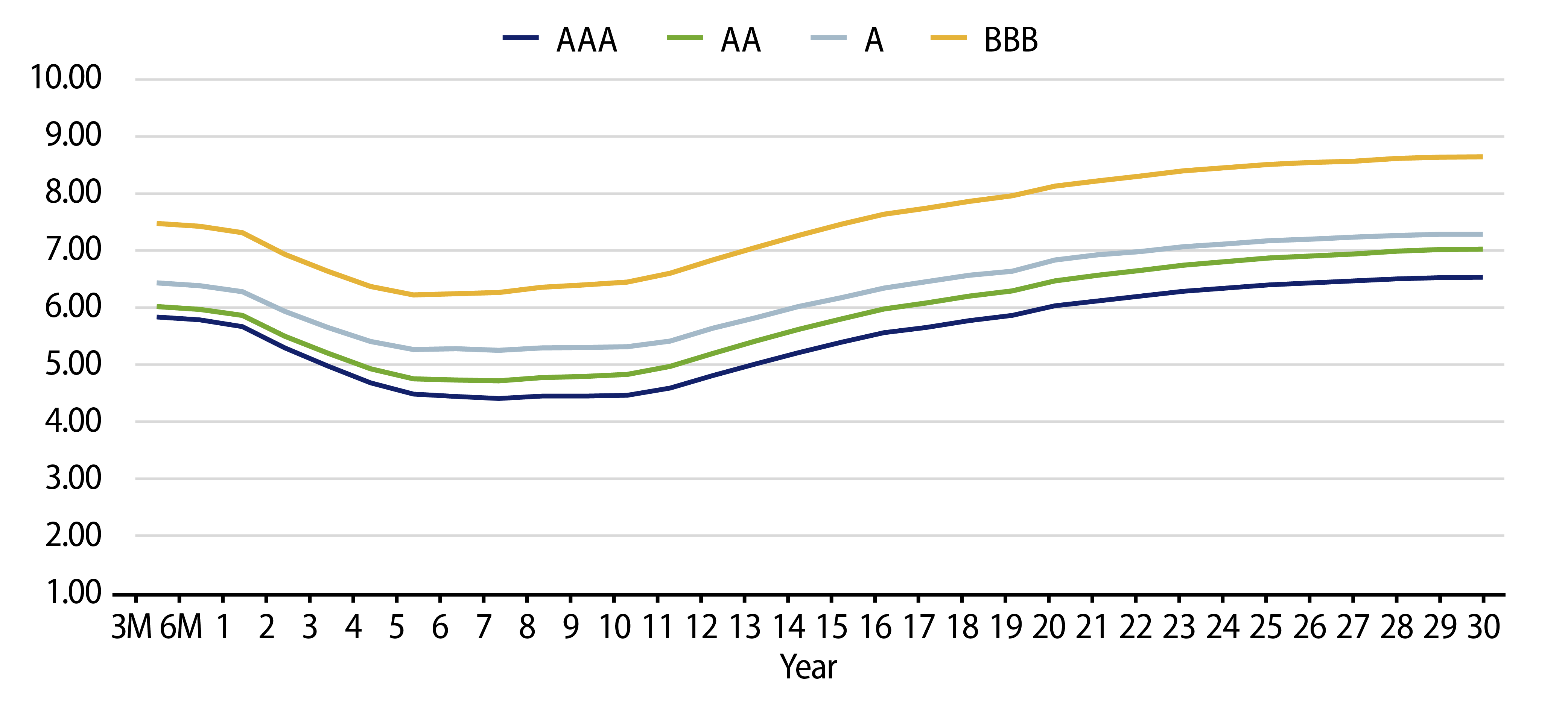

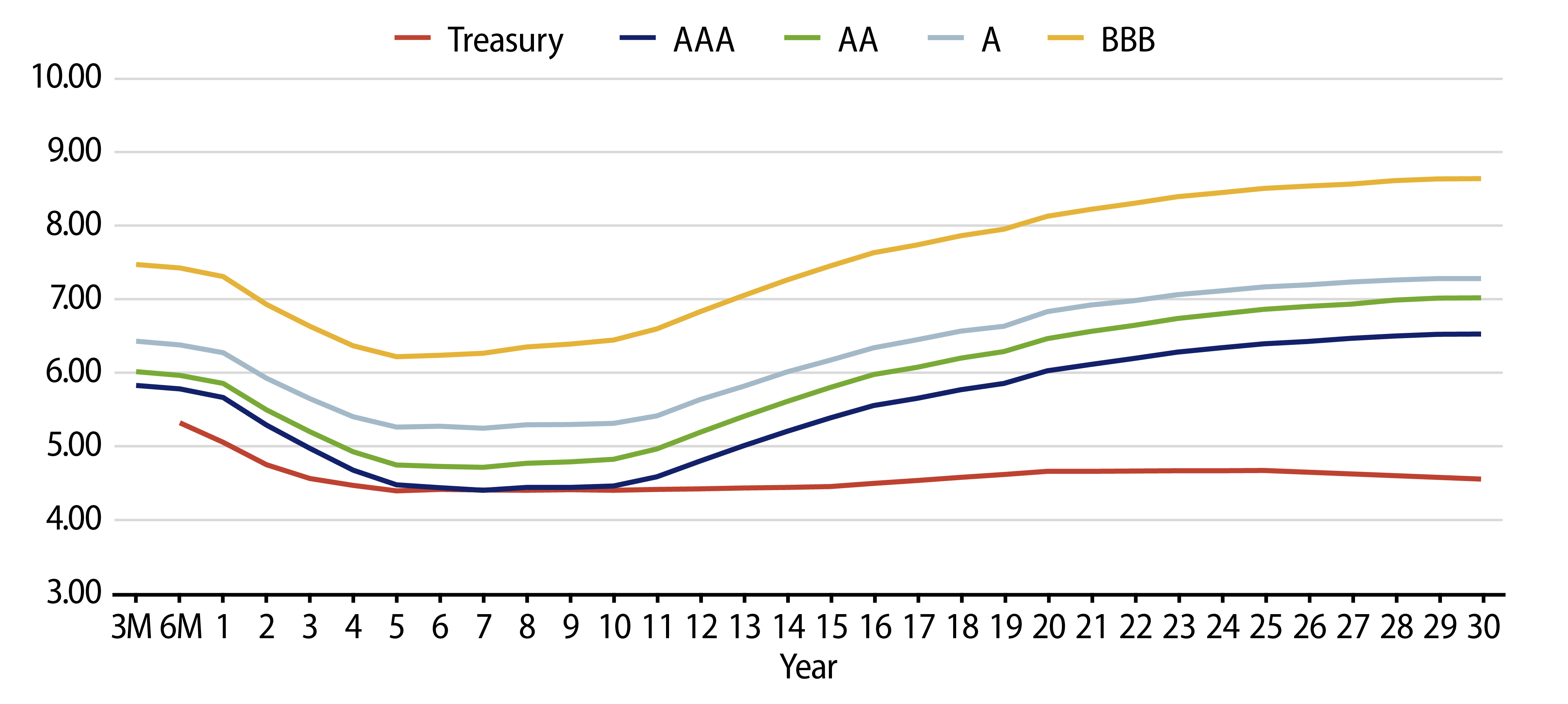

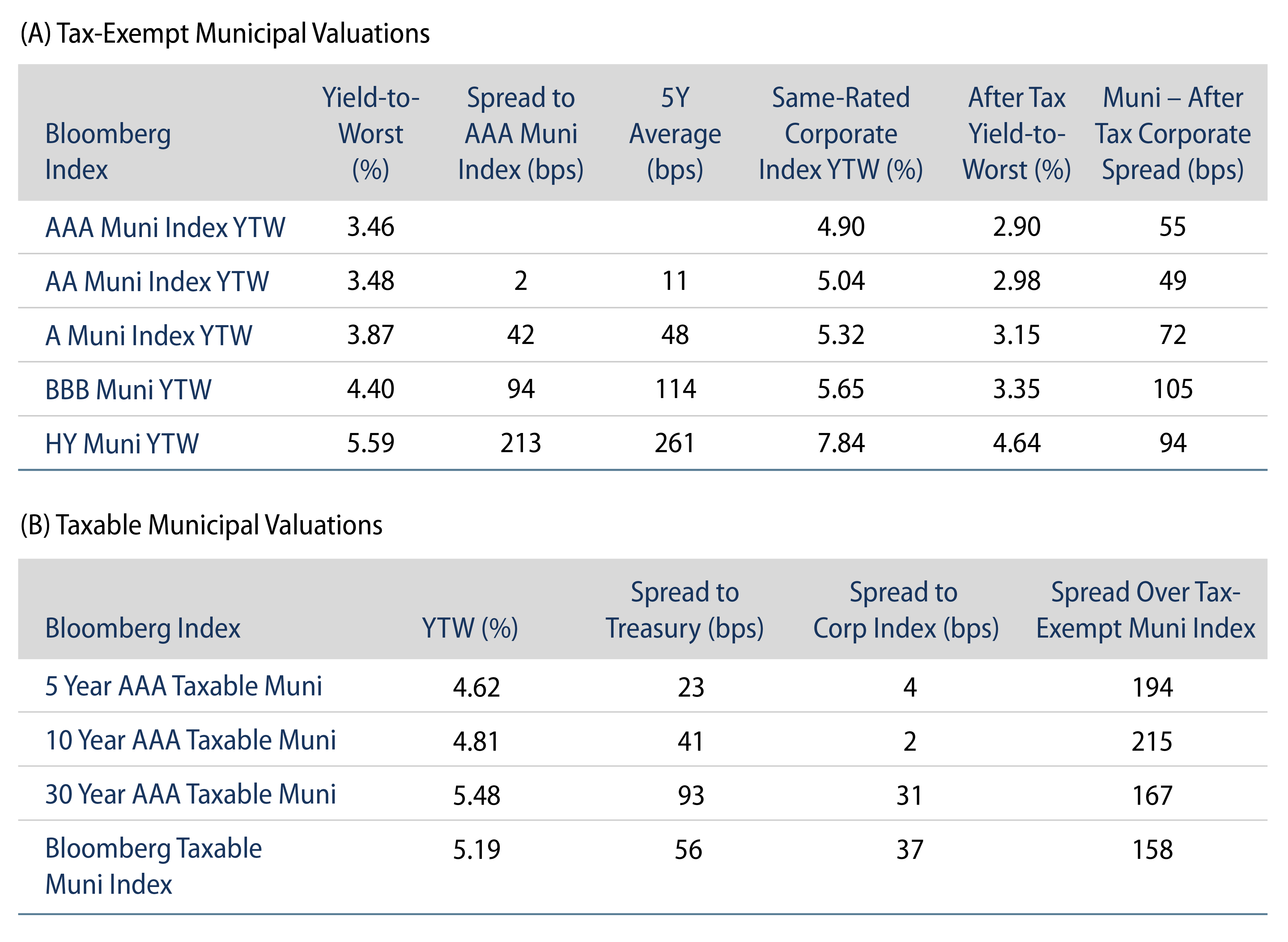

Municipal Credit Curves and Relative Value

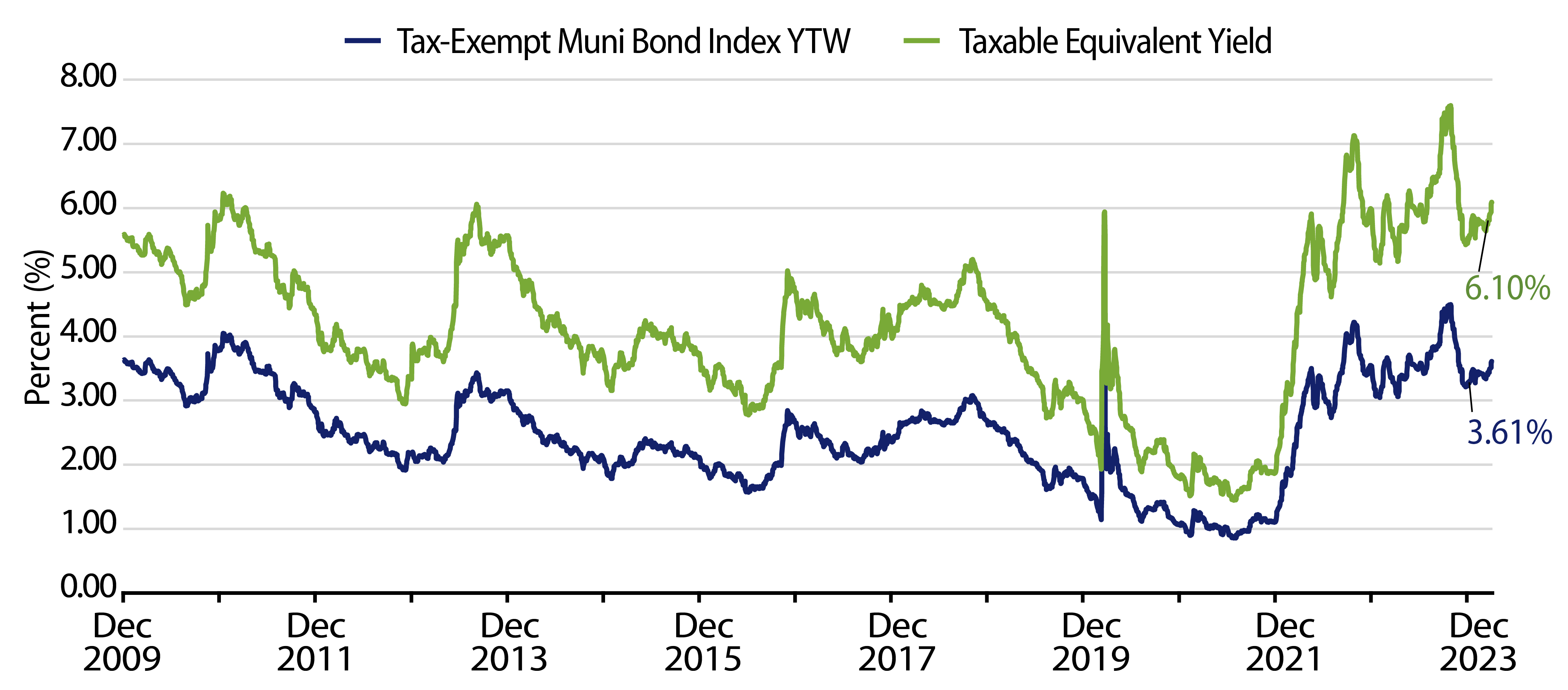

Theme #1: Municipal taxable-equivalent yields are above decade averages.

Theme #2: The inverted yield curve suggests less relative value in 5- and 10-year maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.