Municipals Posted Positive Returns Last Week

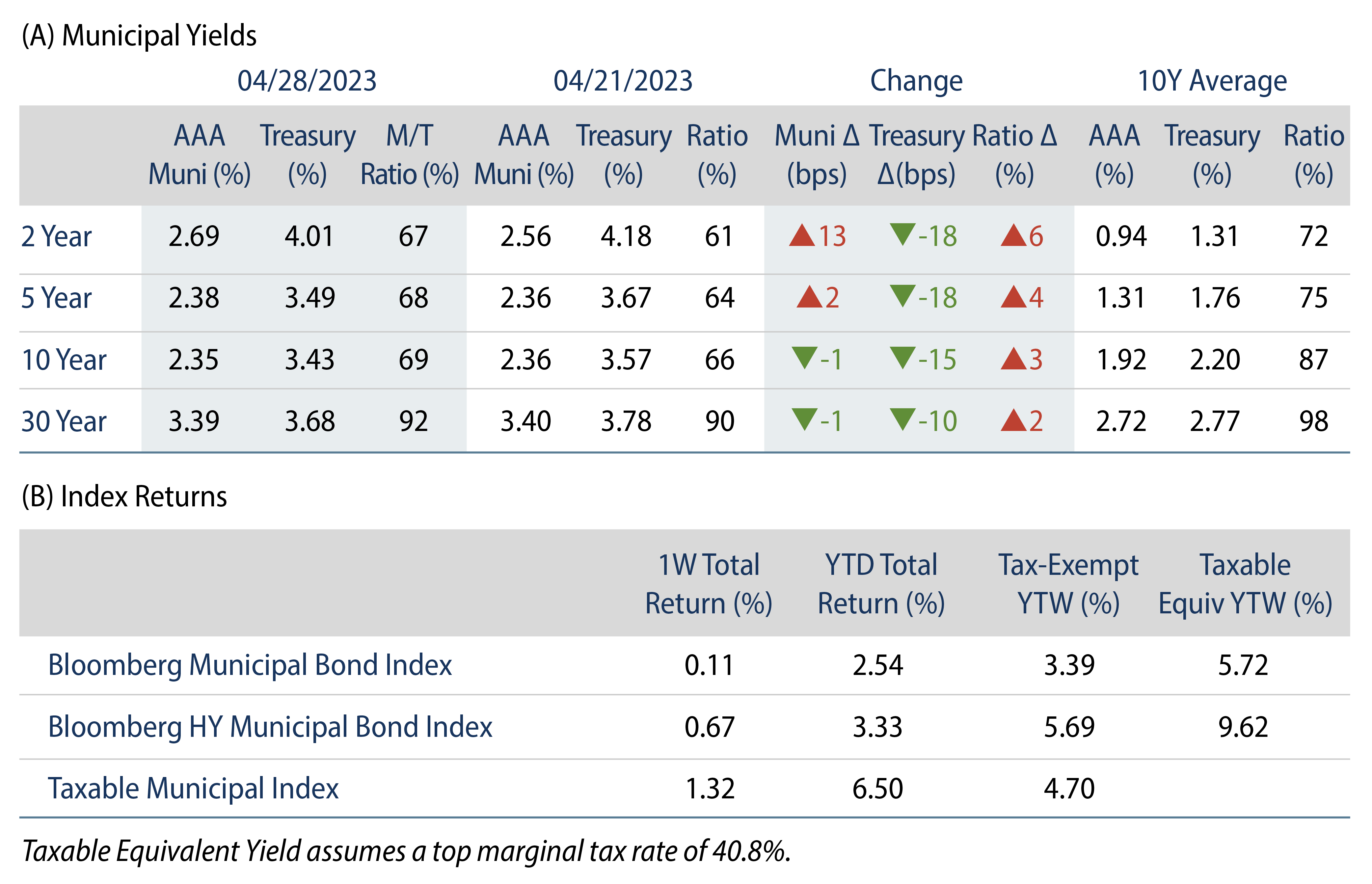

Municipals posted positive returns last week as Treasury rates rallied and the yield curve flattened. High-grade muni yields moved higher at the short end of the curve and lower in longer maturities. Munis underperformed the Treasury rally, as growth concerns sent rates lower following last week’s below-consensus GDP report signaling 1.1% annualized growth. Market technicals improved from the prior week, but remained soft as outflows continued. The Bloomberg Municipal Index returned 0.11% during the week, the High Yield Muni Index returned 0.67% and the Taxable Muni Index returned 1.32%. Following Climate Week, we highlight the progress of green and social issuance in the muni market.

Technicals Improved From the Prior Week as Outflows Slowed

Fund Flows: During the week ending April 26, weekly reporting municipal mutual funds recorded $92 million of net outflows, according to Lipper. Long-term funds recorded $100 million of outflows, high-yield funds recorded $558 million of outflows and intermediate funds recorded $197 million of inflows. This week’s outflows bring year-to-date (YTD) net outflows to $6 billion, though we expect the majority of 2023 reported outflows were from January monthly reporters, reflecting December 2022 demand weakness.

Supply: The muni market recorded $10 billion of new-issue volume last week, down 6% from the prior week. YTD issuance of $108 billion is down 13% year-over year (YoY), with tax-exempt issuance down 7% YoY and taxable issuance down 41% YoY. This week’s calendar is expected to decline to $6 billion. Large transactions include $847 million Southeast Energy Authority and $518 million Energy Northwest transactions.

This Week in Munis: Climate Week

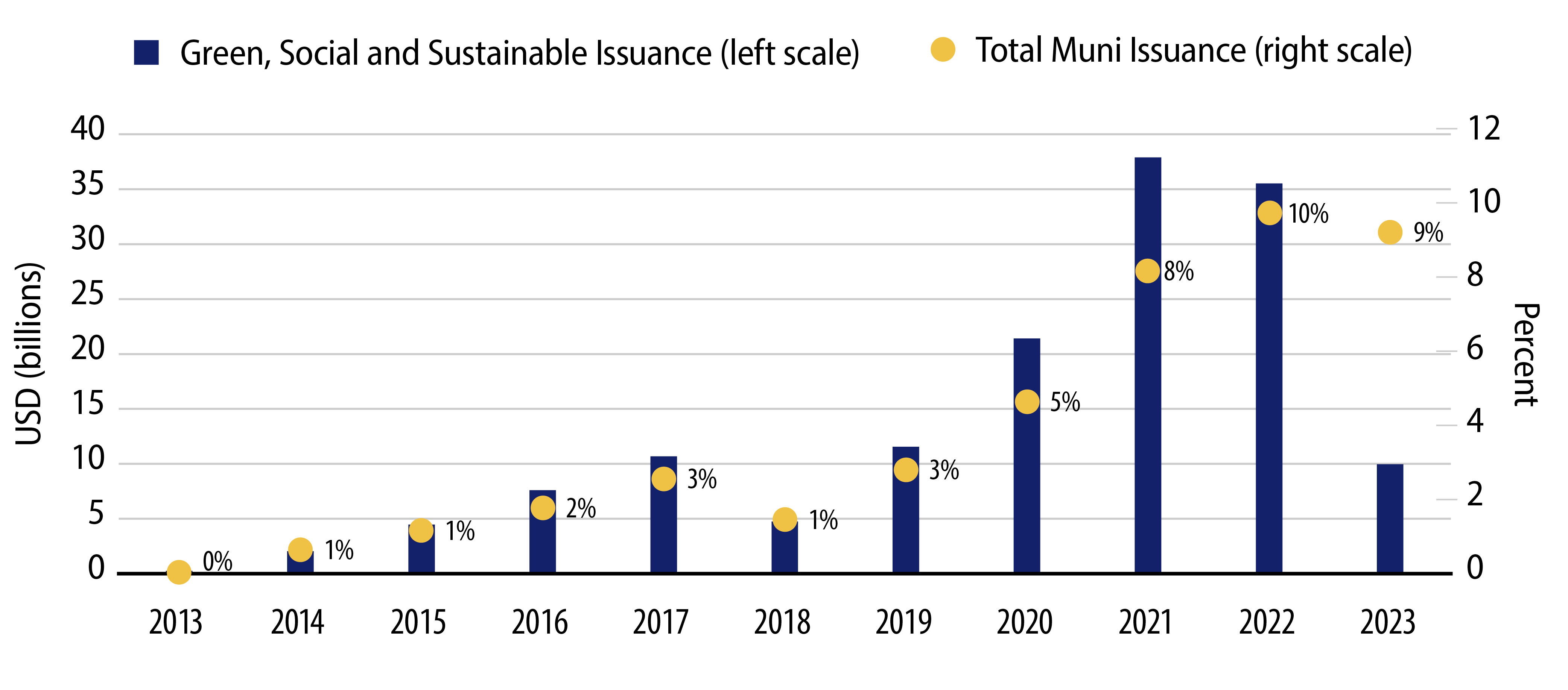

As we highlighted during Climate Week last year, the municipal asset class often aligns with sustainable investor objectives considering positive social and environmental infrastructure often funded with municipal bonds. Municipal issuers began issuing self-labeled green, social and sustainable issuance in earnest in 2013 in accordance with guidelines established from the International Capital Market Association (ICMA) to promote environmental and/or social advancement.

Over the past decade, annual municipal Green, Social and Sustainable bond issuance has grown exponentially to $36 billion in 2022. Last year, issuer-labeled issuance declined 6% from the high observed in 2021, but this was primarily attributable to a 22% decline in total municipal issuance during the year. Despite the YoY decline, the proportion of green and social issuance relative to total municipal issuance increased to 10% in 2022, up from 8% of total municipal issuance in 2021 and just 1% of total municipal issuance in 2018. This trend has continued YTD through April 28, as sustainable issuance remained elevated to total issuance at 9%.

Western Asset expects green and social issuance to continue to grow with developing standards and increasing third party resources for the municipal issuer and investor community. As federal and state resources continue to incentivize sustainable infrastructure initiatives, we could see headline issuers attract global sustainable investment mandates into the municipal market. For example, last month, the State of New York passed a budget which included support for a $4.2 billion environmental green bond referendum on November’s ballot, proceeds from which would provide funds to restore environmental habitats, reduce flood risks, conserve additional lands and open spaces, protect and improve water resources and invest in climate change mitigation projects.

While these tailwinds should support additional sustainable issuance within the municipal market, ESG (environmental, social and governance) investing has also become increasingly politically fraught, which could limit future issuer-labeled muni issuance from certain states. Therefore, we believe it will remain important to maintain an independent process in assessing risks and impact opportunities, regardless of green or social bond labeling.