Munis Posted Positive Returns Last Week

Municipals posted positive returns last week as fixed-income markets saw positive total returns amid the lower yield conditions. Munis generally outperformed, as demand improved with strong fund flows and supply remained elevated. September retail sales data came in stronger than expected and October initial jobless claims of 241,000 came in below consensus and below last month’s levels. Despite the strong data, fixed-income yields largely moved lower across the curve as the market appeared to coalesce around expectations for continued rate cuts this year. Meanwhile, the high-grade muni yield curve steepened, moving lower with Treasuries in long maturities but moving higher in short maturities. The Bloomberg Municipal Index returned 0.23% during the week, the High Yield Muni Index returned 0.34% and the Taxable Muni Index returned 0.23%. This week we highlight potential corporate tax policy implications of the upcoming election.

Muni Inflows and Elevated Supply Persist

Fund Flows (up $1.78 billion): During the week ending October 16, weekly reporting municipal mutual funds recorded $1.7 billion of net inflows, according to Lipper. Long-term funds recorded $997 million of inflows, intermediate funds recorded $541 million of inflows and high-yield funds recorded $36 million of inflows. This week’s inflows led estimated year-to-date (YTD) net inflows higher to $32 billion.

Supply (YTD supply of $413 billion, up 45% YoY): The muni market recorded $16 billion of new-issue volume last week, up 40% from the prior week. YTD issuance of $413 billion is 48% higher than last year’s level, with tax-exempt issuance 51% higher and taxable issuance 13% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $13 billion. The largest deals include $1.5 billion New York City Transitional Finance Authority and $1.5 billion New York Transportation Development Corp (JFK Airport) transactions.

This Week in Munis: Election in Focus—Corporate Income Taxes

Tax policy is typically a key issue in presidential elections, but the upcoming election is especially significant as many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire in 2025. For corporations, the TCJA reduced the highest corporate tax rate to 21% (from 35%). Unlike many of the individual income tax provisions associated with the TCJA, the corporate income rate reduction is not slated to expire in 2025. However, both Harris and Trump have voiced diverging corporate tax policies that could change the economics for corporations to invest in municipal bonds.

Banks and insurance companies have significantly reduced their muni holdings as tax rates declined following the enactment of the TCJA in 2018. According to Federal Reserve data, insurance company muni holdings declined $144 billion (-27%) to $387 billion and bank muni holdings declined $70 billion to $509 billion since 4Q17. Together, the $213 billion decline of these holdings reduced institutional muni market concentration from 29% to 23%, increasing the concentration of the retail holder of muni debt. The higher retail concentration could contribute to greater market volatility as institutions have historically supported the market during bouts of volatility and fund outflows.

Ahead of the upcoming election, Vice President Harris and former President Trump have proposed diverging corporate tax policies. To fund spending initiatives and potentially reduce tax burdens for middle- to lower-income Americans as the TCJA provisions expire, the Harris administration has proposed increasing the corporate tax rate to 28%. Trump, on the other hand, has proposed reducing the corporate tax rate further to 15%.

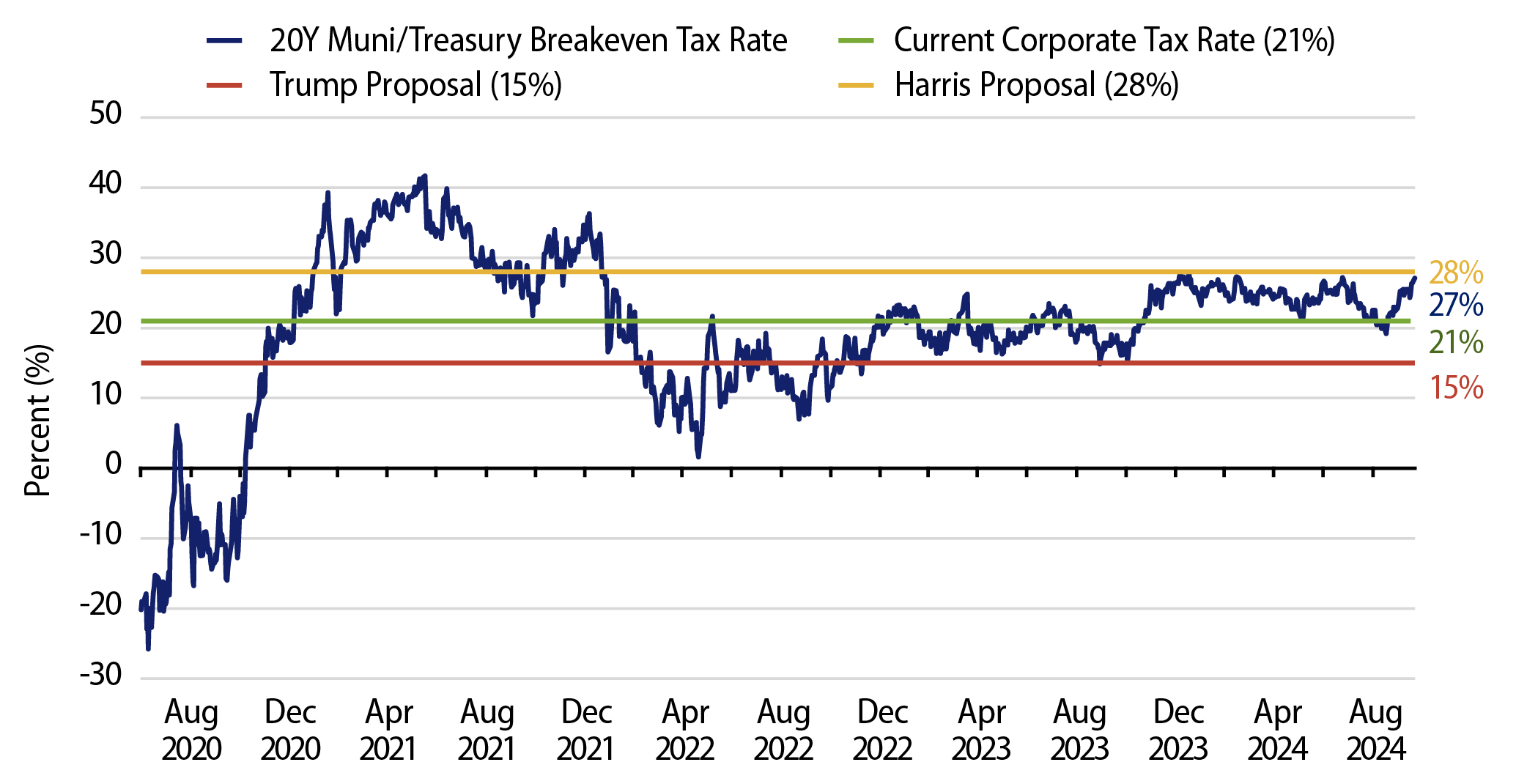

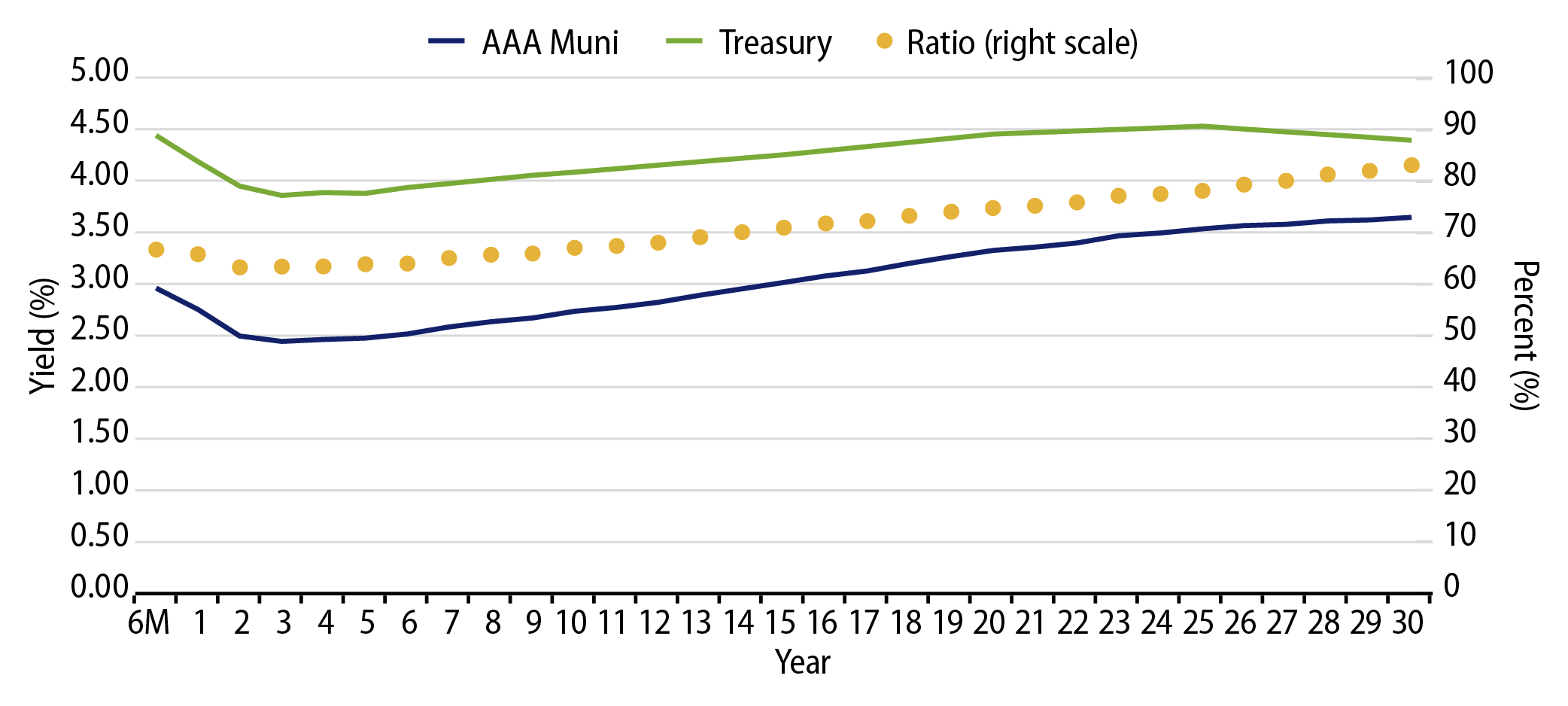

Considering current valuations, the 73% 20-Year Municipal/Treasury Ratio implies a 27% breakeven tax rate for a corporation to be indifferent between a AAA municipal bond and a Treasury bond, after taxes. The current 21% tax rate and a potential 15% Trump-proposed tax rate fall below the 27% breakeven level, indicating that corporations will likely find better value in Treasuries compared to top-quality municipal bonds and justifying the aforementioned declines in holdings. However, the Democrat-proposed rate of 28% falls above current breakeven valuations, implying that institutions can once again find value, albeit marginal, in municipals versus high-quality fixed income.

Municipal Credit Curves and Relative Value

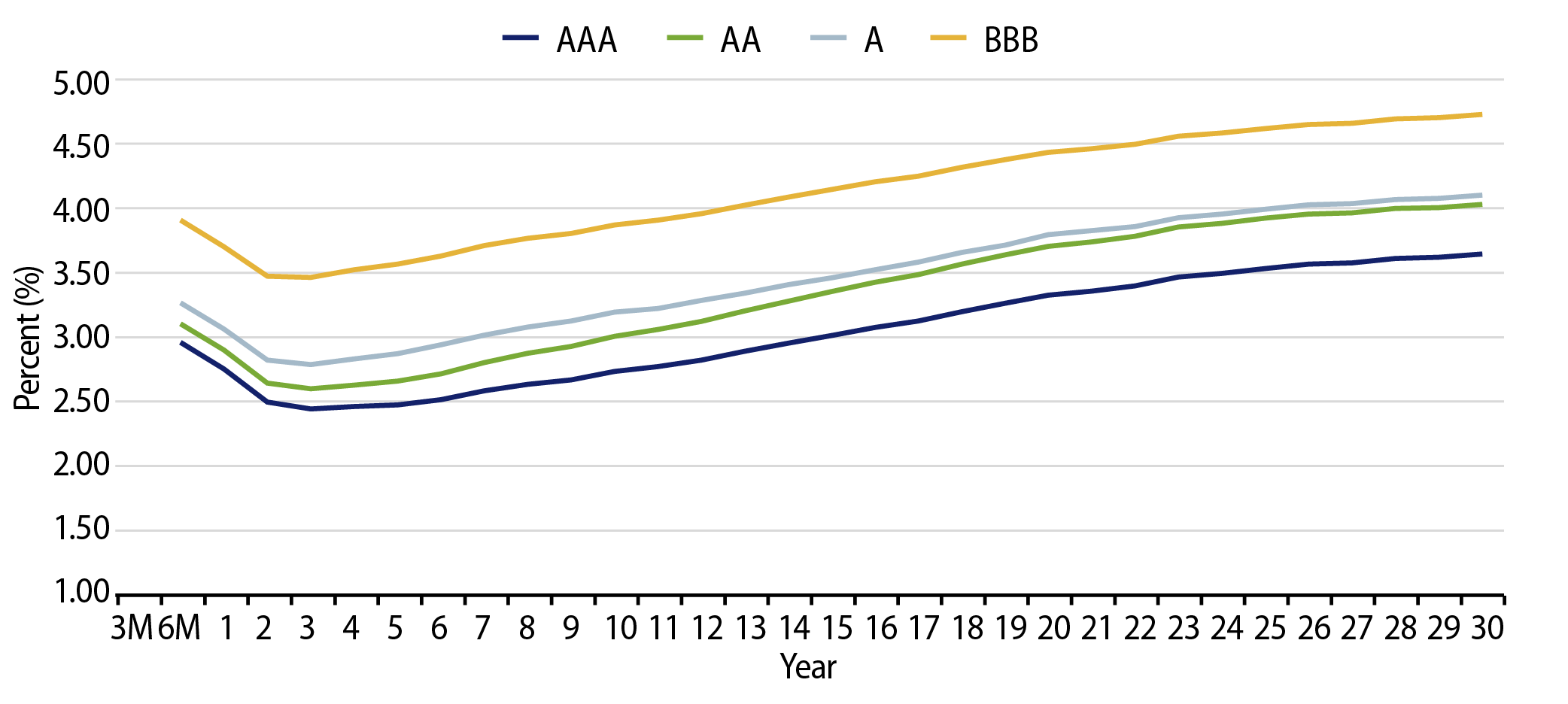

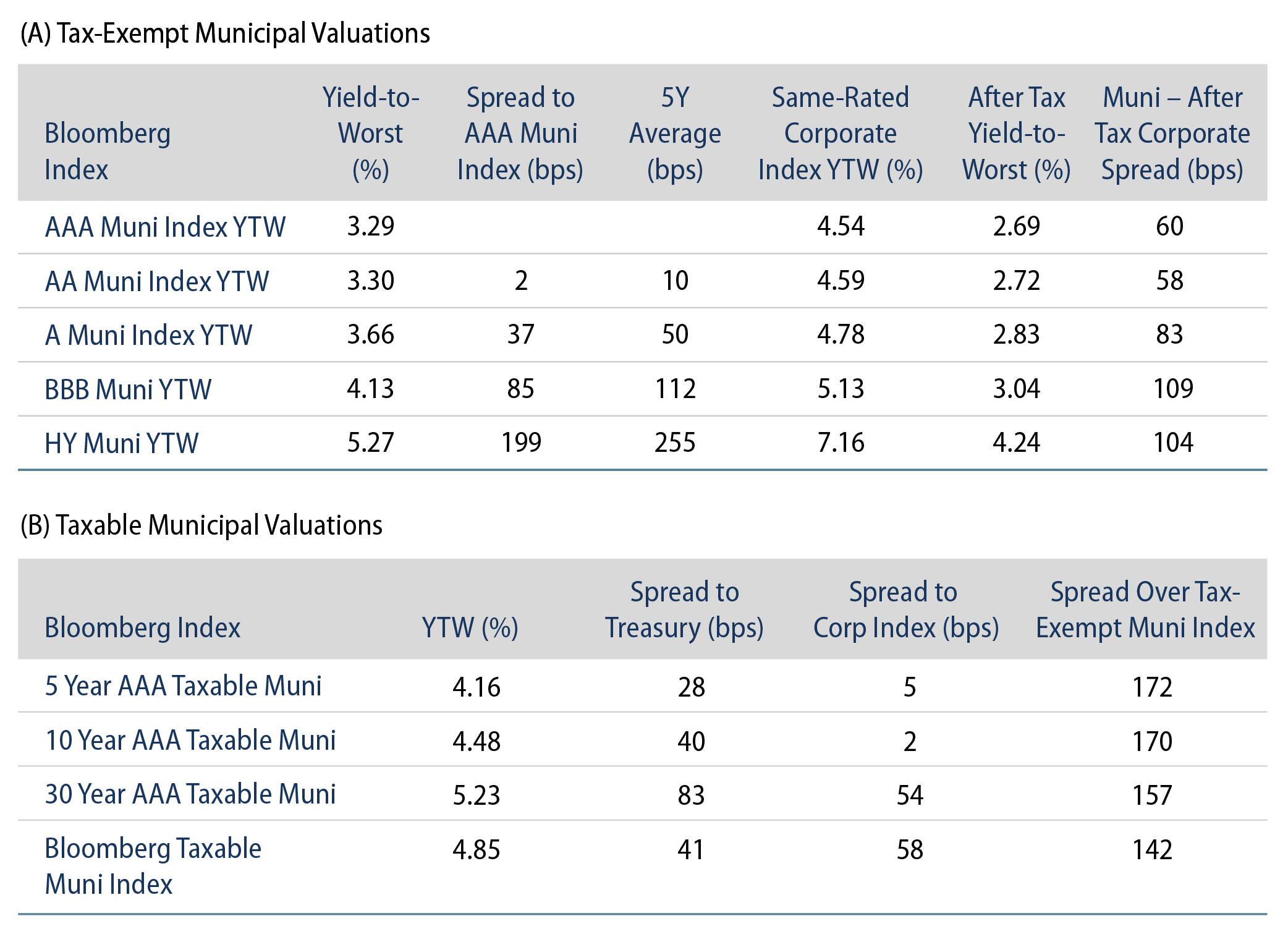

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

Theme #2: The muni yield curve has largely disinverted, offering better rolldown opportunity in intermediate maturities.

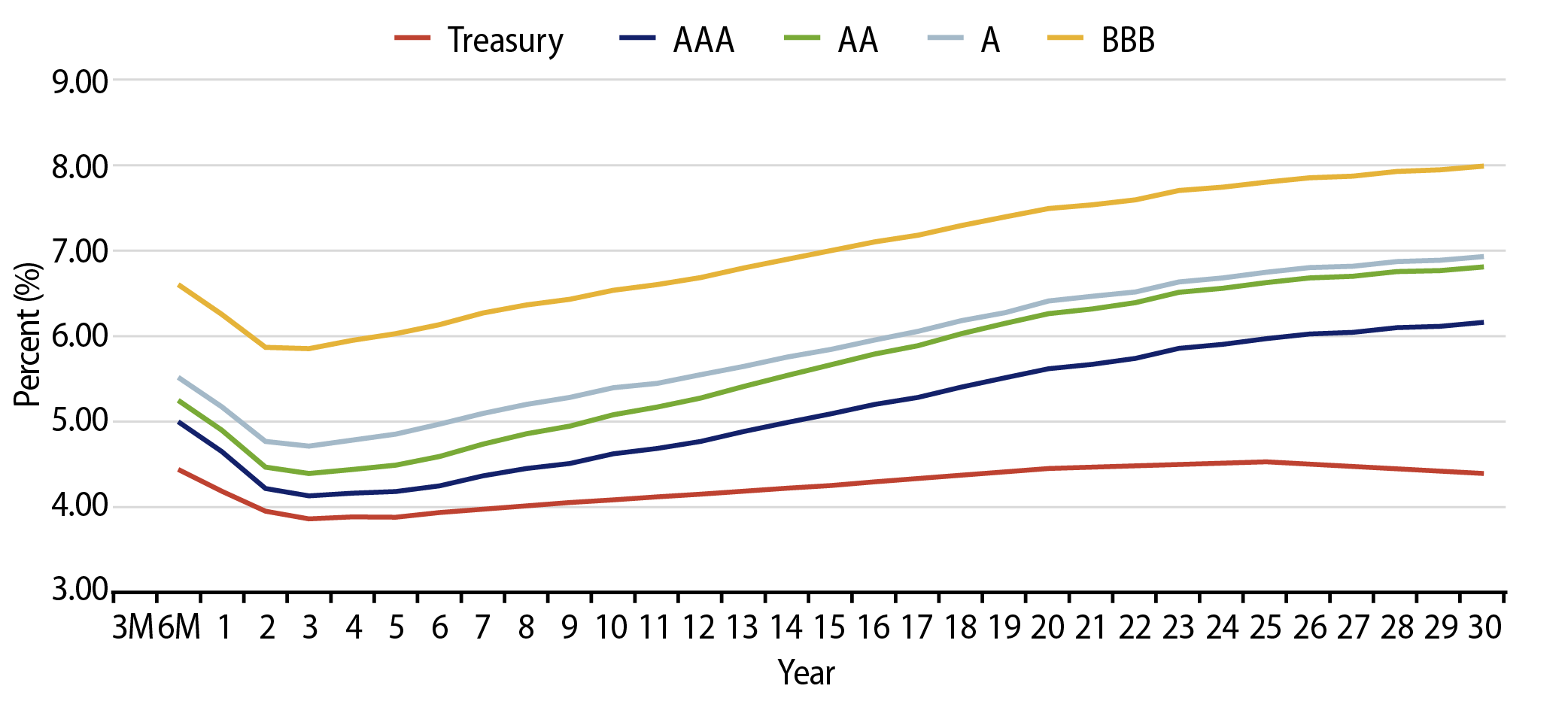

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.