Municipals Posted Positive Returns Last Week

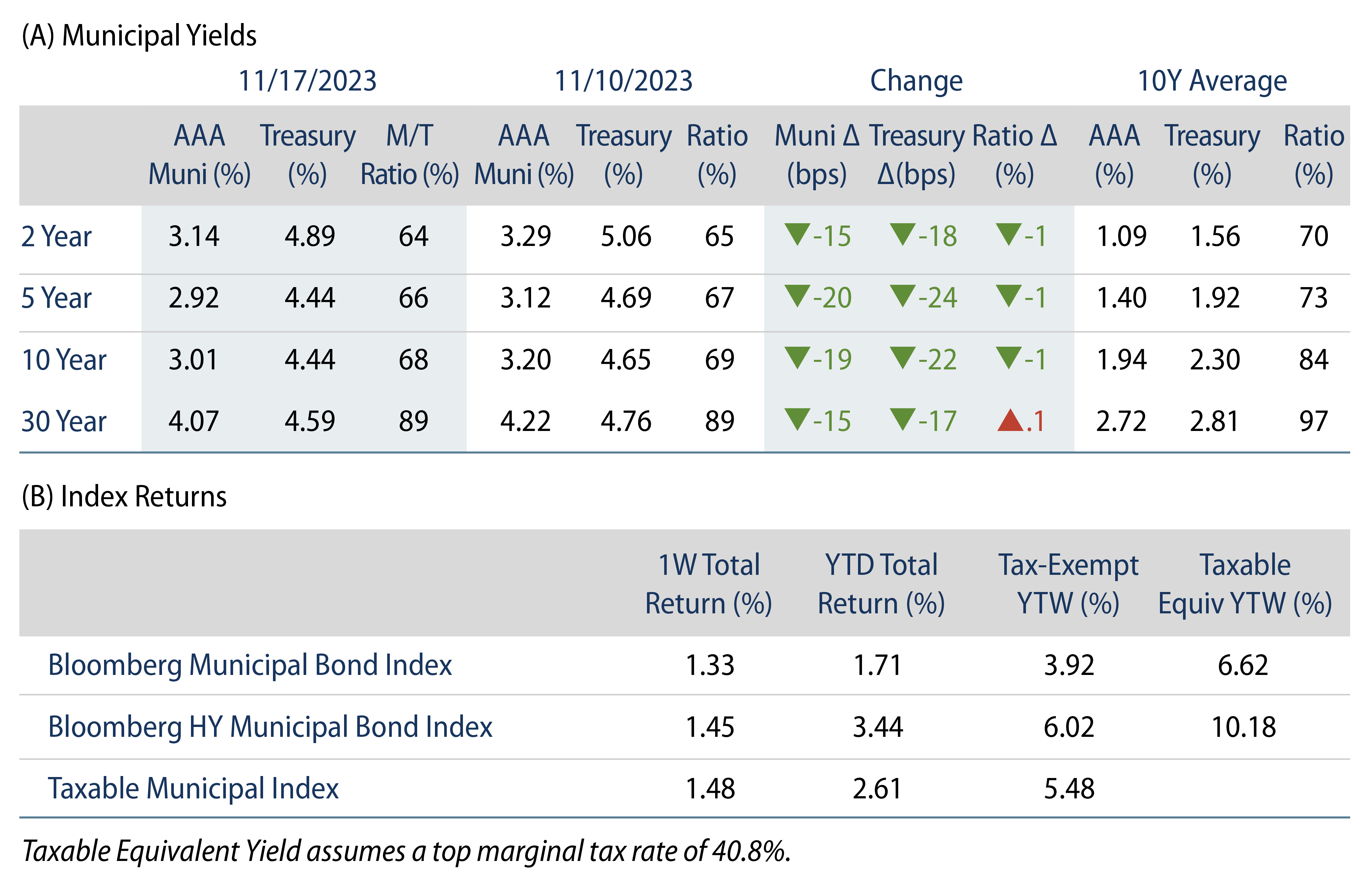

Municipals rallied with Treasuries, driven by lower-than-anticipated inflation data. High-grade muni yields moved lower across the curve. Meanwhile, technicals remained challenged by fund outflows and an elevated supply. The Bloomberg Municipal Index returned 1.33% during the week, the High Yield Muni Index returned 1.45% and the Taxable Muni Index returned 1.48%. This week we highlight diverging municipal bond flow dynamics seen so far this year.

Muni Technicals Remain Challenged by Elevated Supply, Fund Outflows

Fund Flows: During the week ending November 15, weekly reporting municipal mutual funds recorded $235 million of net outflows, according to Lipper. Long-term funds recorded $13 million of inflows, high-yield funds recorded $34 million of inflows and intermediate funds recorded $235 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to an estimated $14 billion.

Supply: The muni market recorded $11 billion of new-issue volume last week, down 16% from the prior week. YTD issuance of $331 billion is in line with last year’s level, with tax-exempt issuance 7% higher and taxable issuance 38% lower year-over-year (YoY). This week’s calendar is expected to be lackluster given the Thanksgiving holiday.

This Week in Munis: Diverging Flow Dynamics

Month-to-date muni outperformance following favorable inflation data and the rapid decline in interest rates might signal a return of investor demand following last year’s $120 billion record outflow cycle that was compounded by $14 billion of outflows this year. However, diving deeper into the flow data may suggest that demand has already returned to major muni market categories.

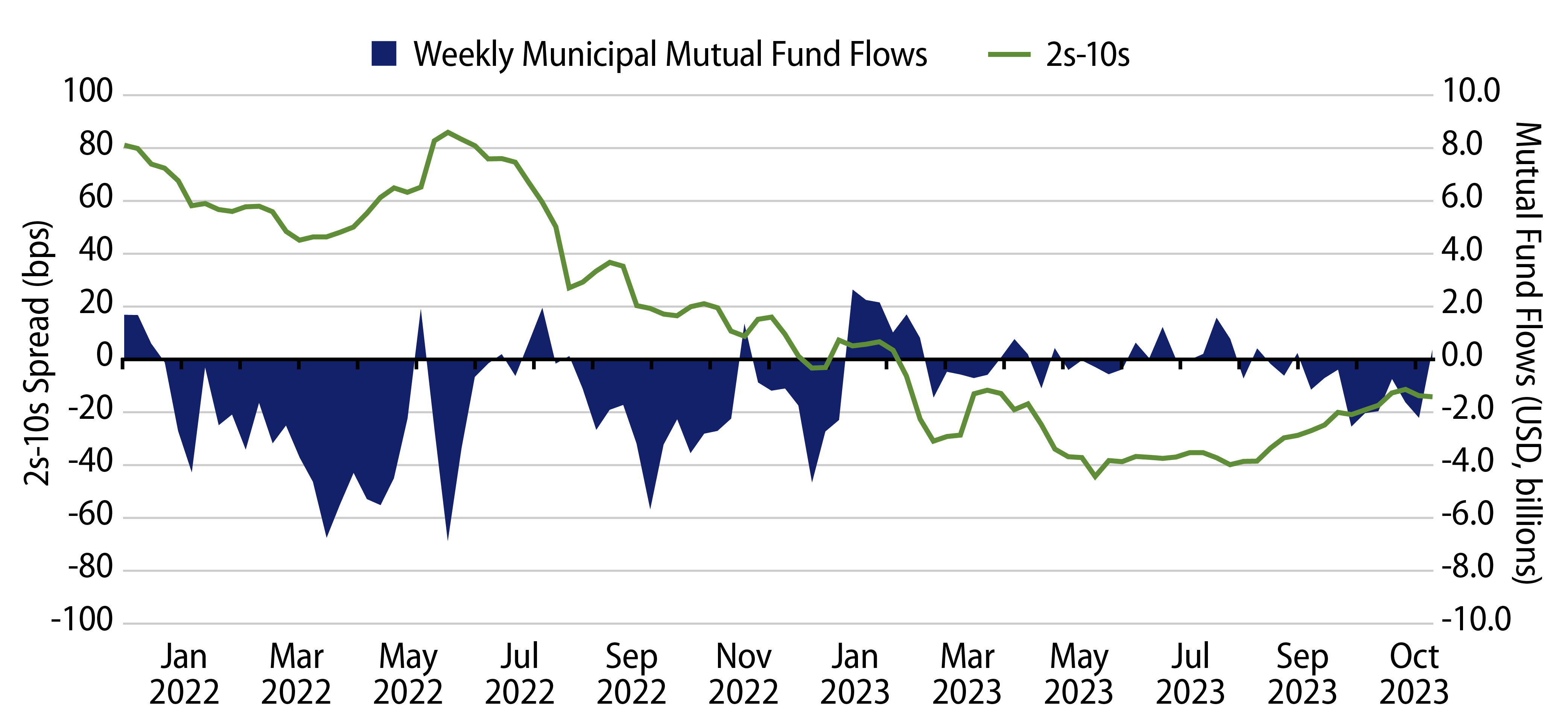

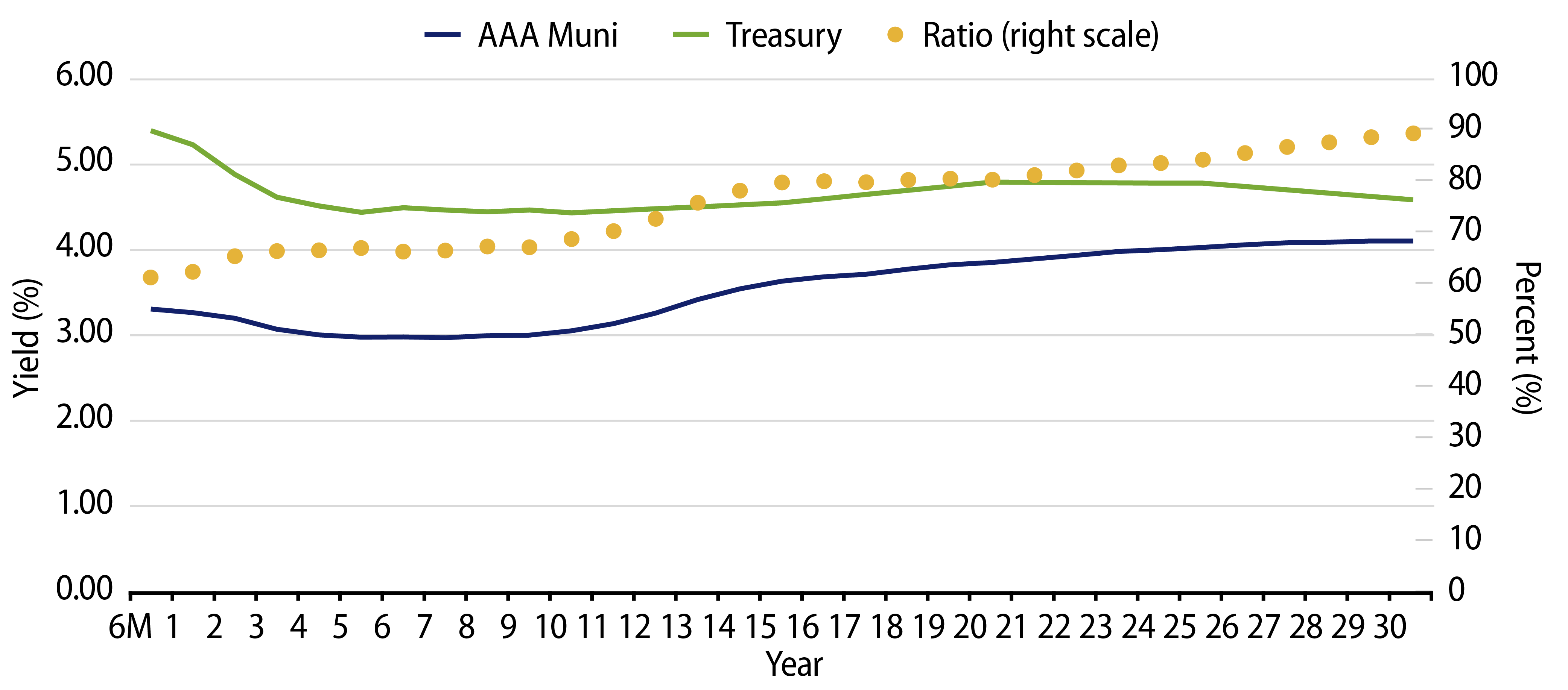

According to Investment Company Institute (ICI), municipal mutual funds garnered $5 billion in the first half of the year, before hemorrhaging nearly $12 billion from June 30 to October 31 amid the stronger economic data and elevated rate volatility. The muni market also competed with attractive front-end rates, evidenced by the inverted yield curve with 2-year municipal yields offering greater yield pickup versus 10-year municipals throughout the year, coinciding with lackluster headline flow activity.

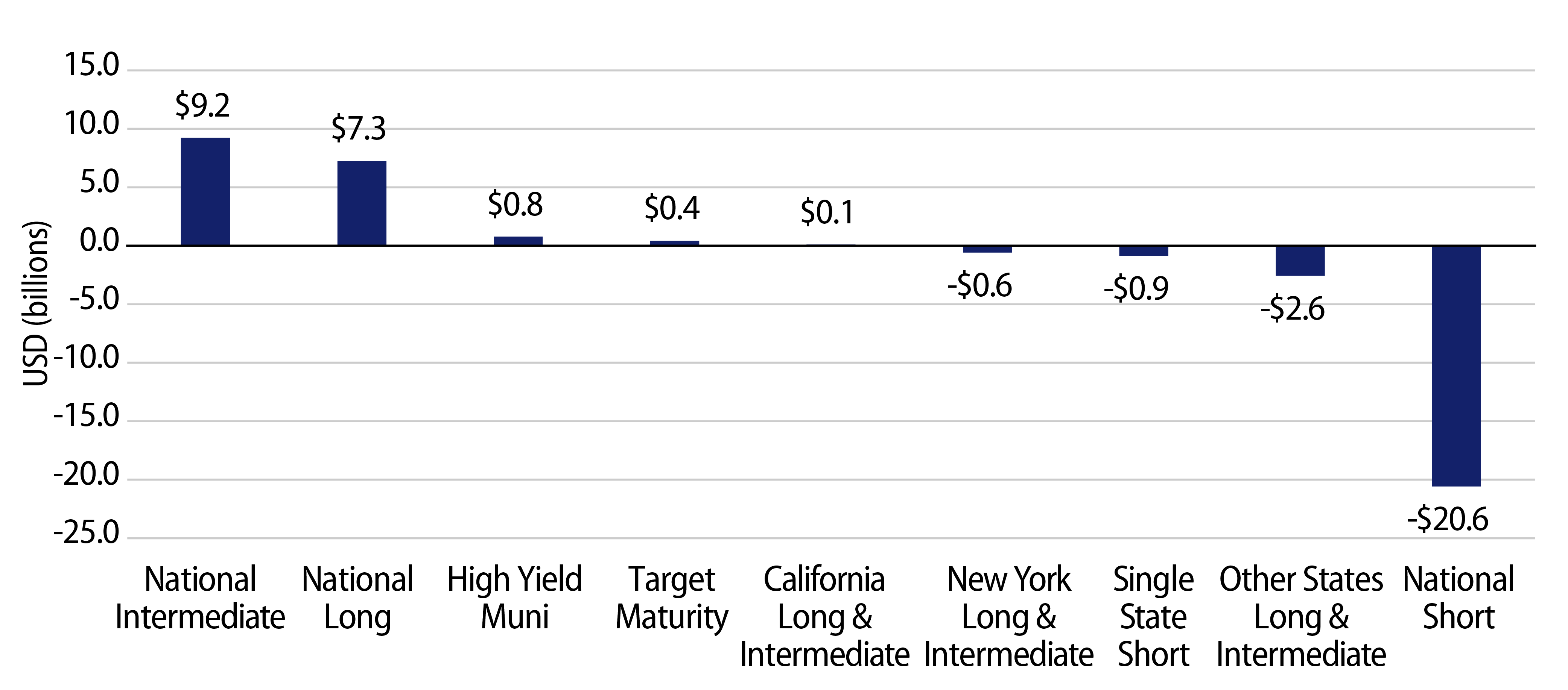

While the YTD headline outflow figure signals challenged demand for the asset class this year, there are already signs municipal investors are returning to the muni market, or moving out the yield curve to more predominant intermediate and long categories. According to Morningstar estimates, intermediate and long categories gained $17 billion of net inflows this year, while short duration strategies experienced nearly $21 billion of outflows.

Western Asset believes municipal investors weighing the scope of market demand and fund flows within their valuation process might be better served by recognizing the $17 billion of market inflows into intermediate, long and high-yield categories, which cover greater proportions of the broader municipal market indices. While some might have the view that the headline outflow figure suggests further market weakness and opportunities ahead, this month’s 50 to 60-bp decline in high-grade muni yields highlights how quickly the attractive income opportunity could pass, particularly if demand outpaces the relatively limited supply we expect heading into the holiday season.

Western Asset Key Themes for Muni Investors

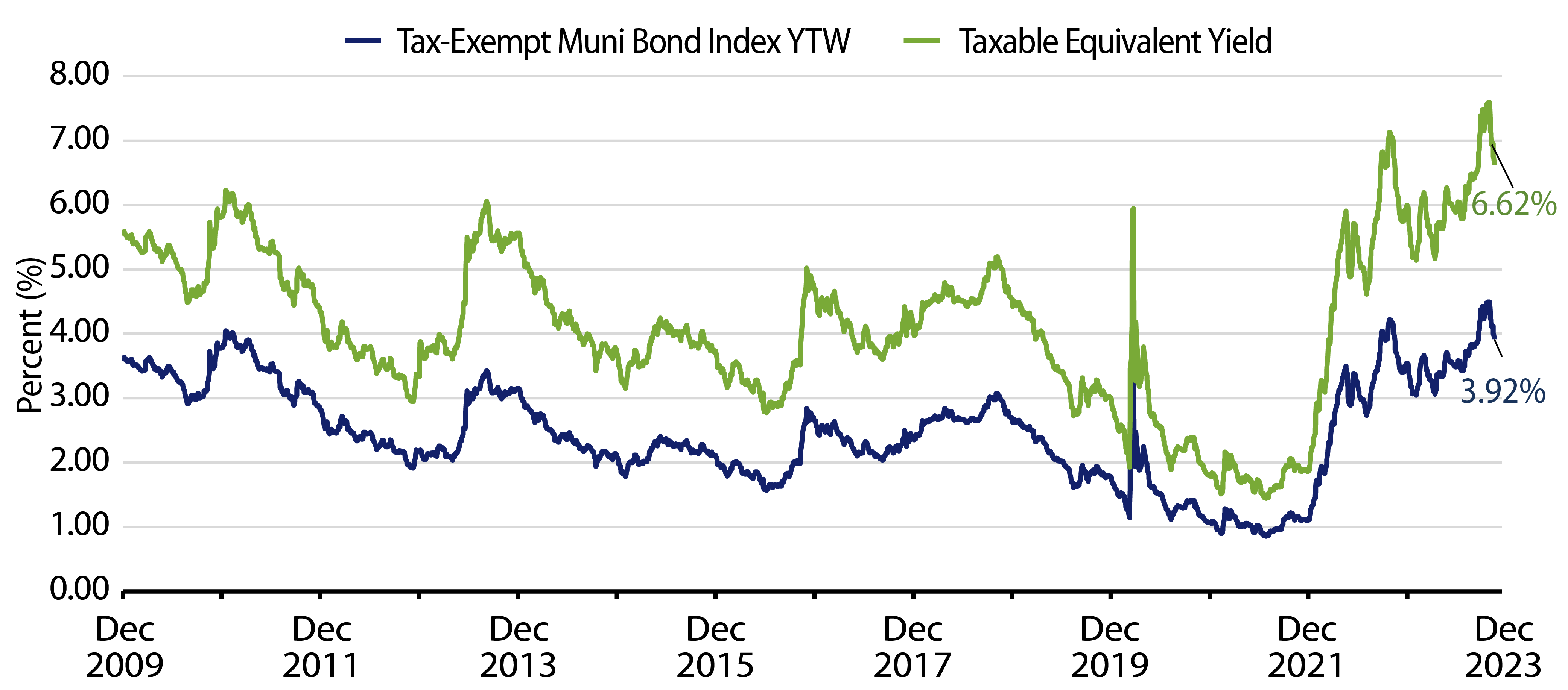

Theme #1: Municipal index yields and taxable equivalent yields are above decade highs.

Theme #2: The inverted yield curve offers opportunities in short and long maturities.

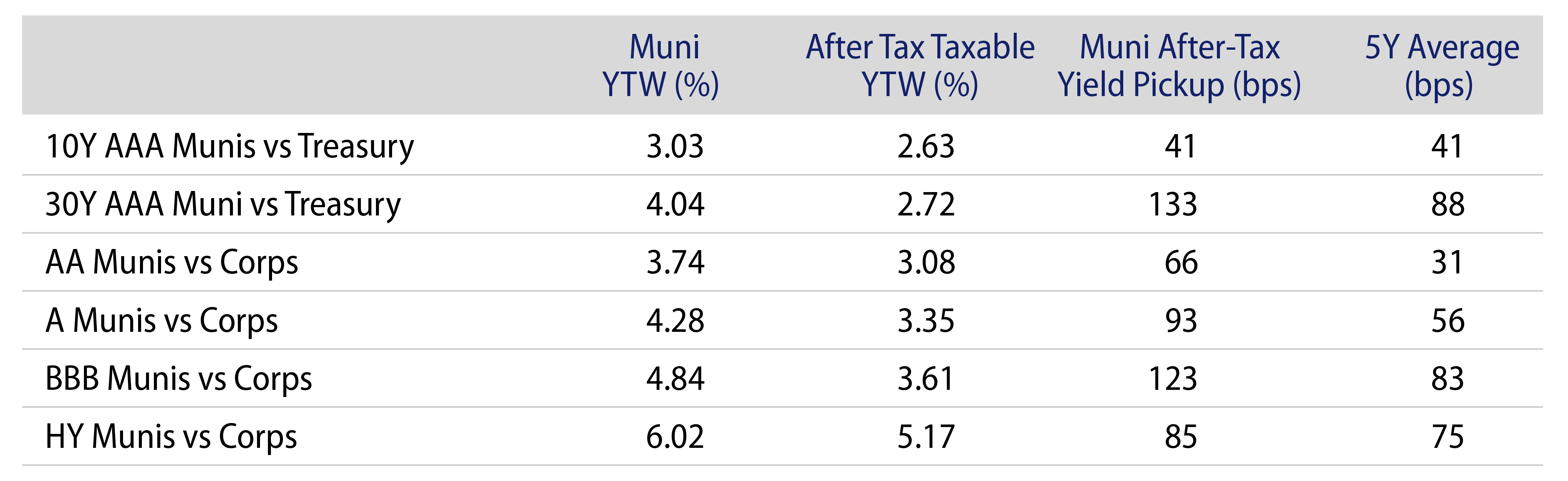

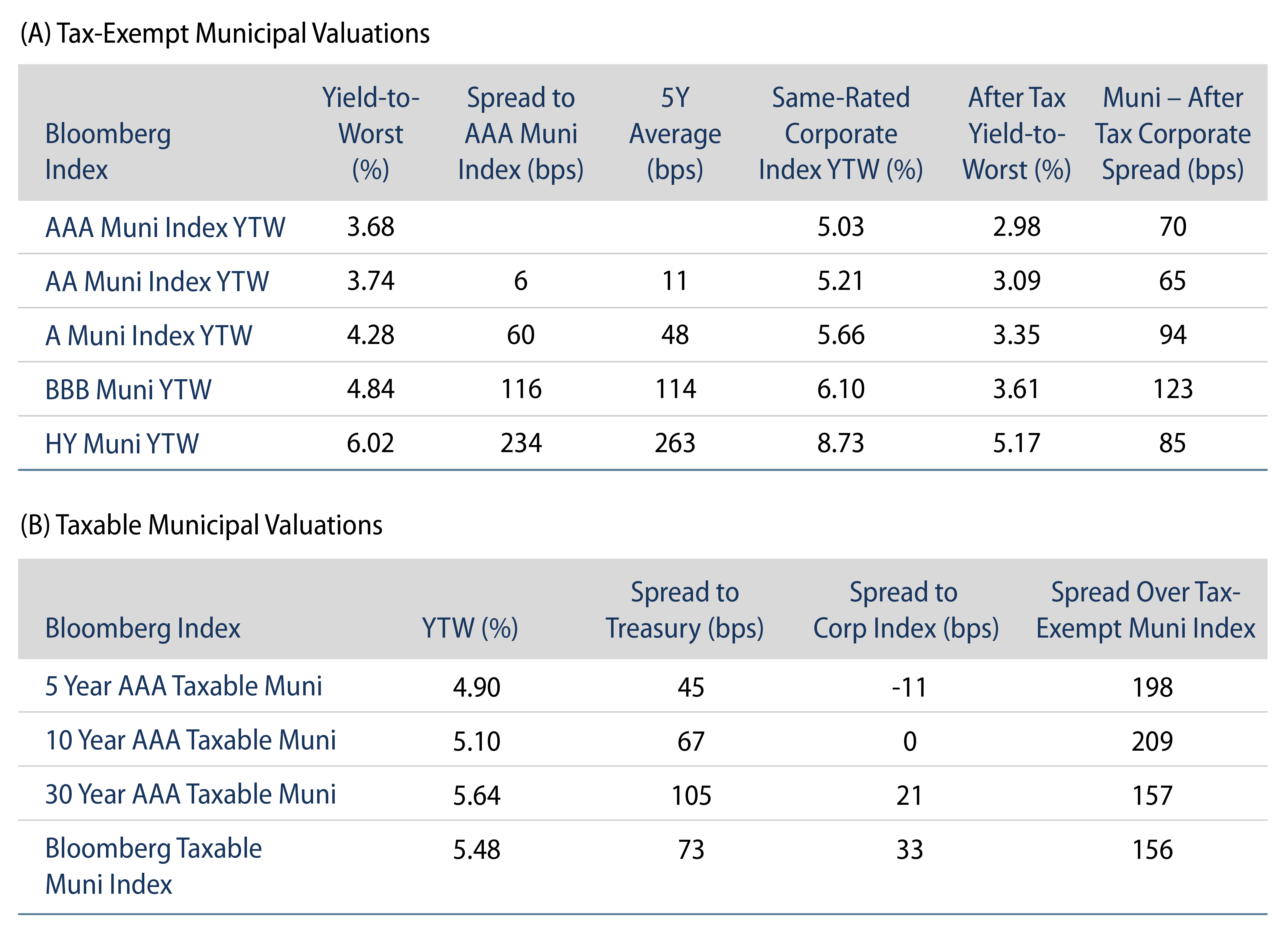

Theme #3: Munis offer attractive after-tax yield pickup vs. corporate credit.