Municipals Posted Negative Returns Last Week

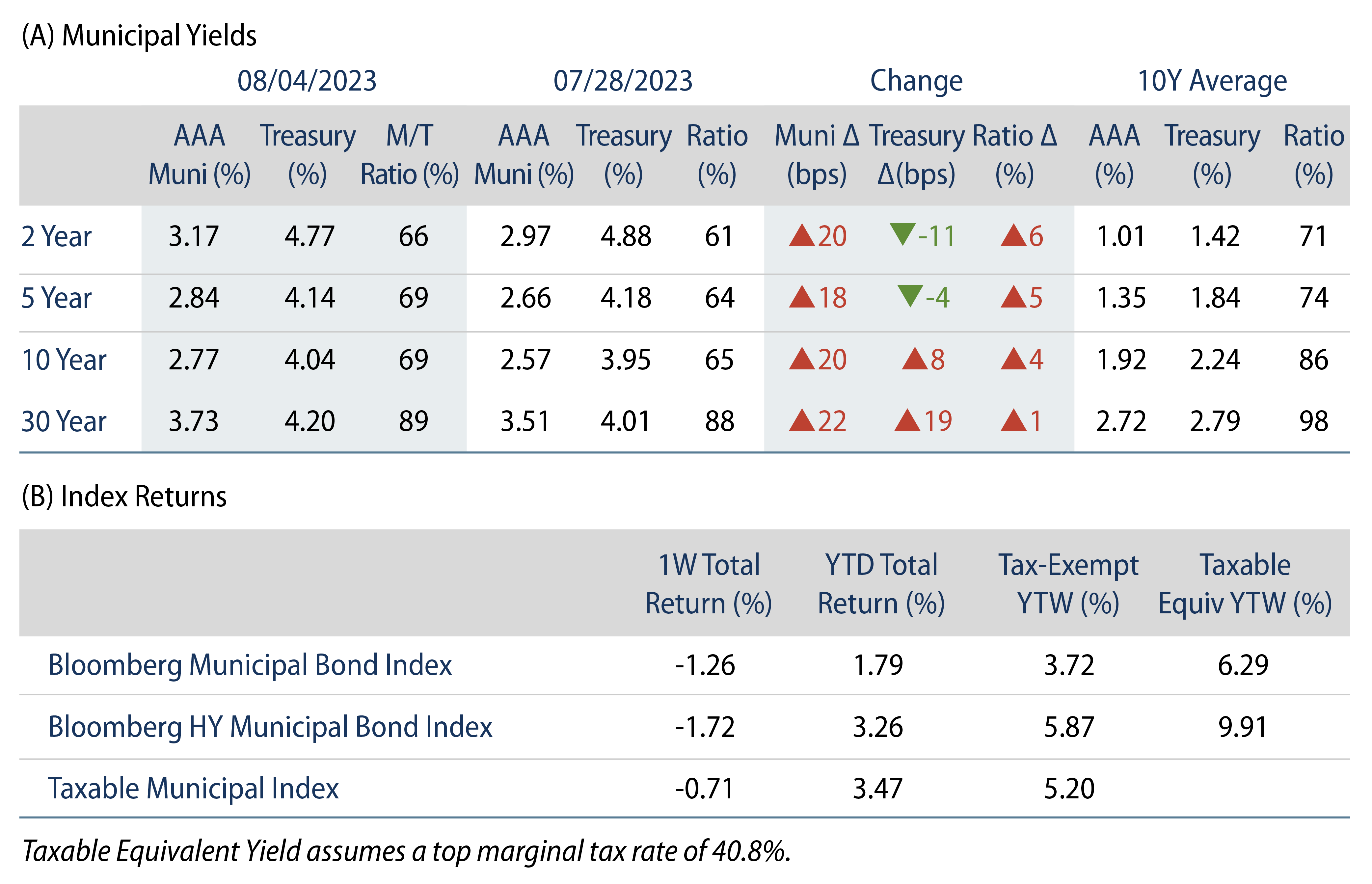

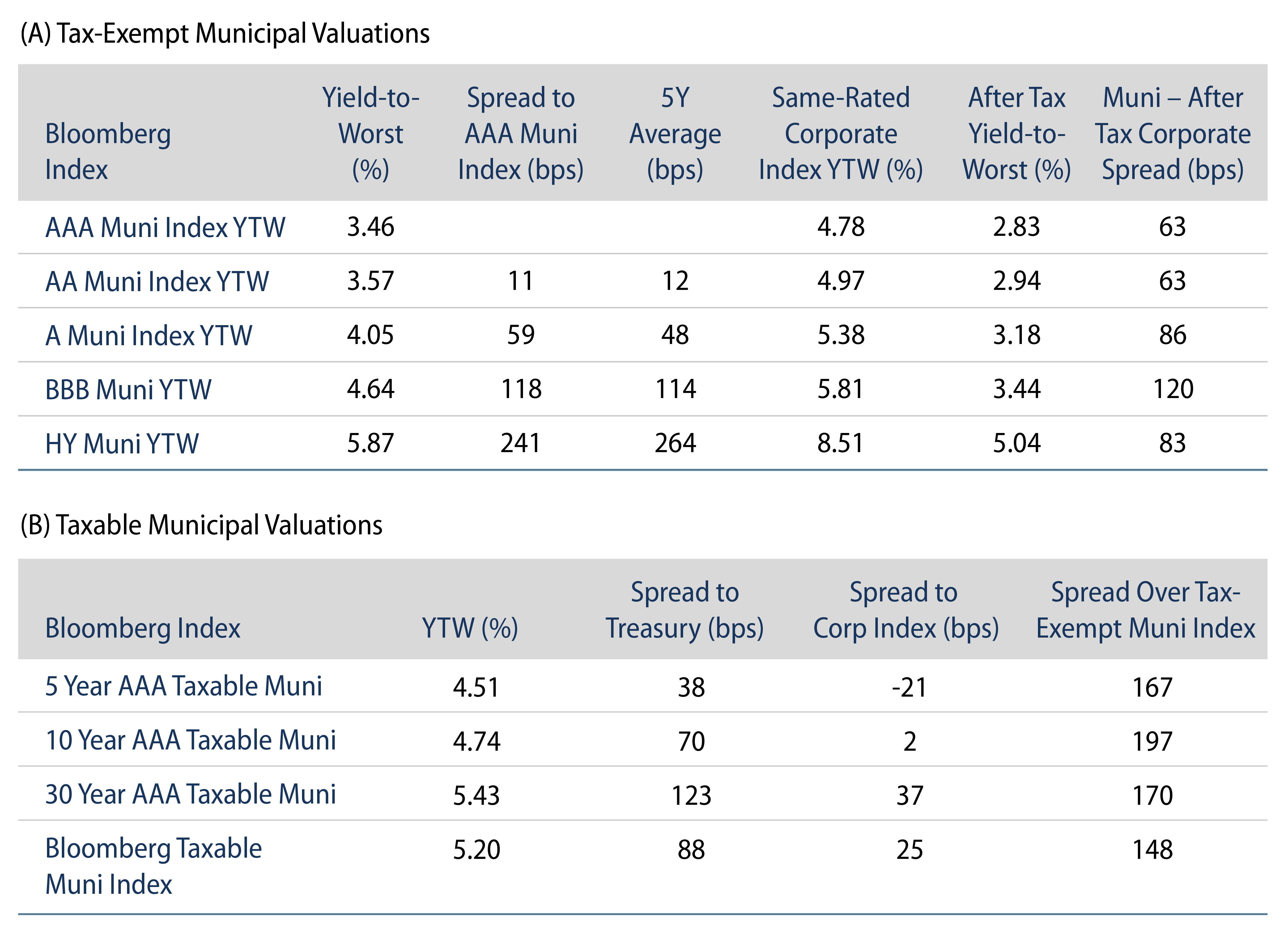

Municipals posted negative returns last week and underperformed fixed-income markets as high-grade muni yields moved higher across the curve. Relatively rich starting valuations, fund outflows and elevated supply conditions all contributed to muni underperformance versus Treasuries, as the Treasury curve steepened following the US downgrade, mixed jobs data and higher than expected issuance plans. Weak technicals were driven by elevated supply and mutual fund outflows. The Bloomberg Municipal Index returned -1.26% during the week, the High Yield Muni Index returned -1.72% and the Taxable Muni Index returned -0.71%. This week we evaluate the muni market reaction to the US downgrade by Fitch Ratings.

Fund Outflows, Elevated Supply Contributed to Weak Technical Conditions

Fund Flows: During the week ending August 2, weekly reporting municipal mutual funds recorded $990 million of net outflows, according to Lipper. Long-term funds recorded $696 million of outflows, high-yield funds recorded $48 million of outflows and intermediate funds recorded $51 million of inflows. This week’s outflows bring year-to-date (YTD) net outflows to $7.2 billion.

Supply: The muni market recorded $11 billion of new-issue volume last week, more than double the prior week’s level. YTD issuance of $210 billion is down 10% year-over year (YoY), with tax-exempt issuance down 4% YoY and taxable issuance down 43% YoY. This week’s calendar is expected to decline to $7 billion. Large transactions include $950 million State of New York General Obligation and $798 million Washington Metropolitan Area Transit Authority transactions.

This Week in Munis: Downgrade Reaction

Last week Fitch downgraded the long-term issuer rating of the US by one notch to AA+ (from AAA), citing expected fiscal deterioration in coming years and a growing debt burden. Following the downgrade, the US rating remains at Aaa by Moody’s, with AA+ ratings by Fitch and S&P, which had lowered its AAA rating in 2011.

From a municipal credit perspective, certain sectors could also see a commensurate downgrade by Fitch, including pre-refunded municipal securities (escrowed by Treasuries), as well as certain sectors subject to Federal appropriation. Beyond these smaller sectors, the vast majority of the municipal market’s 50,000+ issuers are largely independent of the credit profile of the US. Unlike the federal government, states are required by law to pass balanced budgets annually or biannually, installing a level of structural fiscal discipline. Currently 17 of the 50 states hold at least two AAA ratings from public agencies and are now more highly rated than the US.

From a market-reaction perspective, the benchmark AAA MMD callable yield curve moved 3-7 bps higher across the curve in sympathy with Treasuries following the downgrade. However, Western Asset attributes the Treasury market reaction to the announcement of upcoming issuance trends rather than a direct response to the Fitch downgrade.

Western Asset does not anticipate a material municipal market reaction from the Fitch downgrade. For those select segments tied to the federal government’s credit rating, a downgrade will keep these securities at a very high rating level and we would expect very limited price impact from the single-notch rating action. Further, while the municipal market may react to short term bouts of rate volatility should additional concerns materialize at the national level, we would expect the strong credit appeal of the municipal asset class to ultimately draw demand and benefit the asset class in a flight-to-quality environment. At the same time, we recognize the longer-term debt and demographic challenges faced by the nation, and that future funding sources from the federal government could become more scrutinized in the fraught political climate, including more attention on the value of independent credit analysis across the fragmented market.