Macros, Markets and Munis

Munis posted slightly negative returns last week as yields trailed Treasuries higher across the curve despite mixed labor data. Munis generally outperformed as fund inflows persisted at higher yield levels. Ahead of the election and the Federal Open Market Committee (FOMC) meeting this week, fixed-income markets contended with mixed macro data. GDP, job openings and nonfarm payrolls data all came in below expectations as payrolls increased by just 12,000 jobs. This was largely attributable to weather and labor strike events. More favorably, ADP employment data came in above expectations. Meanwhile, muni supply remained elevated ahead of the election. The Bloomberg Municipal Index returned 0.00% during the week, the High Yield Muni Index returned -0.21% and the Taxable Muni Index returned -0.75%. This week we highlight ballot initiative trends at the state and local levels.

Muni Supply Levels Remained Elevated as Fund Inflows Continued

Fund Flows (up $659 million): During the week ending October 30, weekly reporting municipal mutual funds recorded $659 million of net inflows, according to Lipper. Long-term funds recorded $361 million of inflows, intermediate funds recorded $301 million of inflows and high-yield funds recorded $64 million of outflows. This week’s inflows represent the 18th consecutive week of inflows and led estimated year-to-date (YTD) net inflows higher to $34 billion.

Supply (YTD supply of $441 billion, up 45% YoY): The muni market recorded $15 billion of new-issue volume last week, up 9% from the prior week. YTD date issuance of $441 billion is 45% higher than last year’s level, with tax-exempt issuance 48% higher and taxable issuance 12% higher year-over-year (YoY). This week’s calendar is expected to evaporate due to the election, with just $1 billion of planned issuance on the calendar.

This Week in Munis: Election in Focus—Bond Initiatives

While most of the focus around presidential election cycles obviously surrounds the outcome of the presidency and federal policy initiatives, ballot initiatives across states and local governments can impact tax rates and bonding initiatives. These changes can influence municipal credit fundamentals, supply and demand dynamics, and municipal bond valuations.

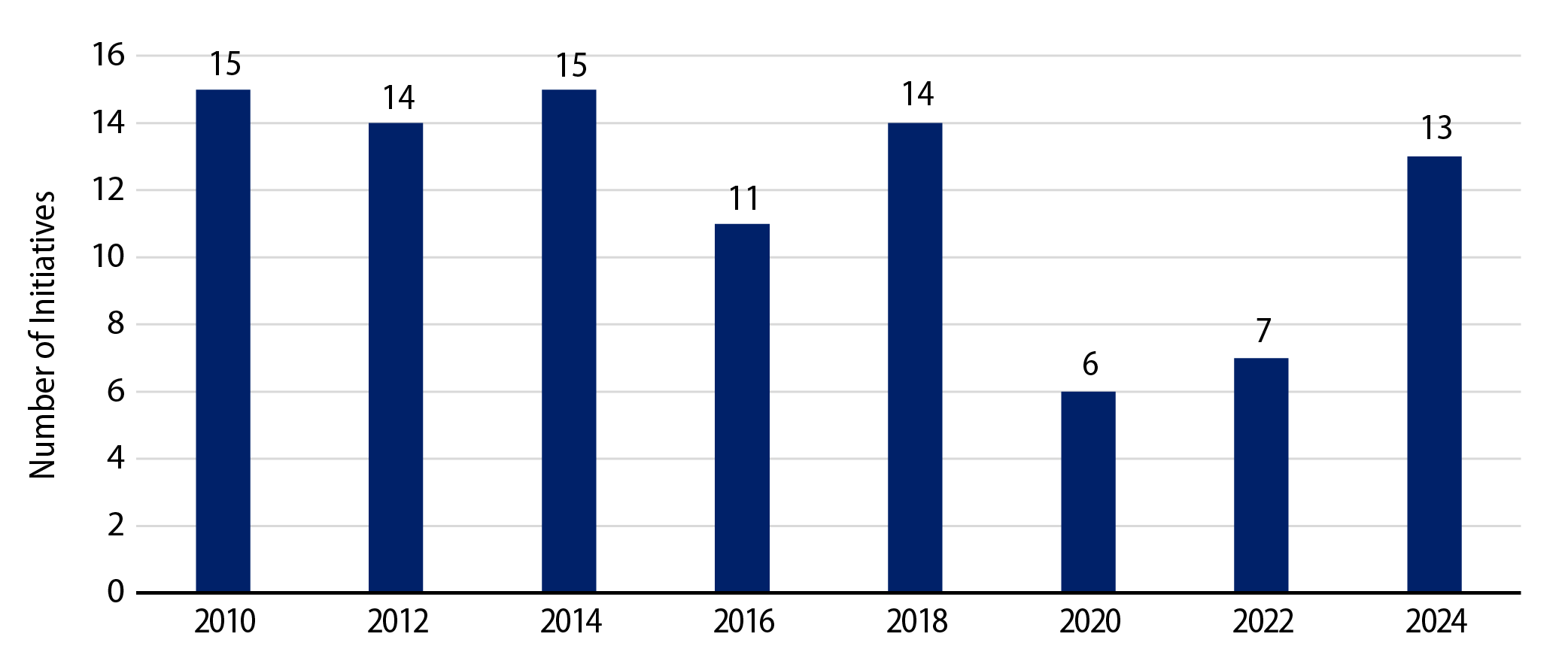

In the 2024 election cycle, there will be 13 statewide bond initiatives on the ballots, over double the number seen during the prior presidential election (six in 2020) and nearly double the prior midterm election cycle (seven in 2022), according to Ballotpedia. Notably, California voters will decide on whether to lower the threshold to pass local bonds and special taxes from 67% to 55%, easing the burden for local governments to fund infrastructure initiatives. Beyond statewide ballot measures, the American Road & Transportation Builders Association reported that approximately 20 states will consider 300 local transportation questions, which involve new sales and property taxes for local transportation infrastructure.

Voter support of measures that increase infrastructure funding and lower issuance thresholds should bode well for potential higher future municipal supply, following a record year of new issuance. More sustained supply growth should bode well for investors challenged by limited muni supply in recent years (prior to 2024) and potentially improve long-term after-tax relative valuations that can often be challenged by heavy demand for tax-exempt income.

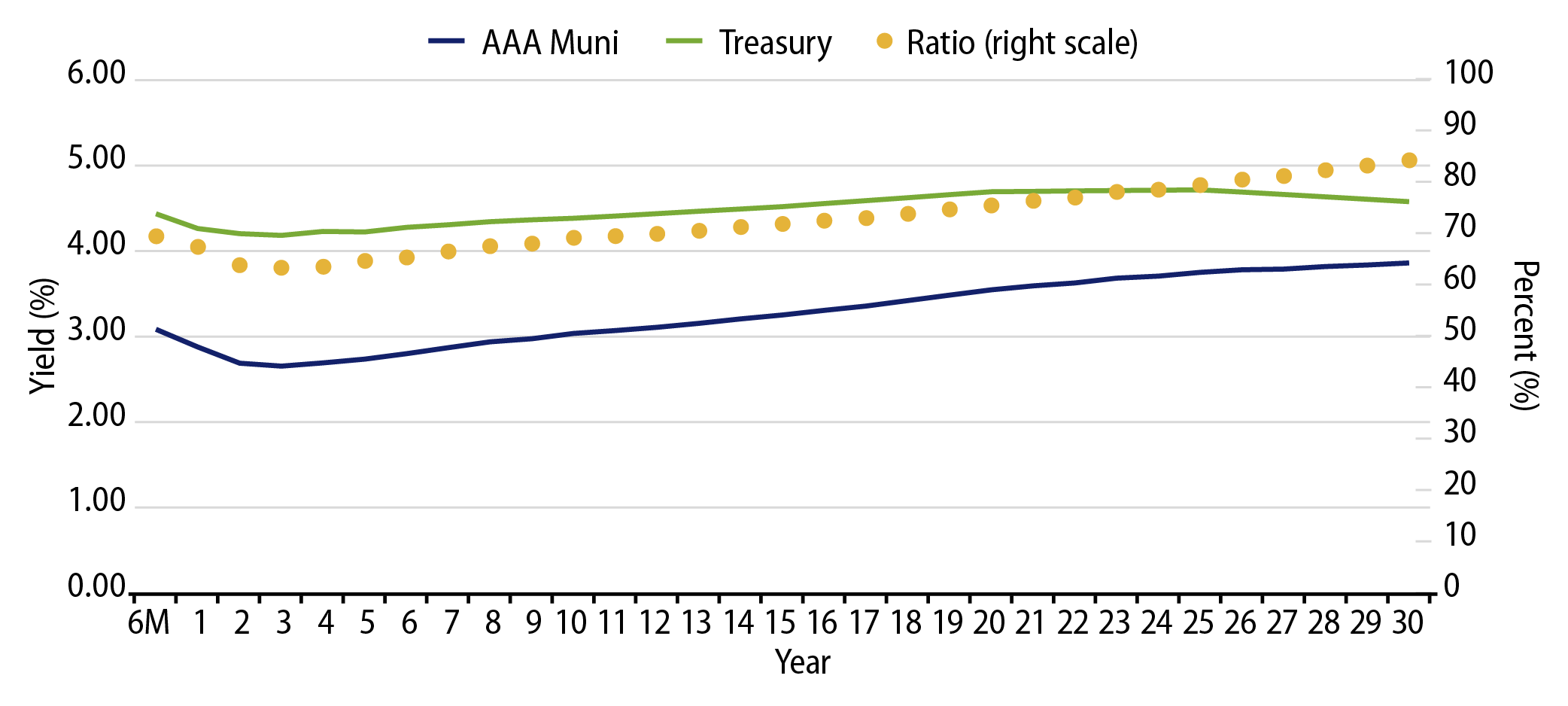

Municipal Credit Curves and Relative Value

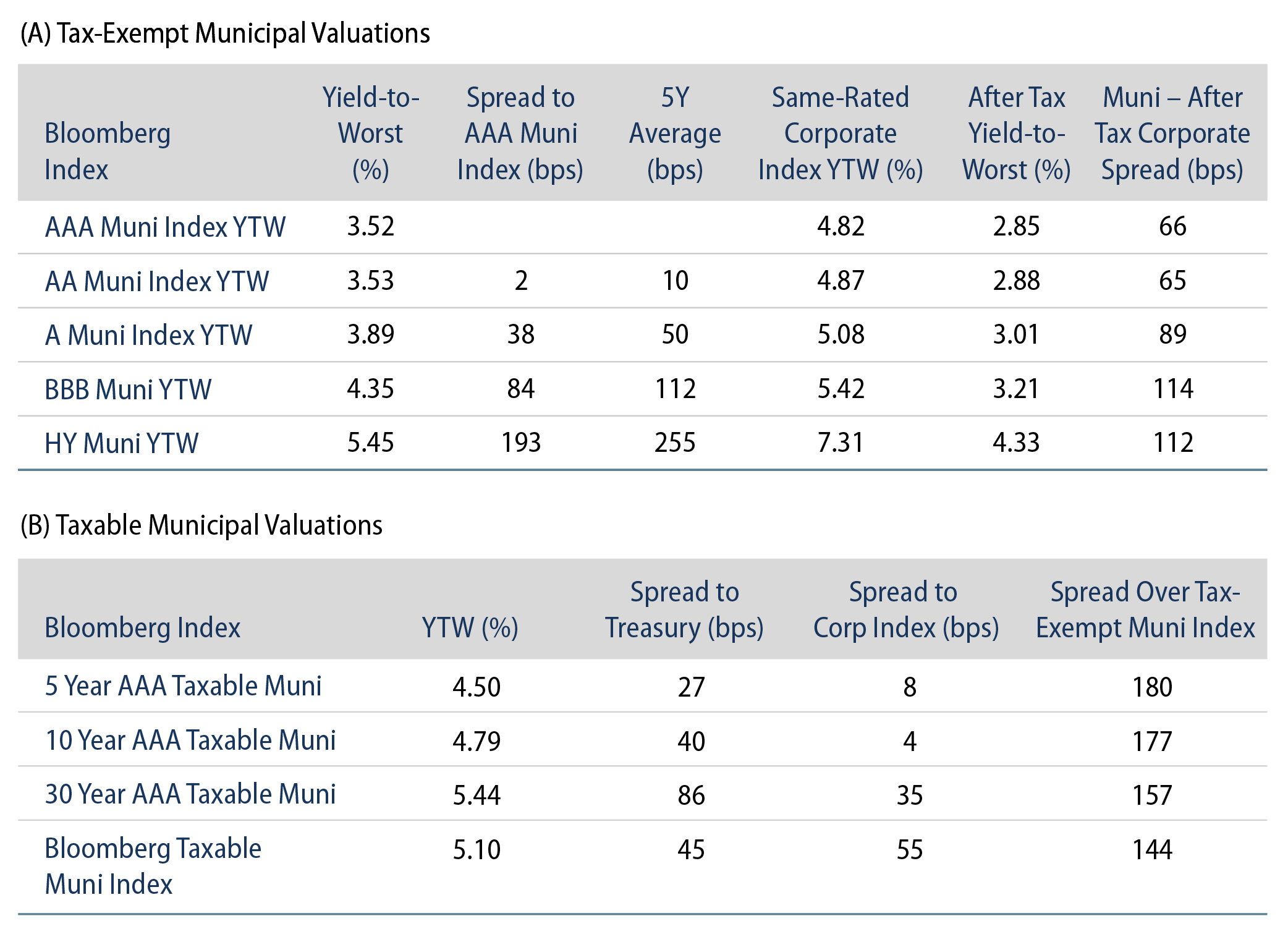

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

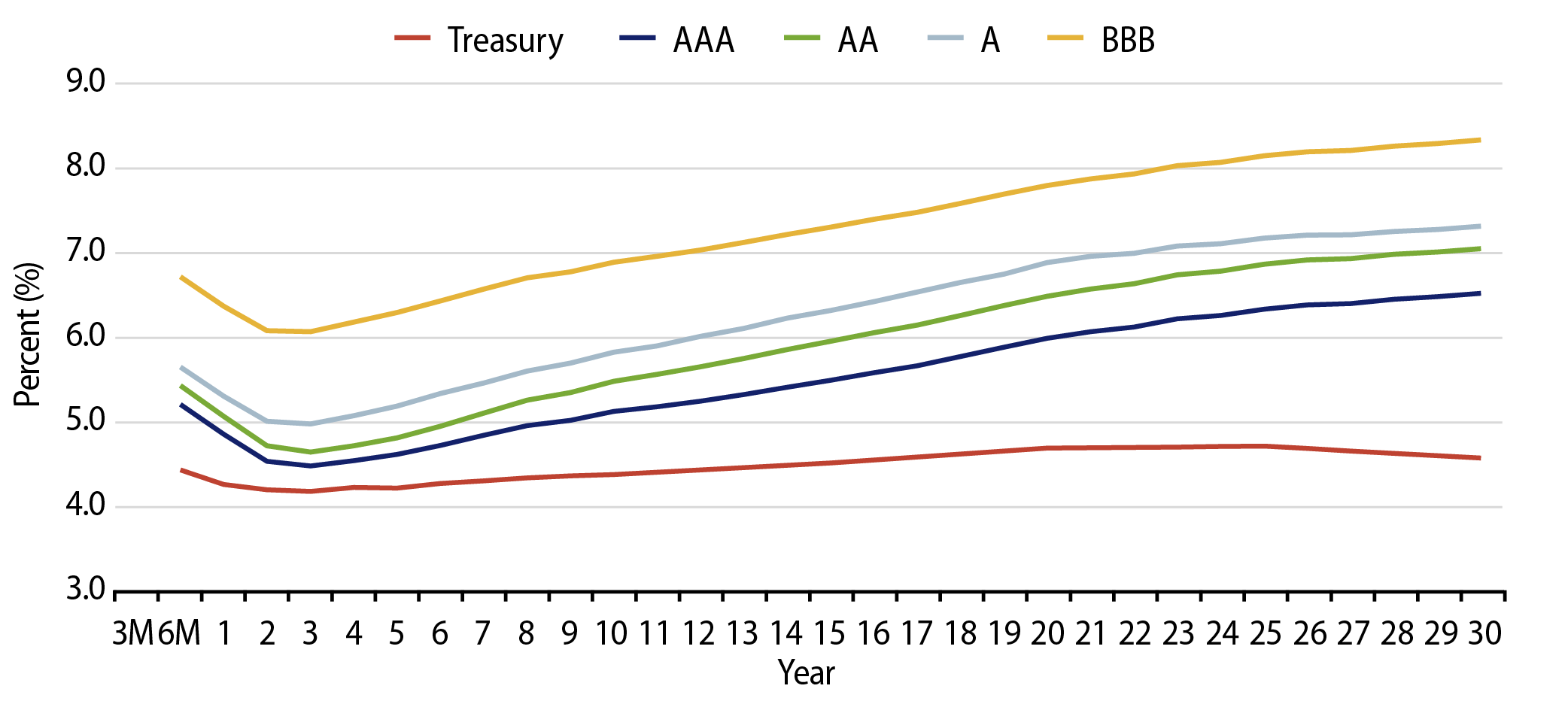

Theme #2: The muni yield curve has largely disinverted, offering better rolldown opportunity in intermediate maturities.

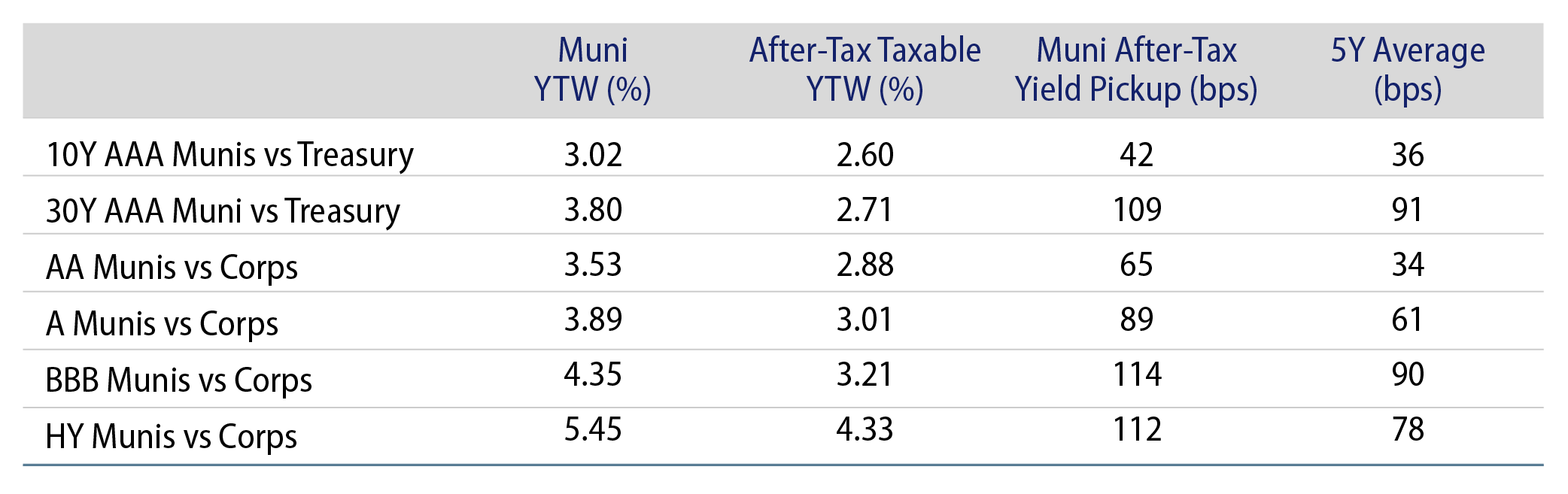

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.