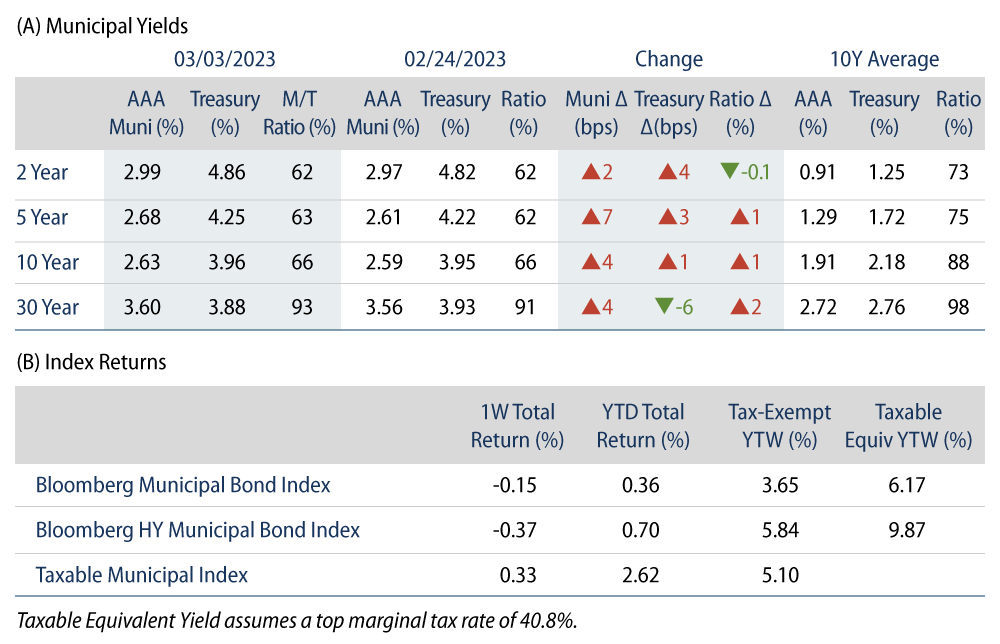

Municipal Yields Moved Higher Last Week

Municipal yields moved higher last week, with high-grade muni yields moving 2-7 bps higher across the curve. Munis weakened amid fund outflows and higher supply conditions. Meanwhile, weaker supply and demand technicals drove municipal underperformance versus Treasuries, as rates moved higher on hawkish Fed rhetoric and stronger than expected labor cost and jobless claims data. The Bloomberg Municipal Index returned -0.15% during the week, the HY Muni Index returned -0.37% and the Taxable Muni Index returned 0.33%. This week we highlight February performance challenges, which reversed a strong start to the year.

Muni Technicals Weakened Amid Fund Outflows and Higher Supply

Fund Flows: During the week ending March 1, weekly reporting municipal mutual funds recorded $905 million of net outflows, according to Lipper. Long-term funds recorded $281 million of outflows, high-yield funds recorded $78 million of outflows and intermediate funds recorded $59 million of outflows. This week’s outflows extend year-to-date (YTD) net outflows to $1.3 billion.

Supply: The muni market recorded $7 billion of new-issue volume last week, approximately double the prior week’s level. YTD issuance of $48 billion is down 16% year-over year (YoY), with tax-exempt issuance down 8% YoY and taxable issuance down 64% YoY. This week’s calendar is expected to increase to $10 billion. Large transactions include $3.5 billion Texas Natural Gas Securitization Finance Corporation and $1.8 billion State of California Taxable General Obligation transactions.

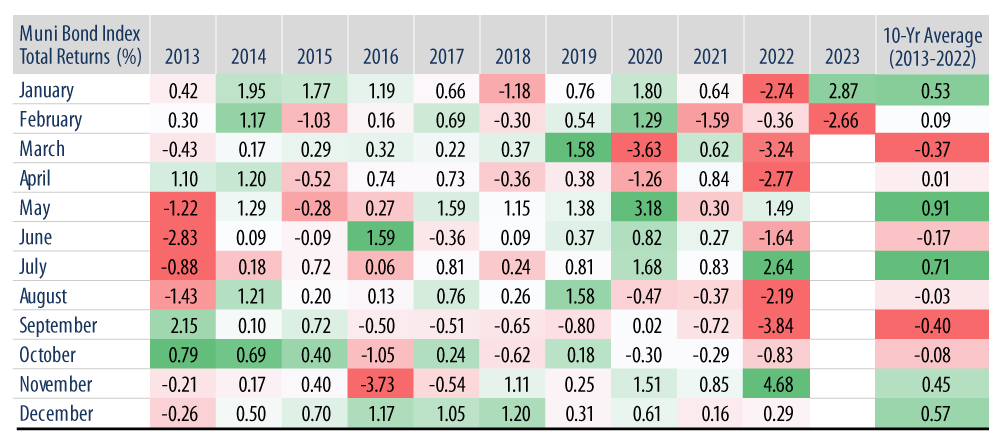

This Week in Munis: February Slump

The Bloomberg Municipal Bond Index returned -2.3% in February, marking the worst February return since 2008. High-yield and taxable municipals fared worse during the month, as the Bloomberg High Yield and Taxable indices returned -3.1% and -2.3%, respectively. The month’s market weakness gave pause to the 8.0% rally that took place over the three months of November through January.

February weakness was largely attributable to interest rate volatility driven by the hotter than anticipated inflation data that pushed rates higher during the month. Notably, the negative performance persisted despite supportive supply and demand conditions. Demand for municipals was positive in February as municipal mutual funds continued to recover from the 2022 record outflow cycle, recording a modest $400 million of net inflows. Meanwhile, new-issue supply of $20 billion remained well below longer-term averages, and marked the lowest February issuance over the last five years.

From a fundamental standpoint, large issuer upgrades continued to underscore the trend of fundamental improvement within the muni market. The State of Illinois and New York City received upgrades from Standard & Poor’s and Fitch, respectively, during the month. Strong revenue performance throughout the pandemic recovery, as well as improved reserve levels, were cited by the agencies and indicate the potential for resiliency ahead of a potential economic slowdown.

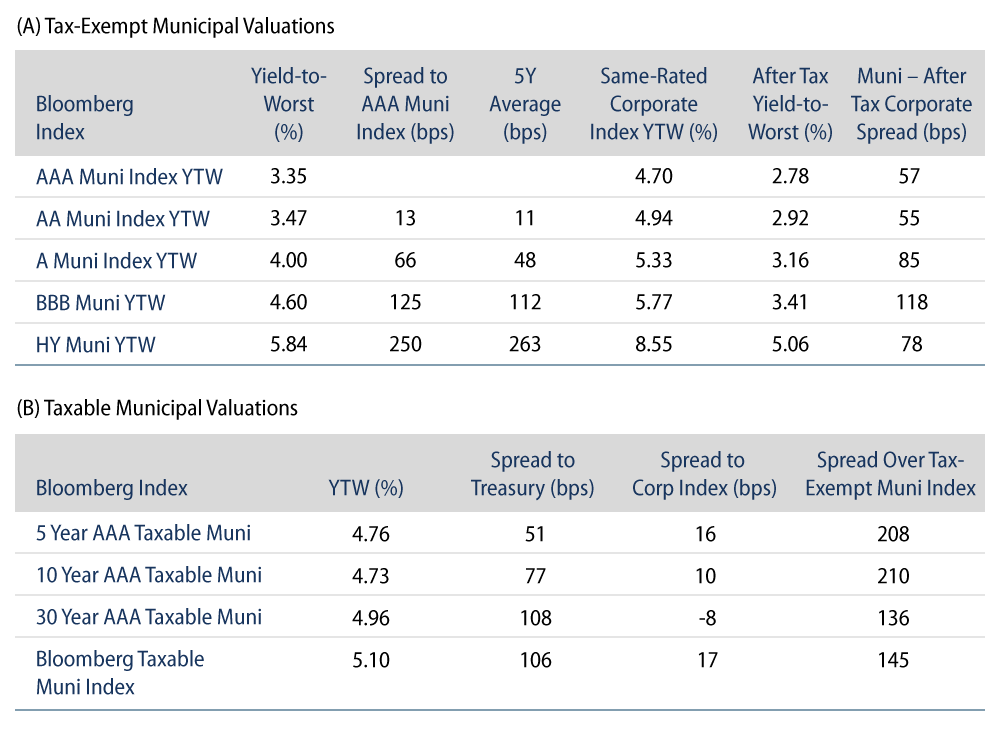

The month’s selloff improved relative valuations of the muni asset class. Municipal relative valuations entered the month at relatively rich levels with Municipal/Treasury ratios ranging from 52% to 88%, which has since improved to a range of 62% to 93%. Considering an anticipated pick-up in issuance heading into March, along with tax-season retail selling, we anticipate weaker technicals to potentially extend near-term market weakness. However, as the average investment-grade municipal index yield of 3.65% remains near a decade high and well above the 10-year average, we expect potential weaker supply and demand conditions to offer a compelling entry point for long-term income seekers in the coming weeks.