Municipals Posted Positive Returns Last Week

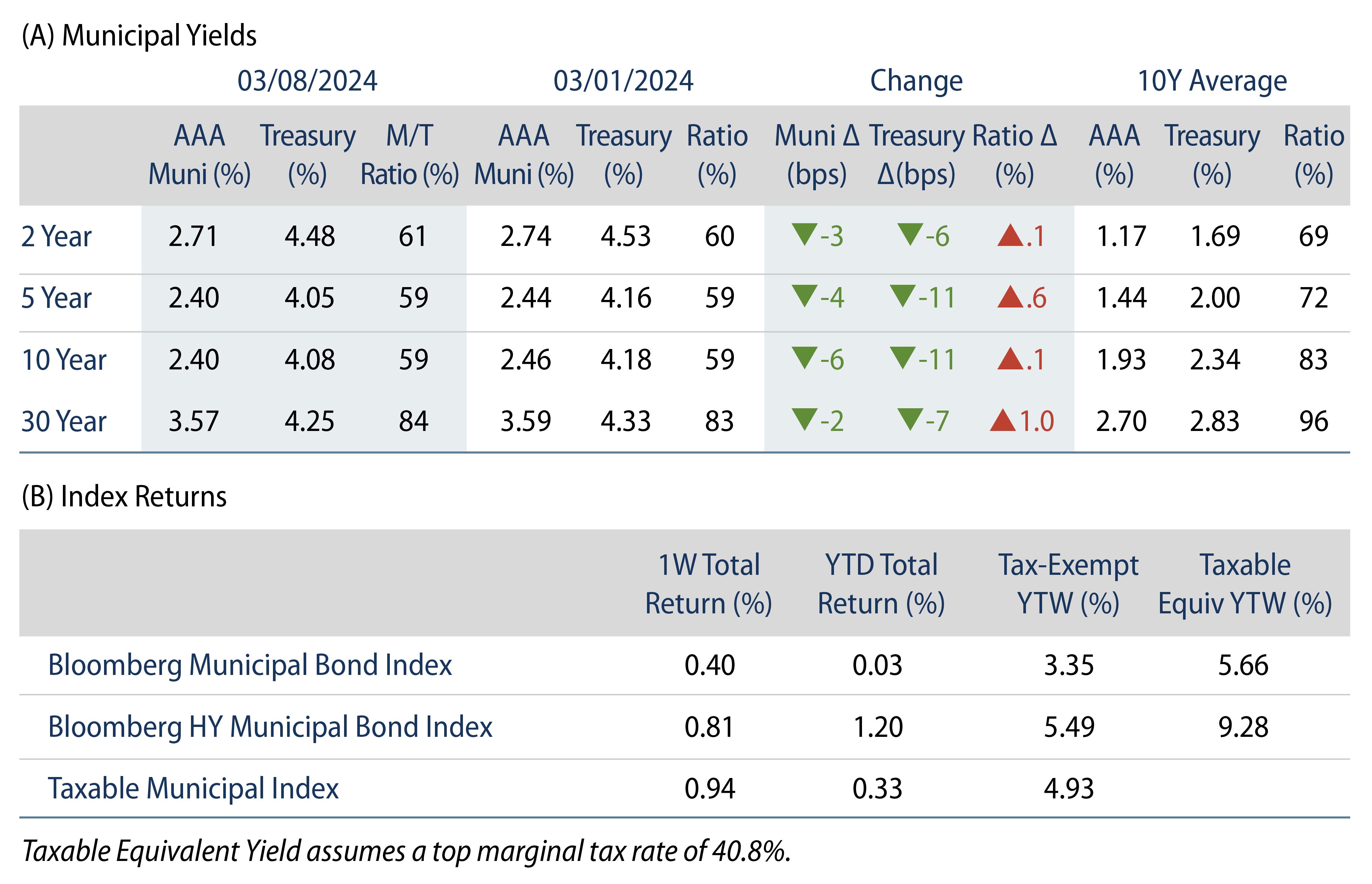

Munis posted positive returns and modestly underperformed the Treasury rally as yields moved lower on weaker economic data earlier in the week, ultimately culminating with significant downward payroll revisions that offset the stronger-than-expected February payrolls data. High-grade muni yields moved lower across the curve. Muni supply and demand trends moved higher during the week. The Bloomberg Municipal Index returned 0.40% during the week, the High Yield Muni Index returned 0.81% and the Taxable Muni Index returned 0.94%. This week we highlight historical performance prior to and following historical fed funds rate cuts.

Technicals Continued to Shift with Higher Supply and Demand

Fund Flows: During the week ending March 6, weekly reporting municipal mutual funds recorded $869 million of net inflows, according to Lipper. Long-term funds recorded $893 million of inflows, intermediate funds recorded $113 million of inflows and high-yield funds recorded $436 million of inflows. Short-term funds posted outflows of $65 million. Last week’s inflows lead estimated year-to-date (YTD) net inflows higher to $5.5 billion.

Supply: The muni market recorded $9.5 billion of new-issue volume last week, up 13% from the prior week. YTD issuance of $73 billion is 55% higher from last year’s level, with tax-exempt issuance 58% higher and taxable issuance 28% higher year-over-year. This week’s calendar is expected to increase to increase to $12 billion. Largest deals include $3 billion Dormitory Authority of the State of New York Personal Income Tax and $1.7 billion Commonspirit Health transactions.

This Week in Munis: Fed Pivot

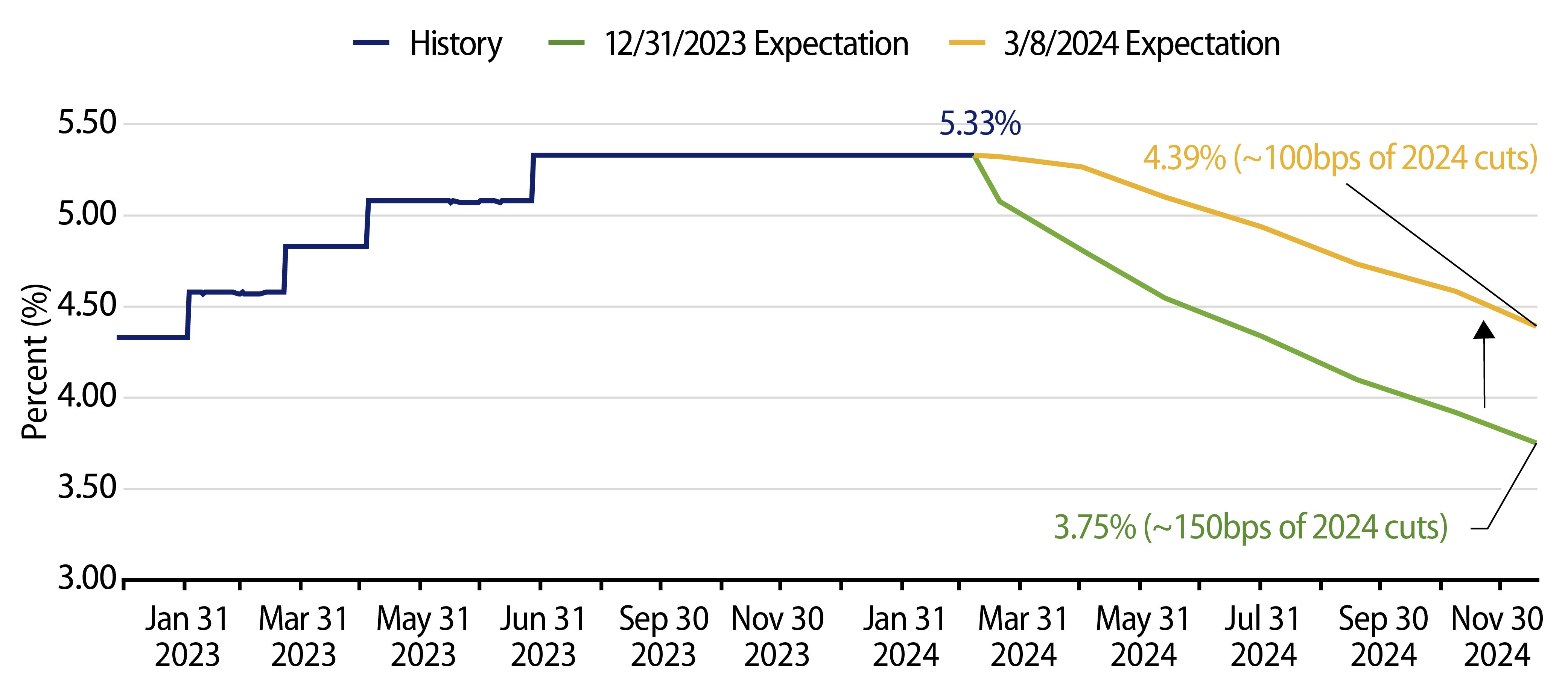

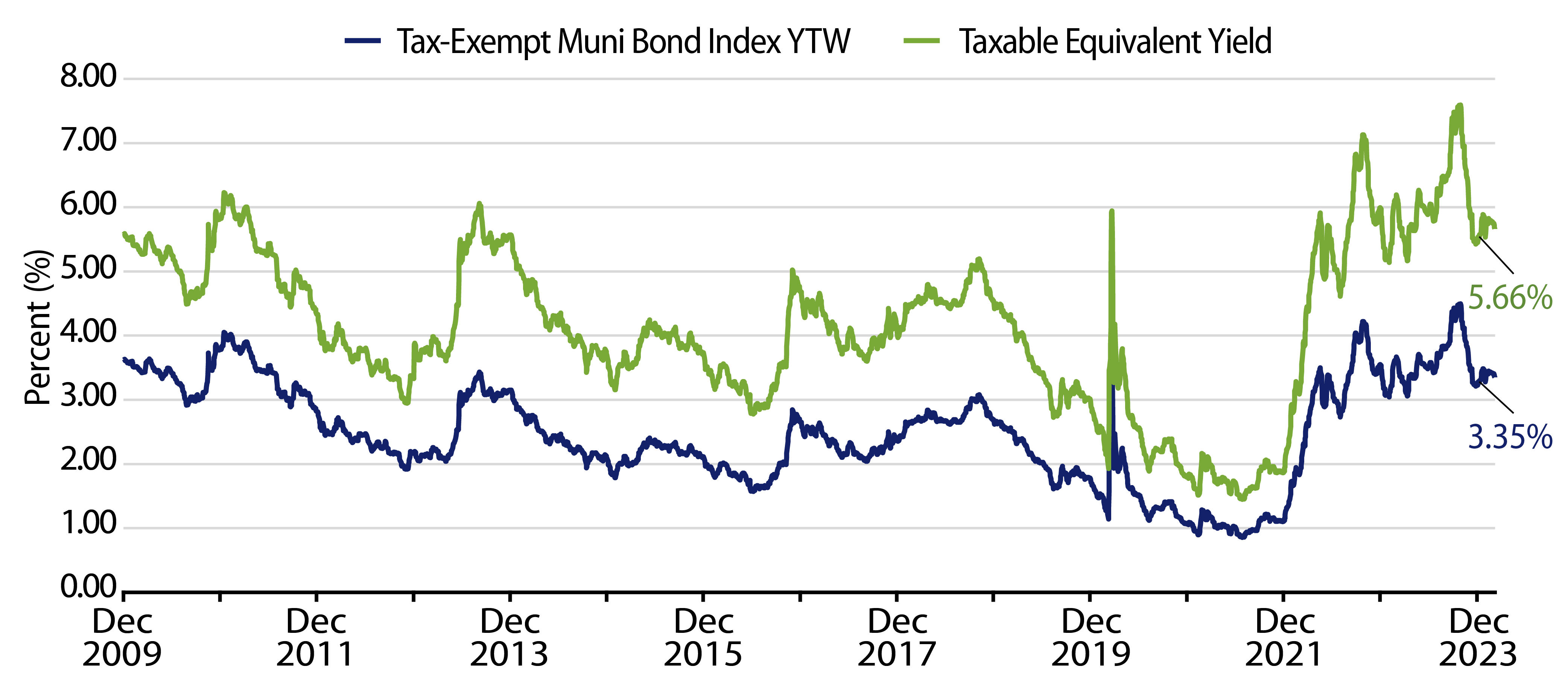

As inflation moderated at the end of 2023 and the Federal Reserve (Fed) telegraphed the end of its hiking cycle, market expectations implied as many as 150 basis points (bps) (1.50%) of 2024 rate cuts at year-end. Economic data has since remained resilient YTD, and 2024 expected rate cuts were reduced to 100 bps as of last week, leading to additional uncertainty around the timing and magnitude of cuts this year.

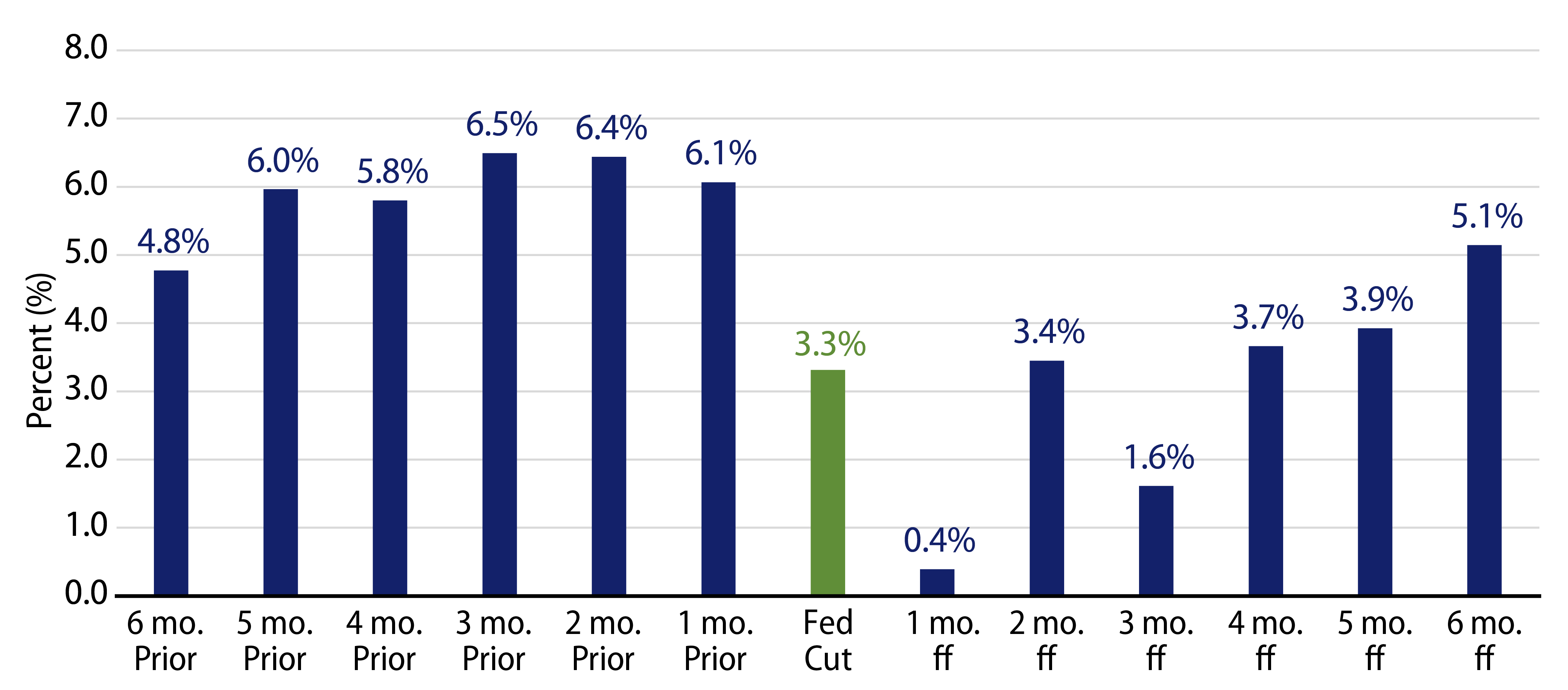

Resilient economic data and a lower probability of a near-term rate cut could lead potential muni investors to wait for the Fed to cut rates before investing in the asset class. However, history has highlighted that those who wait until or after the rate cut could experience less favorable outcomes than those who have entered the market ahead of the cut. Considering the past eight initial rate cuts, Bloomberg Municipal Bond Index 12-month total returns averaged 7.24% in the six months ahead of cuts, while averaging just 3.23% in the six months that followed the initial cut.

While Western Asset believes the Fed will cut rates in 2024, the timing and magnitude could remain in flux. While it may not feel like it, this year’s resilient economic conditions that have moved projected rate cut expectations out three to six months could provide a silver lining and bode well for municipal allocations that are benefiting from higher tax-exempt income levels. If past is precedent, and there can be no guarantee that it is, investors waiting to put cash to work until Fed cuts transpire could be better served by investing prior to the rate cut.

Municipal Credit Curves and Relative Value

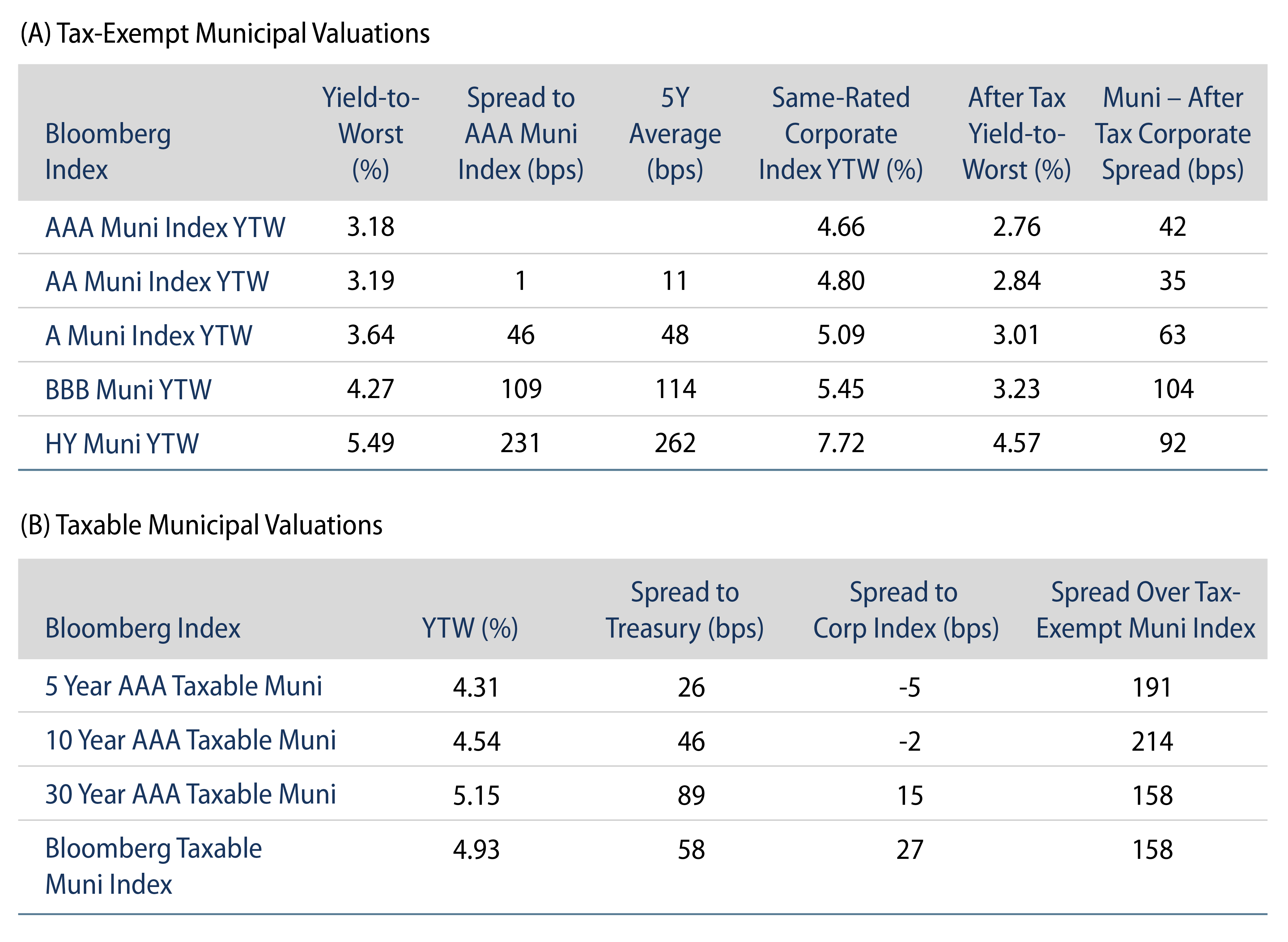

Theme #1: Municipal taxable-equivalent yields are above decade averages.

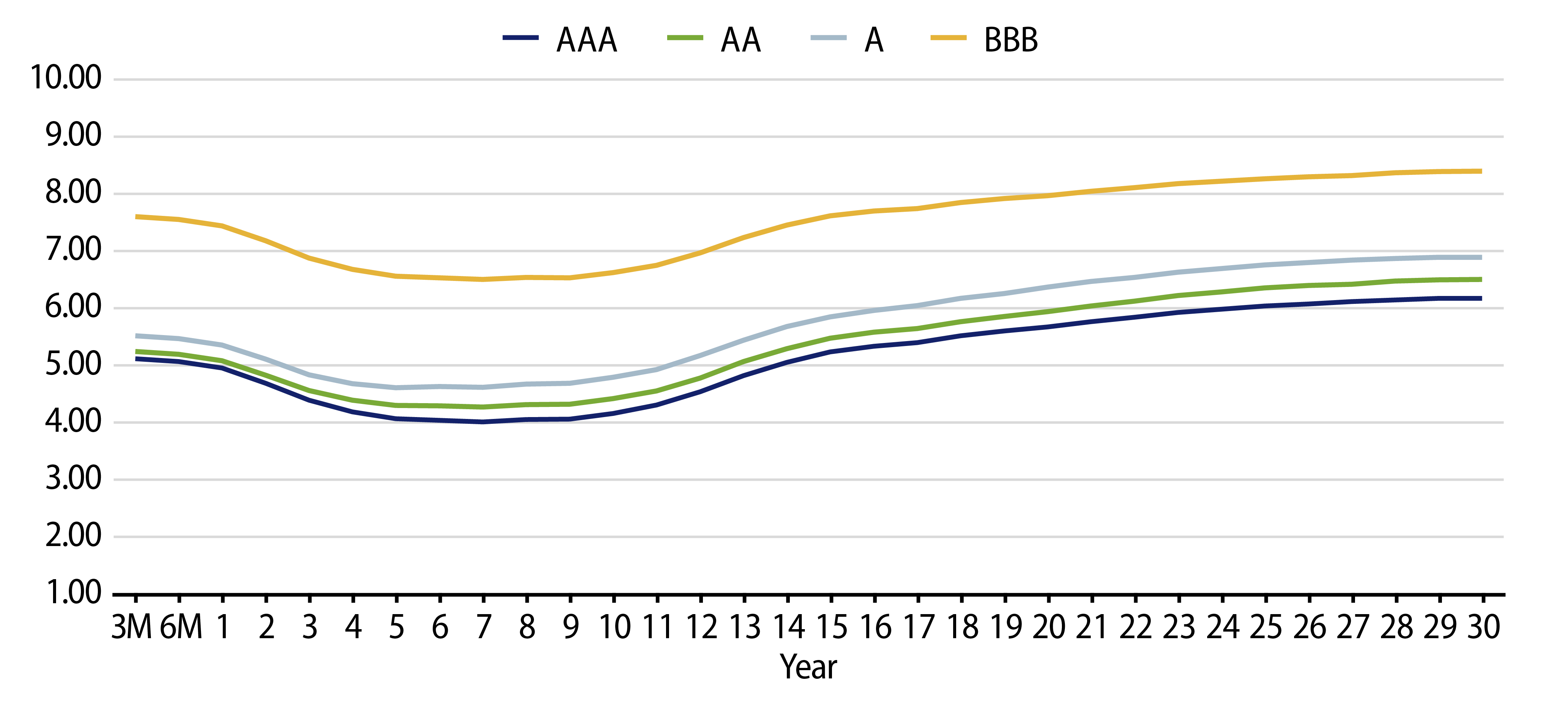

Theme #2: Curve inversion underscores relative value in longer maturities.

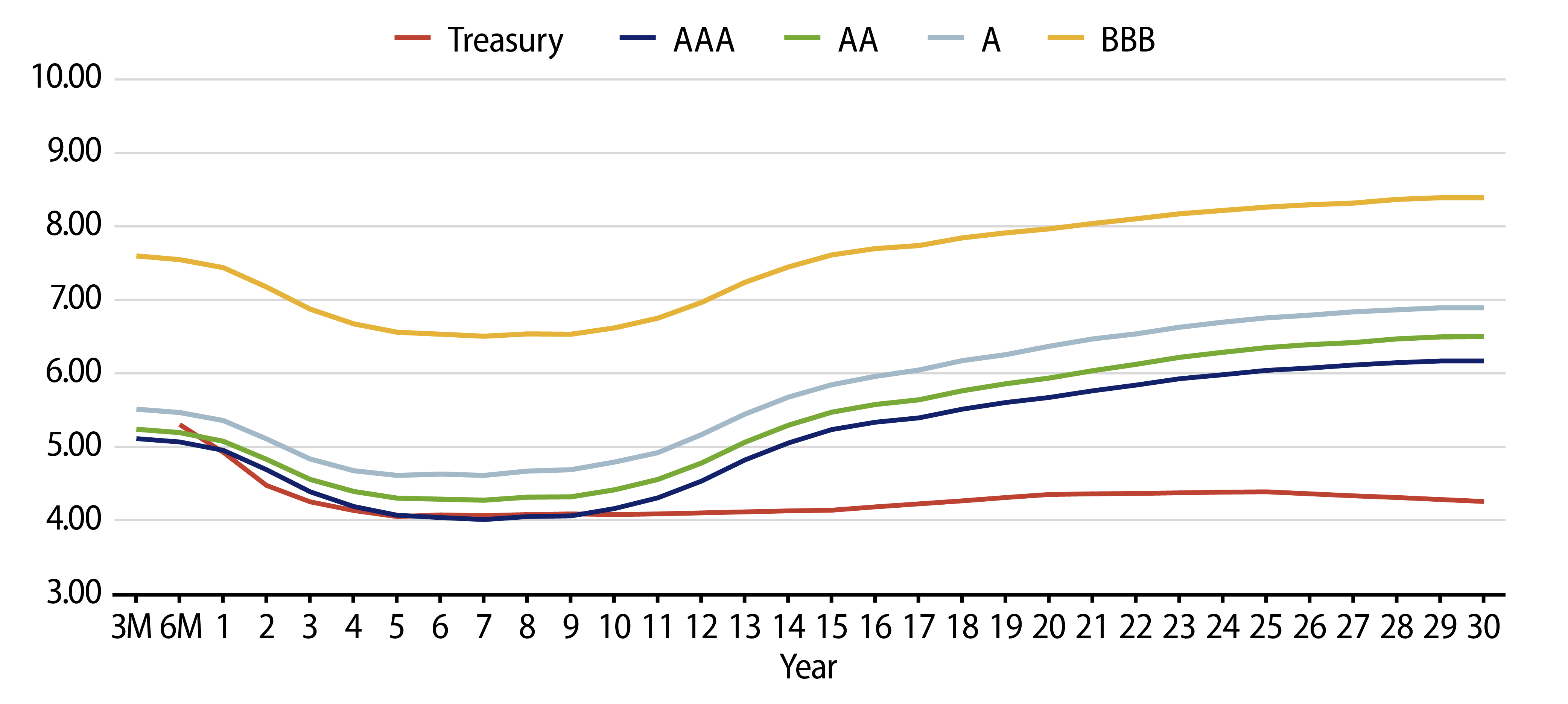

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.